US Treasuries

- Wednesday’s range for UST 10y: 4.525% – 4.57%, closing at 4.535%

Bloomberg: Fed Minutes Signal Officials on Hold Until Inflation Improves

Federal Reserve officials in January expressed their readiness to hold interest rates steady amid stubborn inflation and economic-policy uncertainty.

WSJ: Fed Minutes Show Inflation Jitters Cast a Chill Over Rate Cuts

Officials cited trade policy as a factor that could ‘hinder’ inflation progress.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Conference Call tomorrow, Thursday, February 20, 2025, featuring Jim Bianco

Intraday Commentary from Jim Bianco

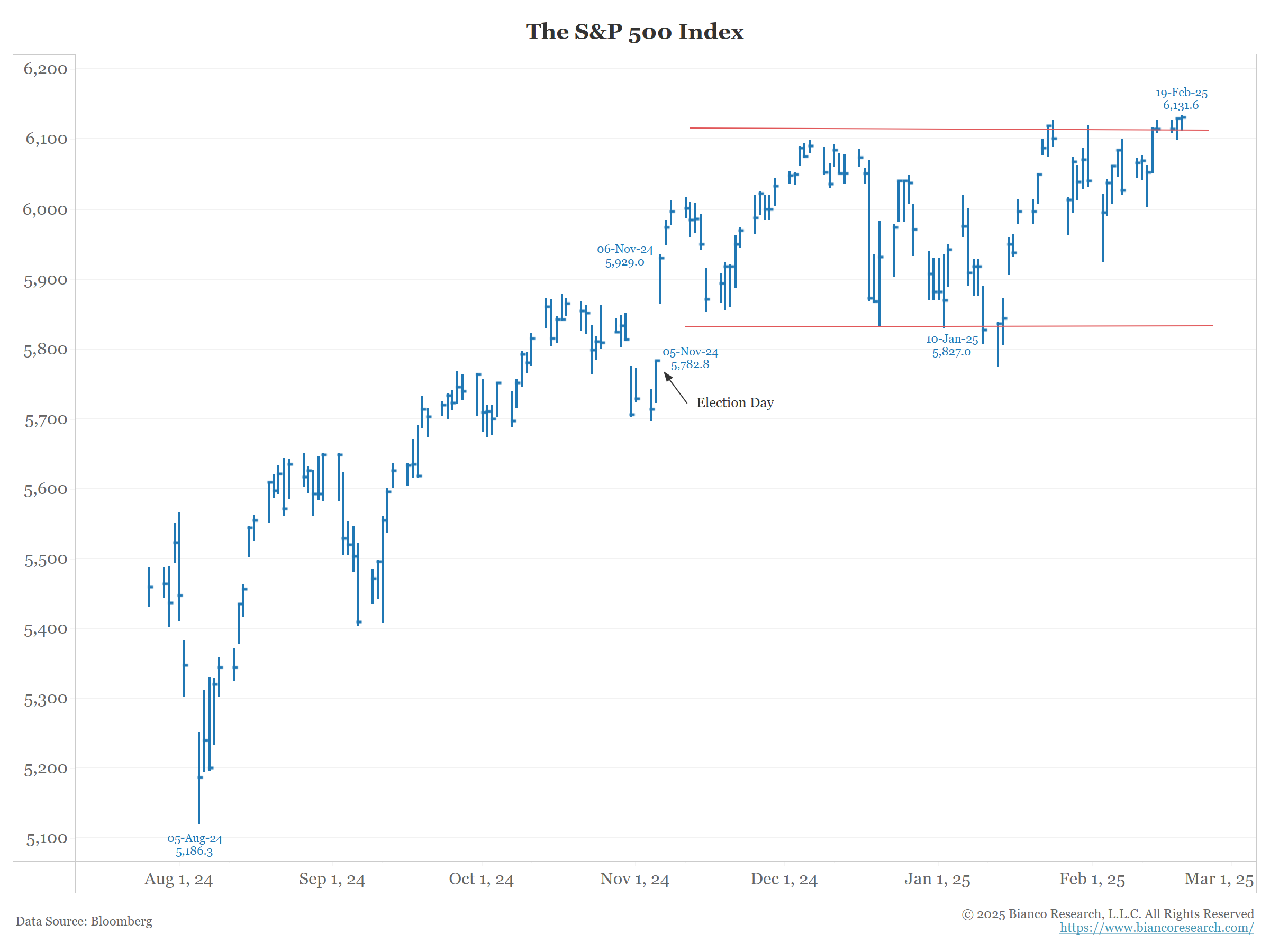

Regarding the stock market, it is at the very top of its recent range (red lines), maybe slightly beyond it. The S&P 500 is effectively unchanged as I write.

Does it break out now, or fail (again) at the top of the post-election range?

In Other News…

USA Today: Tesla rival Nikola files for Chapter 11 bankruptcy citing dire electric vehicle market

Electric vehicle maker Nikola announced on Wednesday that the company filed for Chapter 11 bankruptcy and will pursue the sale of all its assets, citing monetary issues and a struggling and competitive market.

