US Treasuries

- Bonds rallied Friday afternoon: Friday’s range for UST 10y: 4.40% – 4.50%, closing at 4.42%

Jim Bianco featured in Bloomberg:

Bloomberg: ‘Mar-a-Lago Accord’ Chatter Is Getting Wall Street’s Attention

It sounds too radical to even warrant a second thought. That President Donald Trump could force some of the US’s foreign creditors to swap their Treasuries into ultra long-term bonds to ease the country’s debt burden.

And yet, that’s what Jim Bianco corralled his clients to discuss on Thursday after rumors of a so-called ‘Mar-a-Lago Accord’ began making the rounds.

Yesterday’s Conference Call (along with notes) is linked here: The Mar-a-Lago Accord

Bloomberg’s Liz Cap McCormick details the Mar-A-Lago Accords & Recaps Jim Bianco’s Conference Call:

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

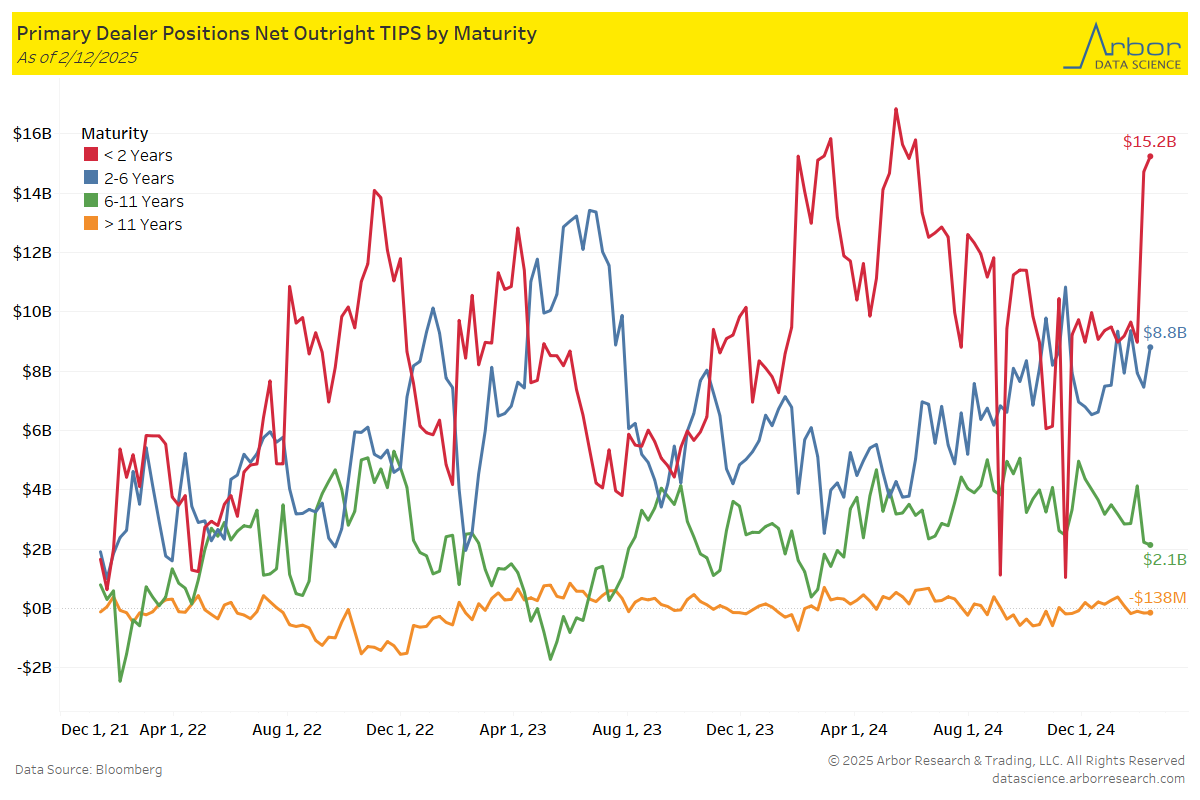

TIPS by Maturity

Week over Week Changes by Maturity

- < 2 years: $14.7 Bn on 2/5/25 to $15.2 Bn on 2/12/25 = $0.52 Bn

- 2 – 6 years: $7.5 Bn on 2/5/25 to $8.8 Bn on 2/12/25 = $1.3 Bn

- 6 – 11 years: $2.2 Bn on 2/5/25 to $2.1 Bn on 2/12/25 = ($0.90 Bn)

