US Treasuries

- Friday’s range for UST 10y: 4.21% – 4.27%, closing at 4.23%

- Fed’s Goolsbee: warns against overreliance on productivity gains

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

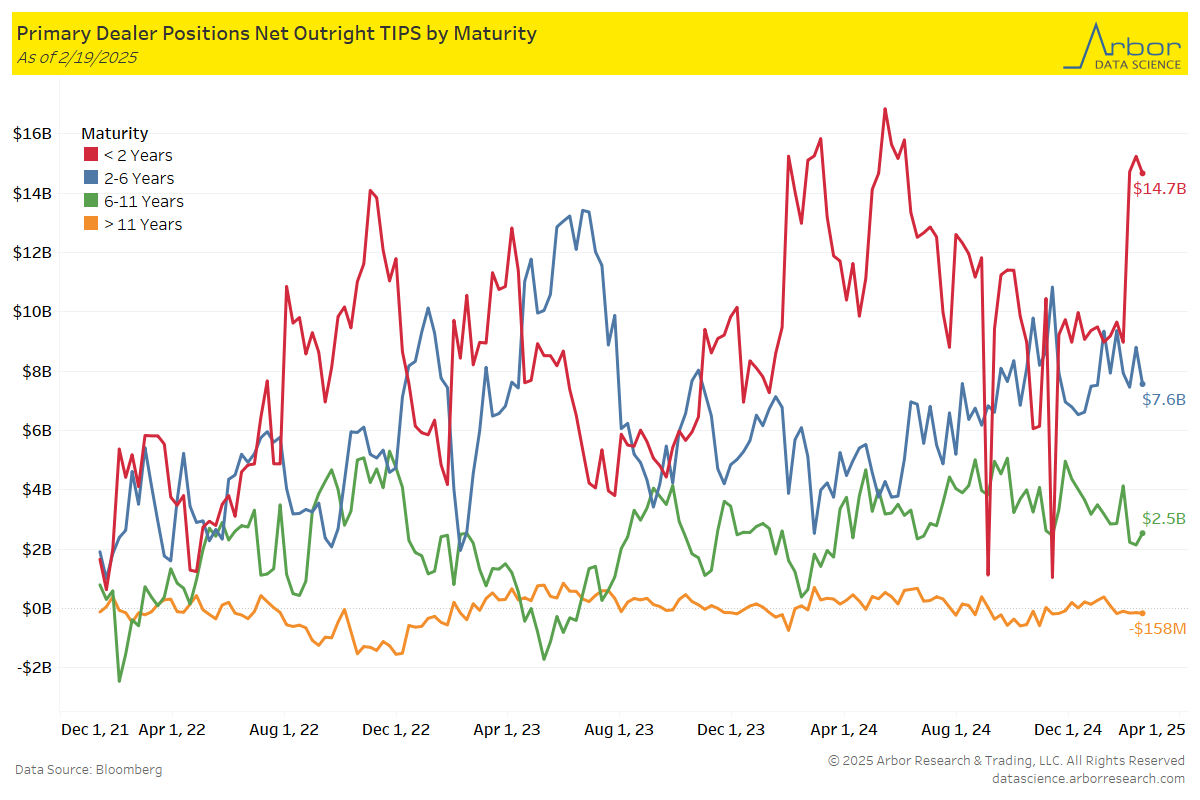

TIPS by Maturity

Week over Week Changes by Maturity

- < 2 years: $15.2 Bn on 2/12/25 to $14.7 Bn on 2/19/25 = ($0.5 Bn)

- 2 – 6 years: $8.8 Bn on 2/12/25 to $7.6 Bn on 2/19/25 = ($1.2 Bn)

- 6 – 11 years: $2.1 Bn on 2/12/25 to $2.5 Bn on 2/19/25 = $0.40 Bn

- > 11 years: ($138 Mn) on 2/12/25 to ($158 Mn) on 2/19/25 = ($20 Mn)

