US Treasuries

- Thursday’s range for UST 10y: 4.49% – 4.53%, closing at 4.50%

Today’s recap:

- US Treasury Secretary Bessent: US “Long Way” from boosting longer-term debt

- Fed’s Bostic: Sees Two Cuts in 2025 Amid Uncertain Outlook; expects inflation to return to Fed’s 2% target

- Fed’s Goolsbee: PCE inflation reading unlikely to be as ‘sobering’ as CPI

- Fed’s Musalem: Flags risk of rising inflation expectations and stagflation

- Fed’s Barr: Offers parting warnings as he prepares to depart role; Independence of Federal Reserve is critical to meet our statutory mandates and serve the American public

Bloomberg: The Treasury Market Has a Demand Problem: Macroscope

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Conference Call Replay & Notes:

Intraday Commentary from Jim Bianco

Firing Federal Government Workers?

But apparently not here:

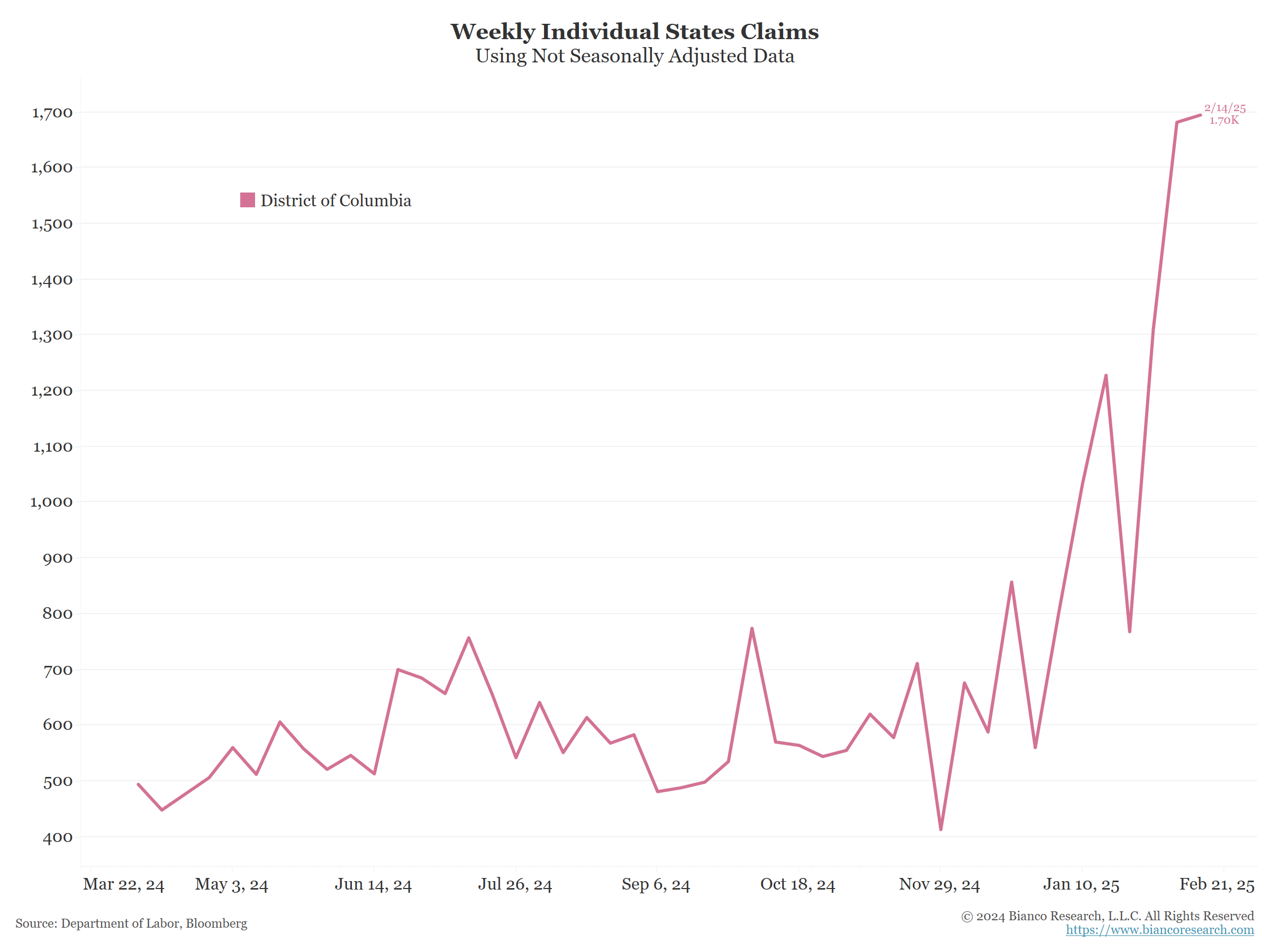

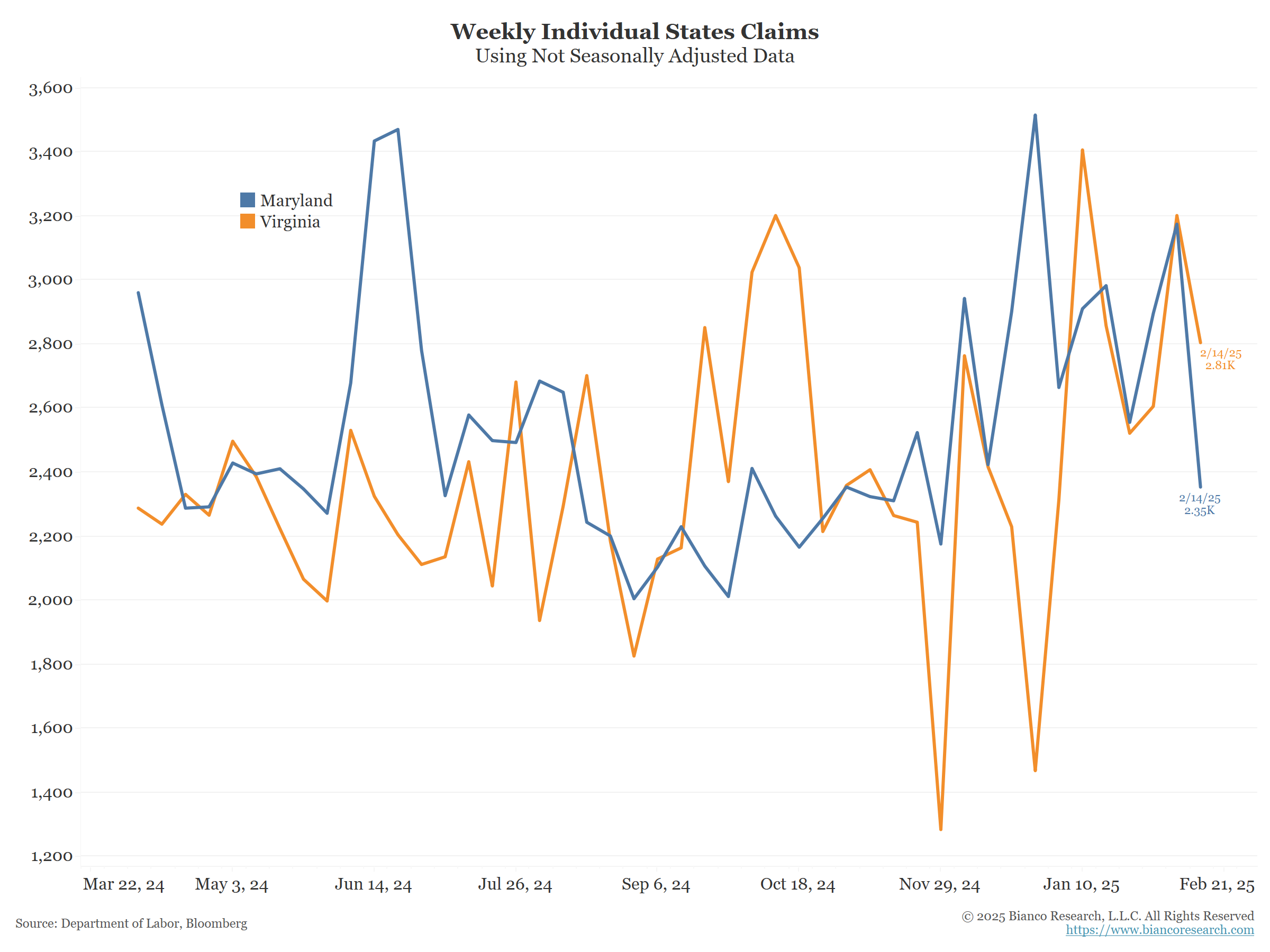

Above I showed the DC and Maryland/Virginia initial claims data. DC is soaring, but it a small number (500 to 1700).

