US Treasuries

- Wednesday’s range for UST 10y: 4.24% – 4.32%, closing at 4.24%

- Treasuries rallied after the Fed kept interest rates steady, as expected

Jim Bianco joins Bloomberg to give his thoughts on today’s FOMC Statement

Bloomberg: Fed Raises Prospects for Stagflation in 2025 Outlook

Fed see risks to both unemployment rate and inflation are skewed toward the upside. It’s similar to 2022 when the Fed raised the rates aggressively.

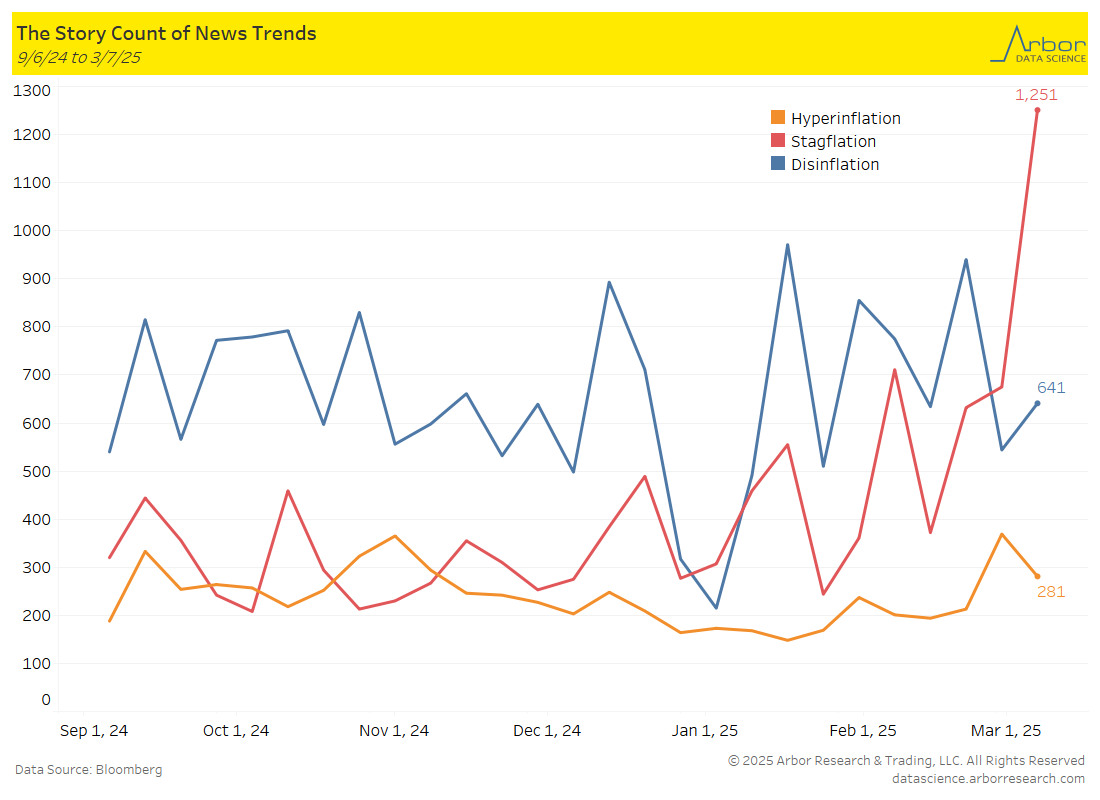

Arbor Data Science: Stagflation on the Rise

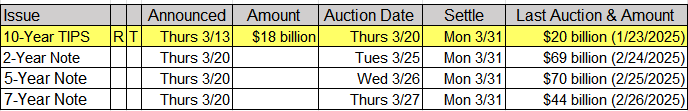

Upcoming US Treasury Supply

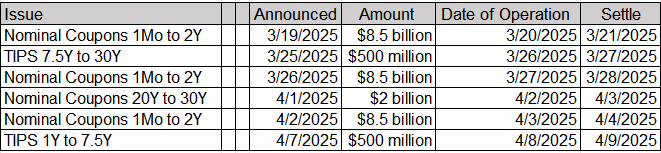

Tentative Schedule of Treasury Buyback Operations

Next Conference Call: Tomorrow, March 20, 2025, featuring Jim Bianco

Intraday Commentary from Jim Bianco

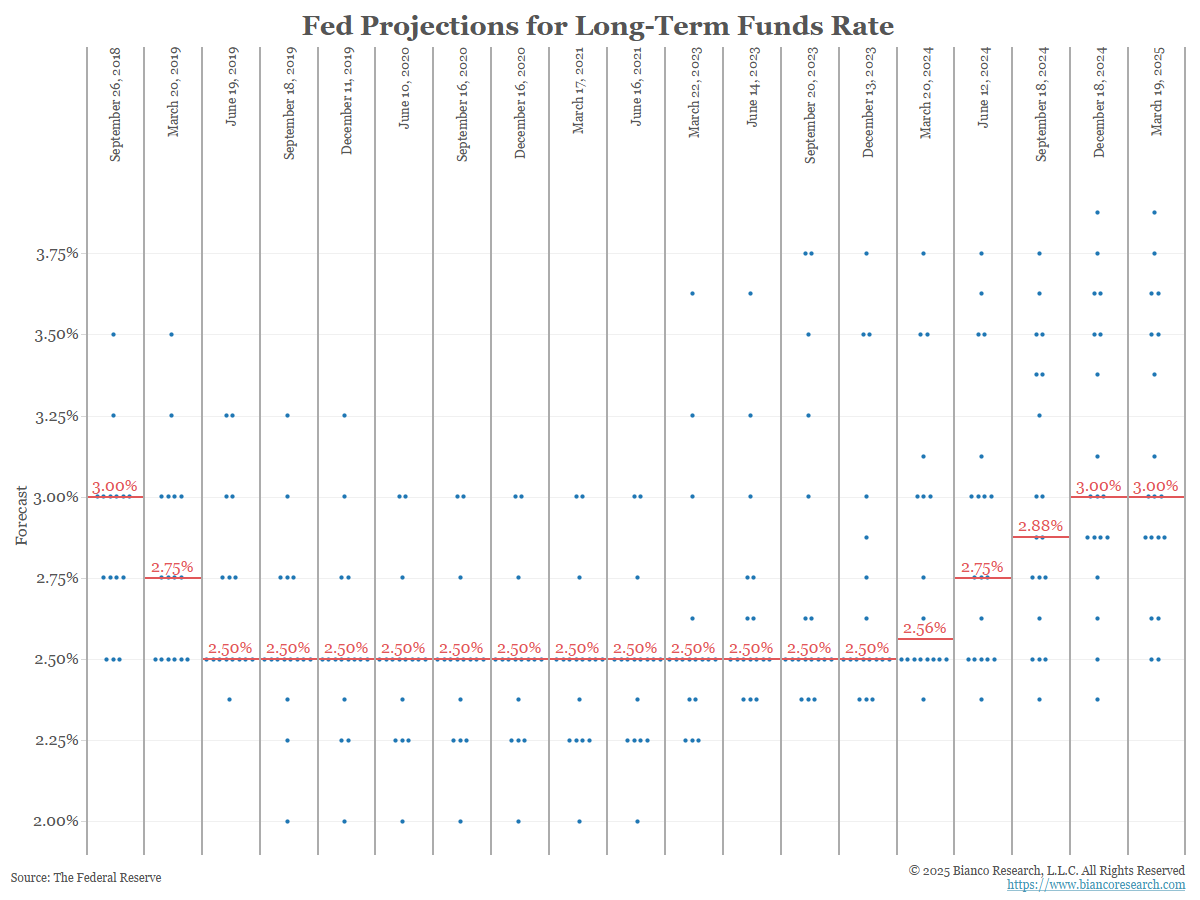

Fed’s LT projections almost identical to last quarter’s SEP…wait and see.