Intraday Commentary from Jim Bianco

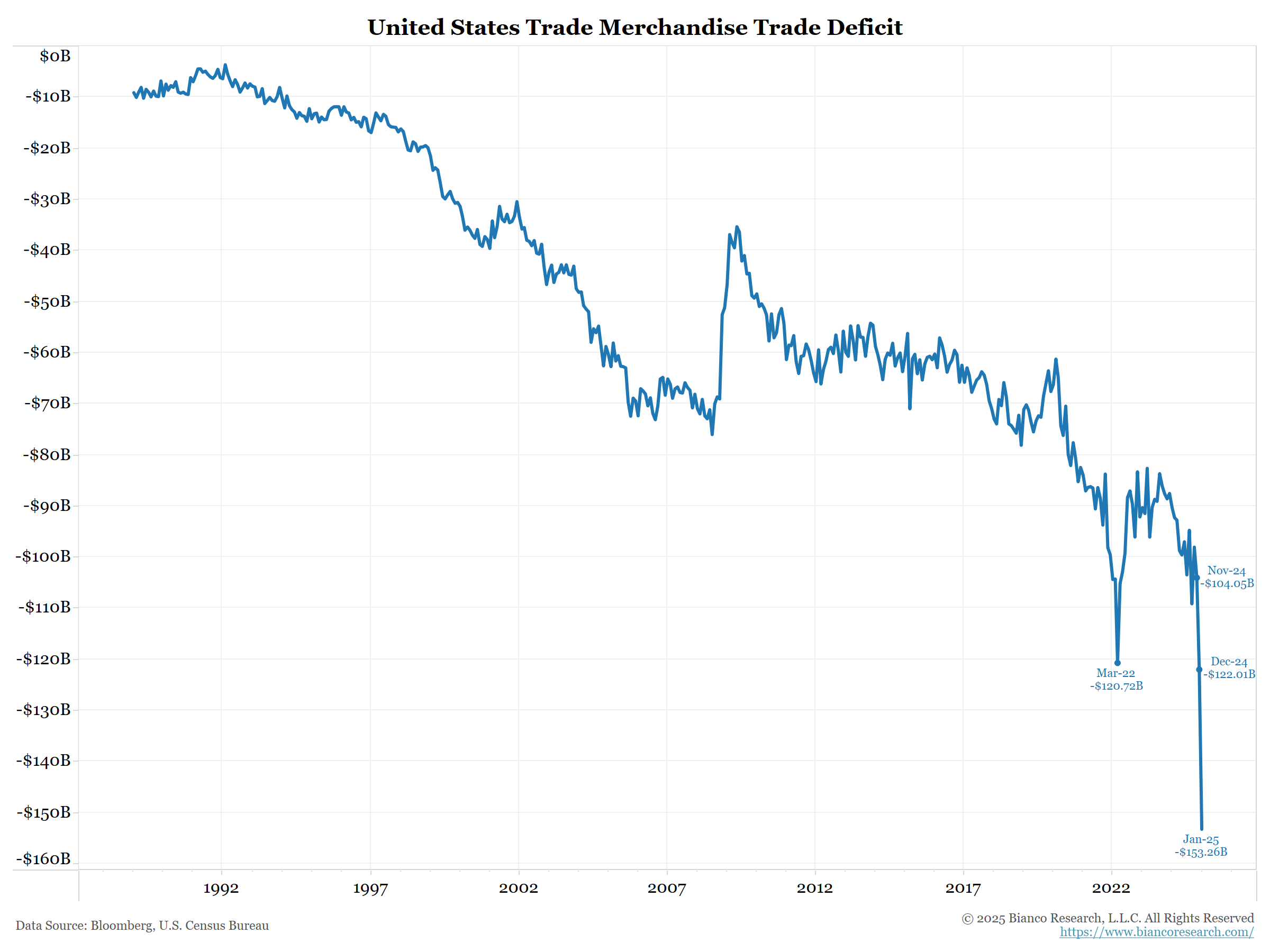

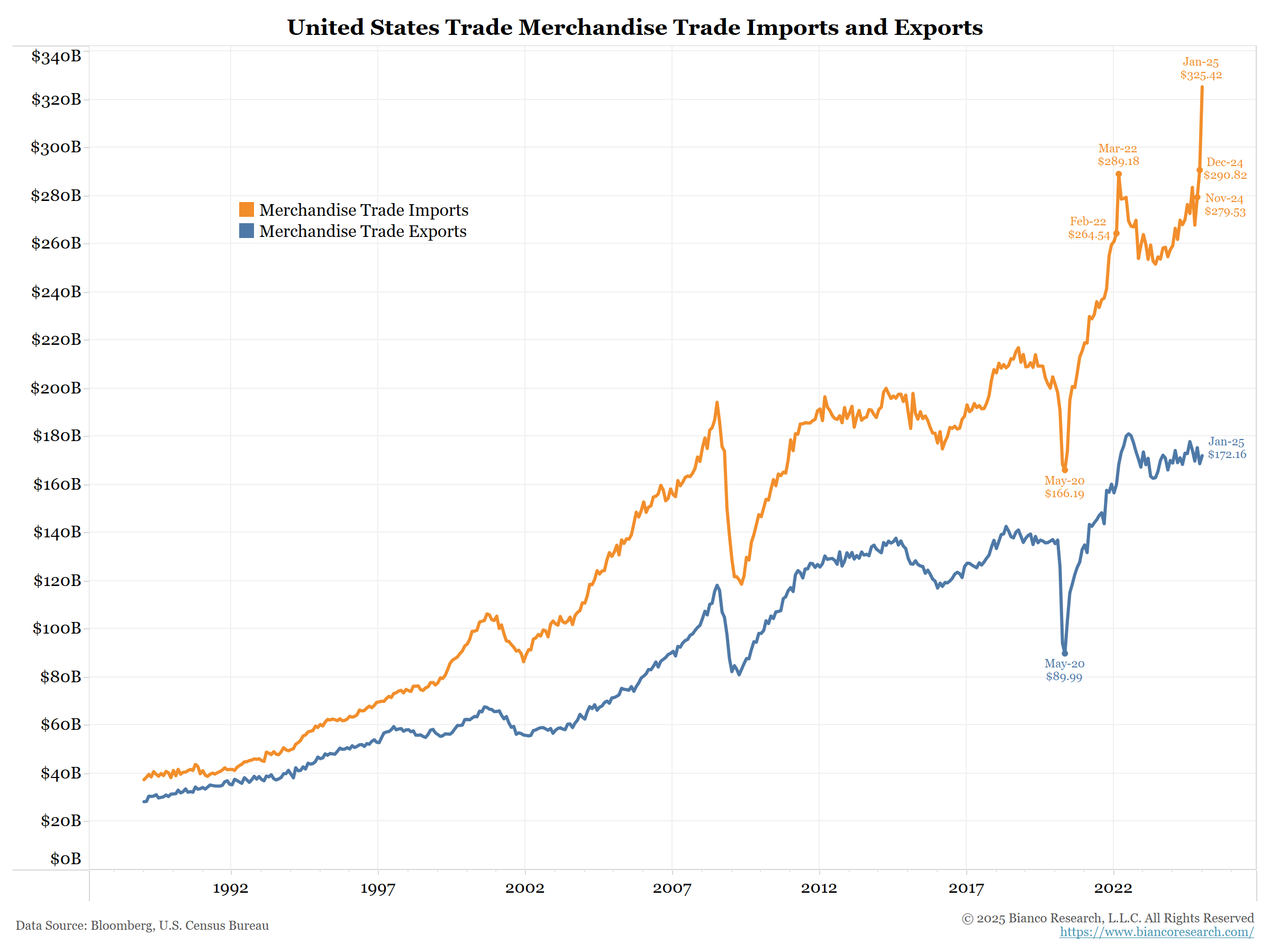

Here is the Merchandise trade deficit. I labeled the last three months to show how much it blew out (and March 2022).

- March 2022 was the start of the Ukraine War and importers rushed imports of products from the Black Sea area (such as grain) ahead of a potential disruption.

- Similarly, the last three months have seen importers rush to bring goods into the country ahead of Trump’s tariffs.

