US Treasuries

- Monday’s range for UST 10y: 4.255% – 4.33%, closing at 4.30%

- Treasuries were mixed in the afternoon with a rally in longer maturities

Bloomberg: T-Bill Supply Pressure on US Repo Rates Seen Encountering Limit

The shrinking supply of Treasury bills is putting downward pressure on financing rates for US government securities, but interest-rate strategists at JPMorgan Chase & Co. say the trend may be reaching its limit.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Next Conference Call will be on: Thursday, March 20, 2025, featuring Jim Bianco

Intraday Commentary from Jim Bianco

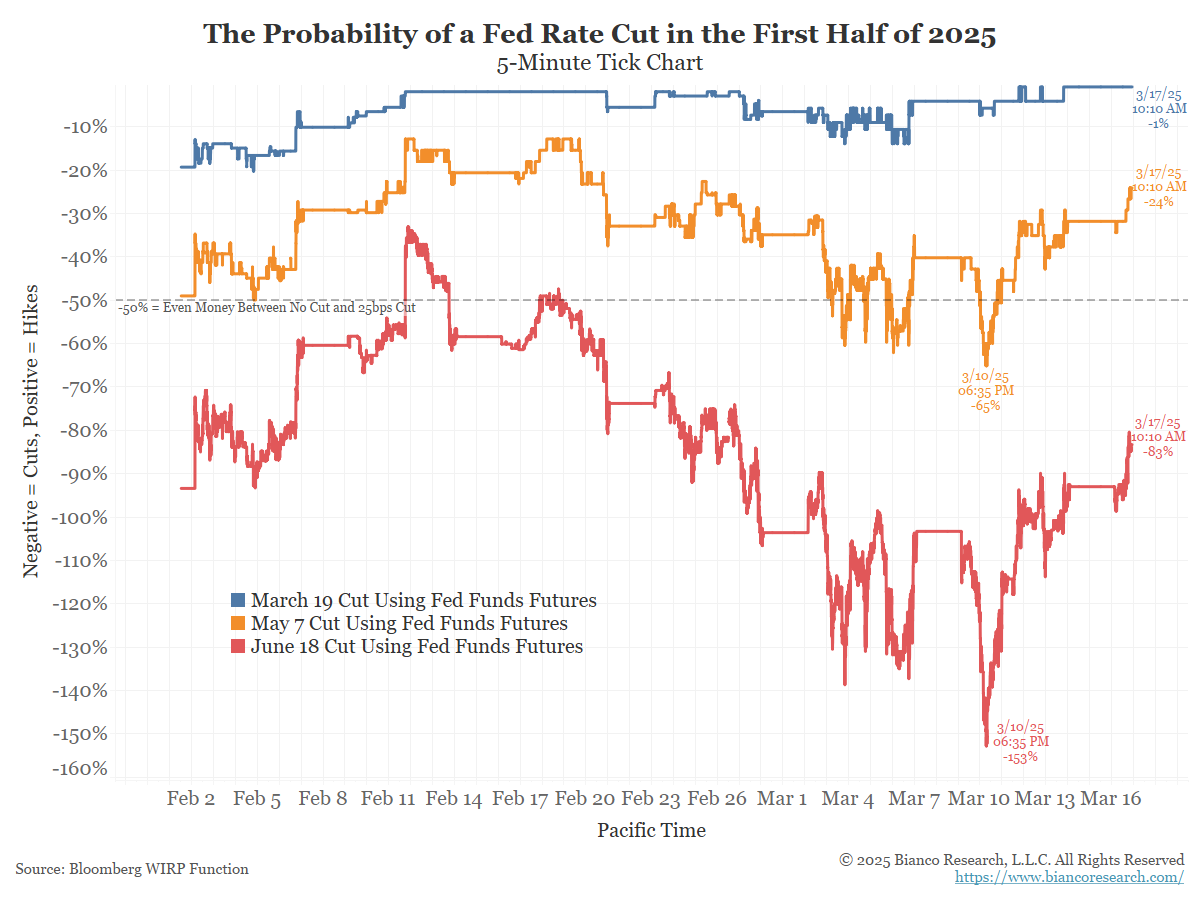

Fed meeting on Wednesday.

I’m calling this the “meeting before the meeting.” If the Fed does not cut on May 7 (orange), the cutting cycle ended last December.

Given all the hyperventilation about recession and falling stock prices, if they cannot find a reason to cut by May 7, they will not find a reason.

The June probability at 83% (17% hold) will deflate to zero if they don’t cut in May. (To be clear, something else unexpected would have to come along to get the Fed to cut.)

Note that after 1 1/2 decent trading days for stocks (big up Friday and small up today), that was enough to deflate May cut probability to 24% (76% hold).

In the News…

The Latest on Oil:

OilPrice: Harold Hamm Sounds the Alarm: Low Oil Prices Could Shut Down US Shale

Shale titan Harold Hamm isn’t mincing words—if oil prices stay this low, drilling in some of America’s prized shale fields could grind to a halt.

OilPrice: Oil’s Oversupply spiral: Can Prices Stay Above $60?

The International Energy Agency just threw a bucket of ice water on oil bulls, reporting that crude supply is outpacing demand by 600,000 bpd and slashing its demand outlook for the year. And the IEA isn’t alone.

In Other News:

The Cool Down: Experts warn of global shift that could cause car insurance prices to skyrocket: ‘Already impacting the industry’

“Ongoing supply chain disruptions — whether from tariffs, COVID-19, or a port strike — are already impacting the industry,” Saldanha said, per Insurance Business in February. “These disruptions drive up costs for auto parts, building materials, and other essentials, leading to higher indemnity expenses.”

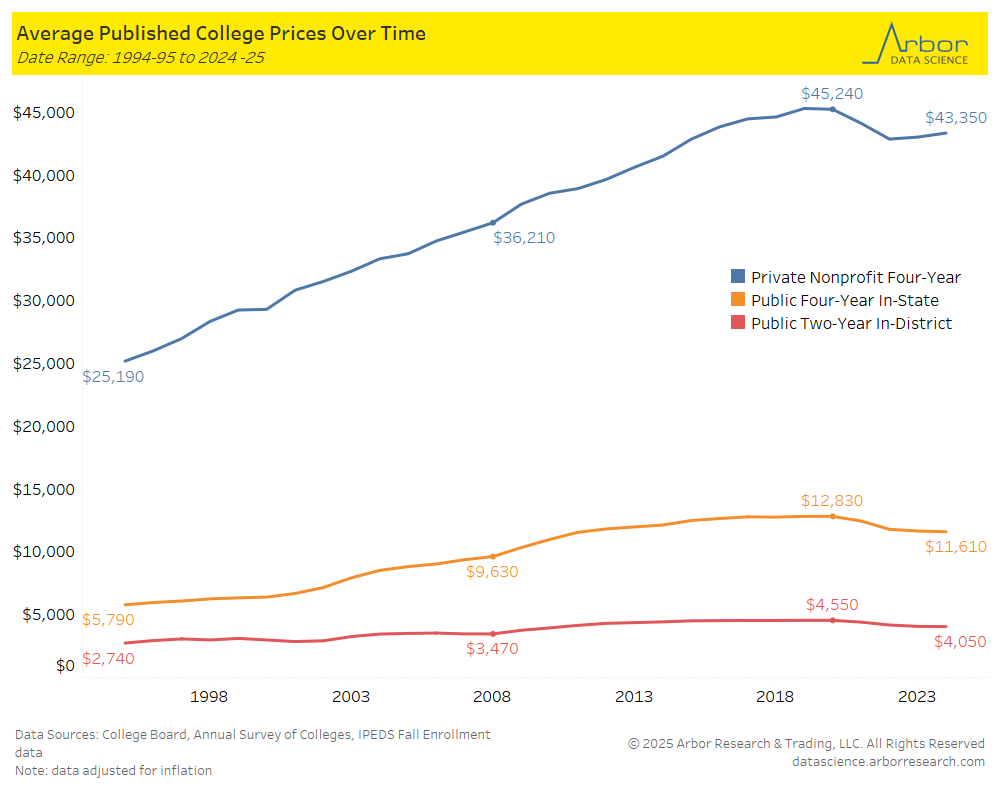

Bloomberg: Harvard Is Going Tuition Free for Families Making Up to $200,000

Harvard University is eliminating tuition for students from families with incomes of $200,000 or less, attempting to broaden access to the school at a time when elite universities are under attack from the White House and lawmakers.

Arbor Data Science: The Increasing Price Tag of Education in the U.S.

Fast Company: March Madness highlights Gen Z’s skyrocketing sports betting addiction

As March Madness begins, a new study reveals the staggering financial, mental, and relationship consequences of sports betting.

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/18/2025 at 08:30am EST: Housing Starts/Housing Starts MoM

- 3/18/2025 at 08:30am EST: Building Permits/Building Permits MoM

- 3/18/2025 at 08:30am EST: Import Price Index MoM/Import Price Index ex Petroleum/Import Price Index YoY

- 3/18/2025 at 08:30am EST: Export Price Index MoM/Export Price Index YoY

- 3/18/2025 at 08:30am EST: New York Fed Services Business Activity

- 3/18/2025 at 09:15am EST: Industrial Production MoM/Capacity Utilization/Manufacturing (SIC) Production

- 3/19/2025 at 07:00am EST: MBA Mortgage Applications

- 3/19/2025 at 02:00pm EST: FOMC Rate Decision

- 3/19/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows

- 3/20/2025 at 08:30am EST: Current Account Balance

- 3/20/2025 at 08:30am EST: Initial Jobless Claims / Continuing Claims

- 3/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 3/20/2025 at 10:00am EST: Leading Index

- 3/20/2025 at 10:00am EST: Existing Home Sales / Existing Homes Sales MoM

- 3/21/2025 at 09:05am EST: Fed’s Williams speaks in the Bahamas

- 3/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 3/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI & S&P Global US Services PMI & S&P Global US Composite PMI