US Treasuries

- Tuesday’s range for UST 10y: 4.17% – 4.29%, closing at 4.28%

- Treasury yields climbed across the curve in the afternoon as stocks unwound early losses

- Tomorrow (Wednesday, 3/12) CPI will be released at 8:30am EST

WSJ: Bowman Seen as Front-Runner for Fed’s Top Banking Cop

-

Michelle Bowman, a Republican governor at the Federal Reserve, is the frontrunner to become the central bank’s top banking regulator, according to people familiar with the matter.

-

Bowman has warned against insufficient measures to combat inflation and has generally preferred higher interest rates.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

In Other News…

OilPrice: Panama Canal Considers Pipeline to Ship Gas to Asia

The Panama Canal is considering an idea to build a pipeline to ship liquefied petroleum gas (LPG) across the key trade chokepoint to potentially bring gas from the U.S. to Japan, according to the canal administrator Ricaurte Vasquez.

MPA: Commercial real estate outlook brightens as NYC offices fill up

Investors regain confidence in New York’s commercial real estate as office demand surges, fueling major deals

SupplyChainBrain: DOJ opens Price-Fixing Probe into U.S. Egg Producers

The U.S. Department of Justice (DOJ) has opened a probe into U.S. egg producers, over claims that companies have colluded to inflate costs to record levels.

ATTOM, a leading curator of land, property data, and real estate analytics, today released its latest Special Housing Risk Report spotlighting county-level housing markets around the United States that are more or less vulnerable to declines, based on home affordability, equity and other measures in the fourth quarter of 2024.

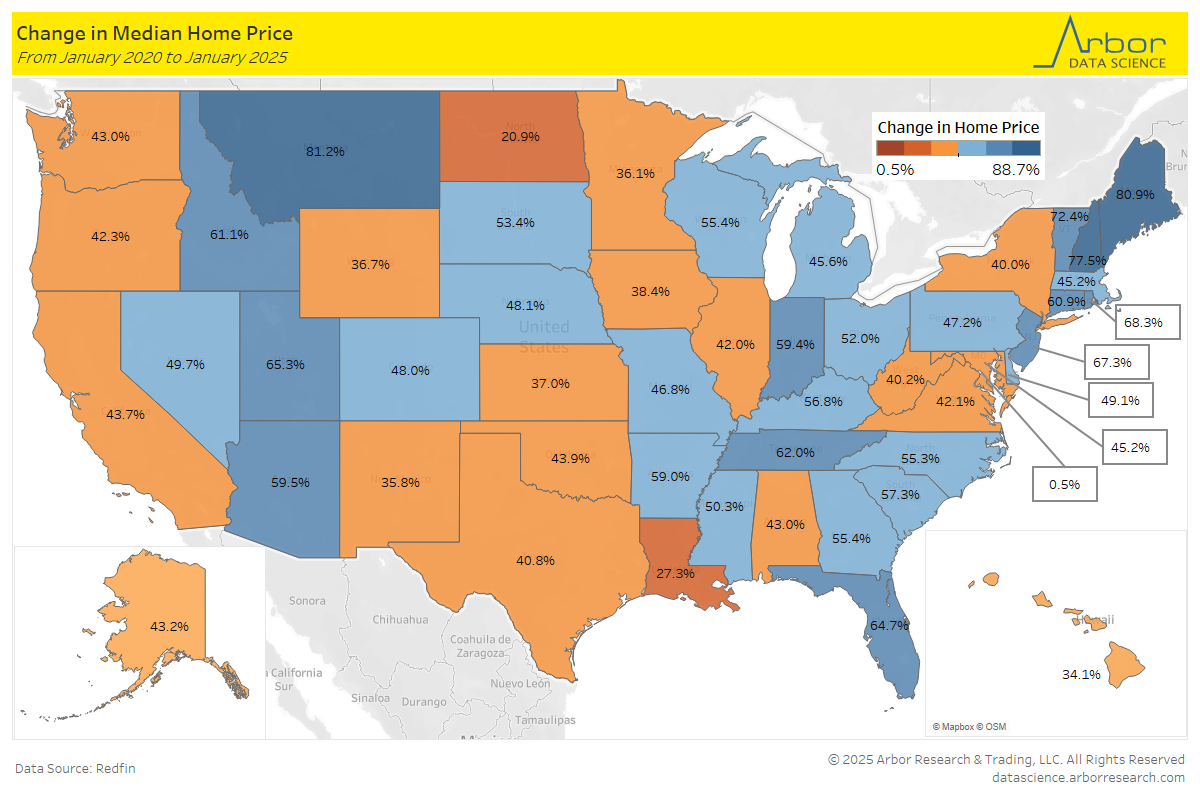

Arbor Data Science: The Transformation of the U.S. Housing Market Since the Pandemic

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth

- 3/14/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 3/14/2025 at 10:00am EST: U. of Mich. 1 Yr- Inflation & U. of Mich. 5-10 Yr Inflation

- 3/17/2025 at 08:30am EST: Retail Sales Advance MoM & Empire Manufacturing

- 3/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 3/17/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 3/18/2025 at 08:30am EST: Housing Starts/Housing Starts MoM

- 3/18/2025 at 08:30am EST: Building Permits/Building Permits MoM

- 3/18/2025 at 08:30am EST: Import Price Index MoM/Import Price Index ex Petroleum/Import Price Index YoY

- 3/18/2025 at 08:30am EST: Export Price Index MoM/Export Price Index YoY

- 3/18/2025 at 08:30am EST: New York Fed Services Business Activity

- 3/18/2025 at 09:15am EST: Industrial Production MoM/Capacity Utilization/Manufacturing (SIC) Production