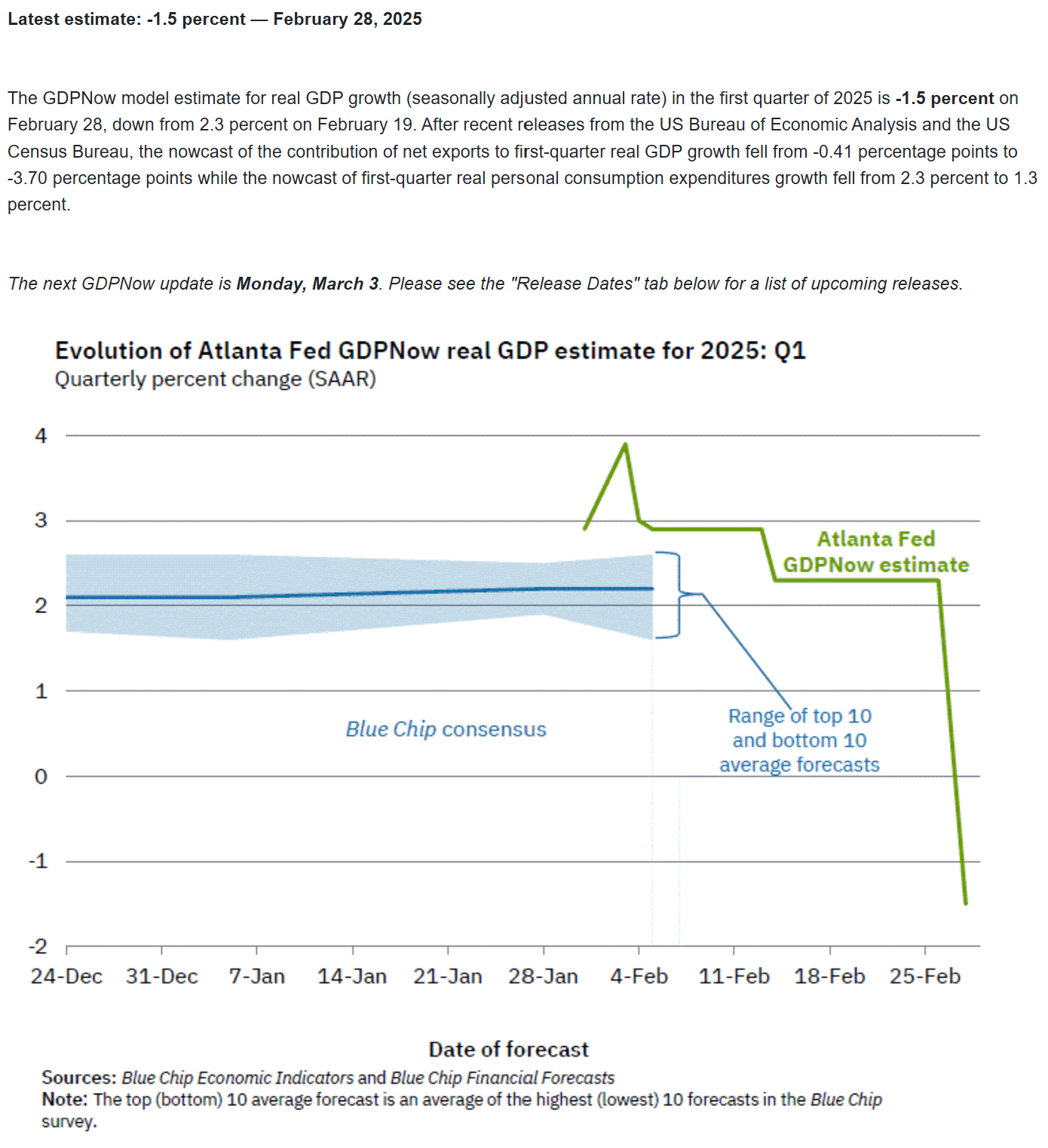

This is evident in the Atlanta Fed GDPnow, which shows it dove to negative territory. The surge in imports dragged the calculation of GDP and drove this decline.

Presumably, this surge will slow and may revert to below-trend levels (as goods are already here), dramatically narrowing the trade deficit, adding back to GDP. The Atlanta Fed GDPnow will reflect this and snap back. This could happen as early as next month or the March report.

In Other News…

Axios: The states that could feel DOGE cuts the most

Federal civilian jobs make up 21% of all nonfarm employment in Washington, D.C. — far more than any state, according to government data analyzed by Pew Research Center.

OilPrice: US Oil, Gas Rig Count Inches Up As Drillers Proceed With Caution

The latest EIA data showed that U.S. crude oil production for the week ending February 21 edged higher to 13.502 million bpd. The figure is still almost 200,000 bpd shy of the all-time high reached during the week of December 6, 2024.

