US Treasuries

- Tuesday’s UST 10y range: 4.50% – 4.545%, closing at 4.54%

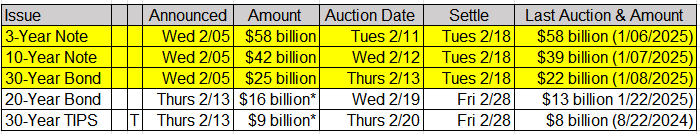

On the docket this week:

- Supply continues:

- $42 bln UST 10y Note auction on Wednesday (2/12/25)

- $25 bln UST 30y Bond auction on Thursday (2/13/25)

- $4 bln Treasury buyback on Wednesday (2/12/25):

- Nominal Coupon 1 Month to 2y

- Powell testifies before the Federal Reserve’s Semi-Annual Monetary Policy Report to the US House Committee on Financial Services on Wednesday, 2/12/2025 at 10:00am EST

- CPI released on Wednesday (2/12/25) at 8:30am EST and PPI released on Thursday (2/13/25) at 8:30am EST

Today’s Recap:

- Fed’s Hammack (non-voter): Rates on hold until inflation ebbs further; Not my base case to raise interest rates this year

- Fed Chair Powell addressed Senate banking panel and reiterated no need to hurry to adjust rates

- The Fed can’t control long rates;

- Even when rates drop, still will have housing shortage;

- Long rates set by supply and demand in the bond market;

- We support regulatory efforts around stablecoins ;

- Believe neutral rate has risen from very low pre-pandemic level

Intraday Commentary from Jim Bianco:

New TVA Expected to Price Today:

- Issuer: Tennessee Valley Authority: $Benchmark 30Y Fixed (Feb. 1, 2055) IPT +65-70

- Exp. Ratings: Aaa/AA+/AA+

- Settlement: Feb. 14, 2025 (T+3)

- ISIN: US880591FC1

- Cusip: 880591FC1

Next TIPS 30y Bond Auction on Thursday, February 20, 2025

Upcoming US Treasury Supply

Bloomberg: Treasury Cuts Sizes of Bill Auctions as Debt-Cap Pressures Bite

The US Treasury Department cut the size of some benchmark bill auctions, the start of what’s likely to be a series of reductions as the government preserves its borrowing authority under the statutory debt ceiling.

Tentative Schedule of Treasury Buyback Operations

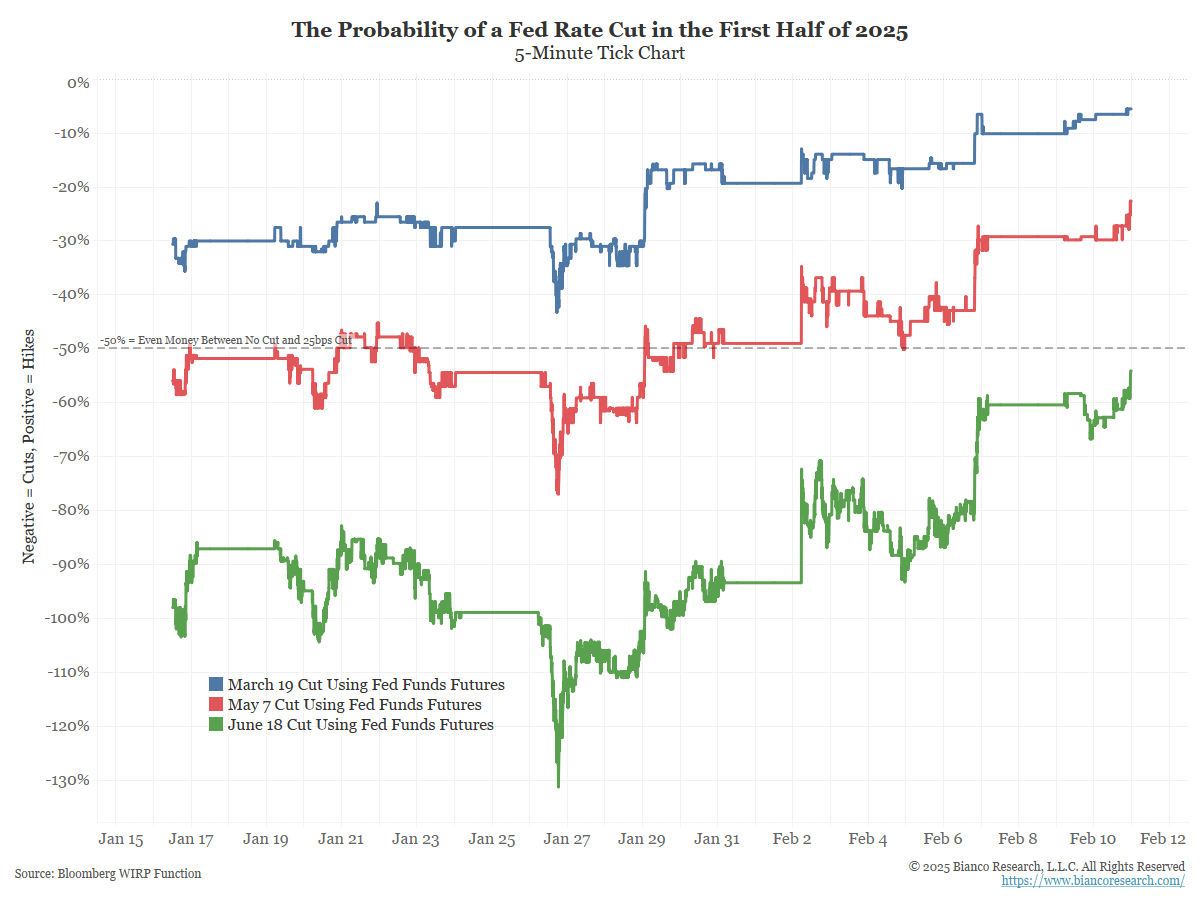

Intraday Commentary from Jim Bianco

Powell today: “Long-Term Inflation Expectations Appear Well Anchored”

To hear Jim’s thoughts, listen to our latest edition of Talking Data. Jim discusses whether inflation is becoming unanchored.

