US Treasuries

- Thursday’s range for UST 10y: 4.17% – 4.245%, closing at 4.23%

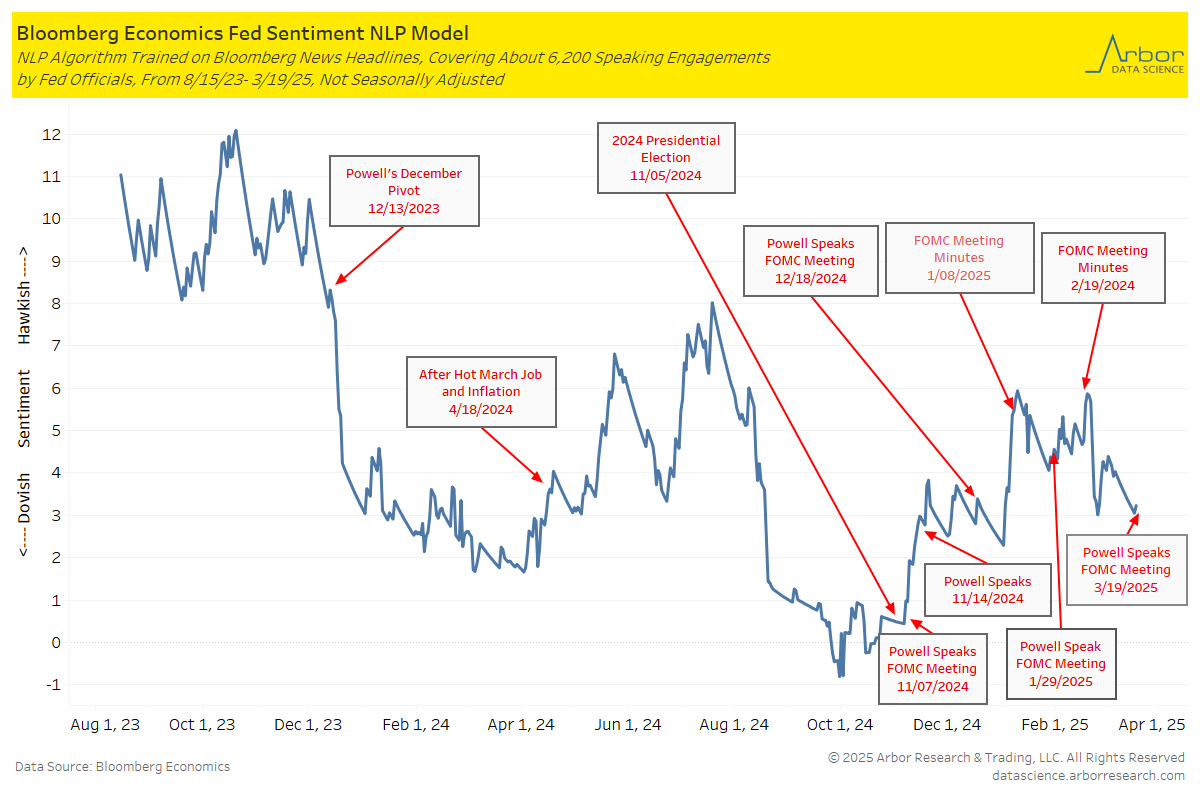

Arbor Data Science:

Bloomberg: A $4.5 Trillion Triple-Witching Gives Investors Yet Another Test

US stocks’ rebound off of last week’s lows will face a new test on Friday, when a pile of options contracts are set to expire in a quarterly event that often stoked volatility in the past.

The so-called “triple-witching” will see about $4.5 trillion of contracts tied to stocks, indexes and exchange-traded funds mature, estimates compiled by Citigroup Inc. show.

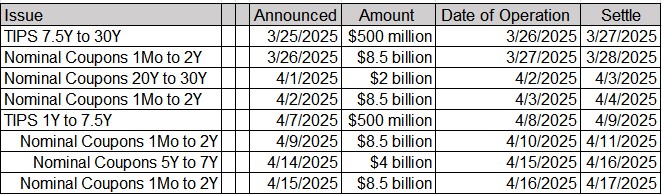

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Conference Call Replay Featuring Jim Bianco

