US Treasuries

- Friday’s UST 10y range: 4.445% – 4.545%, closing at 4.47%

Bloomberg: Traders Look for $10 Million Payout in Bet on 5% US Yield

Options traders are piling into bets the 10-year Treasury yield will jump to 5% — a level last seen in 2023 — within the next five weeks.

Jim Bianco:

10-year yield over the last three days.

Green = reaction to CPI beat on Wednesday.

Red = Since that beat (last hook lower on retail sales miss)

Jim Bianco Joins Bloomberg to discuss Trump Tariffs, the Last Mile of Inflation & Federal Reserve

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

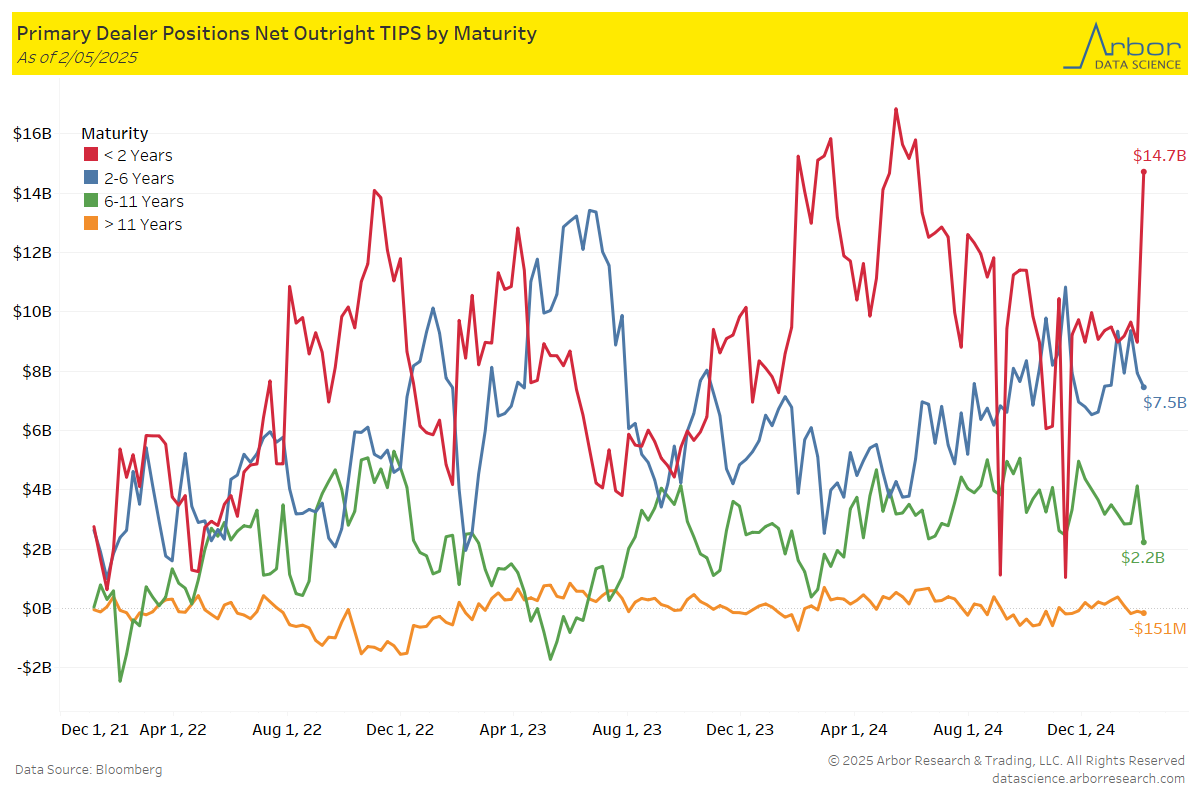

TIPS by Maturity: On Deck: $9 billion 30y TIPS Auction on Thursday, 2/20/2025

Week over Week Changes by Maturity

- < 2 years: $9.0 Bn on 1/29/25 to $14.7 Bn on 2/5/25 = $5.7 Bn

- 2 – 6 years: $7.9 Bn on 1/29/25 to $7.5 Bn on 2/5/25 = ($0.48 Bn)

- 6 – 11 years: $4.1 Bn on 1/29/25 to $2.2 Bn on 2/5/25 = ($1.9 Bn)

- > 11 years: ($90 Mn) on 1/29/25 to ($151 Mn) on 2/5/25 = ($61 Mn)

Intraday Commentary from Jim Bianco:

