US Treasuries

- Tuesday’s range for UST 10y: 4.26% – 4.335%, closing at 4.28%

Bloomberg: Fed Day, Once the Stock Market’s Fixation, Takes on New Meaning

This isn’t the Fed’s stock market anymore.

MarketWatch: Markets on alert for changes to runoff of Fed’s balance sheet

Financial markets are not just focused on what the Federal Reserve says about the future path of interest rates on Wednesday. The markets are also on alert for changes to the Fed’s ongoing runoff of its balance sheet, known as “quantitative tightening,” or QT.

WSJ: March Dot Plot to Highlight Fed Officials’ Outlook

With the Federal Reserve expected to hold interest rates steady this week, the forward-looking dot plot will be in the limelight when the central bank’s two-day policy meeting concludes Wednesday.

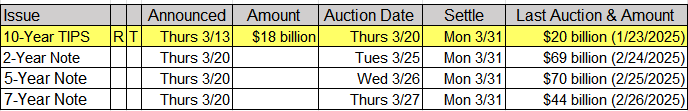

Upcoming US Treasury Supply

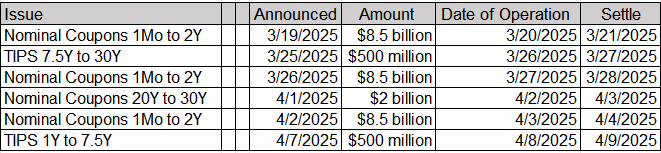

Tentative Schedule of Treasury Buyback Operations

Jim Bianco joins Fox Business to discuss “Uncertainty”, Health of the Consumer & No Landing

