US Treasuries

- Monday’s range for UST 10y: 4.195% – 4.295%, closing at 4.21%

- Bonds rallied driven by a flight to safety over recession fears

Bloomberg: Short-Term Bond ETFs Rake in Billions Amid Recession Alarm Bells

Investors looking for a safe place to hide are shoveling money into ultra-short bond exchange-traded funds as Donald Trump’s economic policies stoke recessionary concerns and a stock-market rout.

The cohort has taken in more than $16 billion so far this year, led by products such as the iShares 0-3 Month Treasury Bond ETF (ticker SGOV), which has seen more than $7 billion come in. The fund took in $1.4 billion last week alone, its largest inflow on record, data compiled by Bloomberg show.

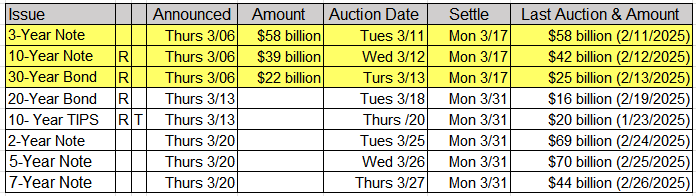

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary from Jim Bianco

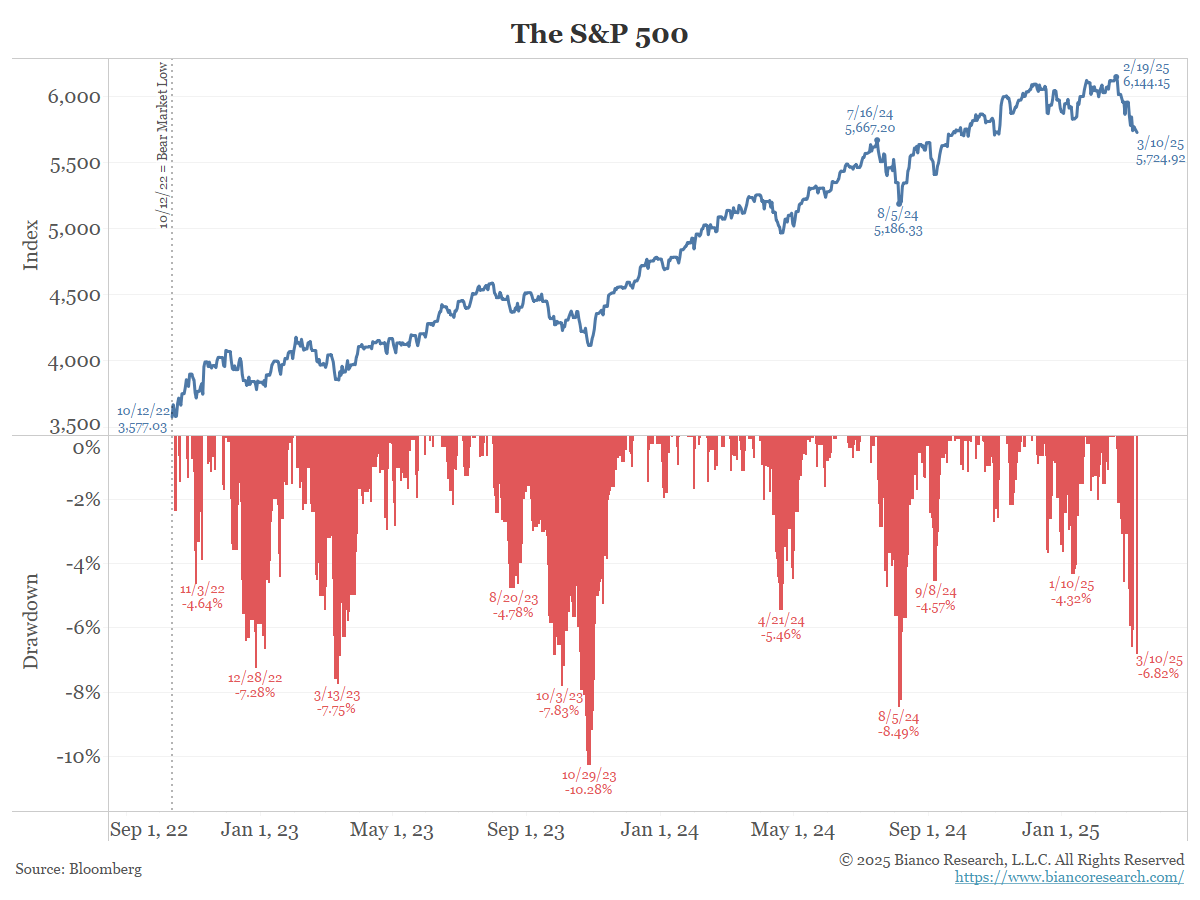

Here is a drawdown chart of the S&P 500. I updated its March 10 level to where it is currently trading pre-market. The correction now is just less than 7%.

