US Treasuries

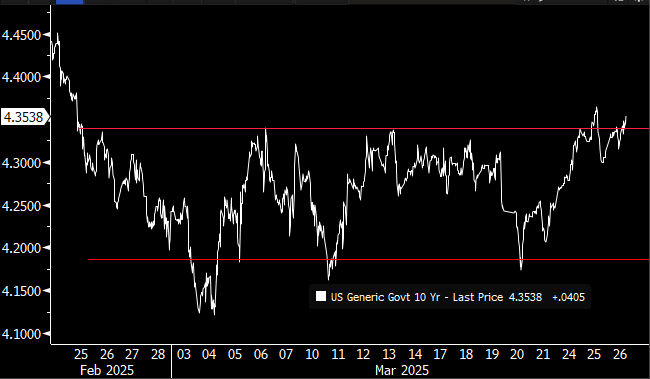

- Wednesday’s range for UST 10y: 4.31% – 4.36%, closing at 4.33%

- Fed’s Kashkari: says Fed has more work to do on lowering US inflation

- Fed’s Musalem: warns tariff inflation impact may not be temporary

Bloomberg: Five-Year Treasuries Are the Go-To for Wall Street’s Risk-Averse

A popular trade is gaining even more steam in the Treasury market as tariffs muddy the Federal Reserve’s interest-rate path and concern builds around US growth: Buy five-year notes.

Bloomberg: Bond Markets Draw Rush of Issuers Before Tariff ‘Liberation Day’

Borrowers are piling into bond markets to get deals done ahead of US President Donald Trump’s plans to impose global tariffs on April 2.