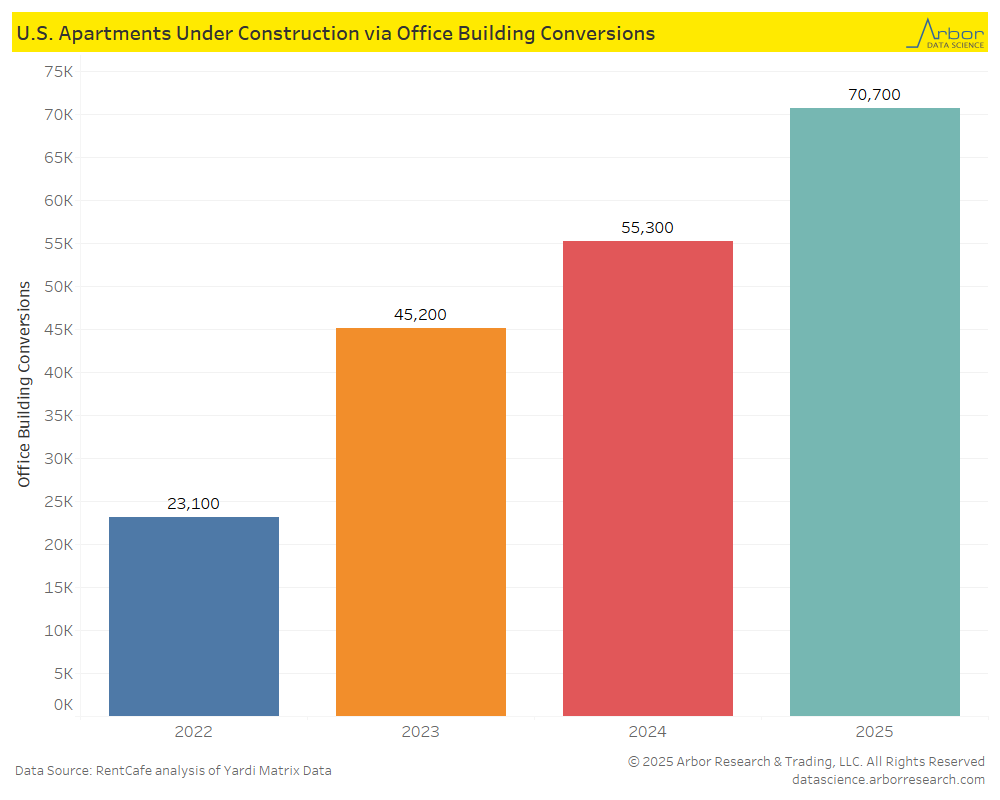

Fast Company: Housing Affordability is so Squeezed that Office-to-Apartment Conversions just Spiked 484%

Pandemic era adoption of work-from-home and hybrid work models has left many office spaces unused, triggering a surge in expired leases and vacant office buildings.

Arbor Data Science:

OilPrice: Tariff Threats Propel Gold Prices to an All-Time High

Gold prices soared to an all-time high on Wednesday after safe haven flows jumped amid U.S. President Donald Trump’s growing tariff threats.

Talking Data: What’s Going on With Gold? featuring Alex Malitas

SupplyChainDive: Tariffs could alter packaging mix, Coca-Cola Says

One possible side effect of tariffs? Shape-shifting packaging.

Upcoming Economic Releases & Fed Speak

- 2/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 2/20/2025 at 08:30am EST: Initial Jobless Claims

- 2/20/2025 at 08:30am EST: Continuing Claims

- 2/20/2025 at 09:35am EST: Goolsbee Speaks in Moderated Q&A

- 2/20/2025 at 10:00am EST: Leading Index

- 2/20/2025 at 12:05pm EST: Musalem Speaks to Economic Club of NY

- 2/20/2025 at 02:30pm EST: Barr Speaks on Supervision and Regulation

- 2/20/2025 at 05:00pm EST: Kugler speaks on Inflation, Phillips Curve

- 2/21/2025 at 05:00pm EST: Bloomberg Feb. United States Economic Survey

- 2/21/2025 at 11:30am EST: Jefferson Speaks on Central Bank Communication

- 2/21/2025 at 09:45am EST: S&P Global US Manufacturing PMI/ Services PMI/ Composite PMI

- 2/21/2025 at 10:00am EST: U of Mich. Sentiment/ Current Conditions/ Expectations

- 2/21/2025 at 10:00am EST: U of Mich. 1 Yr Inflation / 5-10 Year Inflation

- 2/21/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM

- 2/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 2/24/2025 at 2/25/2025 at 08:30am EST: 10:30am EST: Dallas Fed Manf. Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 2/25/2025 at 09:00am EST: FHFA House Price Index MoM & House Price Purchase Index QoQ

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA & S&P CoreLogic CS 20-City YoY NSA

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY NSA

- 2/25/2025 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 2/25/2025 at 10:00am EST: Richmond Fed Manufacturing Index & Richmond Fed Business Conditions

- 2/25/2025 at 10:30am EST: Dallas Fed Services Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 01:00pm EST: Barkin Speaks on Inflation

- 2/26/2025 at 02:00pm EST: Bostic Speaks on Economic Outlook

- 2/26/2025 at 07:00am EST: MBA Mortgage Applications

- 2/26/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 2/26/2025: Fed’s Barkin Repeats Speech on Inflation

- 2/26/2025: Building Permits & Building Permits MoM