US Treasuries

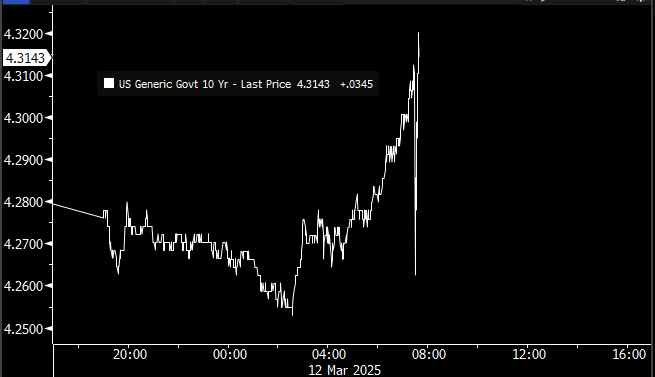

- Wednesday’s range for UST 10y: 4.245% – 4.33%, closing at 4.31%

- Treasuries rallied in the morning after CPI came in lower than forecast, but then yields reversed back to highs of the day

- US High-Grade Issuance: 11 borrowers seized post-CPI window to sell bonds with $11 bln set to price

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Agency Bullets

- We saw trading today in the new TVA 5.25 2/55

- The issue came to market at 60/30s…traded to 56/30s; last week traded at 60/30s, now trading at 64/30s

Talking Data featuring Jim Bianco: The Current State of the Sell-Off

Intraday Commentary from Jim Bianco

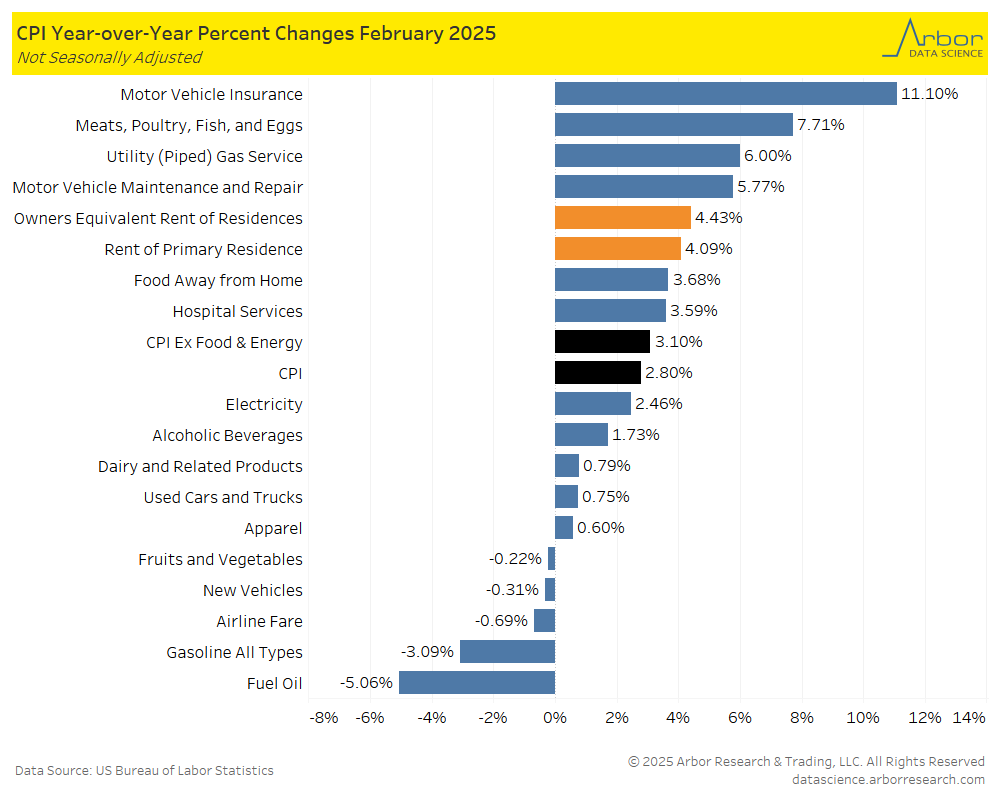

CPI was better than expected. The 10-year yield initially spiked lower, but 12 minutes later yields are at the highs of the day.

Why? See stock futures, they are flying higher. S&P futures are up over 1%, NASDAQ 100 (NDX) futures are up 1.5%.

It’s a risk-on day, meaning that stocks are driving bond yields more than CPI, at least today.

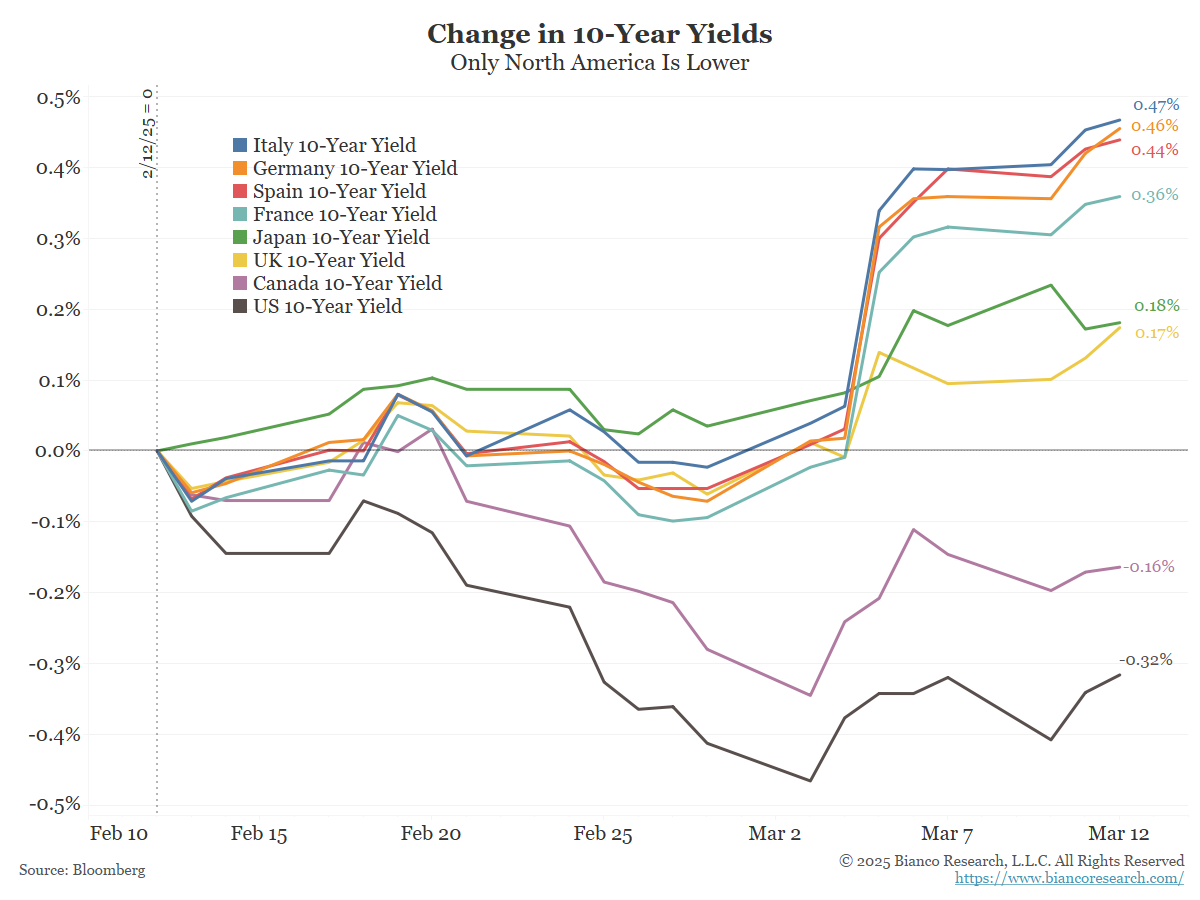

In other words, Inflation fears are a little less, so 10-year yields are higher. And if a tariff-driven recession is lessening, we can turn our attention to the developed world 10-year yields.

This chart shows the change in 10-year yields over the last month. Other than North America, where Canadian yields (purple) closely follow US 10-year yields (black), developed world 10-year yields have been flying higher.

Restated, the 10-year yield needs constant chaos, “wobbly” stocks, to keep rallying (falling yields).

Today, we are getting respite from the chaos (but the day is still young!), so US yields, feeling the pull of the rest of the world, are going higher.

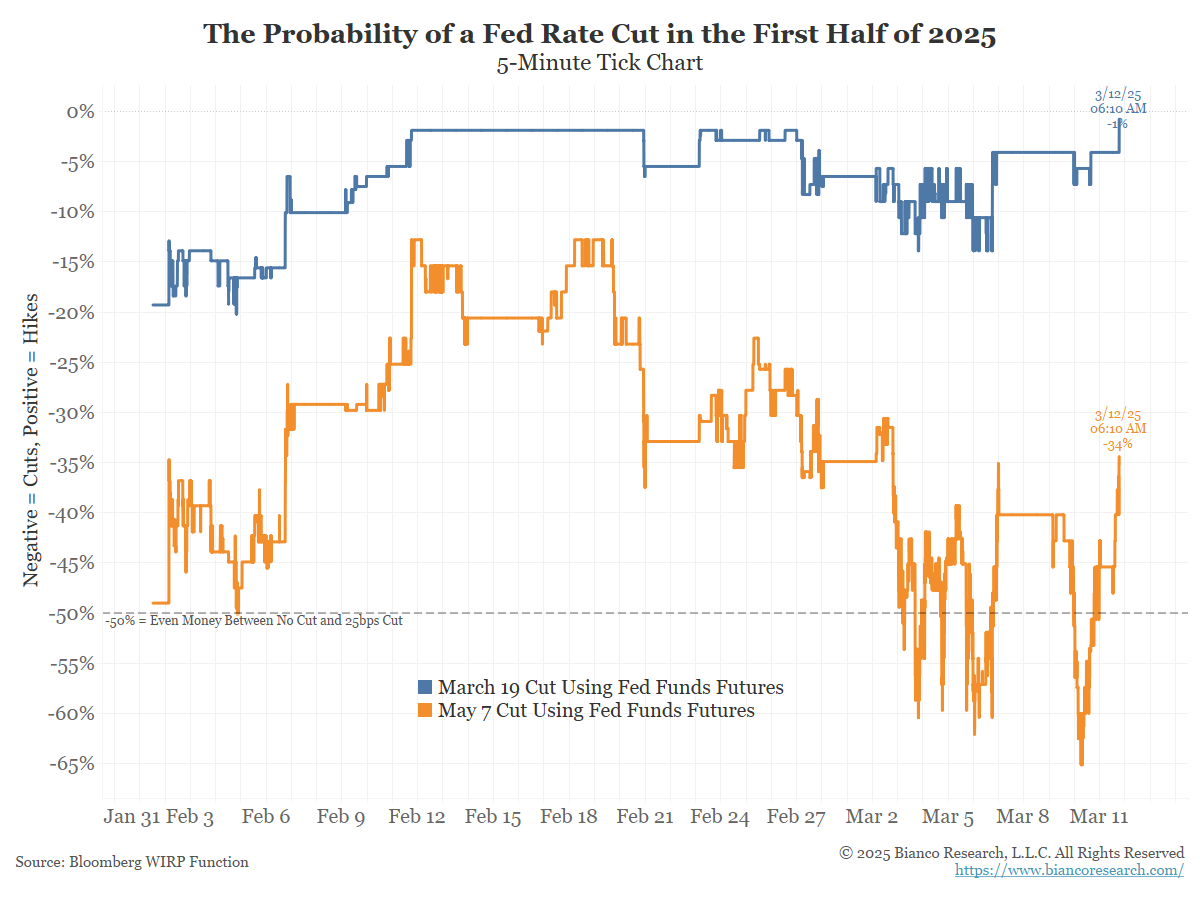

Fed on hold until June:

In Other News… With Tariffs Looming:

Family Handyman: The Reason So Much of America’s Lumber Comes From Canada

We rely on lumber from Canada because the U.S. cannot supply enough softwood to meet its own demand, and Canada is one of the largest softwood producers in the world.

The New York Times: Egg Prices Are Still Surging, Hitting Consumers’ Wallets

Prices for the staple rose 10.4% in February even as overall inflation eased a bit.

KFF Health News: Thought Inflation Was Bad? Health Insurance Premiums Are Rising Even Faster

Average monthly premiums for families with employer-provided health coverage in California’s private sector nearly doubled over the last 15 years, from just over $1,000 in 2008 to almost $2,000 in 2023, a KFF Health News analysis of federal data shows. That’s more than twice the rate of inflation.