Intraday Commentary from Jim Bianco

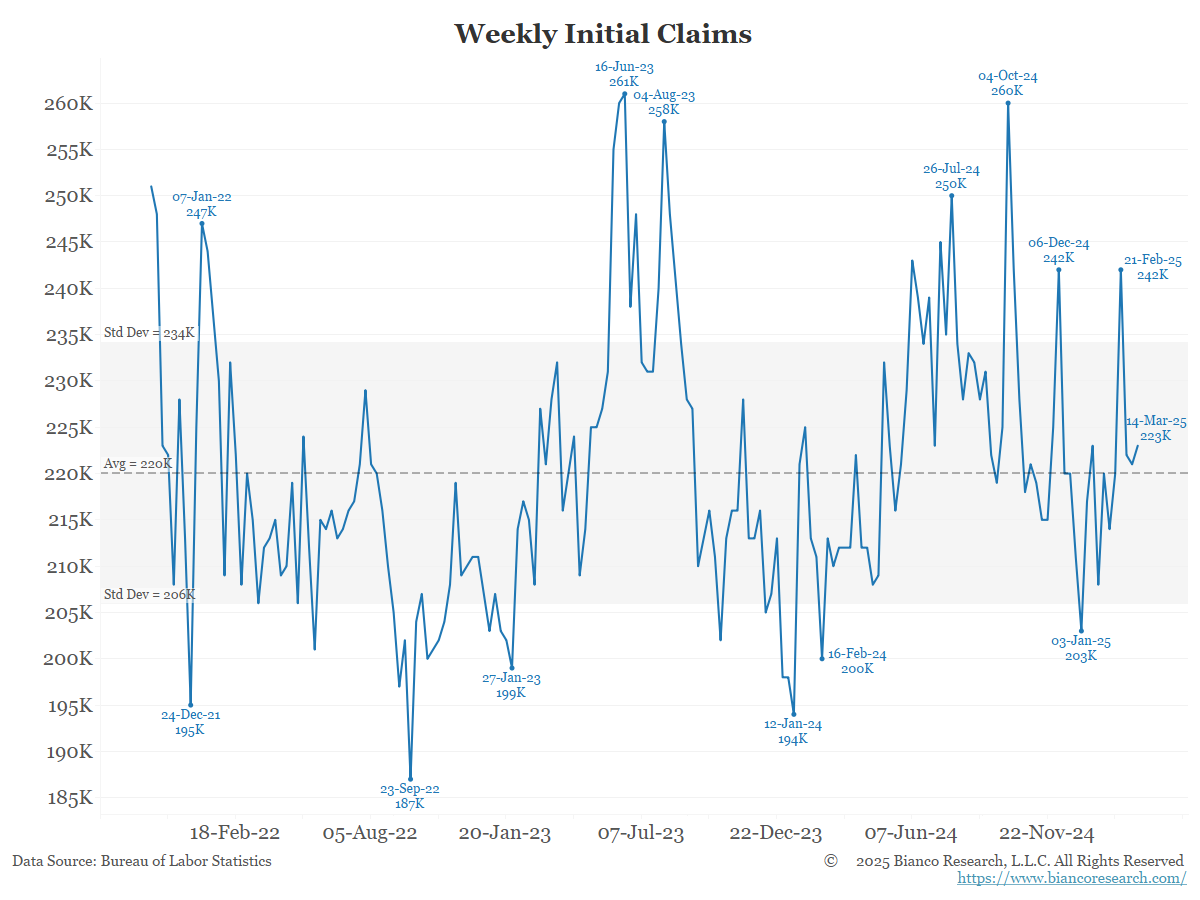

Still no sign of the labor market rolling over

In the News…

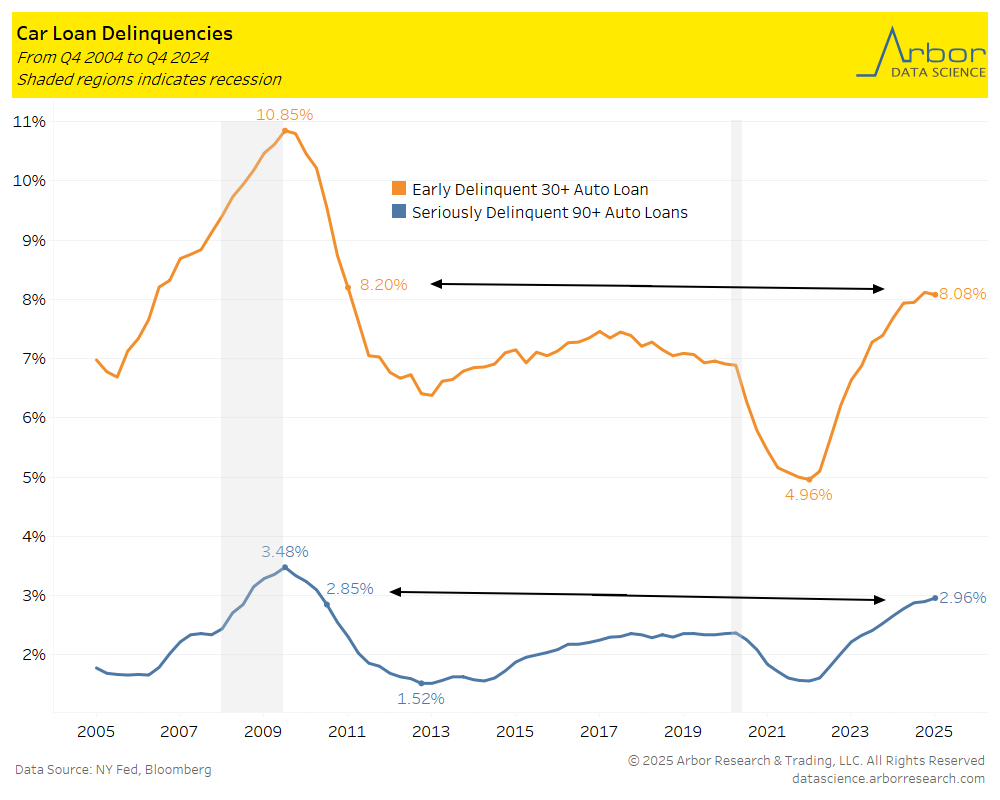

The Economic Times: Disturbing sign of economic trouble: Recession fears surge as Americans default on car loans at record rates, echoing 2008 financial crisis warnings

With mounting worries about the US economy, a new pattern is surfacing among Americans as they are falling behind on car payments at a record pace, as per a report.

Arbor Data Science: Auto Loan Delinquencies Approach 2010 Levels

Axios: Stocks throw off more cash than ever

The record amounts of cash being thrown off by U.S. stocks aren’t just helping to support stock market valuations, they’re also bolstering domestic consumption and international markets.

Fast Company: Housing market map: Zillow once again downgrades its 2025 home price forecast

On Tuesday, Zillow economists published their updated forecast model, projecting that U.S. home prices, as measured by the Zillow Home Value Index, will rise 0.8% between February 2025 and February 2026. That’s another downward revision.

The Guardian: ‘Don’t call it zombie deer disease’: scientists warn of ‘global crisis’ as infections spread across the US

In a scattershot pattern that now extends from coast to coast, continental US states have been announcing new hotspots of chronic wasting disease (CWD). The contagious and always-fatal neurodegenerative disorder infects the cervid family that includes deer, elk, moose and, in higher latitudes, reindeer. There is no vaccine or treatment.

Upcoming Economic Releases & Fed Speak