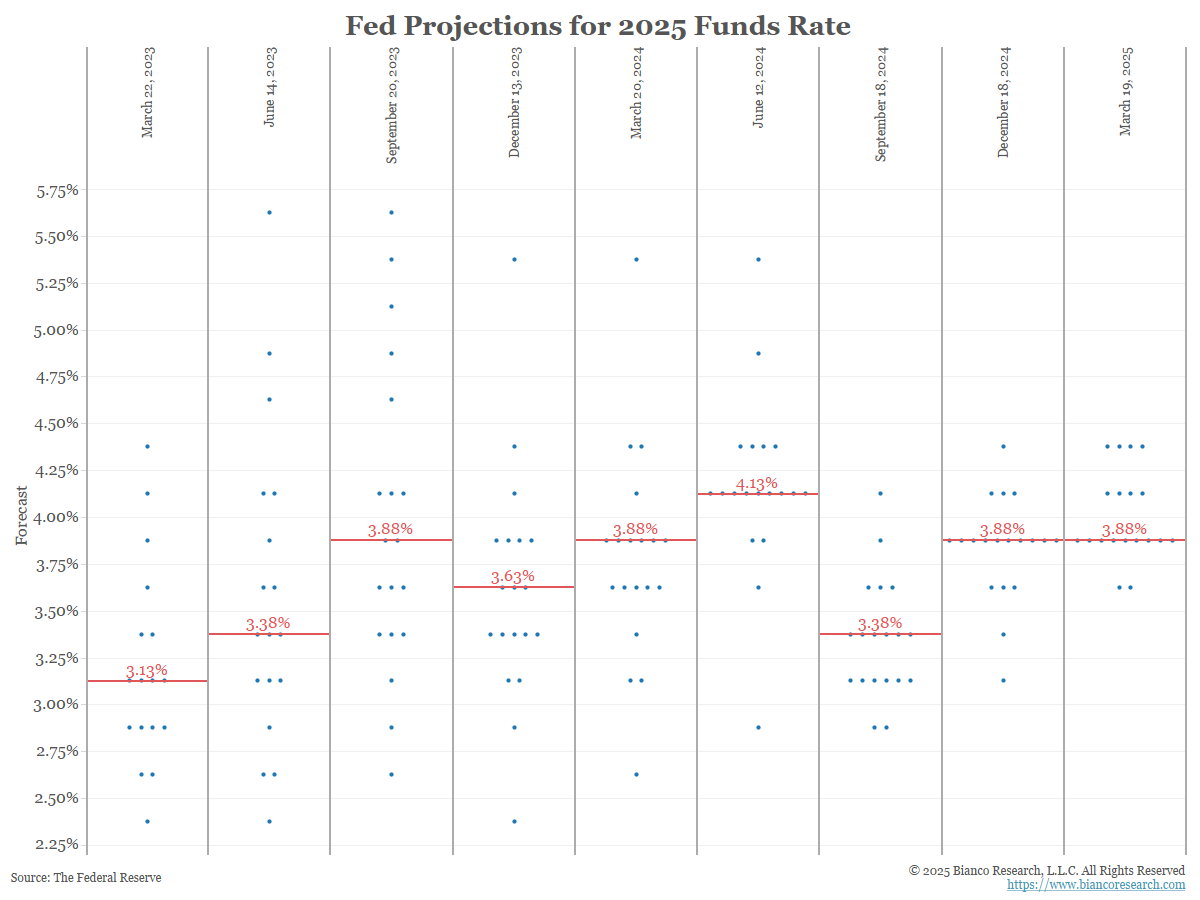

For 2025 projections, median stayed the same but seems most officials raised their year-end forecast 25 bps.

