US Treasuries

- Friday’s range for UST 10y: 4.20% – 4.25%, closing at 4.25%

- Fed’s Goolsbee: says inflationary impact from tariffs could be transitory if they were limited in scope

- Fed’s Williams: says there are no signs of inflation expectations becoming unmoored relative to the pre-pandemic period

- Fed’s Waller: says the banking system still has enough reserves for the central bank to keep its monthly runoff of Treasury securities unchanged

Bloomberg: Treasuries Rally Again With Focus on Fed’s Likely Rate Cuts

The US Treasury market is heading for its best weekly gain this month as economic angst reinforces bets on interest-rate cuts.

CoinTelegraph: Tether’s US treasury holdings surpass Canada, Taiwan, ranks 7th globally

Tether, the $143-billion stablecoin giant, was the world’s seventh-largest buyer of US Treasurys, surpassing some of the world’s largest countries.

Barron’s: Foreigners Dump U.S. Treasuries. You Won’t Believe Who Did the Most Selling

Investors abroad sold longer term Treasuries for three consecutive months, a sign of central bankers reducing their reliance on the U.S. as a financial buffer.

Before the back-to-back net selling of the world’s safest debt, foreigners had kept buying for 15 straight months.

The largest net seller in January was Canada. The U.K. was the largest buyer in January, after having been the largest net seller in December. Norway and Japan were the second and third largest net buyers in January, respectively, Goldman said in a note.

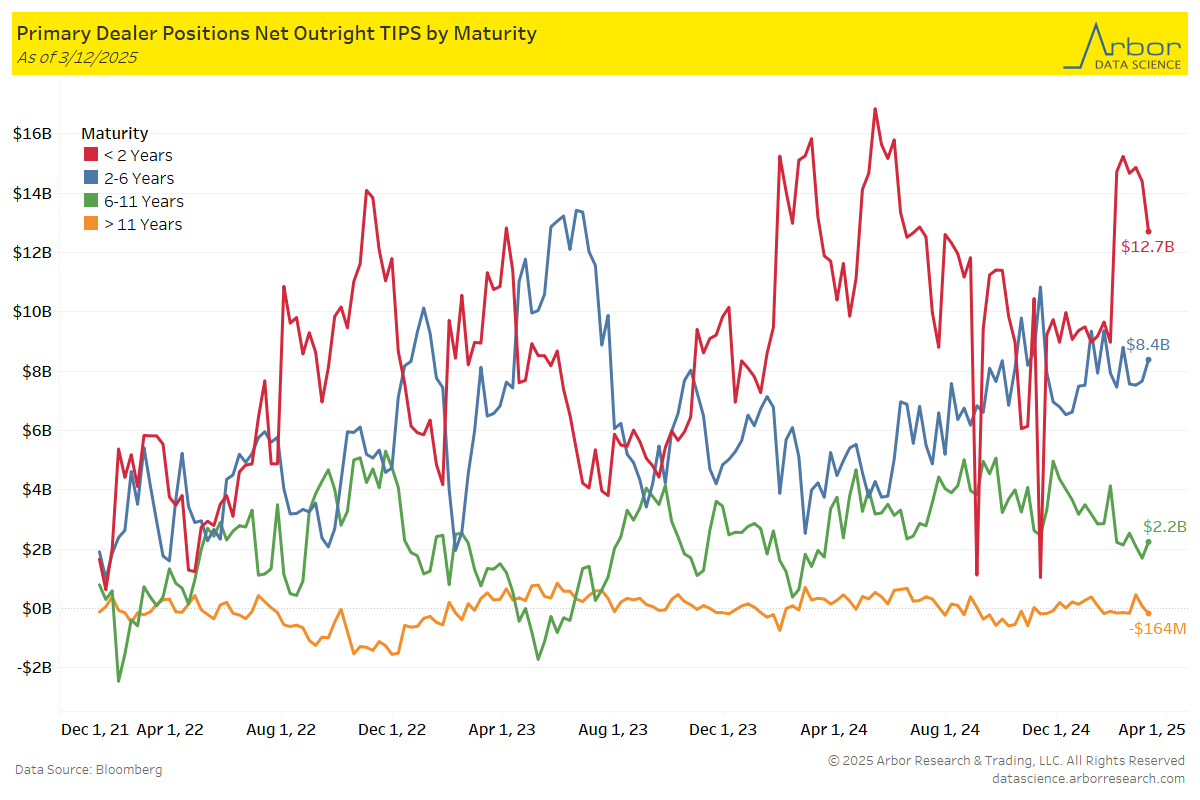

TIPS by Maturity

Data through 3/12/25

- < 2 years: $14.4 Bn on 3/05/25 to $12.7 Bn on 3/12/25 = ($1.7 Bn)

- 2 – 6 years: $7.7 Bn on 3/05/25 to $8.4 Bn on 3/12/25 = $0.7 Bn

- 6 – 11 years: $1.7 Bn on 3/05/25 to $2.2 Bn on 3/12/25 = $0.5 Bn

- > 11 years: $82 Mn on 3/05/25 to ($164 Mn) on 3/12/25 = ($246Mn)

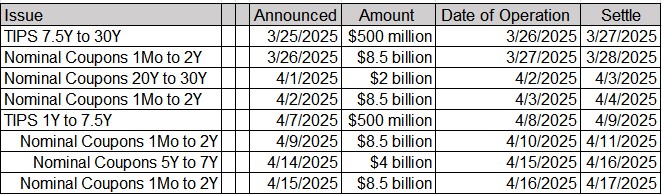

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

In the News…

WSJ: Federal Reserve Posted Loss of $77.6 Billion in 2024

The Federal Reserve ran an operating loss of $77.6 billion last year, the second straight year of large losses.

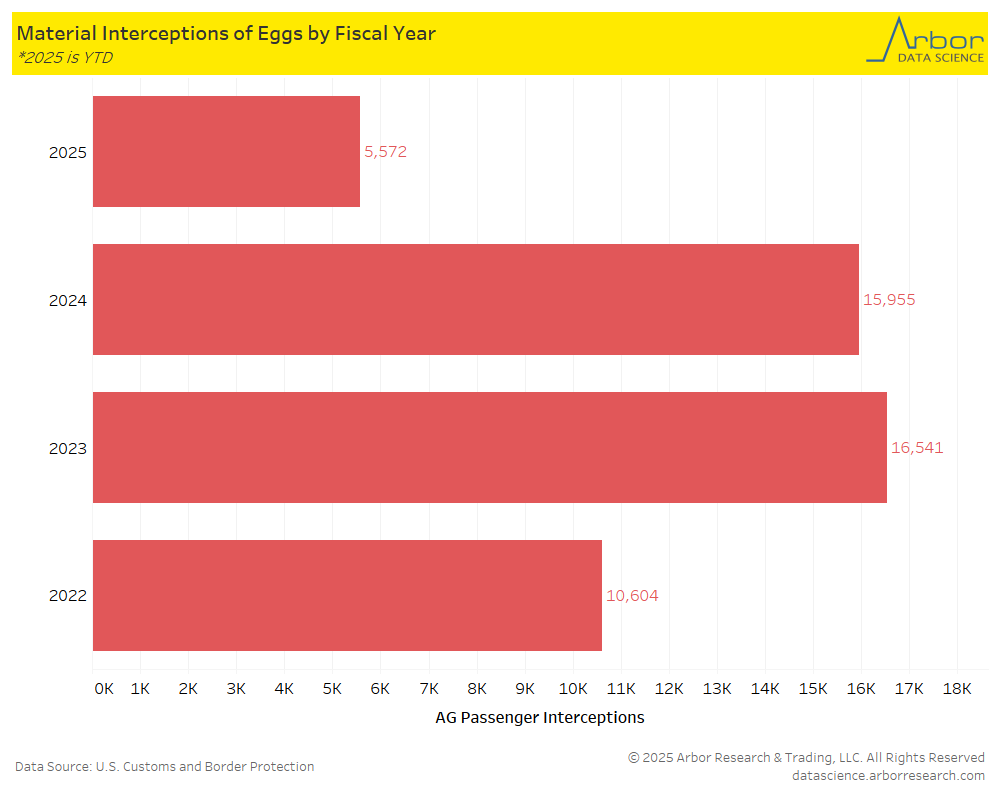

USA Today: Eggs seized at US border more than fentanyl amid bird flu outbreak, federal data shows

Federal data shows that eggs are being seized at U.S. borders more than the synthetic opioid fentanyl, a trend occurring amid an ongoing bird flu outbreak causing poultry shortages across the nation.

Arbor Data Science:

MarketWatch: FedEx is the latest company to sound the alarm on the U.S. economy

FedEx Corp. late Thursday cut its profit outlook for a third straight quarter, saying that it reflected “continued weakness and uncertainty in the U.S. industrial economy.”

FreightWaves: China stops importing liquefied natural gas from US due to tariffs

China has halted imports of liquefied natural gas from the U.S. for the past 40 days amid an escalating global trade war since President Donald Trump took office, reported Bloomberg.

Upcoming Economic Releases & Fed Speak

- 3/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 3/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 3/24/2025 at 09:45am EST: S&P Global US Services PMI /S&P Global US Composite PMI

- 3/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 3/25/2025 at 09:00am EST: FHFA House Price Index MoM

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA

- 3/25/2025 at 09:00am EST: S&P CoreLogic CS 20-City YoY NSA /S&P CoreLogic CS US HPI YoY NSA

- 3/25/2025 at 01:45pm EST: Fed’s Bostic on Bloomberg TV

- 3/25/2025 at 03:10pm EST: Fed’s Barr Speaks on Small Business Lending

- 3/25/2025 at 08:40am EST: Fed’s Kugler Gives Speech on economy, Entrepreneurship

- 3/25/2025 at 09:05am EST: Fed’s Williams Gives Opening Remarks

- 3/25/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 3/25/2025 at 10:00am EST: Conf. Board Consumer Confidence

- 3/25/2025 at 10:00am EST: Conf. Board Present Situation & Conf. Board Expectations

- 3/25/2025 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions

- 3/25/2025: Building Permits & Building Permits MoM

- 3/26/2025 at 07:00am EST: MBA Mortgage Applications

- 3/26/2025 at 08:30am EST: Durable Goods Orders & Durables Ex Transportation

- 3/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 3/26/2025 at 10:00am EST: Fed’s Kashkari Hosts Fed Listens, Conversation

- 3/26/2025 at 01:10pm EST: Fed’s Musalem Speaks on Economy, Monetary Policy

- 3/27/2025 at 08:30am EST: GDP Annualized QoQ & Wholesale Inventories MoM

- 3/27/2025 at 08:30am EST: Personal Consumption & GDP Price Index

- 3/27/2025 at 08:30am EST: Core PCE Price Index QoQ & Advance Goods Trade Balance

- 3/27/2025 at 08:30am EST: Initial Jobless Claims & Retail Inventories MoM & Continuing Claims

- 3/27/2025 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 3/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 3/27/2025 at 04:00pm EST: Fed’s Barkin Gives Speech, Q&A

- 3/28/2025 at 08:30am EST: Personal Income & Personal Spending & Real Personal Spending

- 3/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 3/28/2025 at 10:00am EST: Bloomberg March United States Economic Survey

- 3/28/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions

- 3/28/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 3/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 3/28/2025 at 12:15pm EST: Fed’s Barr Gives Speech on Banking Policy

- 3/28/2025 at 03:30pm EST: Fed’s Bostic Moderates Panel on Housing Finance