There was a similar correction in August (yen carry trade unwound scare), one similar in April, October 2023 was a 10% correction (5% 10-year yields), March 2023 (SVB) failure) and December 2022.

In other words, in the last 2.5 years, there have been five corrections of 5% to 10%. Or about one every 6 to 7 months.

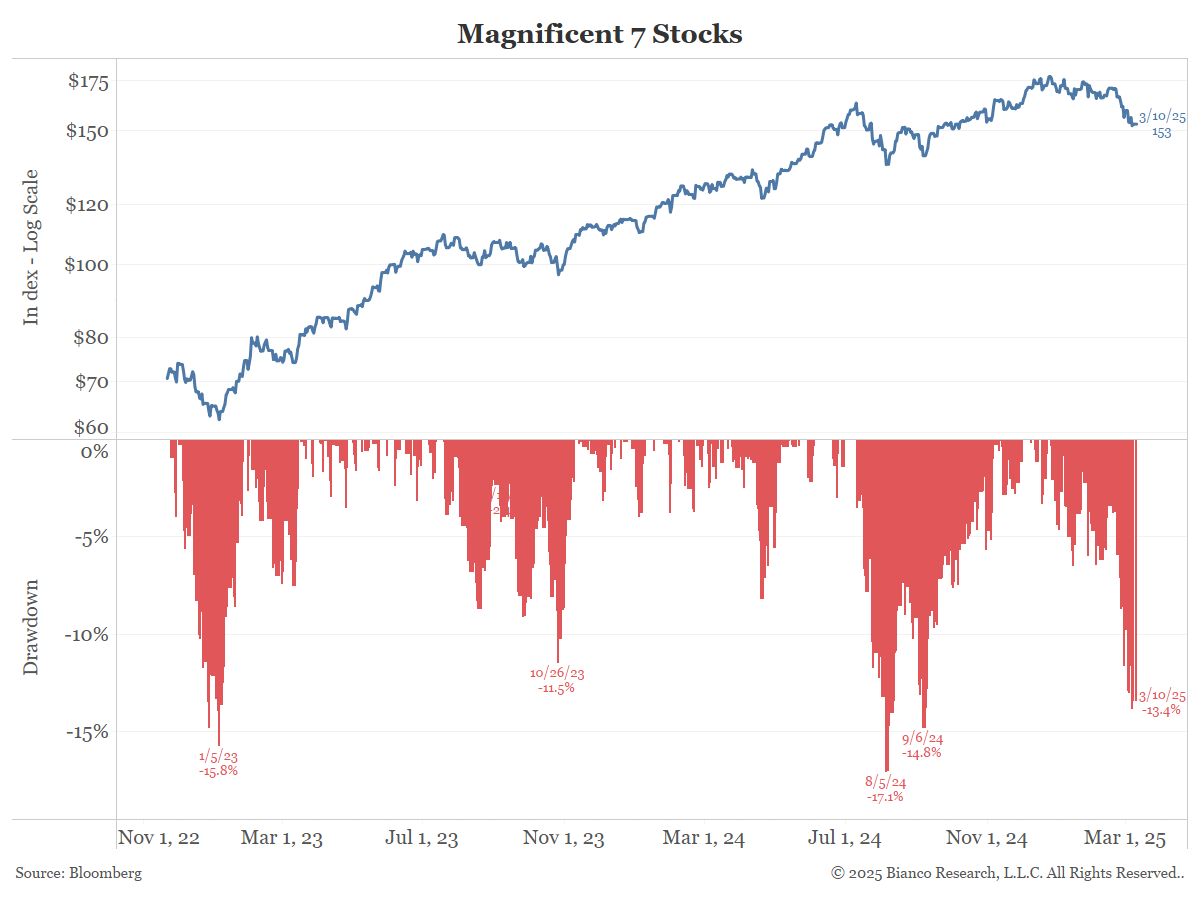

Finally, here are the Mag 7 stocks. As a group, they have corrected 13%. They are more volatile than the S&P 500.