- > 11 years: ($151 Mn) on 2/5/25 to ($138 Mn) on 2/12/25 = ($13 Mn)

Intraday Commentary from Jim Bianco

AI is inflationary!

A couple of days ago I posted this chart. Noting the S&P 500 was at the very top of its post-election rage (upper red line). I asked will it break out?

Two days later the answer is no.

Bloomberg: Fed’s Jefferson Says AI Speeds Impact of Policy on Asset Prices

Jim Bianco:

- It is all Trump fault. See Austan Goolsbee’s headlines yesterday (via BB)

*GOOLSBEE: NERVOUS ABOUT ANYTHING THAT LOOKS LIKE SUPPLY SHOCK

*GOOLSBEE: IF BIG DEPORTATIONS, DIRECT IMPACT ON JOBS CREATED

- And when they cannot torture logic and reasoning enough to blame Trump, then they will mumble the letters “AI” and say that’s the cause for results they do not like.

—

Jefferson said that, for now, he doesn’t think artificial intelligence is changing the way policymakers communicate. He also offered a cautionary note about the technology.

—

Automatic textual analysis has been around for at least a decade. We call it “algo trading.” None of this is new. It may be better (it always gets better over time), but it is not new.

- When things go right, send the FOMC to Oslo to get the Nobel Prize in economics.

- When things go wrong, “orange man bad” and AI is at fault, NEVER the Fed!!