In Other News…

Upcoming Earnings Releases this week:

Arnold&Porter: DOGE and GSA Officials Pledge Acceleration of GSA Lease Portfolio Liquidation

The Trump administration, as part of its initial round of cost reduction efforts, has threatened to terminate the federal government’s leases in commercial buildings around the country. The target is a 50% reduction in office space occupied by the federal government.

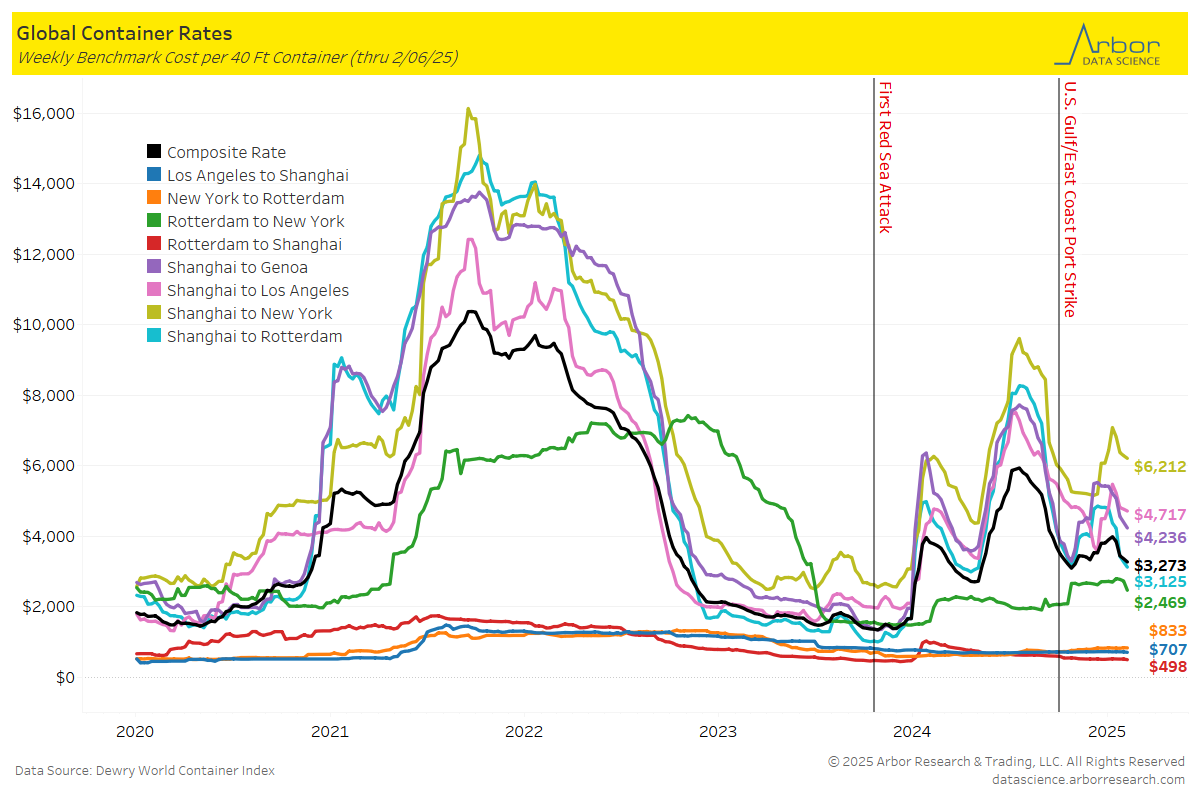

FreightWaves: Waiting for a plunge in Red Sea freight rates? ‘Hold my container,’ says carrier

The head of the Suez Canal said he expects vessel traffic through the Middle East waterway to gradually return to normal by late March and fully recover by the middle of this year.

Arbor Data Science:

Investment News: Wealth management industry is facing a looming retirement crisis, report warns

The US wealth management industry is facing a retirement crisis; not a financial shortfall but a talent shortage caused by retirement of thousands of advisors.

Upcoming Economic Releases & Fed Speak

- 2/12/2025 at 07:00am EST: MBA Mortgage Applications

- 2/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 2/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 2/12/2025 at 08:30am EST: CPI Index NSA & CPI Core Index SA

- 2/12/2025 at 08:30am EST: Real Average Weekly Earnings YoY & Real Average Hourly Earning YoY

- 2/12/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook

- 2/12/2025 at 02:00pm EST: Federal Budget Balance

- 2/12/2025 at 05:05pm EST: Waller Speaks on Stablecoins

- 2/13/2025 at 08:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 2/13/2025 at 08:30am EST: PPI Ex Food, Energy, and Trade MoM & PPI Final Demand YoY

- 2/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 2/13/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/14/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 2/14/2025 at 08:30am EST: Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 2/14/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum MoM

- 2/14/2025 at 08:30am EST: Import Price Index YoY & Export Price Index MoM & Export Price Index YoY

- 2/14/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 2/14/2025 at 10:00am EST: Business Inventories

- 2/14/2025 at 03:00pm EST: Logan Speaks in Moderated Q&A

- 2/18/2025 at 08:30am EST: Empire Manufacturing

- 2/18/2025 at 10:00am EST: NAHB Housing Market Index

- 2/18/2025 at 06:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 2/19/2025 at 09:30am EST: Harker Speaks on the Economy Outloook