This is the fourth such correction of 10% to 15% in the last 2 1/2 years. Or one about every 8 months.

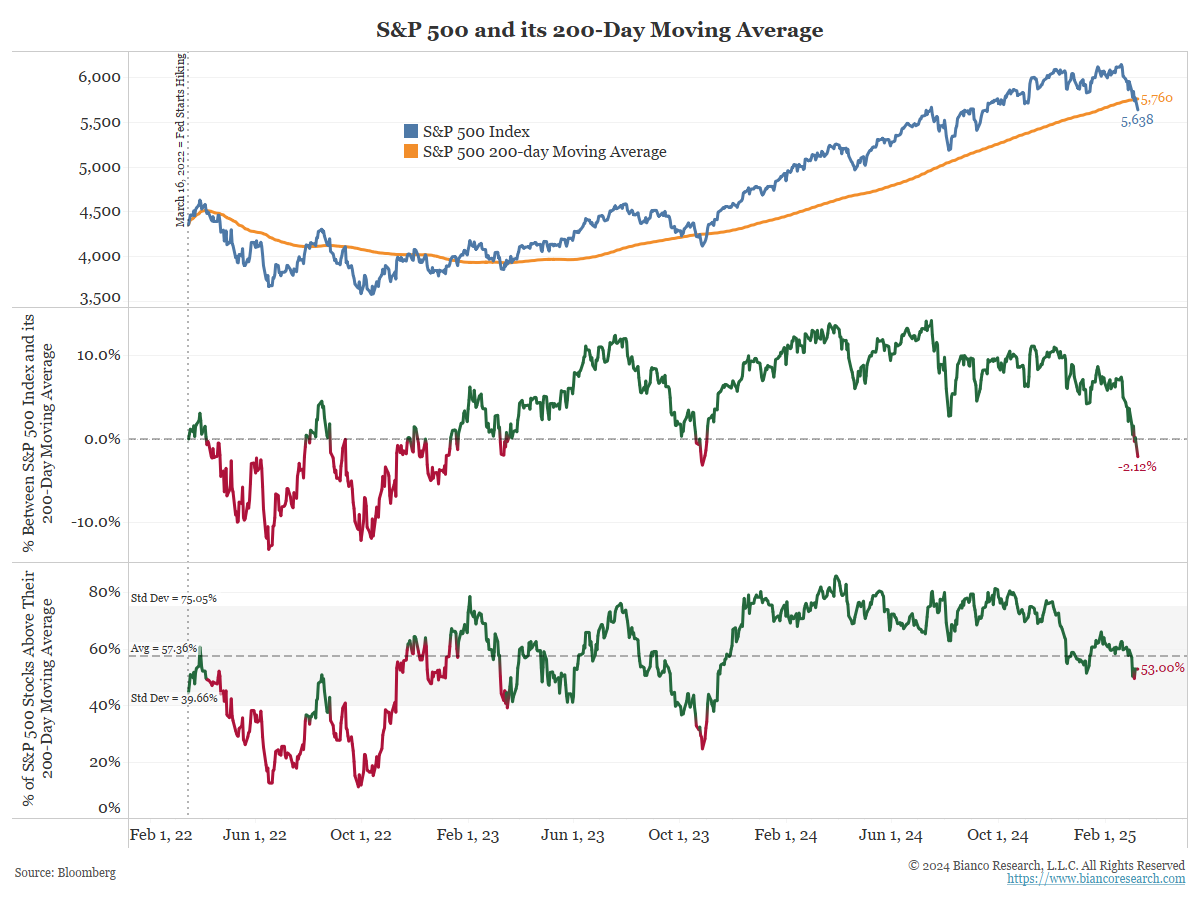

The S&P 500 is 2.12% below its 200-day MA

53% of stocks in the index are above their own individual 200-day MA.