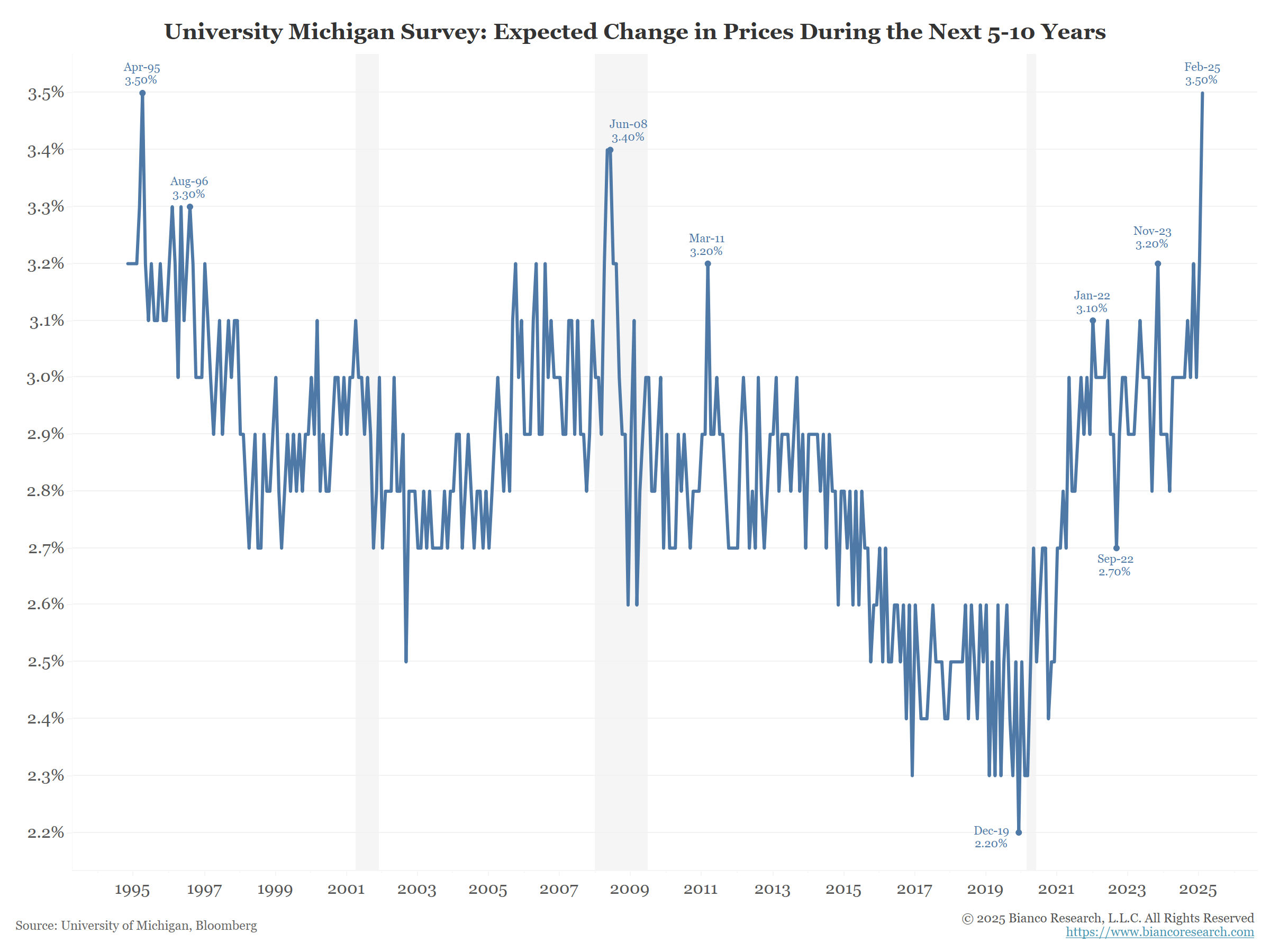

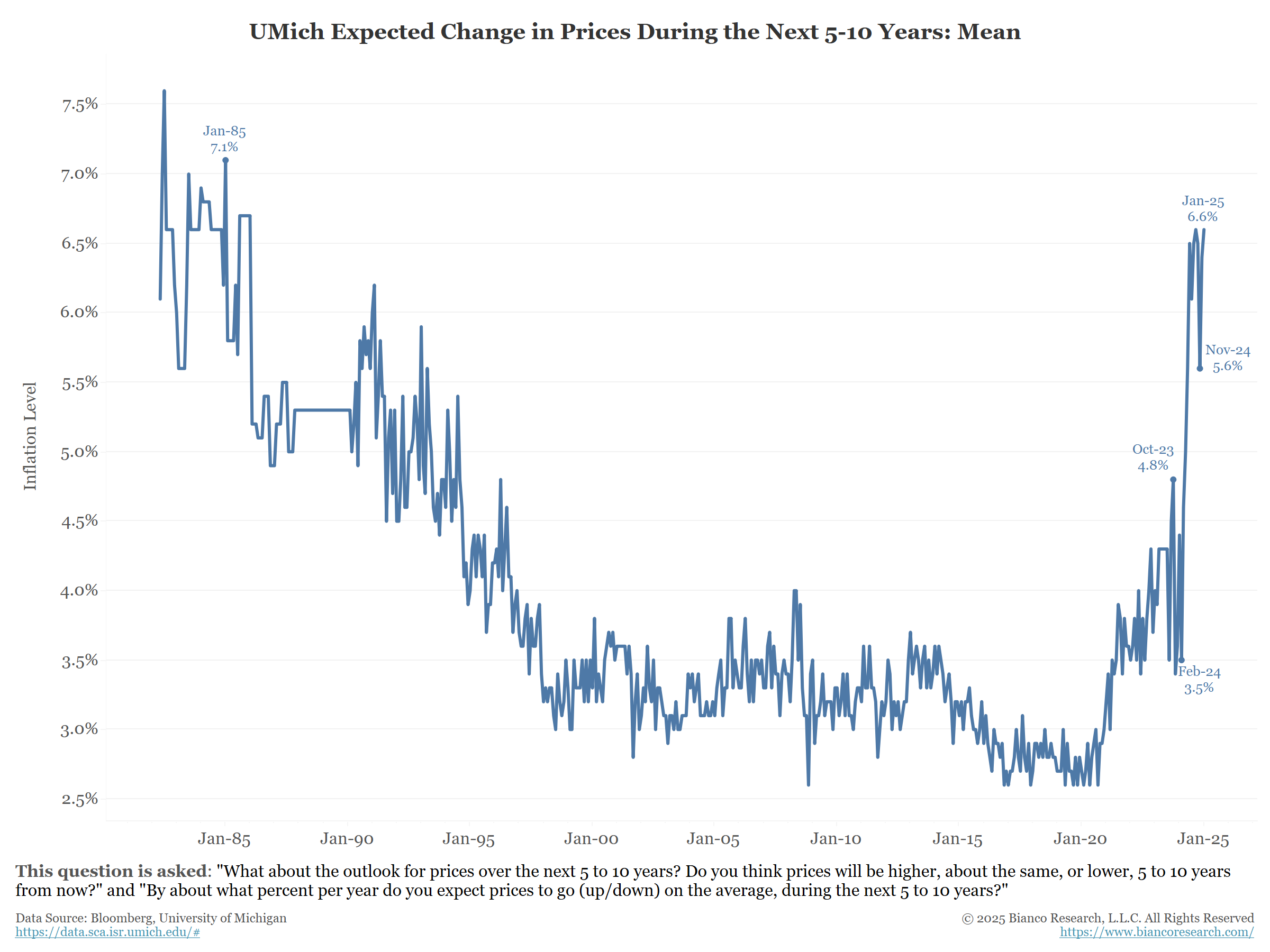

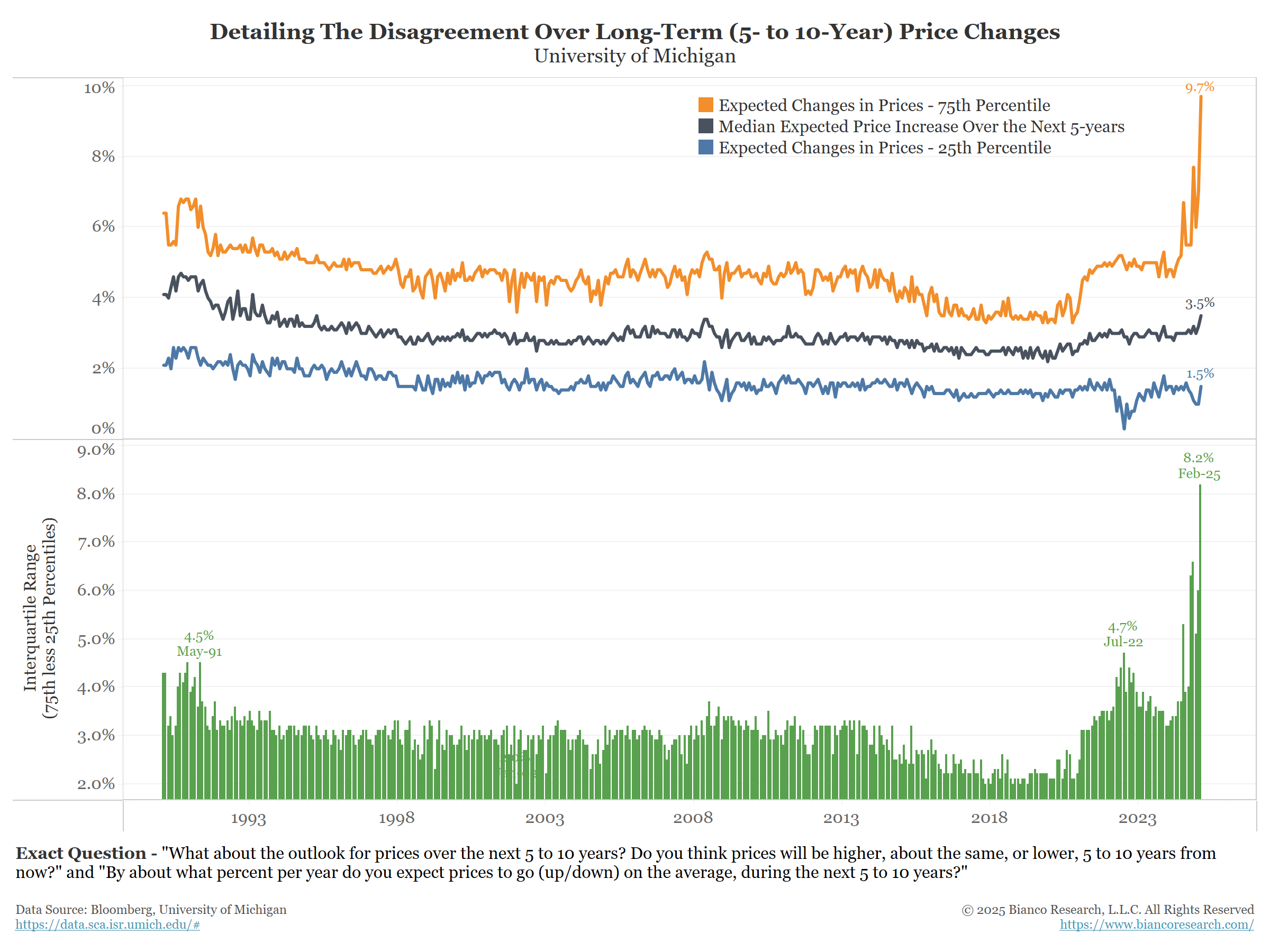

The University of Michigan 5-year inflation expectations for February was out this morning.

A new 30-year high. Can you say “unanchored” inflation?

In Other News…

WSJ: The Wild Economics Behind Ferrari’s Domination of the Luxury Car Market

Limiting production is helping to make its sports cars coveted- and the company the most valuable automaker in Europe

WardsAuto: Auto Market Thrives Despite Rising Inventories, Economic and Political Pressures

Fretting about possible tariffs that would impact the U.S. automotive retail market is understandable, but for now, J.D. Power reports strong market growth.