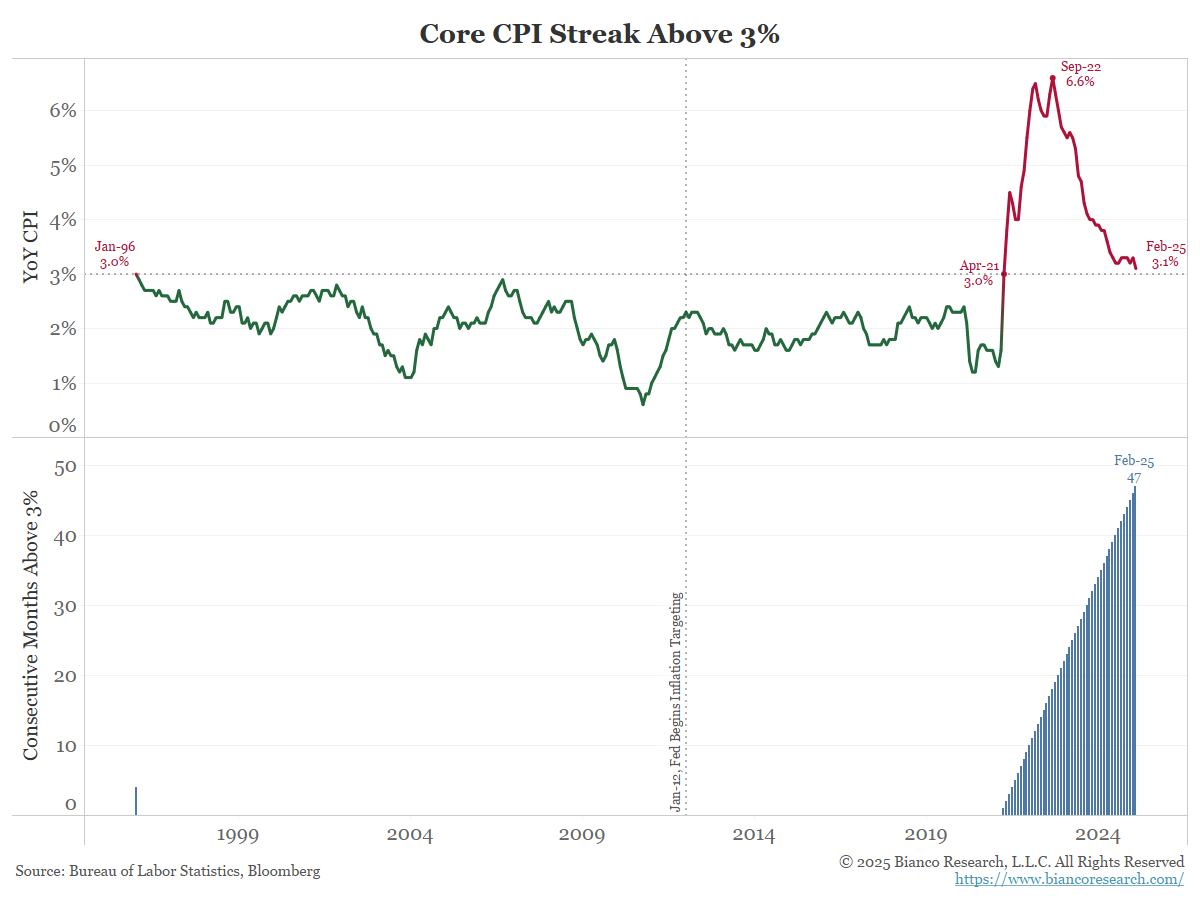

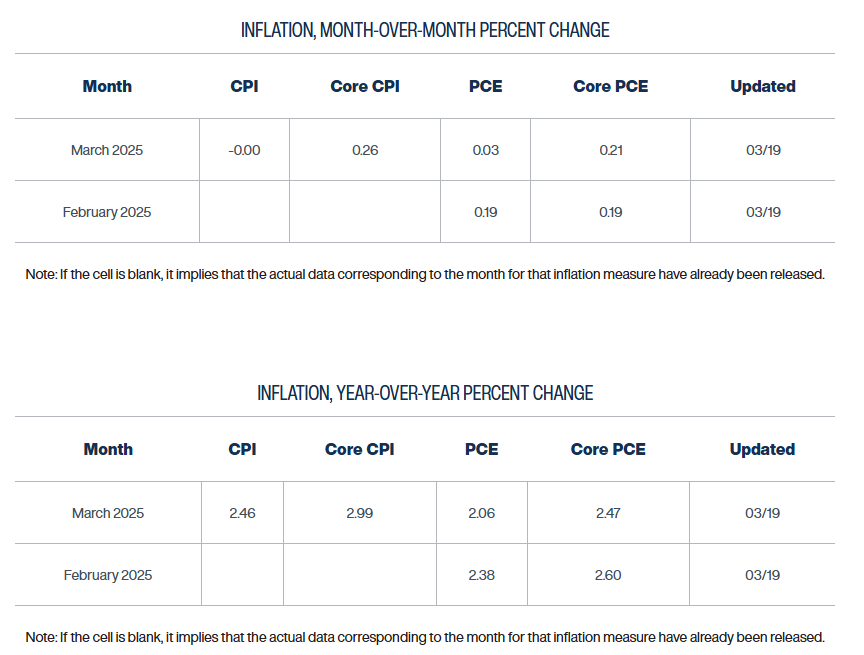

*POWELL: BASE CASE IS THAT INFLATION WILL BE TRANSITORY

47 consecutive months above 3%

And March is expected to round to 48 (2.99%). Transitory is at least five years?