In Other News…

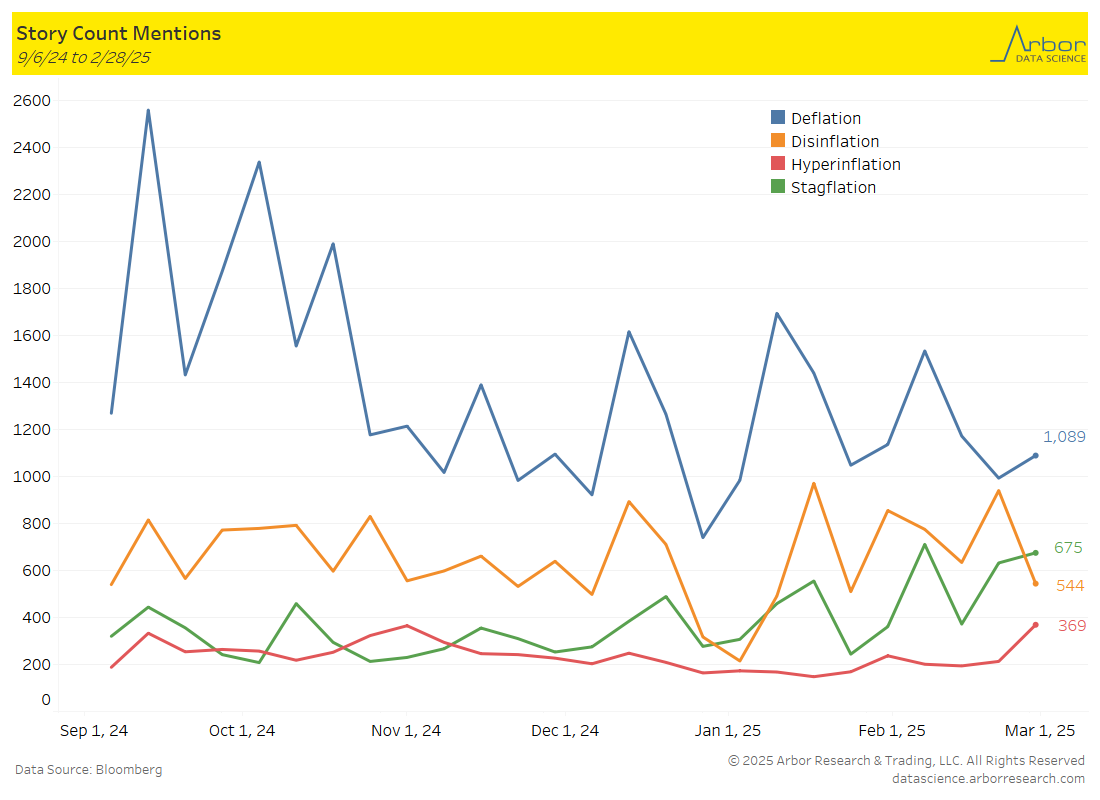

Axios: The real “stagflation” risk: No help from Washington

Global investors are becoming wary of the possibility that President Trump will eventually follow through on his pledge of large, across-the-board tariffs on many of the largest U.S. trading partners.

Arbor Data Science: Mentions of Stagflation in the News Pick Up Steam

Seyfarth: The Property Line: 2025 Is a year of Opportunity in Commercial Real Estate (Markey Survey Takeaways)

In Seyfarth’s 10th annual Real Estate Market Sentiment Survey, commercial real estate executives express optimism for 2025, with 87% expecting a year of opportunity driven by improving market fundamentals and anticipated rate reductions.

The Fence Post: Rounds, Hoeven reintroduce bill to bank foreign purchases of farmland

Sen. Mike Rounds, R-S.D., and Senate Agriculture Appropriations Subcommittee Chairman John Hoeven, R-N.D., last week reintroduced the Promoting Agriculture Safeguards and Security or PASS Act, legislation to ban individuals and entities controlled by China, Russia, Iran and North Korea from purchasing agricultural land and businesses located near U.S. military installations or sensitive sites.

Fortune: Inflation sticker shock is making Gen Z ditch doom spending and revenge travel once and for all

While rising grocery and gas prices are stifling consumer spending, it could benefit people’s relationship with money, especially Gen Z.

Pymts: Big Banks Work to Carve Out Piece of BNPL Space

Banking giants are trying to catch up to FinTechs in offering pay later services.

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations

- 3/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 3/11/2025 at 10:00am EST: JOLTS Job Openings/Job Openings Rate

- 3/11/2025 at 10:00am EST: JOLTS Quits Level/Quits Rate

- 3/11/2025 at 10:00am EST: JOLTS Layoffs Level/Layoffs Rate

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth

- 3/14/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 3/14/2025 at 10:00am EST: U. of Mich. 1 Yr- Inflation & U. of Mich. 5-10 Yr Inflation

- 3/17/2025 at 08:30am EST: Retail Sales Advance MoM & Empire Manufacturing

- 3/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 3/17/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index