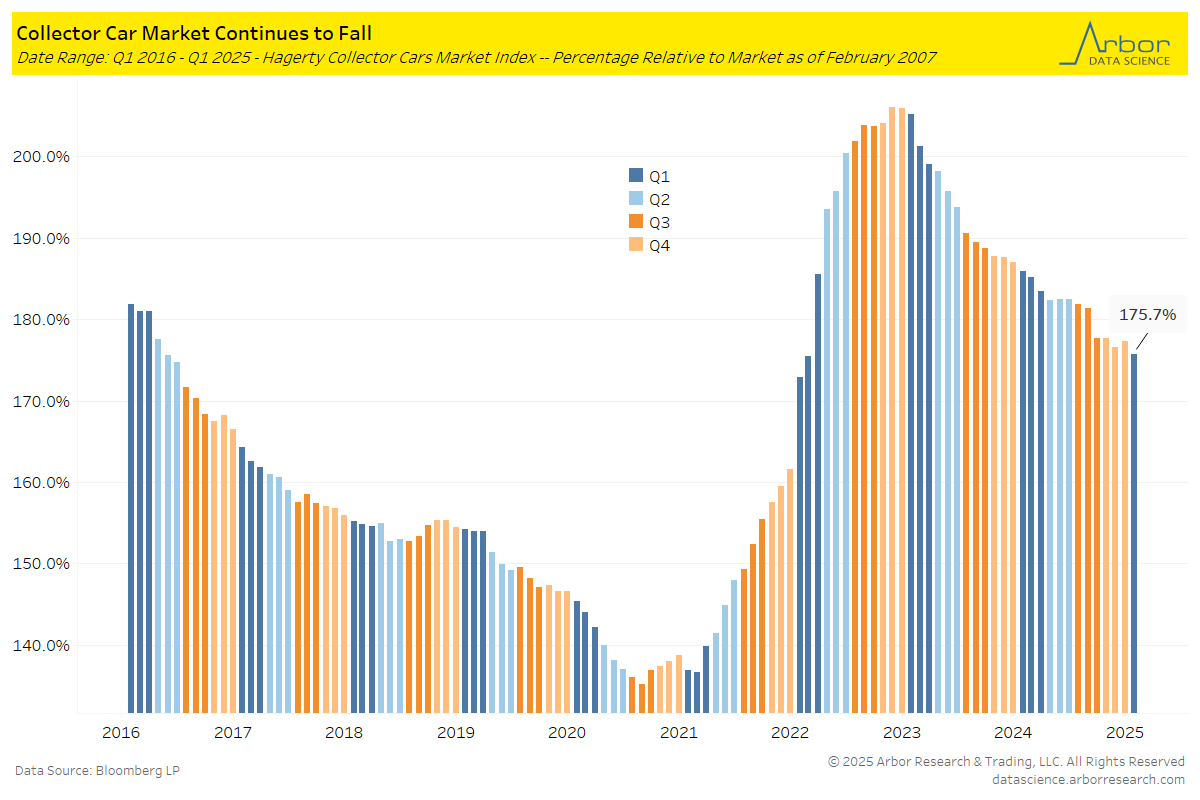

Arbor Data Science: Luxury Cars: Another Duration Asset by Petr Pinkhasov

Upcoming Economic Releases & Fed Speak

- 2/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 2/24/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 2/25/2025 at 04:20am EST: Logan Speaks at Balance Sheet Conference

- 2/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 2/25/2025 at 09:00am EST: FHFA House Price Index MoM & House Price Purchase Index QoQ

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA & S&P CoreLogic CS 20-City YoY NSA

- 2/25/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY NSA

- 2/25/2025 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 2/25/2025 at 10:00am EST: Richmond Fed Manufacturing Index & Richmond Fed Business Conditions

- 2/25/2025 at 10:30am EST: Dallas Fed Services Activity

- 2/25/2025 at 11:45am EST: Barr Gives Remarks on Financial Stability with Q&A

- 2/25/2025 at 01:00pm EST: Barkin Speaks on Inflation

- 2/26/2025 at 07:00am EST: MBA Mortgage Applications

- 2/26/2025: at 08:30am EST: Barkin Repeats Speech on Inflation

- 2/26/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 2/26/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook, Housing

- 2/26/2025: Building Permits & Building Permits MoM

- 2/27/2025 at 08:30am EST: GDP Annualized QoQ

- 2/27/2025 at 08:30am EST: Personal Consumption

- 2/27/2025 at 08:30am EST: GDP Price Index

- 2/27/2025 at 08:30am EST: Core PCE Price Index QoQ

- 2/27/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation

- 2/27/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 2/27/2025 at 08:30am EST: Initial Jobless Claims

- 2/27/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air

- 2/27/2025 at 08:30am EST: Continuing Claims

- 2/27/2025 at 09:15am EST: Schmid Gives Remarks at USDA Event

- 2/27/2025 at 10:00am EST: Pending Home Sales MoM and Pending Home Sales NSA YoY

- 2/27/2025 at 10:00am EST: Barr Speaks on Novel Activity Supevision

- 2/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 2/27/2025 at 11:45am EST: Bowman Speaks on Community Banking

- 2/27/2025 at 01:15pm EST: Hammack Gives Keynote Speech at Conference

- 2/27/2025 at 03:15pm EST: Harker Gives Speech on Economic Outlook

- 2/27/2025: Barkin Repeats Speech on Inflation

- 2/28/2025 at 08:30am EST: Advance Goods Trade Balance & Retail Inventories

- 2/28/2025 at 08:30am EST: Personal Income & Personal Spending

- 2/28/2025 at 08:30am EST: Real Personal Spending & Wholesale Inventories MoM

- 2/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 2/28/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 2/28/2025 at 09:45am EST: MNI Chicago PMI

- 2/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 2/28/2025 at 10:15pm EST: Goolsbee Speaks in Moderated Q&A