Next Conference Call will be on: Thursday, March 20, 2025, featuring Jim Bianco

Intraday Commentary from Jim Bianco

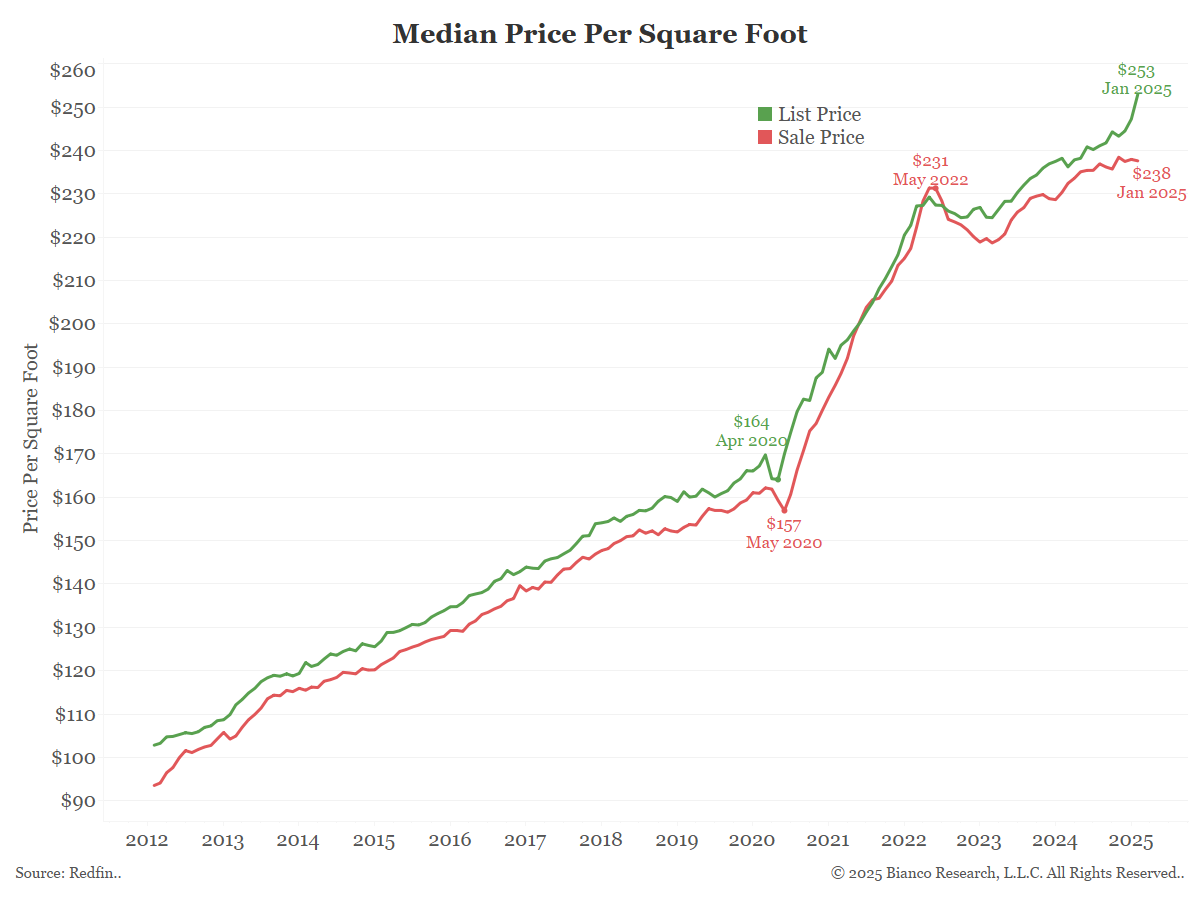

Redfin has the best metric for the AVERAGE home price nationally. They aggregate all the data from multiple listing services across the country.

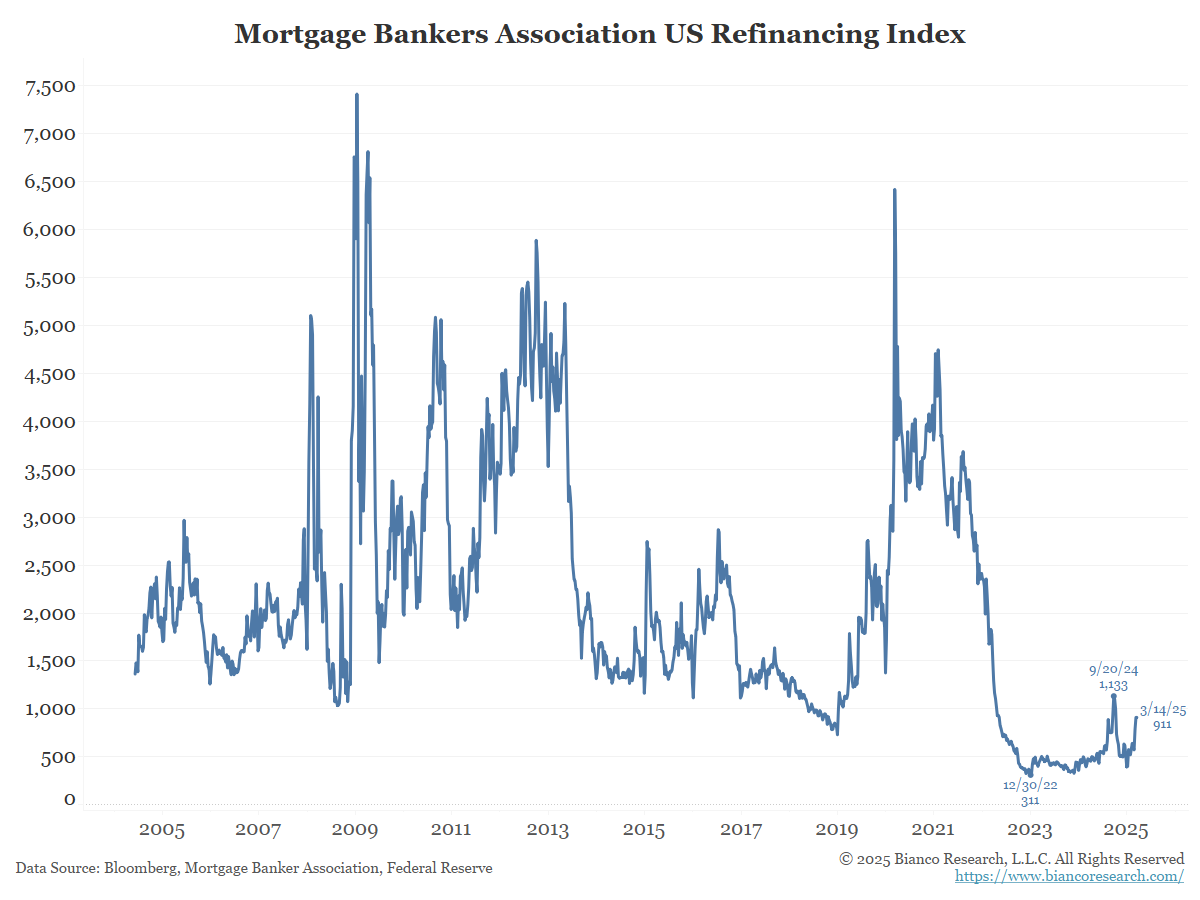

Here is the Mortgage Bankers Association Refinance Index. It means the level (or amount) of refinancing applications every week. So, an index of 300 indicates the number of completed refinancing applications received by mortgage bankers was 1/10th the amount at a level of 3,000.

So, why are so many refinancing applications rejected? Maybe because there are so few of them (compared to pre-pandemic), and the gross amount is actually small.

Why so few refinancings? Because we are no longer in a zero-interest-rate world.

*GERMAN LAWMAKERS BACK LANDMARK DEFENSE SPENDING PLANS

Here is the bigger problem with European defense. It has different meanings for different countries.

Poland, which says a border with Russia, is taking it very seriously; they want to build a 500k person army and want the French to provide them with nukes. In other words, they are taking this deadly seriously.

Atlantic Council: Why Poland’s president wants US nuclear weapons

Conversely Spain, which is about 1,000 miles away away from the Russian border is not taking it seriously. They are all for defense spending, but what to “green wash” it.

—

Spanish Prime Minister Pedro Sánchez, whose country is at the bottom of Nato’s military budget rankings, has called for a broader definition of defense spending to include cyber security, anti-terrorism and efforts to combat climate change.

“But in Spain that is not the case. Our threat is not Russia bringing its troops across the Pyrenees,” he said. “When we talk about Russia it’s more a hybrid threat. It’s the threat of cyber attacks. So what we have to do is not just talk about defense, but fundamentally talk about security.”

FT: Spain’s Pedro Sanchez calls for cyber and climate to count as defense spending

So, color me skeptical. At the end of the day, their is a good chance this will be wasteful spending that will increase inflation, lower standards of living and provide little to no real defense shield.

I hope they prove me wrong.

In the News…

Oil Price: Trump Pledges a U.S. Coal Renaissance

President Donald Trump is authorizing the Administration to work to boost U.S. coal power generation in an effort to counter China’s economic advantage over America due to the constant rise in Chinese coal power plants.

