US Treasuries

- Thursday’s range for UST 10y: 4.26% – 4.31%, closing at 4.28%

- Fed’s Schmid: says Fed may need to balance growth concerns, inflation; MBS holdings are influencing 10-year yields by 50-80 bps

- Fed’s Bowman: urges more tailored regulation for Community Banks

- Fed’s Hammack: says rates on hold, not meaningfully restrictive; post-Gfc era of low neutral rates may be an anomaly

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

In Other News…

OilPrice: WTI Jumps to $70 as U.S. Sanctions Rekindle Supply Concerns

Oil prices jumped early on Thursday as concerns about supply with intensified U.S. sanctions on Iran and Venezuela trumped demand woes and the possibility of peace in Ukraine.

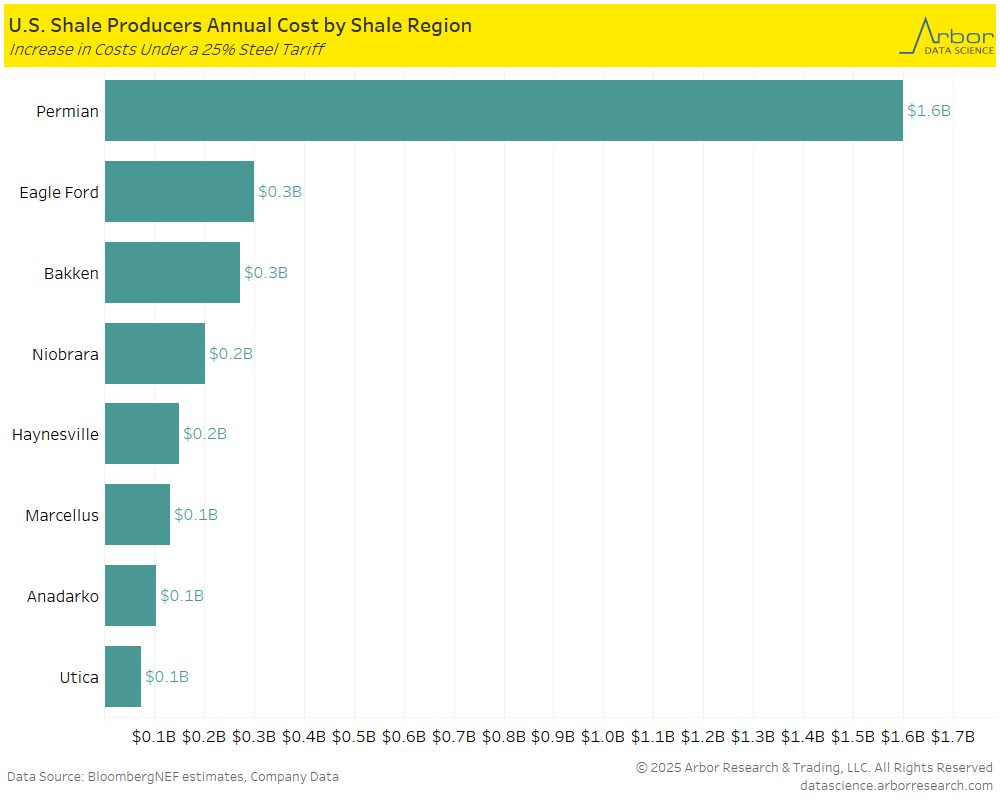

Arbor Data Science: The Hidden Oil Tariffs by Sam Rines

With the tariff headlines dominating the financial news, it is worth putting some perspective on the indirect effects.

Sea Intelligence: Volume shift from East to West Coast in 2024-2H

Up until the end of 2022, the trend was a downwards one, moving in favour of the East Coast ports.