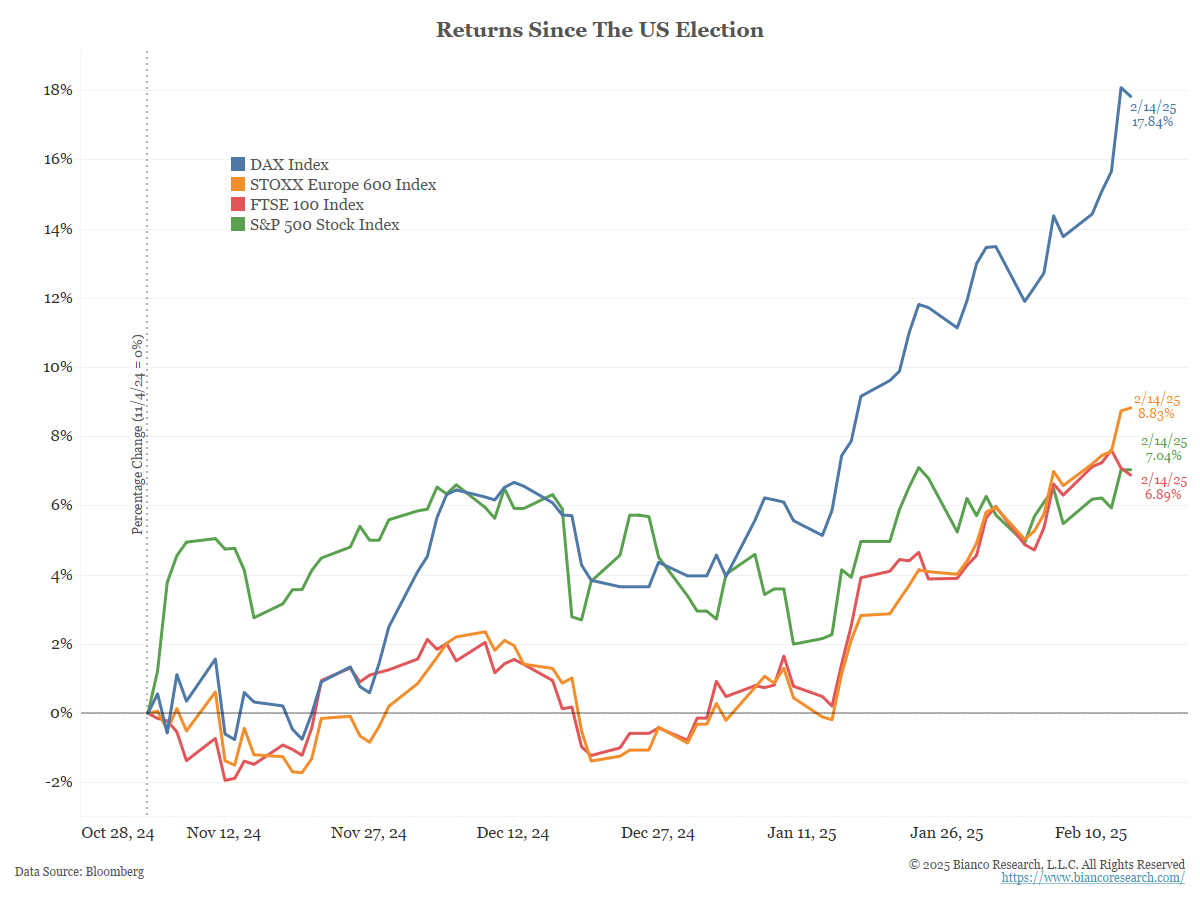

Here are the returns since the US election for the German DAX Stock Index (blue), the European STOXX 600 (orange), the UK FTSE Stock Index (red) and the S&P 500 (green).

Unpopular opinion … The best thing to happen to EUROPE, and especially GERMANY, is Donald Trump.

Europe has been stuck in a rut of sedentary thinking and too much regulation (“The US innovates, Europe regulates”). Trump’s presence will force much-needed change in Europe/Germany.

Now, EUROPE has to follow through and dump its current political class (and ECB head), which caused their problems and continues to hold them back.

The DAX is up 17% since US election Day, 5% (about 30%) is SAP.10 stocks are 62% of the DAX.

In Other News…

CIO: Corporate Pensions Continue Funding Surplus Rise in January

The average funding ratio of U.S. corporate pension funds continues to exceed 100% after growing further in January, pushing to a recent high.

OilPrice: Shell Sees LNG Boom Through 2030

The world’s top LNG trader, Shell, expects global demand for liquefied natural gas to jump at least through 2030 in all scenarios it has modeled in a new energy security report.

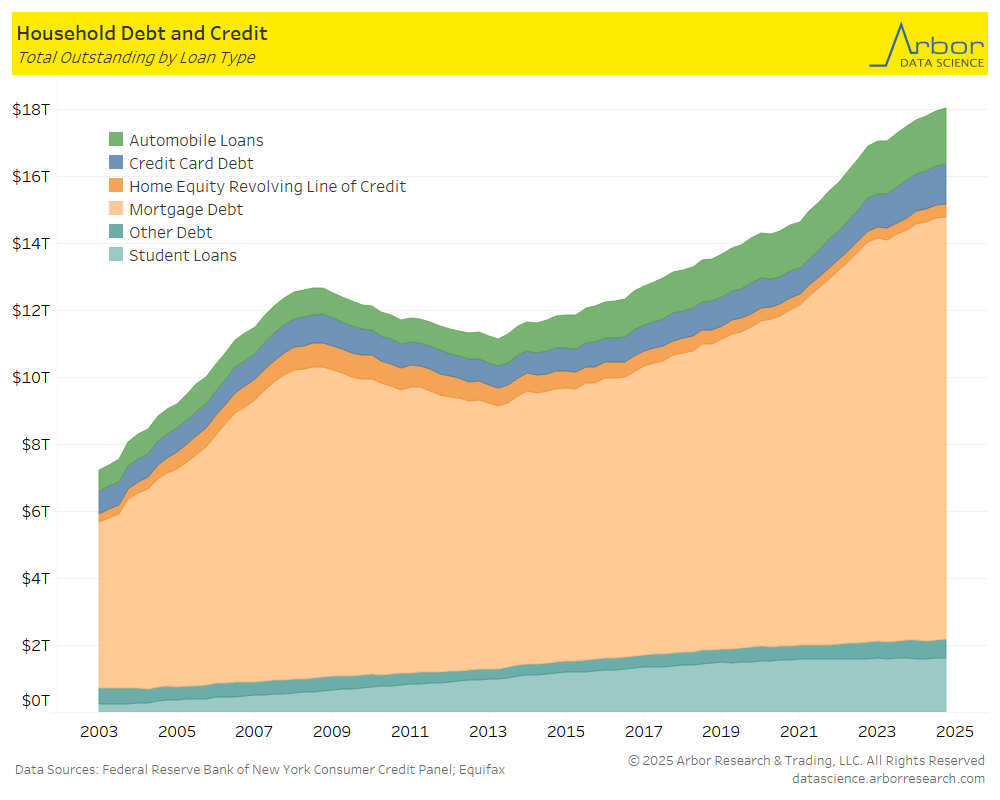

Barrons: Consumer Spending Looks Shaky. Why It Isn’t Time to Panic

Consumers can only take so many years of higher prices and stretched wallets. Wall Street is starting to worry that shoppers might finally be hitting their limit.

Arbor Data Science:

Axios: In-person work doubled over the past year, survey says

The office is back: The share of people who reported working mostly in-person doubled in 2024 from the previous year, according to a survey from McKinsey released Friday morning.

Upcoming Economic Releases & Fed Speak

- 2/17/2025 at 09:30am EST: Harker Speaks on the Economy Outlook

- 2/17/2025 at 09:30am EST: Bowman Speaks to American Bankers Association

- 2/18/2025 at 08:30am EST: Empire Manufacturing

- 2/18/2025 at 10:00am EST: NAHB Housing Market Index

- 2/18/2025 at 10:20am EST: Daly Speaks to American Bankers Association

- 2/18/2025 at 06:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 2/19/2025 at 07:00am EST: MBA Mortgage Applications

- 2/19/2025 at 08:30am EST: Housing Starts & Housing Starts MoM

- 2/19/2025 at 08:30am EST: Building Permits & Building Permits MoM

- 2/19/2025 at 08:30am EST: New York Fed Services Business Activity

- 2/19/2025 at 02:00pm EST: FOMC Meeting Minutes

- 2/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 2/20/2025 at 08:30am EST: Initial Jobless Claims

- 2/20/2025 at 08:30am EST: Continuing Claims

- 2/20/2025 at 09:35am EST: Goolsbee Speaks in Moderated Q&A

- 2/20/2025 at 10:00am EST: Leading Index

- 2/20/2025 at 12:05pm EST: Musalem Speaks to Economic Club of NY

- 2/20/2025 at 02:30pm EST: Barr Speaks on Supervision and Regulation

- 2/20/2025 at 05:00pm EST: Kugler speaks on Inflation, Phillips Curve

- 2/21/2025 at 05:00pm EST: Bloomberg Feb. United States Economic Survey

- 2/21/2025 at 11:30am EST: Jefferson Speaks on Central Bank Communication

- 2/21/2025 at 09:45am EST: S&P Global US Manufacturing PMI/ Services PMI/ Composite PMI

- 2/21/2025 at 10:00am EST: U of Mich. Sentiment/ Current Conditions/ Expectations

- 2/21/2025 at 10:00am EST: U of Mich. 1 Yr Inflation / 5-10 Year Inflation

- 2/21/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM