US Treasuries

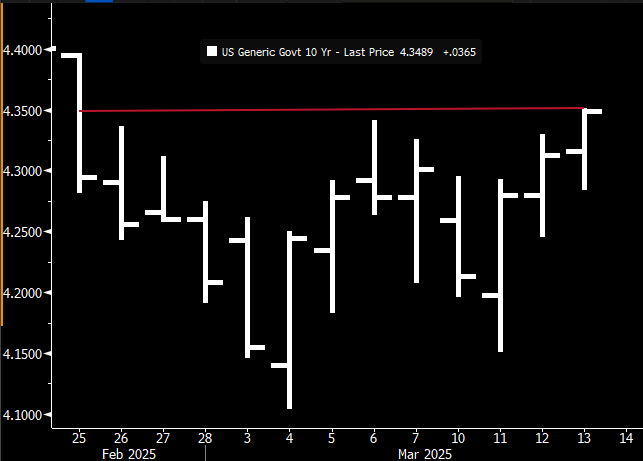

- Thursday’s range for UST 10y: 4.255% – 4.34%, closing at 4.28%

- On Wednesday and Thursday, we saw large buying of longer maturity off the run UST issues

- 2047/2052 were target maturities

Bloomberg: Latest Inflation Reading Put the Federal Reserve in a Bind

Markets will be laser focused on Federal Reserve policy and economic projections next week, looking for signs about where interest rates are heading. Unfortunately, policymakers, led by Chair Jerome Powell, face a backdrop unlike any they’ve confronted before, and it’s likely to leave them as confused as the rest of us.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary from Jim Bianco

Bar chart of the 10-year yield. As I write, it reached 4.35%. This is the highest yield since February 25.

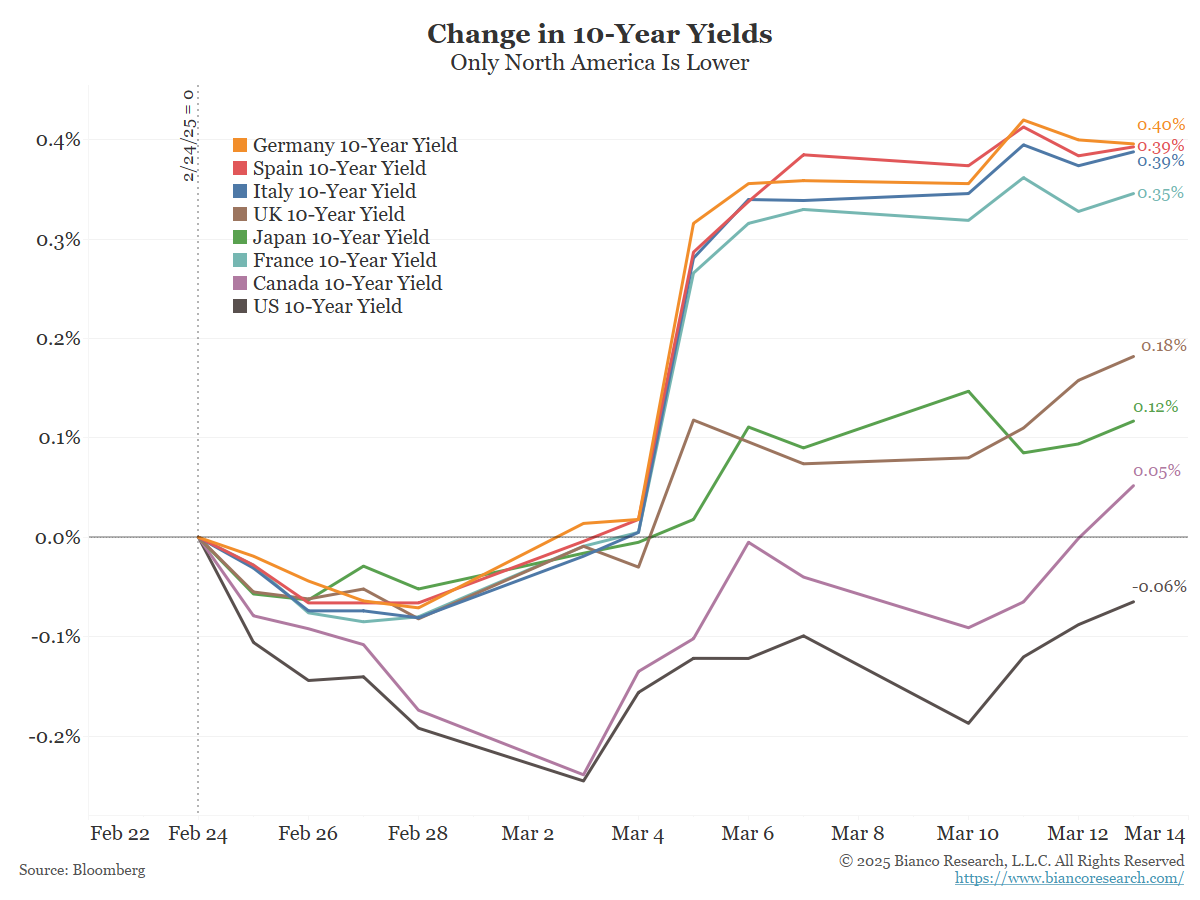

Since February 24, developed world 10-year yields are soaring. Only the US is lower, but only 6 bps now.

First we would argue the pull of higher yields around the world are keeping US yields up even though stocks are now down 8% to 10%.

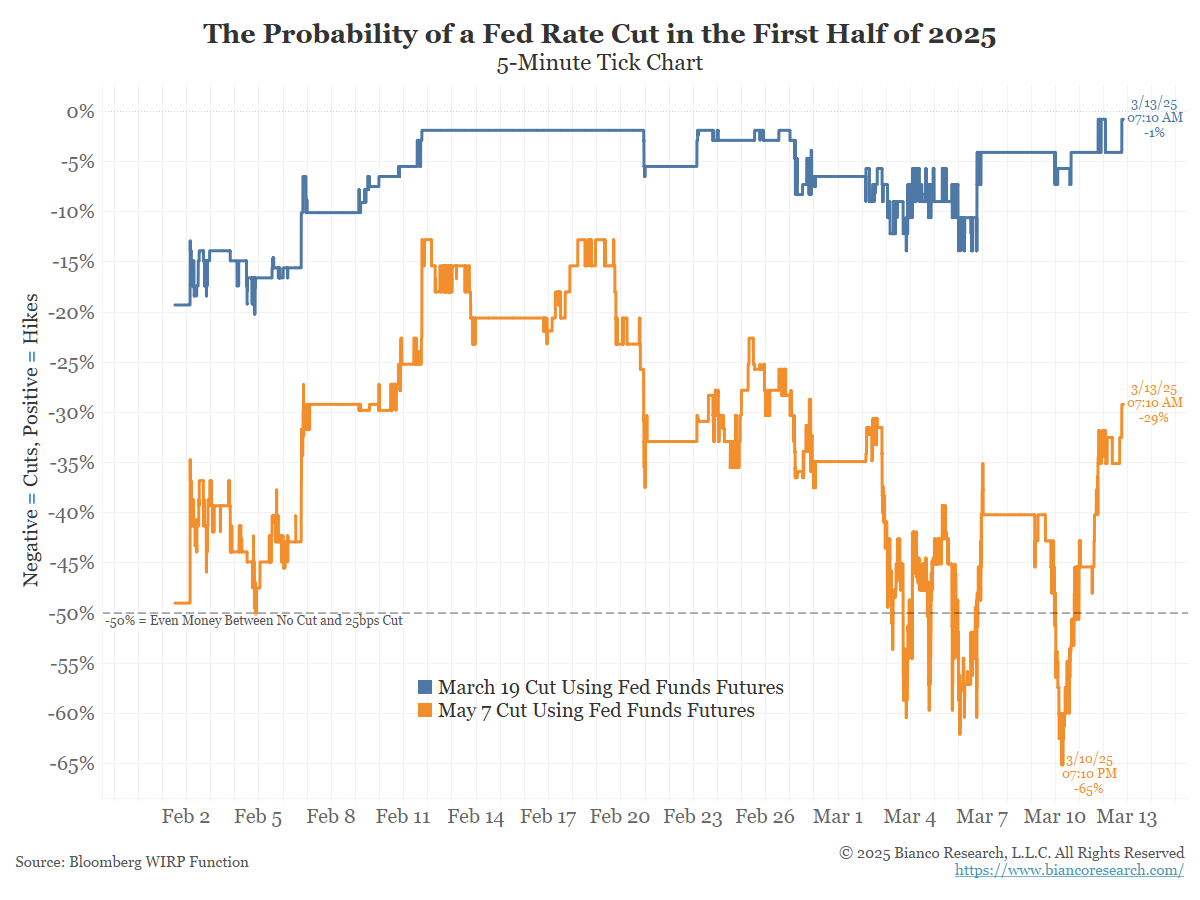

We can see clues of this in the market pricing. Blue is the probability of a rate cut next week, March 19. 1% probability of a cut (99% hold).Orange is the May 7 meeting. 35% probability of a cut, 65% of cut.

If tariffs will crush the economy, it should be evident by May. Yet the market does not think the Fed will find a reason to cut in two months.

In Other News…

OilPrice: U.S. Natural Gas Demand Set to Stay at Record High in 2025 and 2026

Data centers and liquefied natural gas exports are set to keep natural gas demand in the United States at a record high this year and next, energy executives said at CERAweek. Infrastructure shortages, however, could make growth problematic.

Axios: U.S. cities are growing again – thanks to immigration

An exodus of city-dwellers rocked many U.S. metros during the COVID-19 pandemic, but some are now clawing back residents (and their productivity, creativity, tax dollars, etc.)

Bloomberg: Deutsche Bank Sees More Headwinds From Commercial Real Estate

Deutsche Bank AG expects headwinds to continue in commercial real estate markets, with weaknesses especially pronounced in the US where leasing activity is slower and vacancy rates are higher than in Europe.

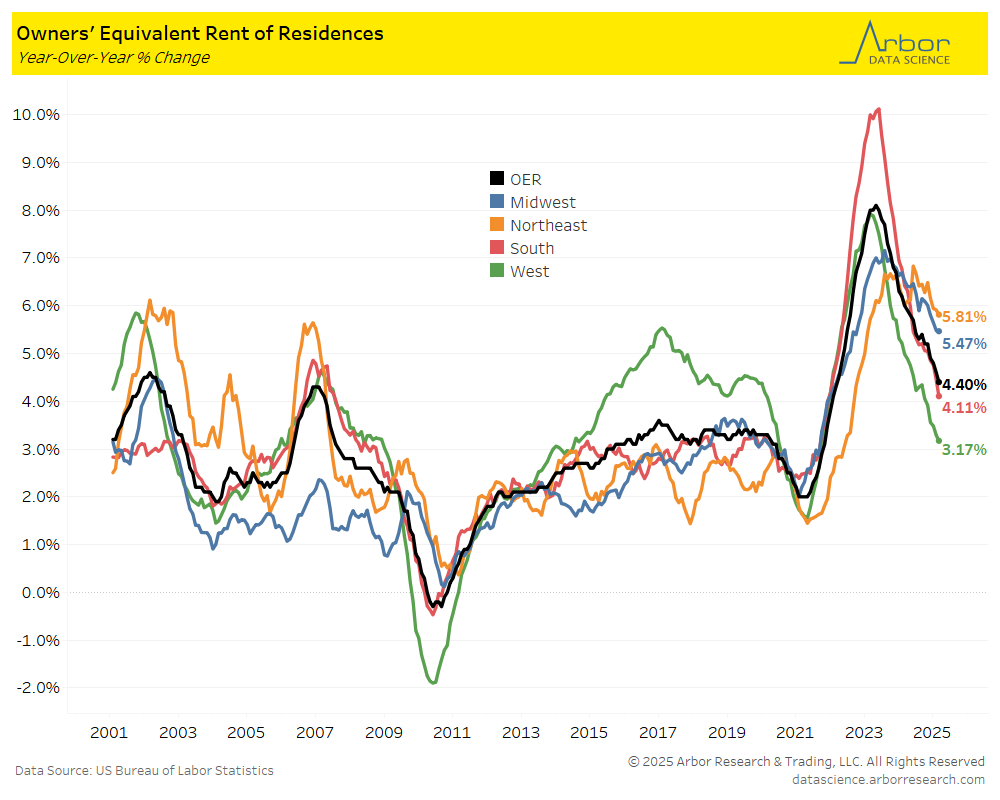

Barron’s: Shelter Inflation Softened in February. It’s Still Persistent.

While housing continues to account for a significant portion of the overall price growth felt by Americans, last month did deliver some cooler data.

Arbor Data Science: Shelter is a Regional Problem Now (Our Latest on OER) by Sam Rines

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth

- 3/14/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 3/14/2025 at 10:00am EST: U. of Mich. 1 Yr- Inflation & U. of Mich. 5-10 Yr Inflation

- 3/17/2025 at 08:30am EST: Retail Sales Advance MoM & Empire Manufacturing

- 3/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 3/17/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 3/18/2025 at 08:30am EST: Housing Starts/Housing Starts MoM

- 3/18/2025 at 08:30am EST: Building Permits/Building Permits MoM

- 3/18/2025 at 08:30am EST: Import Price Index MoM/Import Price Index ex Petroleum/Import Price Index YoY

- 3/18/2025 at 08:30am EST: Export Price Index MoM/Export Price Index YoY

- 3/18/2025 at 08:30am EST: New York Fed Services Business Activity

- 3/18/2025 at 09:15am EST: Industrial Production MoM/Capacity Utilization/Manufacturing (SIC) Production

- 3/19/2025 at 07:00am EST: MBA Mortgage Applications

- 3/19/2025 at 02:00pm EST: FOMC Rate Decision

- 3/19/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows

- 3/20/2025 at 08:30am EST: Current Account Balance

- 3/20/2025 at 08:30am EST: Initial Jobless Claims / Continuing Claims

- 3/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 3/20/2025 at 10:00am EST: Leading Index

- 3/20/2025 at 10:00am EST: Existing Home Sales / Existing Homes Sales MoM