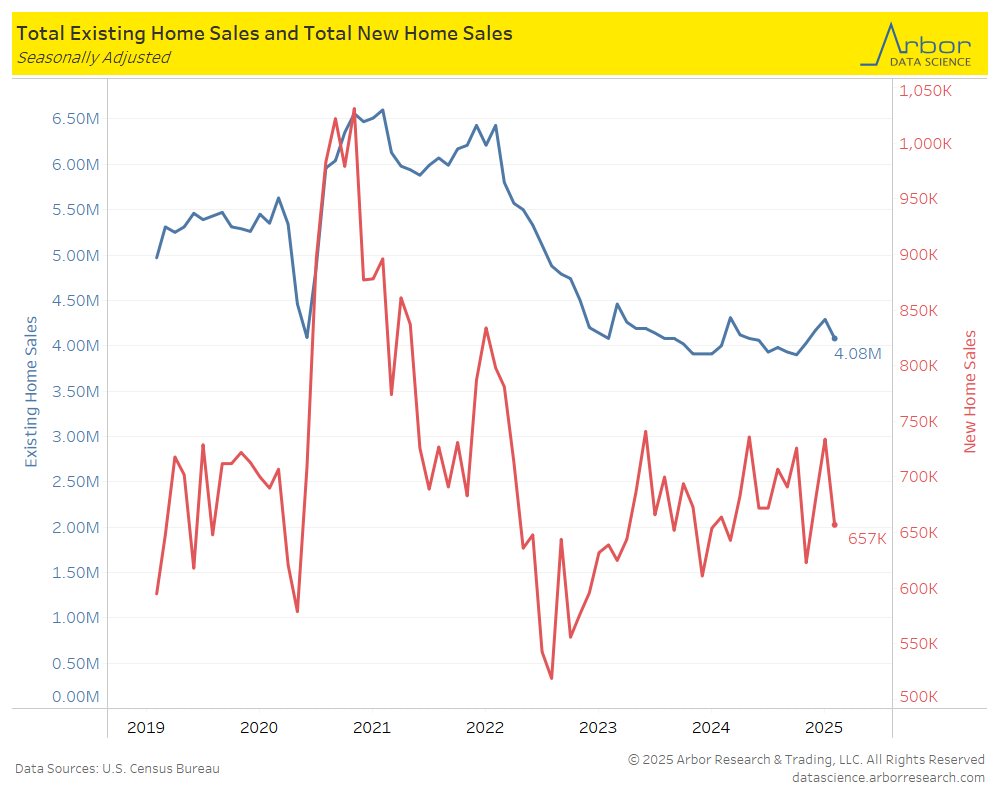

Latest News on Housing…

yahoo!finance: Housing contract activity sinks to all-time low in January amid high rates, cold weather

Pending sales declined in all parts of the country except the Northeast

RedFin: Florida Has More Homes for Sale Than Ever Before

Florida ended January with 172,209 homes for sale—the highest inventory of any month on record. That’s up 22.7% from a year earlier.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 2/28/2025 at 08:30am EST: Advance Goods Trade Balance & Retail Inventories

- 2/28/2025 at 08:30am EST: Personal Income & Personal Spending

- 2/28/2025 at 08:30am EST: Real Personal Spending & Wholesale Inventories MoM

- 2/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 2/28/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 2/28/2025 at 09:45am EST: MNI Chicago PMI

- 2/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 2/28/2025 at 10:15pm EST: Goolsbee Speaks in Moderated Q&A

- 3/03/2025 at 9:45am EST: S&P Global US Manufacturing PMI

- 3/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 3/03/2025 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 3/03/2025: Wards Total Vehicle Sales

- 3/03/2025 at 12:35pm EST: Musalem Speaks on Economy, Policy

- 3/04/2025 at 02:20pm EST: Williams Speaks at Bloomberg Invest Forum

- 3/04/2025: Barkin Repeats Speech on Inflation

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00am EST: Federal Reserve Releases Beige Book

- 3/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 3/06/2025 at 08:30am EST: Trade Balance; Nonfarm Productivity; Unit Labor Costs

- 3/06/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/06/2025 at 10:00am EST: Wholesale Inventories MoM and Wholesale Trade Sales MoM

- 3/06/2025 at 07:00pm EST: Bostic speaks on Economy