US Treasuries

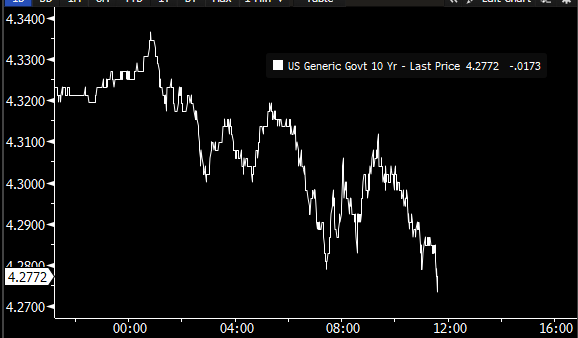

- Wednesday’s range for UST 10y: 4.245% – 4.335%, closing at 4.25%

- Fed’s Bostic: says rates need to remain in restrictive territory

Bloomberg: Treasury Investors Anticipate Fed Shift Back to Growth Risks

“Bonds are responding to the potential of lower supply,” Jim Bianco, president and macro strategist at Bianco Research, said on Bloomberg Television. “Now whether that happens, that’s for later this year. And whether that’s stimulative or inflationary, that’s for later this year.”

Jim Bianco in the Media today:

Jim Bianco joins Bloomberg to discuss the Mar-A-Lago Accord

Jim Bianco joins Bloomberg Radio to discuss Sticky Inflation, Fed Policy, Global Economy, Earnings

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Agency Bullets

- > 3 years quiet today, just 4 issues tracing

- New TVA 30s trading at +58

Intraday Commentary from Jim Bianco

“Bonds are responding to the potential of lower supply,” Jim Bianco, president and macro strategist at Bianco Research, said on Bloomberg Television. “Now whether that happens, that’s for later this year. And whether that’s stimulative or inflationary, that’s for later this year.”

Regarding the quote above …Here is what Trump said last month:

Roll Call (January 23, 2025) Speech: Donald Trump Delivers Remarks Via Video at the World Economic Forum – January 23, 2025

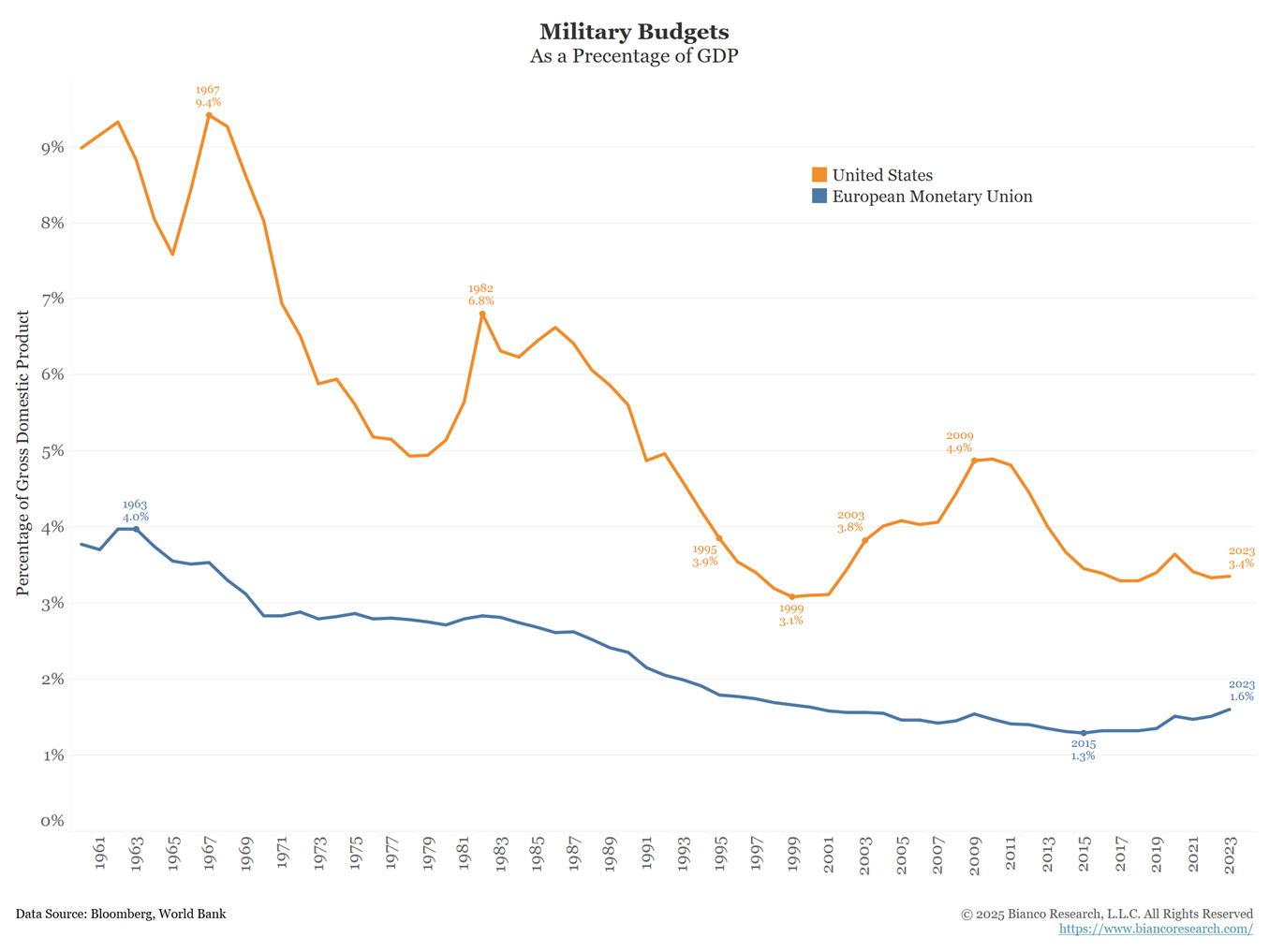

Trump: Finally, as we restore common sense in America, we’re moving quickly to bring back strength and peace and stability abroad. I’m also going to ask all NATO nations to increase defense spending to 5 percent of GDP, which is what it should have been years ago. It was only at 2 percent, and most nations didn’t pay until I came along. I insisted that they pay, and they did, because the United States was really paying the difference at that time, and it was unfair to the United States. But many, many things have been unfair for many years to the United States.

Here is a chart of what Trump was arguing. Source: The World Bank

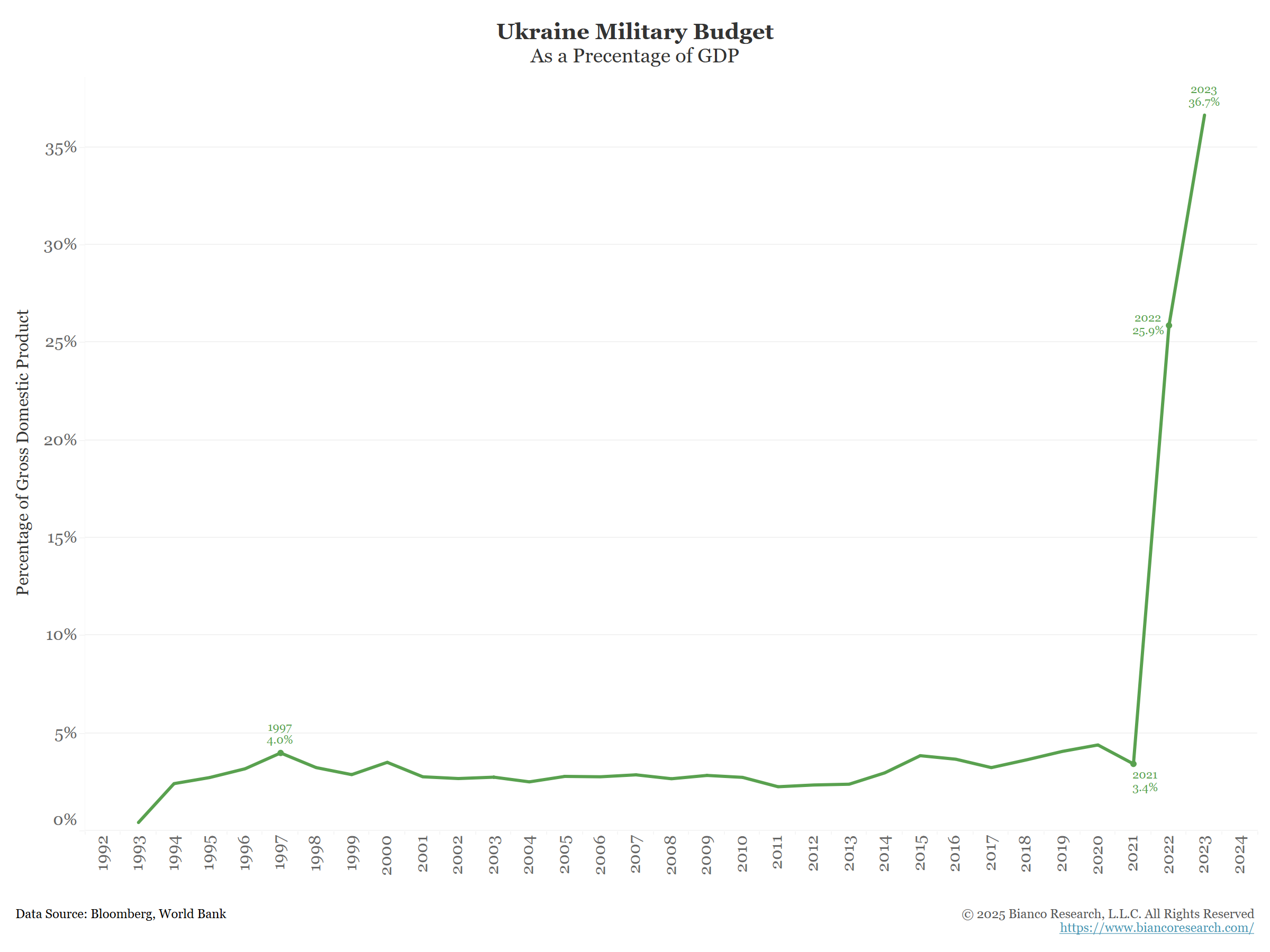

And Europe is stepping up some headlines …

Bloomberg: Germany Discussing €200 Billion for Emergency Defense Fund

Germany’s chancellor-in-waiting Friedrich Merz has opened talks with the Social Democrats to quickly approve as much as €200 billion ($210 billion) in special defense spending, according to a person familiar with those discussions.

Jim Bianco: Barely a month past Trump’s Davos speech and they are talking abut $3 trillion in spending.

Bloomberg: Europe Has a $3 Trillion Defense Dilemma Worthy of Hamlet

Jim Bianco:

And now Germany is willing to suspend their “debt brake” which prevents them from deficit spend. German election winner Friedrich Merz is looking at using the outgoing parliament to lift the country’s strict “debt brake” before newly elected far-right and far-left lawmakers can take their seats. The manoeuvre would allow the leader of the centre-right Christian Democratic Union to reform the borrowing cap to allow more defense spending.

FT: Friedrich Merz examines using outgoing parliament to loosen debt brake

Jim Bianco:

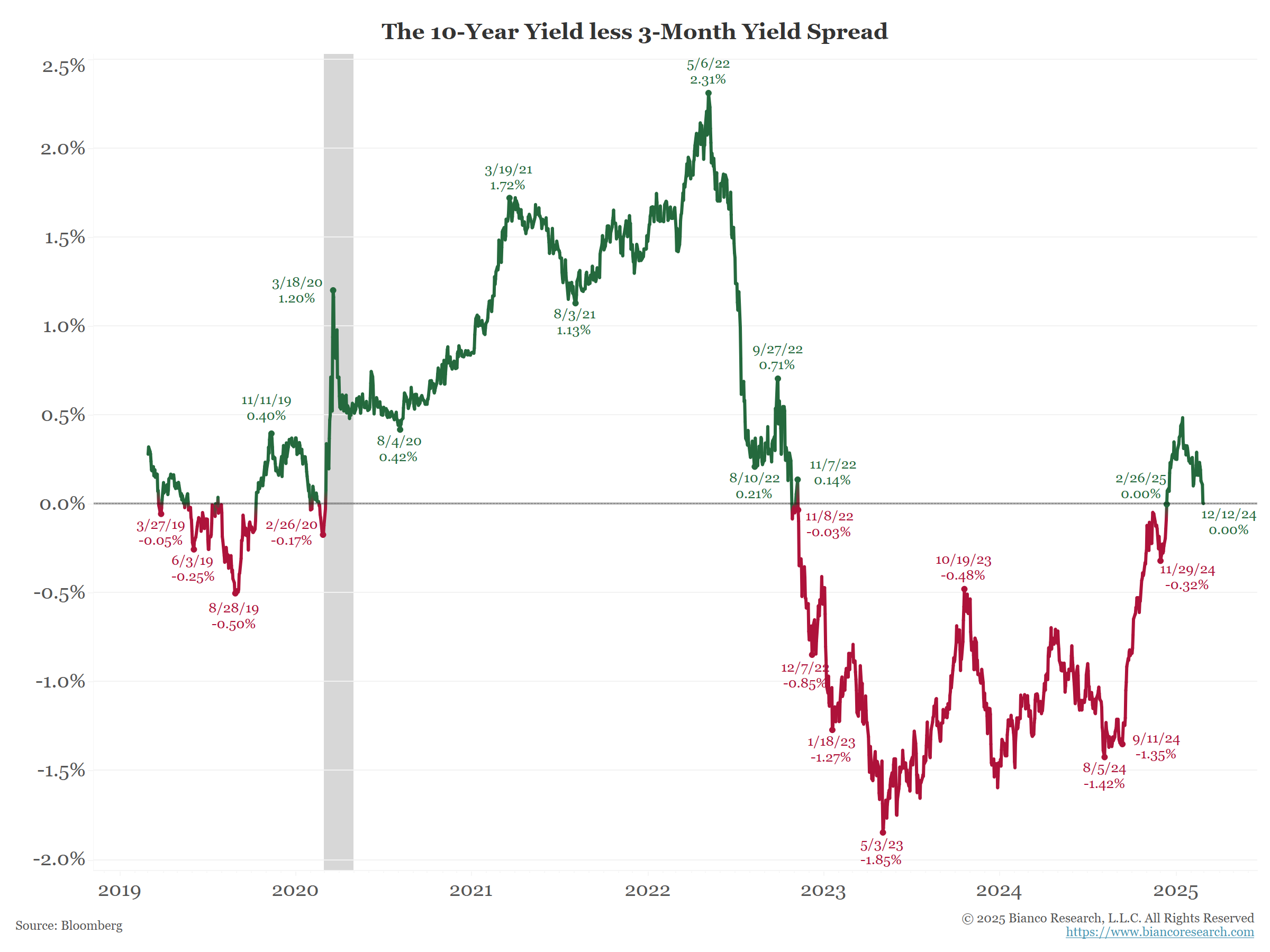

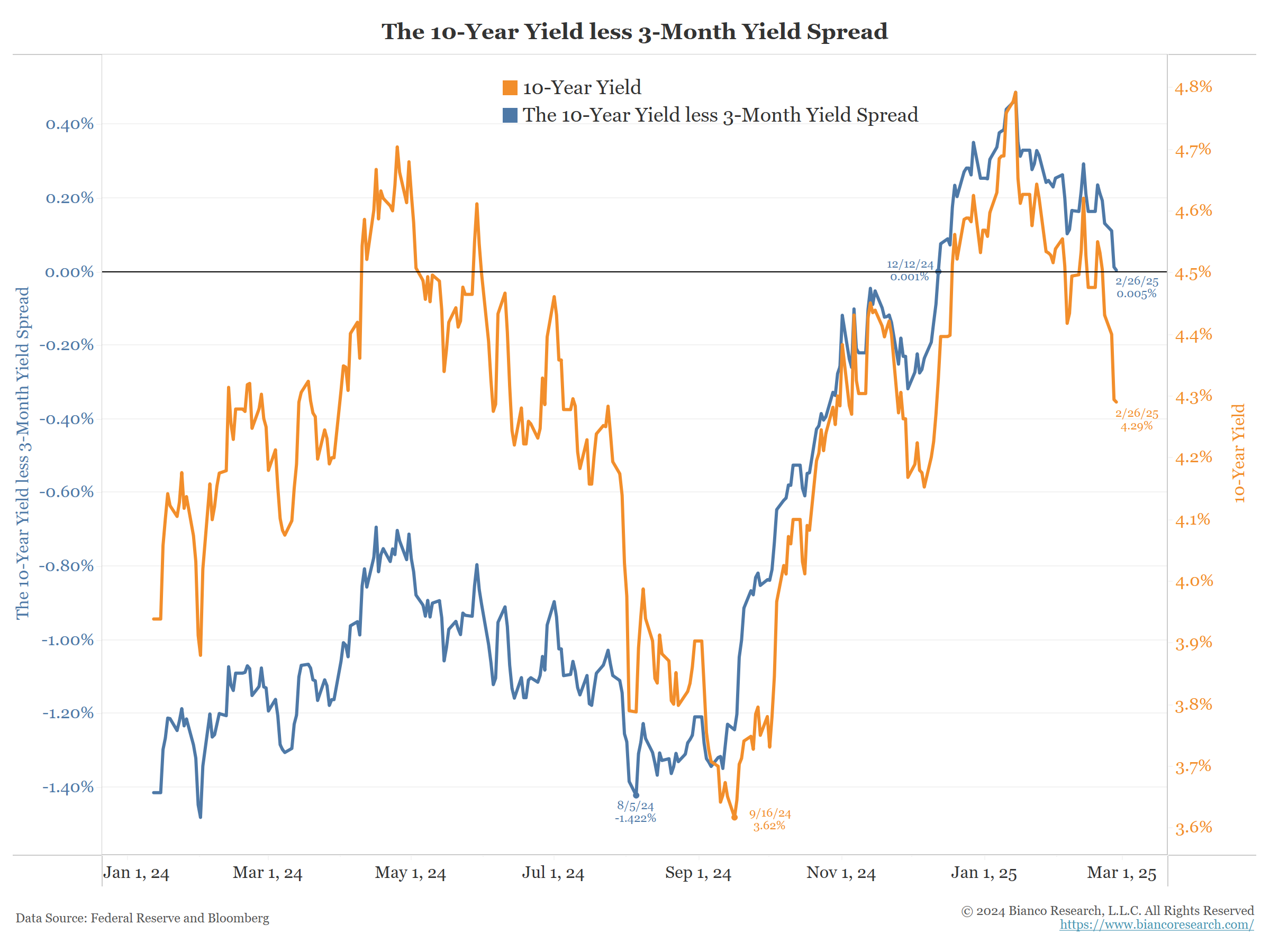

Guess what … the yield curve is inverting AGAIN.

Driving the yield curve inversion (blue) has been falling 10-year yields (orange).

In other words, a bull flattener

Effectively the front end is anchored as the Fed is on hold. So it does not move much. The curve reacts to changes in long rates. And since they are falling, the curve is flattening.

What does it mean? It USED TO mean a recession is coming. But as the first yield curve chart shows, this has not been working the last few years. So, I’m not sure it means anything.

In Other News…

FB: 2024 Farm Bankruptcies Highlight Worsening Farm Credit

Farm Bankruptcies Up 55% From 2023

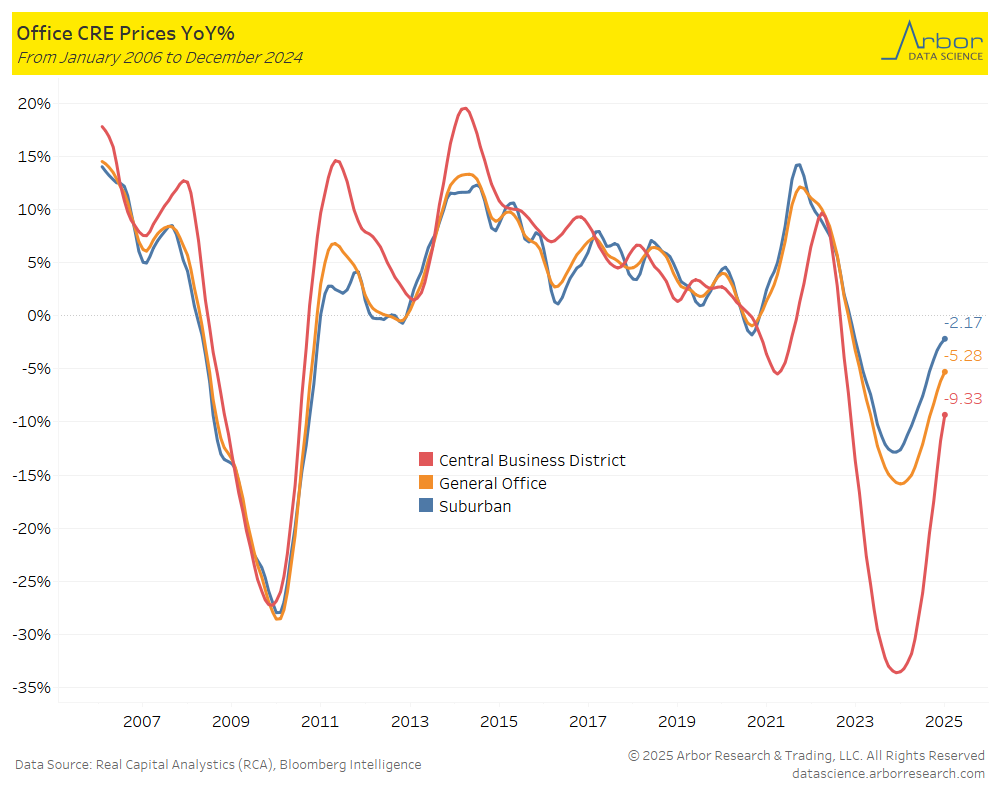

WSJ: The Investor Who Won Big on Zombie Malls Is Going All In on Empty Offices

An investor known for squeezing cash out of dying malls is now trying a similar approach to profit from tanking office towers.

Arbor Data Science:

Bloomberg: US to Boost Egg Imports as Trump Calls Price Surge a ‘Disaster’

The nation will look to import between 70 million and 100 million eggs during the next month or two, the US Department of Agriculture said Wednesday as it announced a five-part plan with $1 billion in funding to address bird flu.

Upcoming Economic Releases & Fed Speak

- 2/27/2025 at 08:00am: Barkin Repeats Speech on Inflation

- 2/27/2025 at 08:30am EST: GDP Annualized QoQ

- 2/27/2025 at 08:30am EST: Personal Consumption

- 2/27/2025 at 08:30am EST: GDP Price Index

- 2/27/2025 at 08:30am EST: Core PCE Price Index QoQ

- 2/27/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation

- 2/27/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 2/27/2025 at 08:30am EST: Initial Jobless Claims

- 2/27/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air

- 2/27/2025 at 08:30am EST: Continuing Claims

- 2/27/2025 at 09:15am EST: Schmid Gives Remarks at USDA Event

- 2/27/2025 at 10:00am EST: Pending Home Sales MoM and Pending Home Sales NSA YoY

- 2/27/2025 at 10:00am EST: Barr Speaks on Novel Activity Supevision

- 2/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 2/27/2025 at 11:45am EST: Bowman Speaks on Community Banking

- 2/27/2025 at 01:15pm EST: Hammack Gives Keynote Speech at Conference

- 2/27/2025 at 03:15pm EST: Harker Gives Speech on Economic Outlook

- 2/28/2025 at 08:30am EST: Advance Goods Trade Balance & Retail Inventories

- 2/28/2025 at 08:30am EST: Personal Income & Personal Spending

- 2/28/2025 at 08:30am EST: Real Personal Spending & Wholesale Inventories MoM

- 2/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 2/28/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 2/28/2025 at 09:45am EST: MNI Chicago PMI

- 2/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 2/28/2025 at 10:15pm EST: Goolsbee Speaks in Moderated Q&A

- 3/03/2025 at 9:45am EST: S&P Global US Manufacturing PMI

- 3/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 3/03/2025 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 3/03/2025: Wards Total Vehicle Sales

- 3/03/2025 at 12:35pm EST: Musalem Speaks on Economy, Policy

- 3/04/2025 at 02:20pm EST: Williams Speaks at Bloomberg Invest Forum

- 3/04/2025: Barkin Repeats Speech on Inflation

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00om EST: Federal Reserve Releases Beige Book