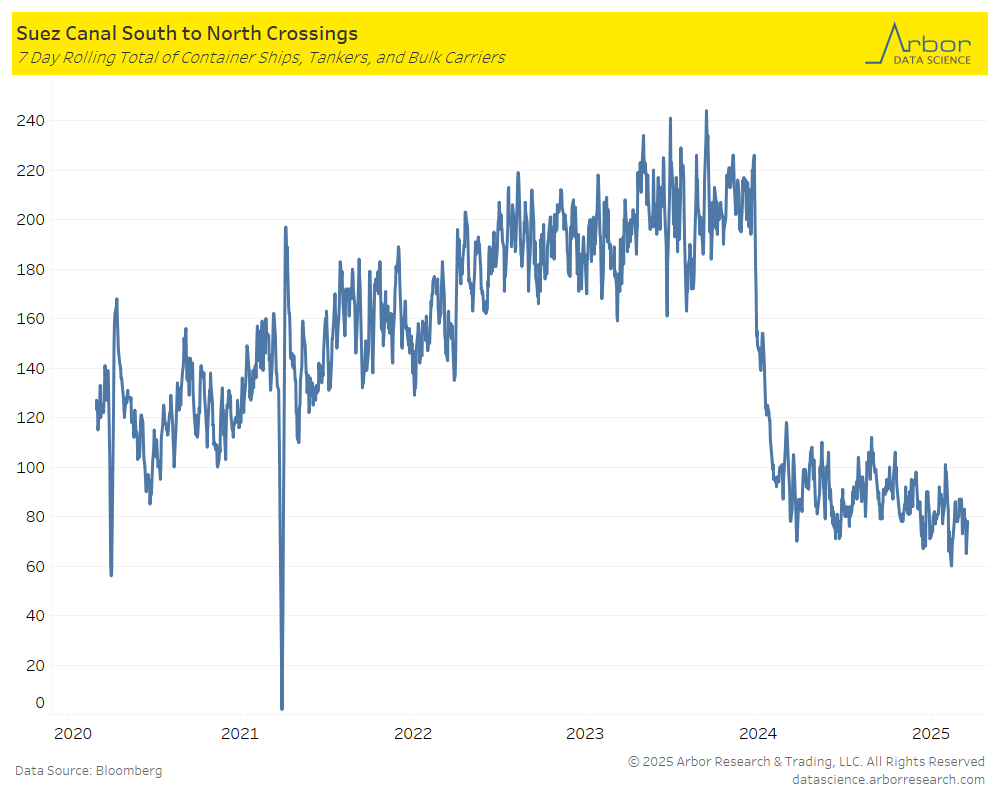

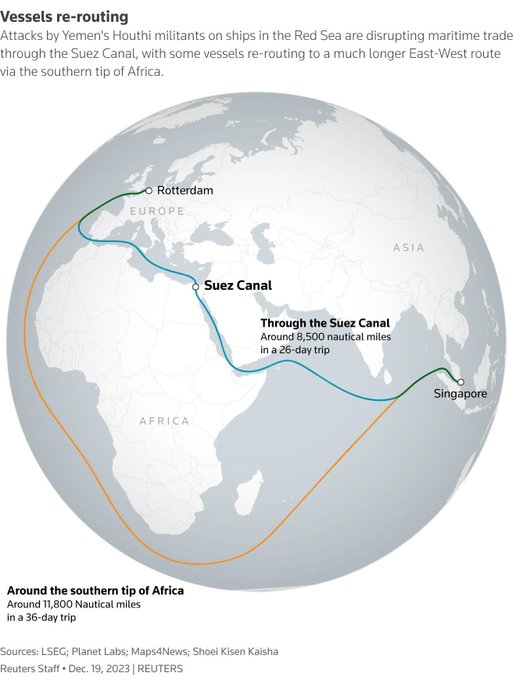

Latest on the Red Sea

SeatradeMaritime: Houthi ban US vessels from Red Sea in response to Yemen attacks

The Houthi have said they will ban US vessels from navigation of the southern Red Sea, Arabian Sea, and Gulf Aden, and that it will target US Navy ships in response to US airstrikes on Yemen.

Bianco Research (In today’s Newclips): Will the Red Sea Finally Be Opened?

If effective, Trump’s new policy against the Houthis could open the Red Sea, impact shipping costs and lower inflation.

Arbor Data Science: Global Supply Chain Update – March 19, 2025

SupplyChainBrain: From Farms to Factories: The Shocking Reach of the Child Labor Crisis

Despite decades of progress, child labor remains deeply embedded in global supply chains, with millions of children engaged in hazardous and exploitative work to produce everyday goods. The scope of the problem is truly shocking.

In Côte d’Ivoire and Ghana alone — which together produce nearly 60% of the world’s cocoa — the U.S. Bureau of Labor Affairs says there are roughly 1.56 million children engaged in child labor.

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/19/2025 at 07:00am EST: MBA Mortgage Applications

- 3/19/2025 at 02:00pm EST: FOMC Rate Decision

- 3/19/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows

- 3/20/2025 at 08:30am EST: Current Account Balance

- 3/20/2025 at 08:30am EST: Initial Jobless Claims / Continuing Claims

- 3/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 3/20/2025 at 10:00am EST: Leading Index

- 3/20/2025 at 10:00am EST: Existing Home Sales / Existing Homes Sales MoM

- 3/21/2025 at 09:05am EST: Fed’s Williams Speaks in the Bahamas

- 3/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 3/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI /S&P Global US Services PMI /S&P Global US Composite PMI

- 3/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 3/25/2025 at 09:00am EST: FHFA House Price Index MoM

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA / S&P CoreLogic CS 20-City YoY NSA /S&P CoreLogic CS US HPI YoY NSA

- 3/25/2025 at 09:05am EST: Fed’s Williams Gives Opening Remarks

- 3/25/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 3/25/2025 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 3/25/2025 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions

- 3/25/2025: Building Permits & Building Permits MoM