US Treasuries

- Tuesday’s range for UST 10y: 4.28% – 4.38%, closing at 4.29%

- Fed’s Logan: backs shortening maturity of central bank’s balance sheet

- Fed’s Barr: says monetary policy ‘Inextricably’ tied to stability

- Fed’s Barkin: says appropriate for Fed to remain ‘Modestly Restrictive’

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco in the Media: Unveiling the Mar-A-Lago Accord: Jim Bianco Has Been Out In Front of this Topic for Weeks…. Podcast in Newsclips tomorrow following up on this hot topic

Bloomberg’s Odd Lots: Jim Bianco Explains the “Mar-a-Lago Accord’

Will the Trump administration attempt to reorder the international financial system?

The so-called “Mar-a-Lago Accord” has suddenly become a hot topic on Wall Street, with some investors and analysts starting to take the idea more seriously, holding meetings with clients and publishing research notes about the rumored plan.

On this episode, we speak with Jim Bianco, president and founder of Bianco Research, who has been briefing his clients about the possibilities.

Intraday Commentary from Jim Bianco

In Other News…

Institutional Investor: Most Endowment Returns Aren’t High Enough to Cover Universities’ Costs

Executive recruiter Charles Skorina, who also tracks the business, said endowments must return 8 percent annually to generate enough investment earnings to cover their costs and only 42 of 119 funds with more than $1 billion in assets have achieved that. The average return for the entire group was 7.7 percent.

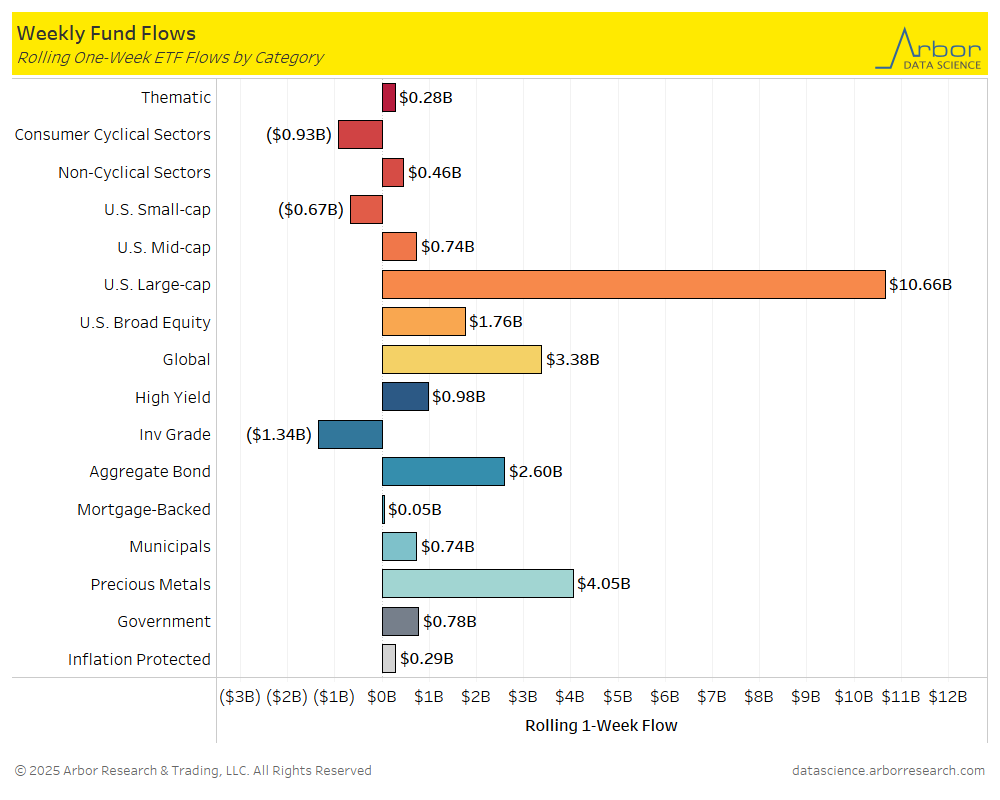

Arbor Data Science: Investor Flows – U.S. Large Cap ETF Inflows Gain Traction

SupplyChainBrain: U.S. Companies’ Responses to Tariff Threats Vary Widely

The corporate responses to a looming trade war are currently ranging from doomsday predictions of huge losses, to commitments to onshore manufacturing operations.

Axios: Texas, Mississippi have the most detained immigrants

Facilities in Mississippi and Texas are holding the most detainees among the tens of thousands who’ve been rounded up across the nation during the ongoing crackdown on illegal immigration, according to newly released federal data.

Upcoming Economic Releases & Fed Speak

- 2/26/2025 at 07:00am EST: MBA Mortgage Applications

- 2/26/2025: at 08:30am EST: Barkin Repeats Speech on Inflation

- 2/26/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 2/26/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook, Housing

- 2/26/2025: Building Permits & Building Permits MoM

- 2/27/2025 at 08:00am: Barkin Repeats Speech on Inflation

- 2/27/2025 at 08:30am EST: GDP Annualized QoQ

- 2/27/2025 at 08:30am EST: Personal Consumption

- 2/27/2025 at 08:30am EST: GDP Price Index

- 2/27/2025 at 08:30am EST: Core PCE Price Index QoQ

- 2/27/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation

- 2/27/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 2/27/2025 at 08:30am EST: Initial Jobless Claims

- 2/27/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air

- 2/27/2025 at 08:30am EST: Continuing Claims

- 2/27/2025 at 09:15am EST: Schmid Gives Remarks at USDA Event

- 2/27/2025 at 10:00am EST: Pending Home Sales MoM and Pending Home Sales NSA YoY

- 2/27/2025 at 10:00am EST: Barr Speaks on Novel Activity Supevision

- 2/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 2/27/2025 at 11:45am EST: Bowman Speaks on Community Banking

- 2/27/2025 at 01:15pm EST: Hammack Gives Keynote Speech at Conference

- 2/27/2025 at 03:15pm EST: Harker Gives Speech on Economic Outlook

- 2/28/2025 at 08:30am EST: Advance Goods Trade Balance & Retail Inventories

- 2/28/2025 at 08:30am EST: Personal Income & Personal Spending

- 2/28/2025 at 08:30am EST: Real Personal Spending & Wholesale Inventories MoM

- 2/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 2/28/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 2/28/2025 at 09:45am EST: MNI Chicago PMI

- 2/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 2/28/2025 at 10:15pm EST: Goolsbee Speaks in Moderated Q&A

- 3/03/2025 at 9:45am EST: S&P Global US Manufacturing PMI

- 3/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 3/03/2025 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 3/03/2025: Wards Total Vehicle Sales

- 3/03/2025 at 12:35pm EST: Musalem Speaks on Economy, Policy

- 3/04/2025 at 02:20pm EST: Williams Speaks at Bloomberg Invest Forum

- 3/04/2025: Barkin Repeats Speech on Inflation