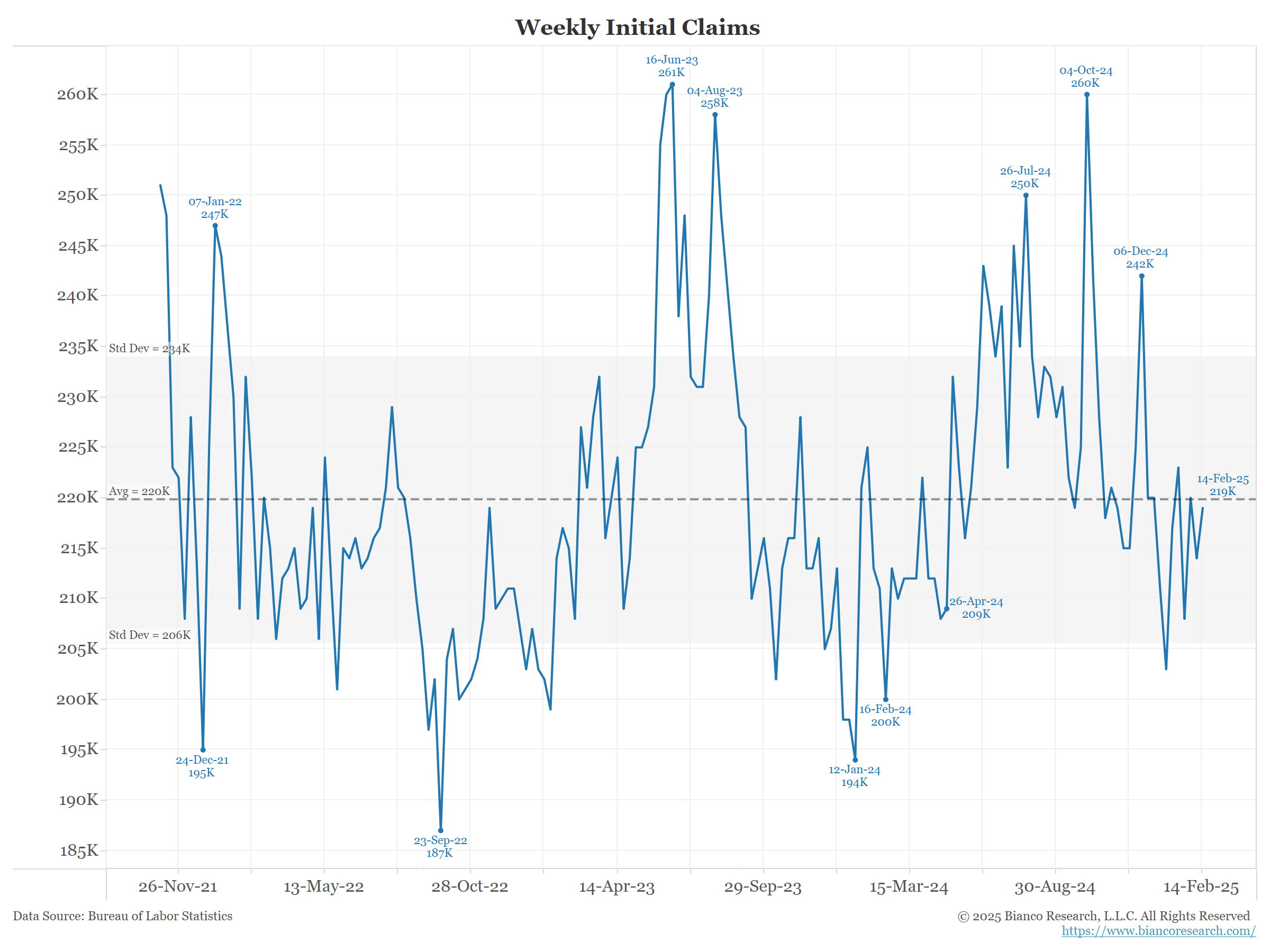

Here is the same chart nationally. It is dead-on it average of the last three years.

The latest reading above is 219k. The four week average is 215k.

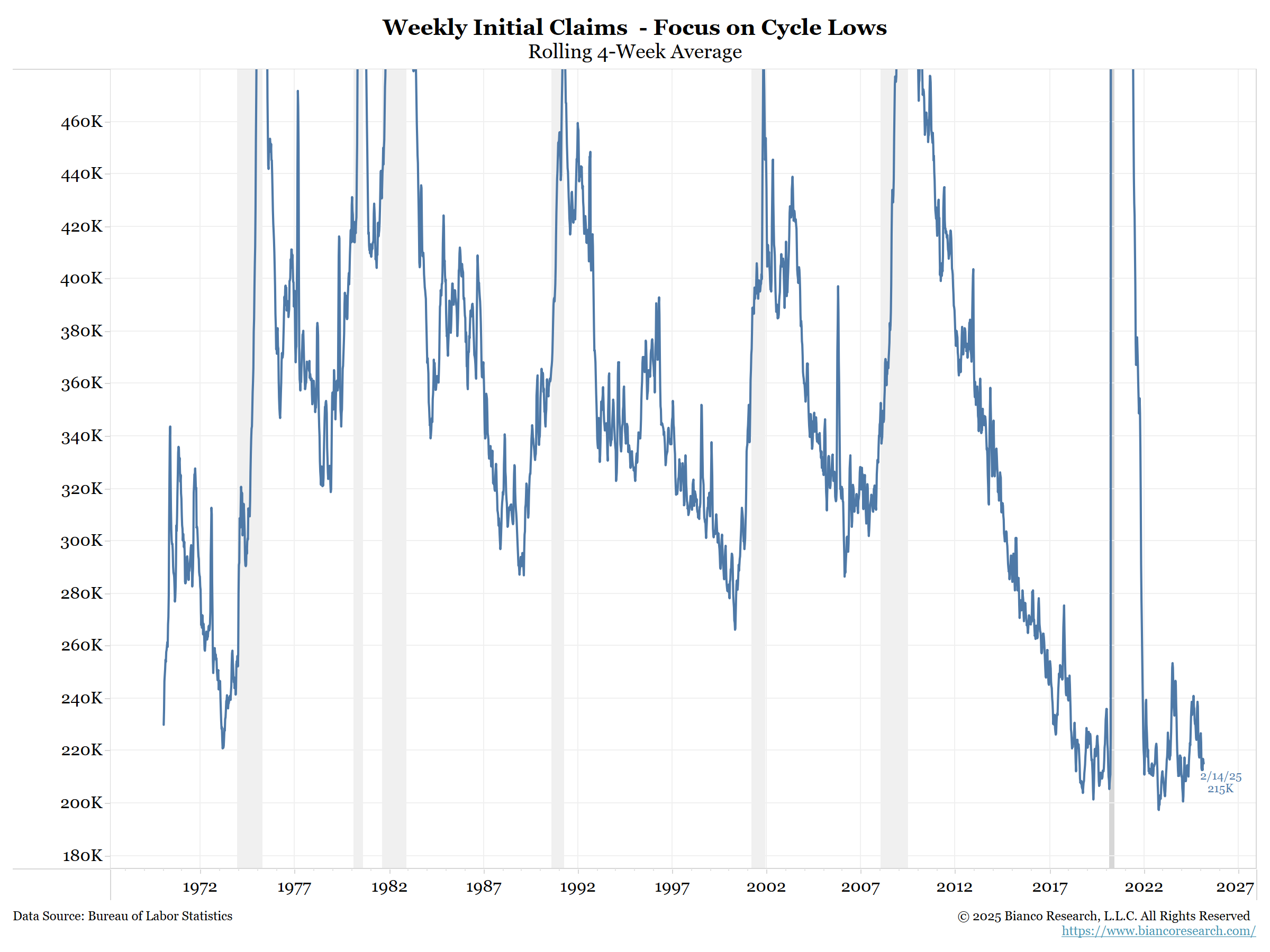

Here is the 4 week average going back 50+ years. I cut of the top to focus on the lows.

215k remains one of the lowest initial claim reading of the last half-century.

In Other News…

ATTOM: Zombie Foreclosures Remain A Small Fraction of U.S. Housing Inventory In First Quarter of 2025

The report also reveals that 212,268 residential properties in the U.S. are in the process of foreclosure in the first quarter of this year, down 1.5 percent from the fourth quarter of last year and down 12.6 percent from the first quarter of 2024.

Among those pre-foreclosure properties, 7,094 sit vacant as zombie foreclosures (pre-foreclosure properties abandoned by owners) in the first quarter of 2025. That figure is virtually the same as in the last quarter, but down 3.3 percent from a year ago.

CBS News: Bird flu confirmed in rats for the first time, USDA reports

Bird flu has been detected in rats for the first time, the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service confirmed Wednesday.

The College Investor: Why Student Loan Borrowers Are Losing 100+ Credit Points

For thousands of federal student loan borrowers, the past few weeks have been a wake-up call. As credit monitoring services send out alerts, many are realizing that their credit scores have dropped by over 100 points—some by as much as 200—due to missed student loan payments.

Bloomberg: Here Are Early Signs of Impact From Trump’s Cuts to Federal Workforce

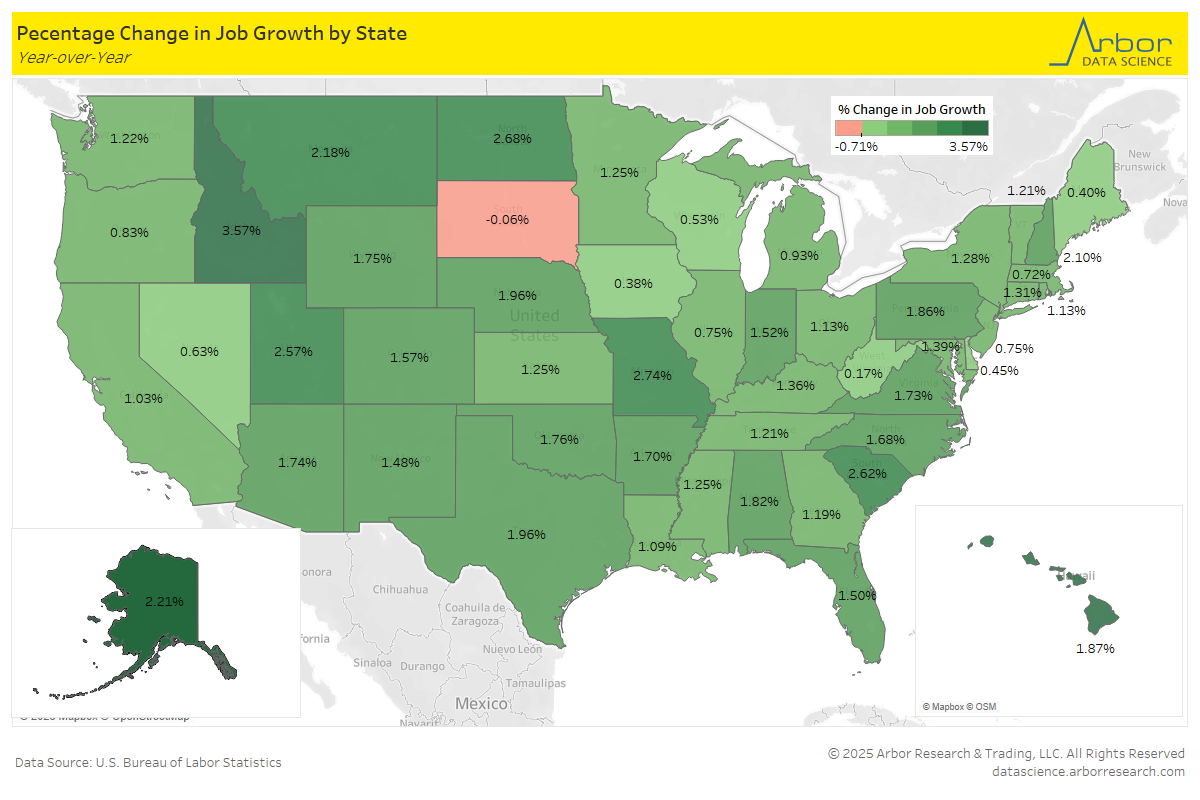

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 2/21/2025 at 05:00pm EST: Bloomberg Feb. United States Economic Survey

- 2/21/2025 at 11:30am EST: Jefferson Speaks on Central Bank Communication

- 2/21/2025 at 09:45am EST: S&P Global US Manufacturing PMI/ Services PMI/ Composite PMI

- 2/21/2025 at 10:00am EST: U of Mich. Sentiment/ Current Conditions/ Expectations

- 2/21/2025 at 10:00am EST: U of Mich. 1 Yr Inflation / 5-10 Year Inflation

- 2/21/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM

- 2/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 2/24/2025 at 2/25/2025 at 08:30am EST: 10:30am EST: Dallas Fed Manf. Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 2/25/2025 at 09:00am EST: FHFA House Price Index MoM & House Price Purchase Index QoQ

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA & S&P CoreLogic CS 20-City YoY NSA

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY NSA

- 2/25/2025 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 2/25/2025 at 10:00am EST: Richmond Fed Manufacturing Index & Richmond Fed Business Conditions