Arbor Data Science: OER by Sam Rines

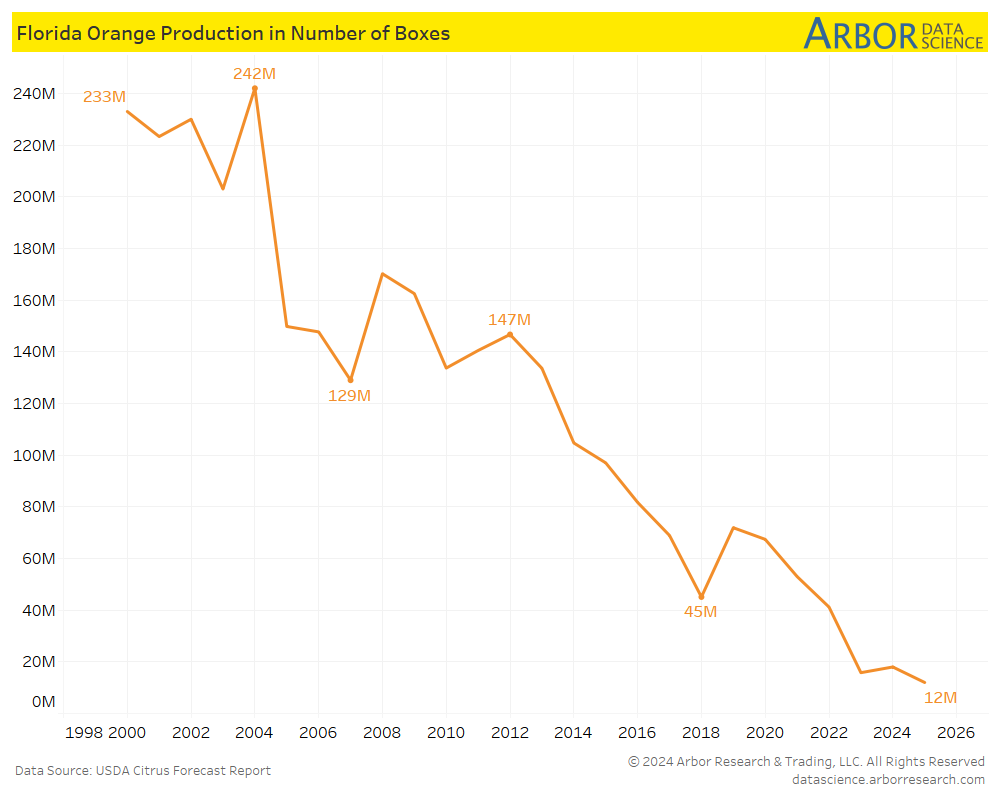

Fresh Plaza: Florida orange forecast rises slightly but remains 35% below last season

Fresh Plaza: Florida orange forecast rises slightly but remains 35% below last season

The USDA Agricultural Statistics Board has released the 2024 – 2025 Florida all-orange forecast, estimating total production at 11.6 million boxes, up 100,000 boxes from the February forecast.

Arbor Data Science: The Orange Squeeze in Florida (published 12/16/24)

SupplyChainBrain: Houthis Threaten to Resume Attacks in Red Sea

Houthi rebels in Yemen are threatening to resume attacks on commercial ships moving through the Red Sea region, unless Israel reopens Gaza to international aid.

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth

- 3/14/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 3/14/2025 at 10:00am EST: U. of Mich. 1 Yr- Inflation & U. of Mich. 5-10 Yr Inflation

- 3/17/2025 at 08:30am EST: Retail Sales Advance MoM & Empire Manufacturing

- 3/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 3/17/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 3/18/2025 at 08:30am EST: Housing Starts/Housing Starts MoM

- 3/18/2025 at 08:30am EST: Building Permits/Building Permits MoM

- 3/18/2025 at 08:30am EST: Import Price Index MoM/Import Price Index ex Petroleum/Import Price Index YoY

- 3/18/2025 at 08:30am EST: Export Price Index MoM/Export Price Index YoY

- 3/18/2025 at 08:30am EST: New York Fed Services Business Activity

- 3/18/2025 at 09:15am EST: Industrial Production MoM/Capacity Utilization/Manufacturing (SIC) Production

- 3/19/2025 at 07:00am EST: MBA Mortgage Applications

- 3/19/2025 at 02:00pm EST: FOMC Rate Decision

- 3/19/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows