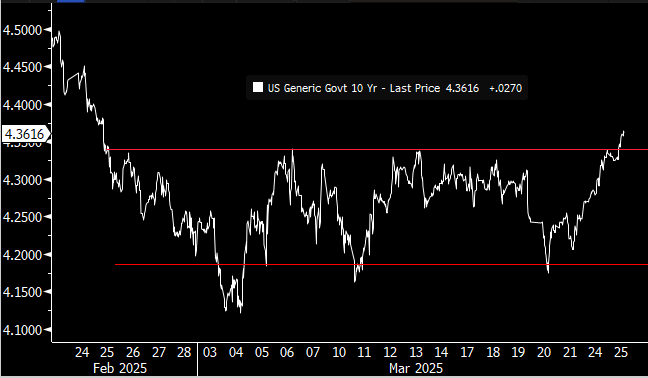

US Treasuries

- Tuesday’s range for UST 10y: 4.30% – 4.365%, closing at 4.31%

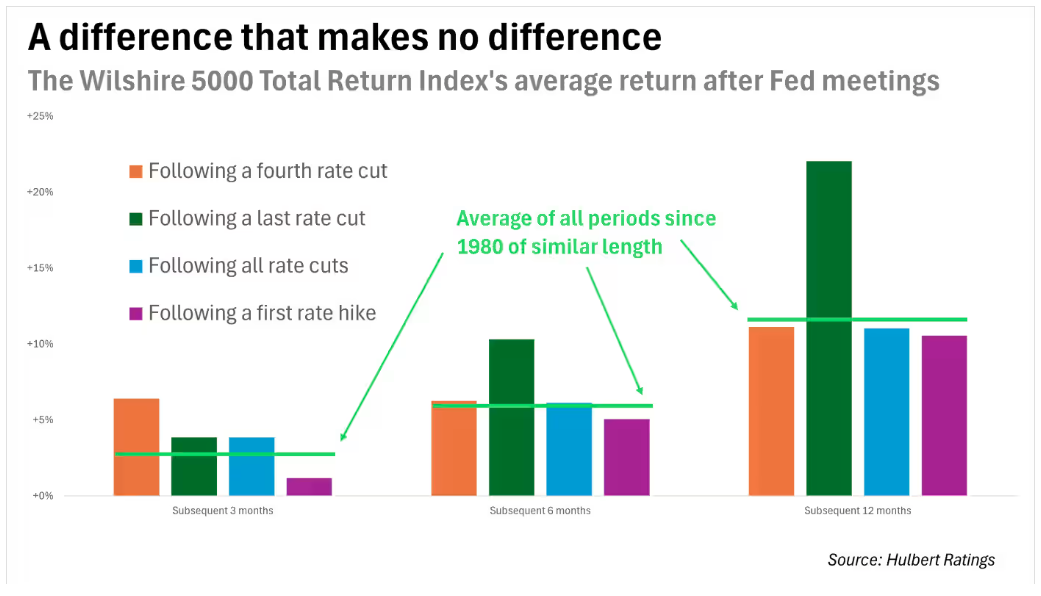

MarketWatch: Fed decisions impact the stock market – just not in the way you think

The stock market’s average return is about the same, regardless of whether the Fed cuts rates, raises them or leaves them unchanged.

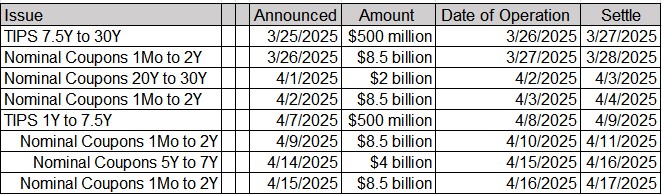

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco Joins Bloomberg Radio to discuss “Uncertainty” in the Market & American Exceptionalism

Jim Bianco Joins Fox Business to discuss “Uncertainty”, US Exceptionalism & the Federal Reserve

Intraday Commentary From Jim Bianco

The 10-year yield broke out.

The Highest levels since Feb 24.

*US COPPER FUTURES HIT RECORD HIGH AS TRADERS BET ON TARIFFS

Tariffs are legit reason? Or “Dr. Copper, the medal with a PhD in economics.”

All-time peaks in copper are associated with periods of strong nominal growth.

Such growth can be driven by real economic activity, inflation, or a combination of both.

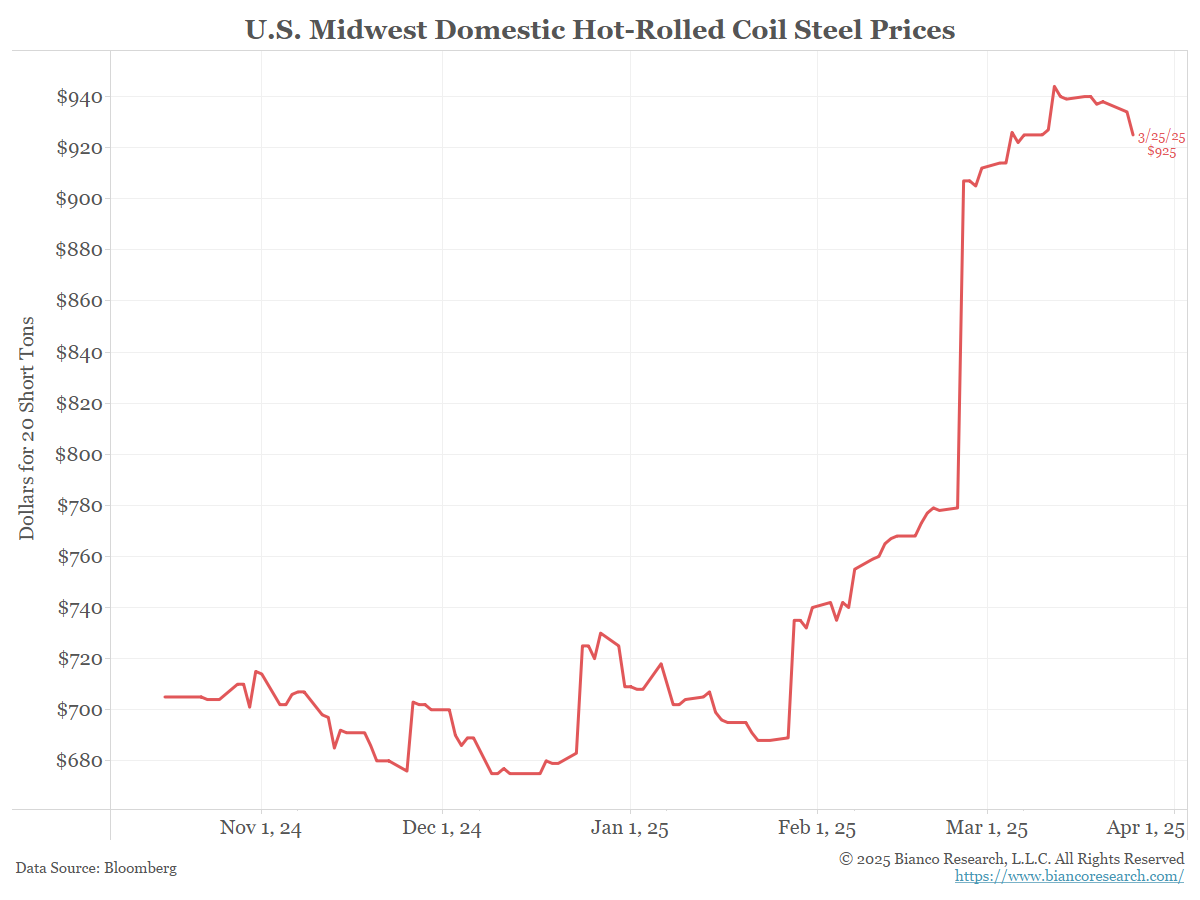

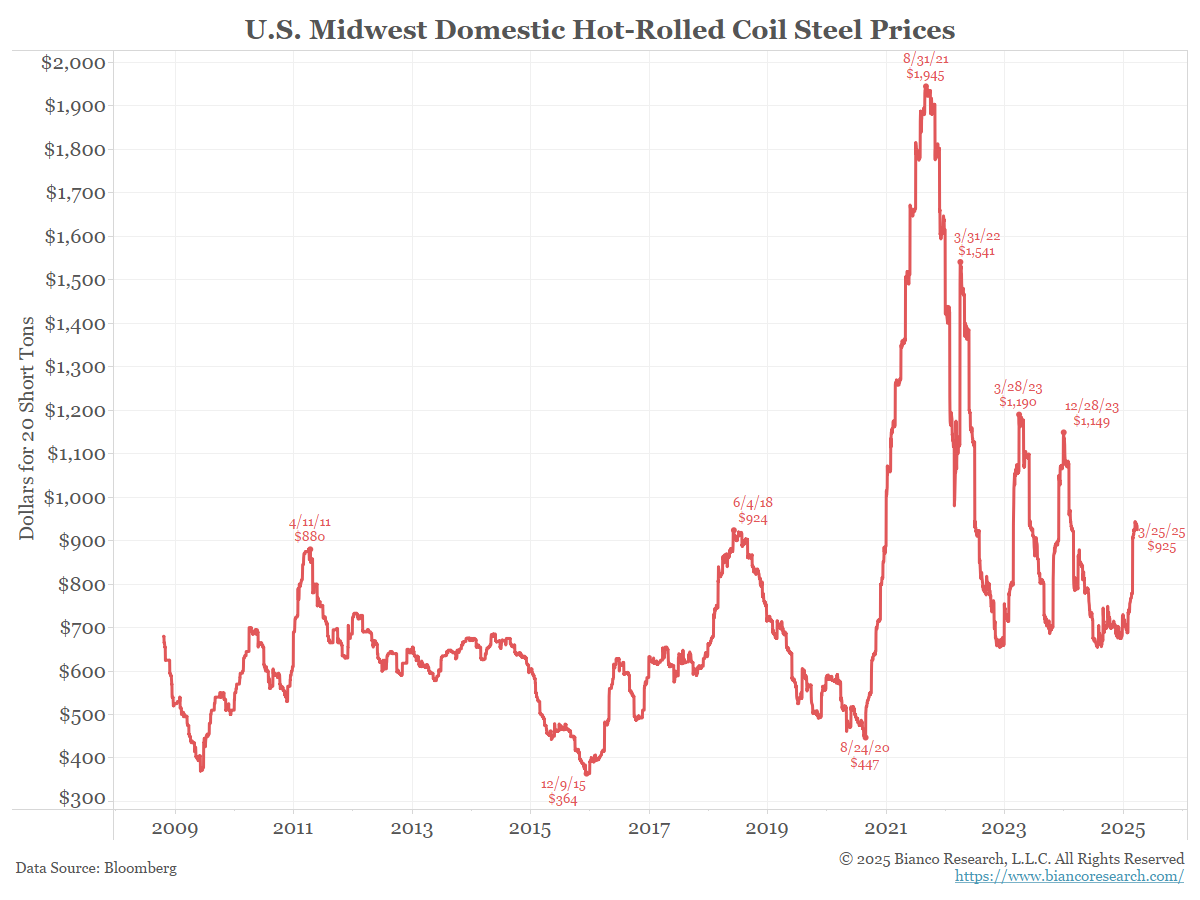

Speaking of Tariffs, versions of this chart are going around suggesting the impact that tariffs are having on steel prices.

The above chart is not wrong. But if a longer history is shown, the picture changes.

Looks like more than tariffs are going on in this market.

In the News…

Axios: Job applications surge from workers at DOGE-targeted agencies

This is a highly educated bunch, spread around the country — and they’re entering the job market at a time when hiring for those with advanced degrees has stalled out.

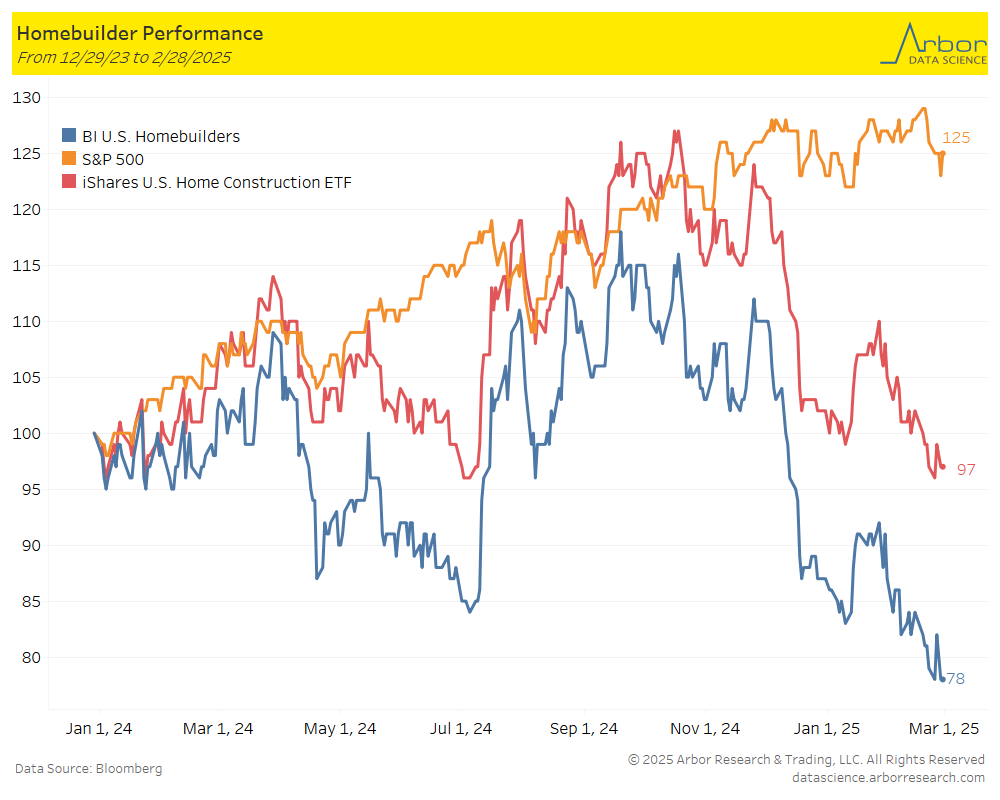

Arbor Data Science:

SupplyChainBrain: NTSB Recommends Evaluation of 68 Bridges for Risk of Collapse from Vessel Strike

The U.S. National Transportation Safety Board recommended March 20 that 30 owners of 68 bridges across 19 states conduct a vulnerability assessment to determine the risk of bridge collapse from a vessel collision, part of the ongoing investigation into the March 2024 collapse of the Francis Scott Key Bridge in Baltimore.

Brownfield Ag News: Two-Thirds of Rural Bankers Expect 2025 Farm Income Decline

Many rural bankers in the Midwest are expecting a decline in net farm income this year.

Upcoming Economic Releases & Fed Speak

- 3/26/2025 at 07:00am EST: MBA Mortgage Applications

- 3/26/2025 at 08:30am EST: Durable Goods Orders & Durables Ex Transportation

- 3/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 3/26/2025 at 10:00am EST: Fed’s Kashkari Hosts Fed Listens, Conversation

- 3/26/2025 at 01:10pm EST: Fed’s Musalem Speaks on Economy, Monetary Policy

- 3/27/2025 at 08:30am EST: GDP Annualized QoQ & Wholesale Inventories MoM

- 3/27/2025 at 08:30am EST: Personal Consumption & GDP Price Index

- 3/27/2025 at 08:30am EST: Core PCE Price Index QoQ & Advance Goods Trade Balance

- 3/27/2025 at 08:30am EST: Initial Jobless Claims & Retail Inventories MoM & Continuing Claims

- 3/27/2025 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 3/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 3/27/2025 at 04:30pm EST: Fed’s Barkin Gives Speech, Q&A

- 3/27/2025 at 04:30pm EST: Fed’s Collins Speaks in Fireside Chat on Economy

- 3/28/2025 at 08:30am EST: Personal Income & Personal Spending & Real Personal Spending

- 3/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 3/28/2025 at 10:00am EST: Bloomberg March United States Economic Survey

- 3/28/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions

- 3/28/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 3/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 3/28/2025 at 12:15pm EST: Fed’s Barr Gives Speech on Banking Policy

- 3/28/2025 at 03:30pm EST: Fed’s Bostic Moderates Panel on Housing Finance

- 3/31/2025 at 09:45am EST: MNI Chicago PMI

- 3/31/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 4/01/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 4/01/2025 at 10:00am EST: Construction Spending MoM

- 4/01/2025 at 10:00am EST: JOLTS Job Openings & JOLTS Job Openings Rate

- 4/01/2025 at 10:00am EST: JOLTS Quits Level & JOLTS Quits Rate

- 4/01/2025 at 10:00am EST: JOLTS Layoffs Level & JOLTS Layoffs Rate

- 4/01/2025 at 10:00am EST: ISM Manufacturing & ISM Prices Paid

- 4/01/2025 at 10:00am EST: ISM New orders & ISM Employment

- 4/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 4/01/2025: Wards Total Vehicle Sales