- 2/25/2025 at 10:30am EST: Dallas Fed Services Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 01:00pm EST: Barkin Speaks on Inflation

- 2/26/2025 at 02:00pm EST: Bostic Speaks on Economic Outlook

- 2/26/2025 at 07:00am EST: MBA Mortgage Applications

- 2/26/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 2/26/2025: Fed’s Barkin Repeats Speech on Inflation

- 2/26/2025: Building Permits & Building Permits MoM

- 2/27/2025 at 08:30am EST: GDP Annualized QoQ

- 2/27/2025 at 08:30am EST: Personal Consumption

- 2/27/2025 at 08:30am EST: GDP Price Index

- 2/27/2025 at 08:30am EST: Core PCE Price Index QoQ

- 2/27/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation

- 2/27/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 2/27/2025 at 08:30am EST: Initial Jobless Claims

- 2/27/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air

- 2/27/2025 at 08:30am EST: Continuing Claims

- 2/27/2025 at 10:00am EST: Pending Home Sales MoM and Pending Home Sales NSA YoY

- 2/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 2/27/2025 at 01:15pm EST: Hammack Gives Keynote Speech at Conference

- 2/27/2025 at 03:15pm EST: Harker Gives Speech on Economic Outlook

- 2/27/2025: Barkin Repeats Speech on Inflation