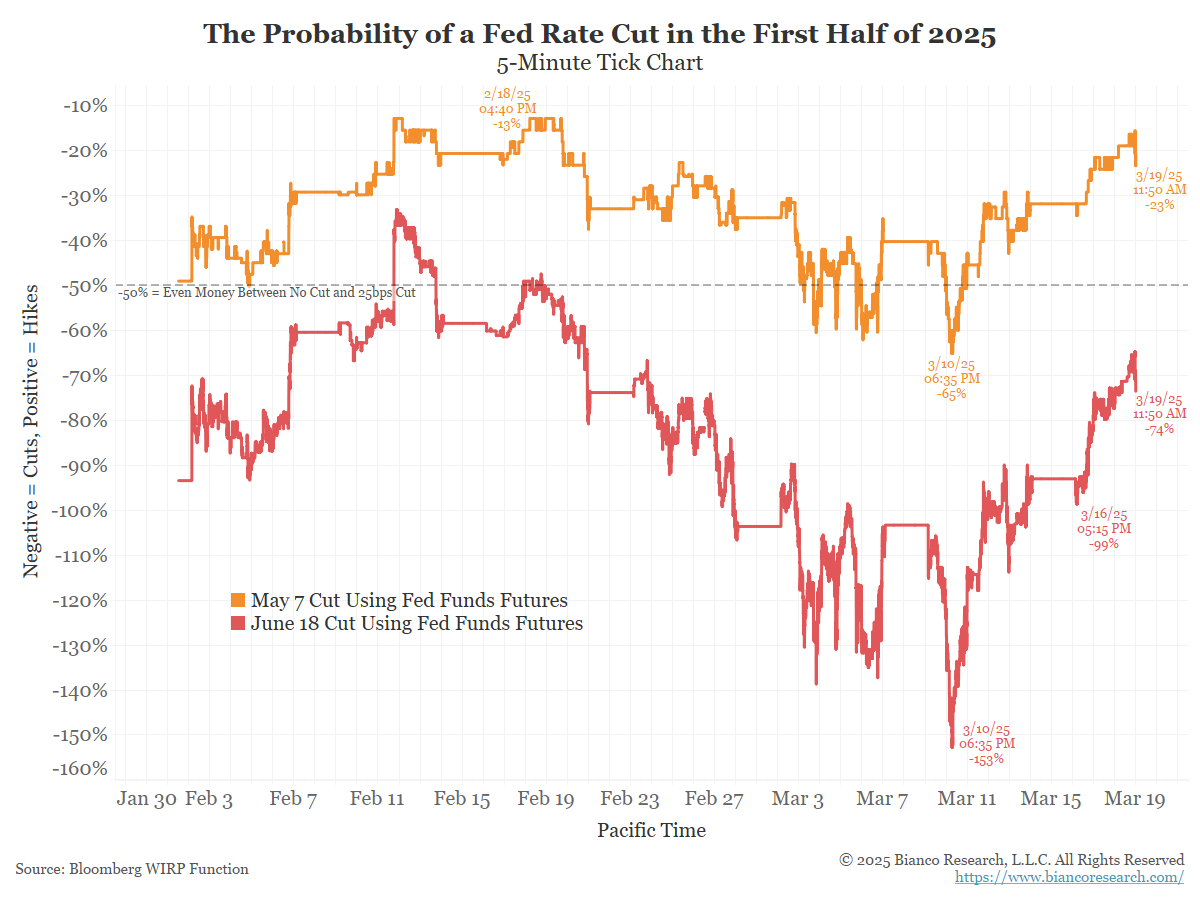

The market is not buying a dovish tilt. Still only 23% of a cut in May (orange) and its includes the first 20 minutes of the presser.

In the News…

Bloomberg: US Mortgage Rates Increase for First Time in Nine Weeks

The average US 30-year mortgage rate rose for the first time since early January, causing a pullback in refinancing and tempering purchase activity.

Axios: Money managers’ vibes are off

The net share of managers expecting the global economy to be stronger this year than last year was a modest -2% in February. In March, it was -44%. That’s the second biggest drop in global growth expectations ever.

DataCenterDynamics: Chevron to develop and power data centers in the US

Oil giant looks to get a slice of the data center pie

Oil Price: Crude Oil Inventory Increase Offset by Continued Product Inventory Declines

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 4.593 million barrels for the week ending March 14. Analysts had expected a smaller 1.7 million-barrel build.

