US Treasuries

- Tuesday’s range for UST 10y: 4.50% – 4.54%, closing at 4.54%

Today’s recap:

- Fed’s Daly: Regulation should help community banks thrive; Fed Policy should be restrictive until inflation falls

- Fed’s Barr: AI’s speed presents risk at wide scale; Generative AI use could “lead to herding behavior and the concentration of risk, potentially amplifying market volatility.”

Marketwatch: Bonds issued by defense contractors are being snapped up, as stocks fall on talk of spending cuts

U.S. defense stocks have taken a drubbing in recent weeks, and took a steep downturn late last week after President Trump mooted cutting defense spending in half, but bonds issued by those companies are telling a different story.

Jim Bianco Joins Fox Business to Discuss

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Conference Call Thursday, February 20, 2025, Featuring Jim Bianco

In Other News…

Bloomberg: Higher Rents Are Coming If Interest Rates Don’t Budge

An expected drop in US apartment supply has landlords planning hikes.

RentCafe: Record-Breaking 71K Apartments Set to Emerge From Office Conversions

Office-to-apartment conversions are surging in popularity, with 2025 set to reach a record-breaking milestone of almost 71,000 units in the pipeline.

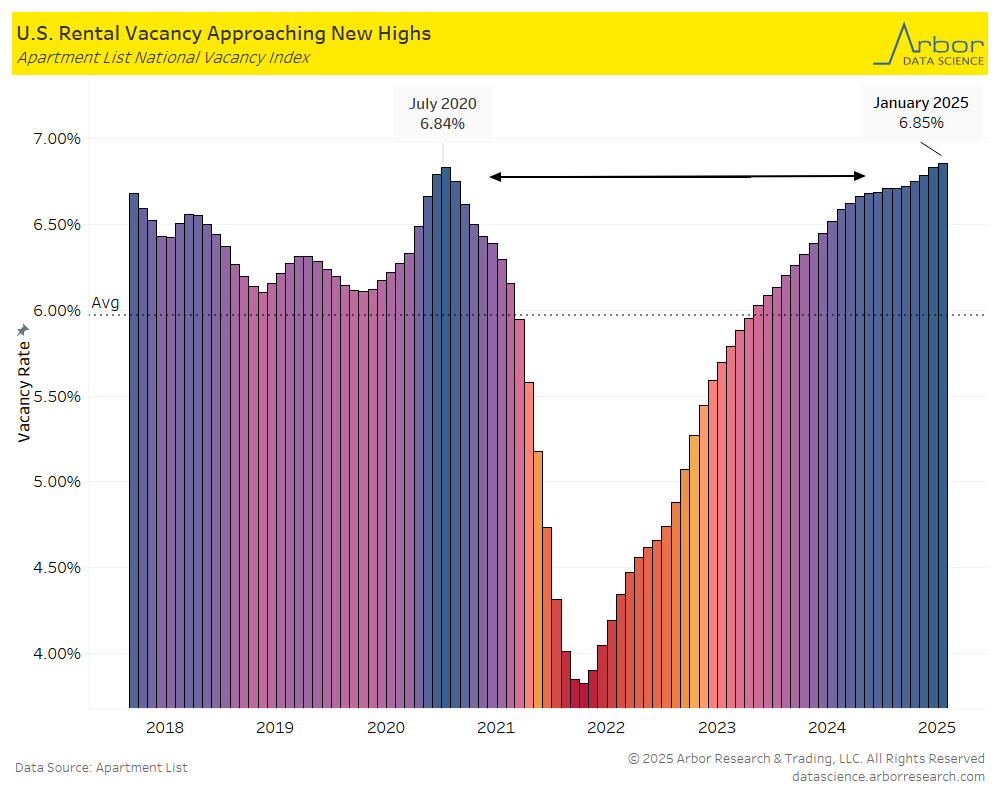

Arbor Data Science: U.S. Rental Vacancy Rate Surpasses July 2020 Peak

Axios: Updated bird flu vaccine for poultry gets license

Axios: Updated bird flu vaccine for poultry gets license

The U.S. Department of Agriculture gave conditional approval for an updated bird flu vaccine to protect poultry against the H5N1 strain that’s stricken more than 150 million birds in commercial and backyard flocks.

And the layoff news continues…

CNN: Southwest to lay off 15% of its corporate staff, including senior leadership

Southwest Airlines said Monday it will cut 15% of its corporate workforce, or 1,750 people — the first mass layoffs in the company’s history.

SupplyChainBrain: Trump says New Tariffs on Autos Coming Around April 2

Imports accounted for roughly half of the U.S. auto market last year. About 80% of Volkswagen AG’s U.S. sales are imported, while 65% of Hyundai-Kia’s U.S. sales are imported, according to figures from Global Data, a market researcher.

OilPrice: LNG Tanker Braves the Red Sea

A liquefied natural gas carrier has braved the Red Sea for only the second time since last June after the Yemeni Houthis launched an offensive against most vessels perusing the route.

Upcoming Economic Releases & Fed Speak

- 2/19/2025 at 07:00am EST: MBA Mortgage Applications

- 2/19/2025 at 08:30am EST: Housing Starts & Housing Starts MoM

- 2/19/2025 at 08:30am EST: Building Permits & Building Permits MoM

- 2/19/2025 at 08:30am EST: New York Fed Services Business Activity

- 2/19/2025 at 02:00pm EST: FOMC Meeting Minutes

- 2/19/2025 at 05:00pm EST: Jefferson Speaks on Household Balance Sheet

- 2/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 2/20/2025 at 08:30am EST: Initial Jobless Claims

- 2/20/2025 at 08:30am EST: Continuing Claims

- 2/20/2025 at 09:35am EST: Goolsbee Speaks in Moderated Q&A

- 2/20/2025 at 10:00am EST: Leading Index

- 2/20/2025 at 12:05pm EST: Musalem Speaks to Economic Club of NY

- 2/20/2025 at 02:30pm EST: Barr Speaks on Supervision and Regulation

- 2/20/2025 at 05:00pm EST: Kugler speaks on Inflation, Phillips Curve

- 2/21/2025 at 05:00pm EST: Bloomberg Feb. United States Economic Survey

- 2/21/2025 at 11:30am EST: Jefferson Speaks on Central Bank Communication

- 2/21/2025 at 09:45am EST: S&P Global US Manufacturing PMI/ Services PMI/ Composite PMI

- 2/21/2025 at 10:00am EST: U of Mich. Sentiment/ Current Conditions/ Expectations

- 2/21/2025 at 10:00am EST: U of Mich. 1 Yr Inflation / 5-10 Year Inflation

- 2/21/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM

- 2/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 2/24/2025 at 2/25/2025 at 08:30am EST: 10:30am EST: Dallas Fed Manf. Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 2/25/2025 at 09:00am EST: FHFA House Price Index MoM & House Price Purchase Index QoQ

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA & S&P CoreLogic CS 20-City YoY NSA

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY NSA

- 2/25/2025 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 2/25/2025 at 10:00am EST: Richmond Fed Manufacturing Index & Richmond Fed Business Conditions

- 2/25/2025 at 10:30am EST: Dallas Fed Services Activity

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 2/05) were down 10.79bln @60.53bln

- Dealer positions <2yrs TIPS (as of 2/05) were up 5.74bln @14.72bln.

- Dealer positions in 2-6yrs TIPS (as of 2/05) were down 475mln @7.45bln.

- Dealer positions in 6-11yrs TIPS (as of 2/05) were down 1.90bln @2.23mln.

- Dealer positions > 11yrs TIPS (as of 2/05) were up 61mln @-152mln.

- Dealer positions in < 2yrs Coupons (as of 2/05) were up 8.93bln @68.80bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 2/05) were down 1.09bln @25.76bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 2/05) were up 1.98bln @90.68bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 2/05) were down 1.17bln @20.53bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 2/05) were down 1.80bln @30.12bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 2/05) were up 1.63bln @26.128bln.

- Dealer positions in > 21 years Coupons (as of 2/05) were up 1.04bln @40.37bln.