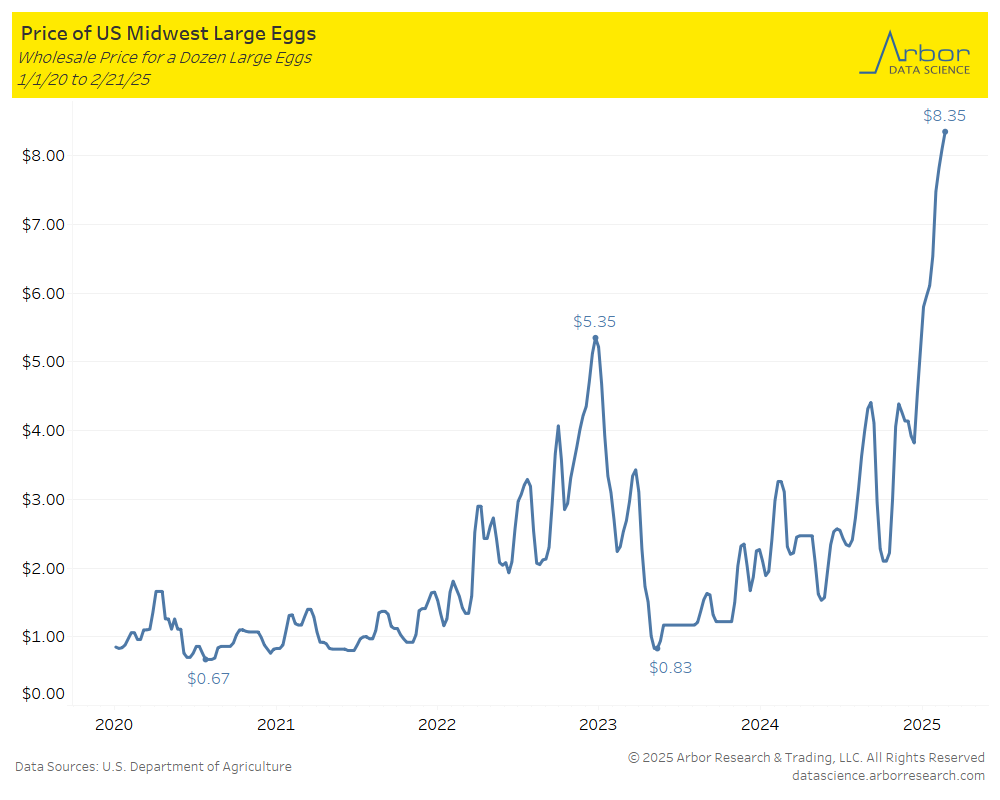

Bloomberg: Walmart CEO Warns Food Prices Are Causing ‘Frustration and Pain’

Higher prices for everything from beef and eggs to fuel present a challenge for retailers including Walmart, which has become one of the world’s largest companies by offering “everyday low prices.”

AP: Egg prices could jump 41% this year, USDA says, as Trump’s bird flu plan is unveiled

The U.S. Agriculture Department predicts record egg prices could soar more than 40% in 2025, as the Trump administration offered the first new details Wednesday about its plan to battle bird flu and ease costs.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 3/03/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 3/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 3/03/2025 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 3/03/2025: Wards Total Vehicle Sales

- 3/03/2025 at 12:35pm EST: Musalem Speaks on Economy, Policy

- 3/04/2025 at 02:20pm EST: Williams Speaks at Bloomberg Invest Forum

- 3/04/2025: Barkin Repeats Speech on Inflation

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00am EST: Federal Reserve Releases Beige Book

- 3/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 3/06/2025 at 08:30am EST: Trade Balance; Nonfarm Productivity; Unit Labor Costs

- 3/06/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/06/2025 at 10:00am EST: Wholesale Inventories MoM and Wholesale Trade Sales MoM

- 3/06/2025 at 07:00pm EST: Bostic speaks on Economy

- 3/07/2025 at 08:30am EST: Change in Nonfarm Payrolls % Two-Month Payroll Net Revision

- 3/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufact. Payrolls

- 3/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly YoY & Average Weekly Hours All Employees

- 3/07/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate & Underemployment Rate

- 3/07/2025 at 10:15am EST: Bowman Speaks on Policy Transmission

- 3/07/2025 at 10:45am EST: Williams Speaks on Panel on Policy Transmission

- 3/07/2025 at 12:20am EST: Kugler Speaks on Rebalancing Labor Markets

- 3/07/2025 at 12:30am EST: Powell Speaks on the Economic Outlook

- 3/07/2025 at 01:00pm EST: Kugler Appears on Panel Discussion

- 3/07/2025 at 03:00pm EST: Consumer Credit