Insurance News: Insurance industry posts first profit in four years

The US property and casualty (P/C) insurance industry reported its first underwriting profit since 2020, recording a net underwriting gain of $22.9 billion in 2024, according to an AM Best report.

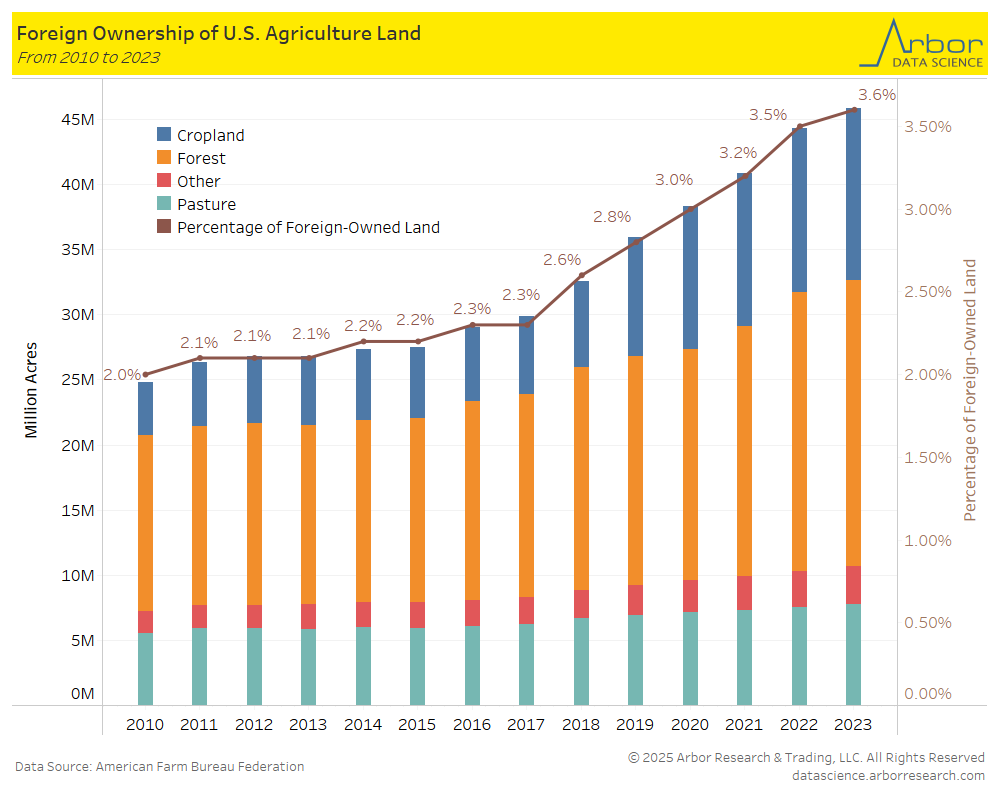

Arbor Data Science: Largest Foreign Ownership of US Ag Land (And It is Not China)

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/20/2025 at 08:30am EST: Current Account Balance

- 3/20/2025 at 08:30am EST: Initial Jobless Claims / Continuing Claims

- 3/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 3/20/2025 at 10:00am EST: Leading Index

- 3/20/2025 at 10:00am EST: Existing Home Sales / Existing Homes Sales MoM

- 3/21/2025 at 09:05am EST: Fed’s Williams Speaks in the Bahamas

- 3/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 3/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 3/24/2025 at 09:45am EST: S&P Global US Services PMI /S&P Global US Composite PMI

- 3/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 3/25/2025 at 09:00am EST: FHFA House Price Index MoM

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City YoY NSA /S&P CoreLogic CS US HPI YoY NSA

- 3/25/2025 at 09:05am EST: Fed’s Williams Gives Opening Remarks

- 3/25/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 3/25/2025 at 10:00am EST: Conf. Board Consumer Confidence

- 3/25/2025 at 10:00am EST: Conf. Board Present Situation & Conf. Board Expectations

- 3/25/2025 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions

- 3/25/2025: Building Permits & Building Permits MoM

- 3/26/2025 at 07:00am EST: MBA Mortgage Applications

- 3/26/2025 at 08:30am EST: Durable Goods Orders & Durables Ex Transportation

- 3/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 3/26/2025 at 01:10pm EST: Fed’s Musalem Speaks on Economy, Monetary Policy