- 3/21/2025 at 08:30am EST: Fed’s Goolsbee on CNBC

- 3/21/2025 at 09:05am EST: Fed’s Williams Speaks in the Bahamas

- 3/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 3/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 3/24/2025 at 09:45am EST: S&P Global US Services PMI /S&P Global US Composite PMI

- 3/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 3/25/2025 at 09:00am EST: FHFA House Price Index MoM

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City YoY NSA /S&P CoreLogic CS US HPI YoY NSA

- 3/25/2025 at 09:05am EST: Fed’s Williams Gives Opening Remarks

- 3/25/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 3/25/2025 at 10:00am EST: Conf. Board Consumer Confidence

- 3/25/2025 at 10:00am EST: Conf. Board Present Situation & Conf. Board Expectations

- 3/25/2025 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions

- 3/25/2025: Building Permits & Building Permits MoM

- 3/26/2025 at 07:00am EST: MBA Mortgage Applications

- 3/26/2025 at 08:30am EST: Durable Goods Orders & Durables Ex Transportation

- 3/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 3/26/2025 at 01:10pm EST: Fed’s Musalem Speaks on Economy, Monetary Policy

- 3/27/2025 at 08:30am EST: GDP Annualized QoQ & Wholesale Inventories MoM

- 3/27/2025 at 08:30am EST: Personal Consumption & GDP Price Index

- 3/27/2025 at 08:30am EST: Core PCE Price Index QoQ & Advance Goods Trade Balance

- 3/27/2025 at 08:30am EST: Initial Jobless Claims & Retail Inventories MoM & Continuing Claims

- 3/27/2025 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 3/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 3/27/2025 at 04:00pm EST: Fed’s Barkin Gives Speech, Q&A