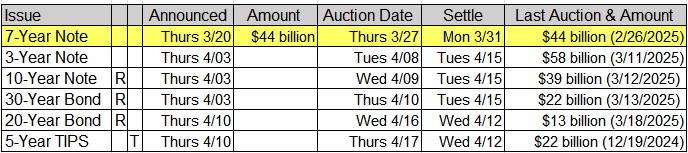

Upcoming US Treasury Supply

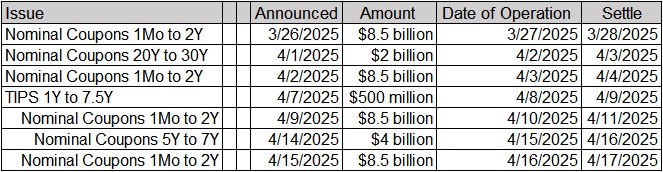

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary From Jim Bianco

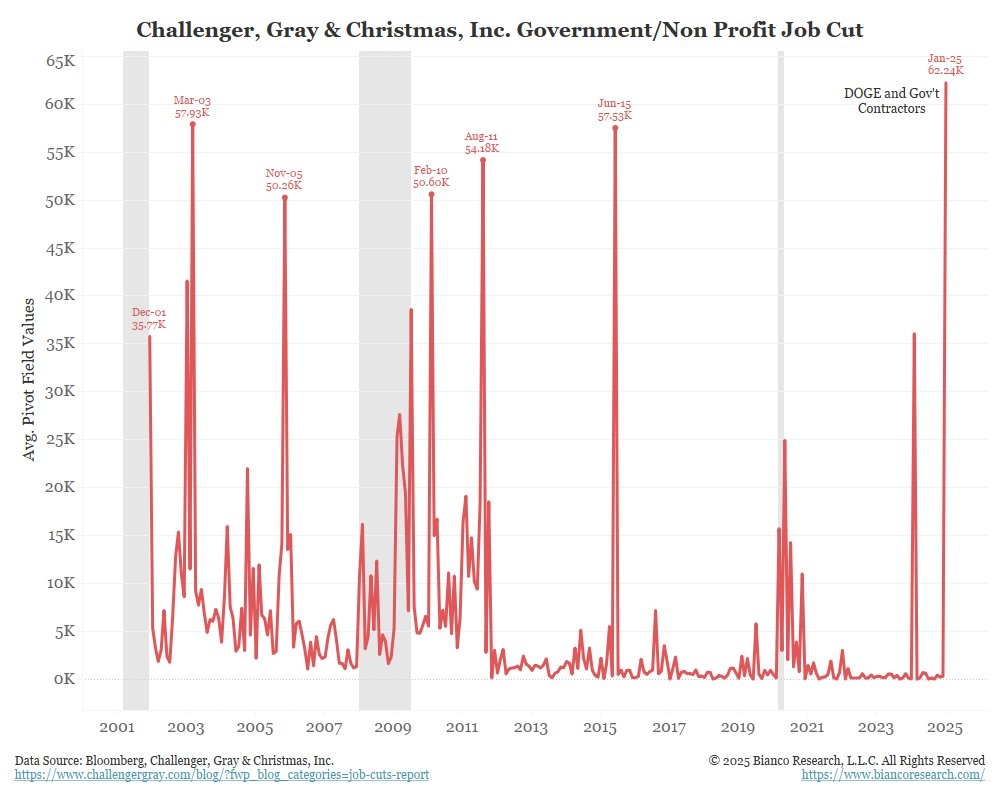

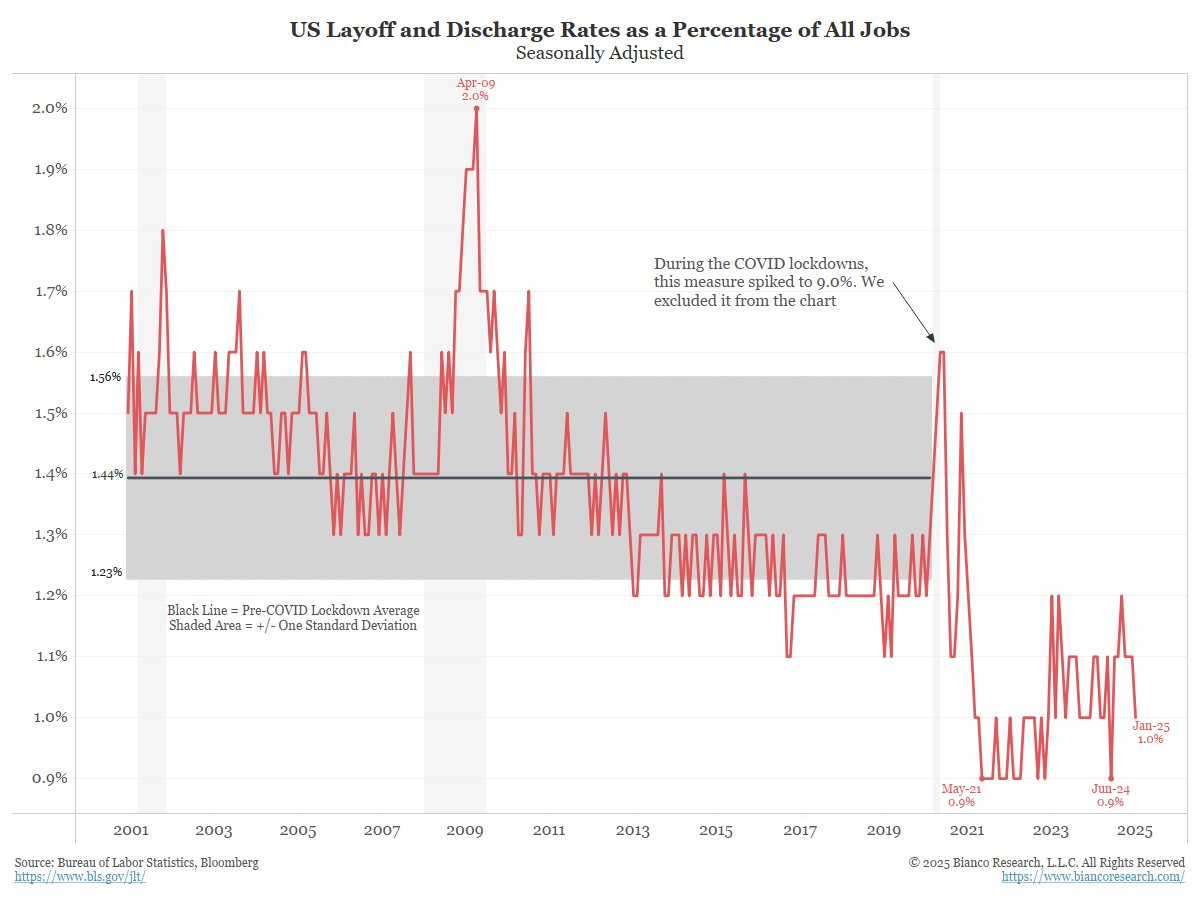

Careful with the chart above. Challenger noted that most of these job cuts are government and government contractors (also DOGE).

Strip them out and the private sector is ok. Further announcements to rehire are up.

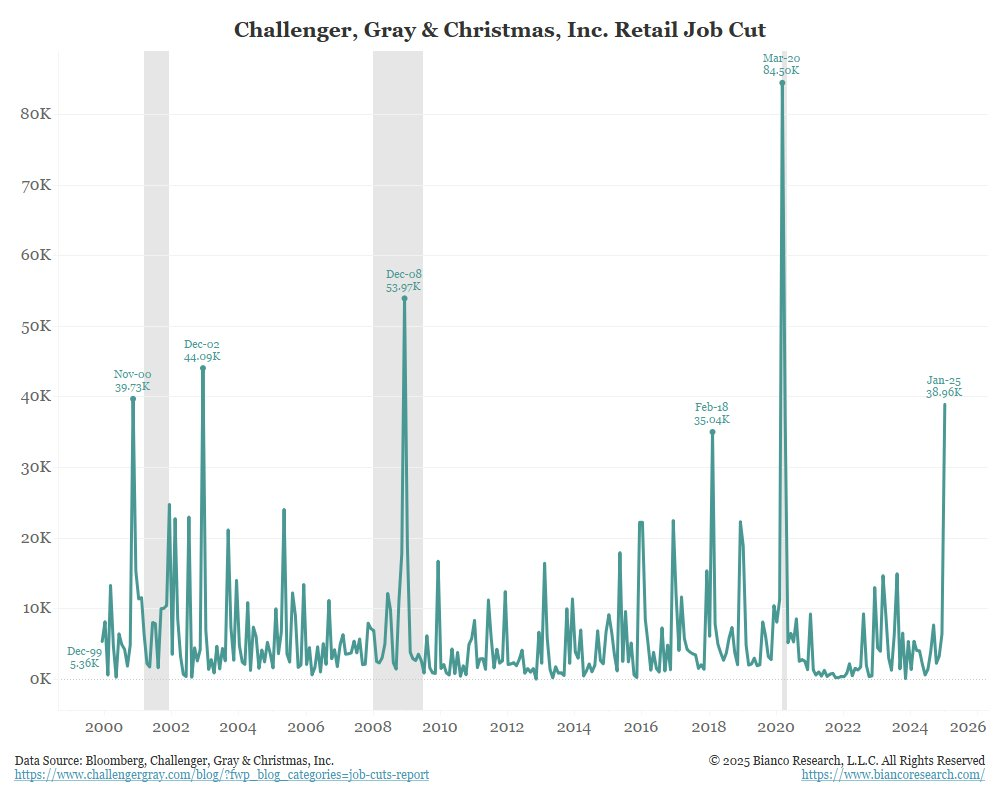

ChallengerGray: Job Cuts Surge on DOGE Actions, Retail Woes; Highest Monthly Total Since July 2020

One point of concern is retail layoffs. This is not enough to indict the entire economy.

Excluding retail, DOGE and Gov’t contractors (also DOGE), the rest of the economy is experiencing low levels of job cuts. Layoffs as a percentage of the workforce remain near historic lows.

10-year yield still flirting with breaking out

In the News…

USA Today: Early hurricane forecast predicts active season with ‘multiple impacts’ in US

We’re now getting a first glimpse at how dangerous the 2025 Atlantic hurricane season might be.

On Wednesday morning, AccuWeather released its forecast, which calls for another active season “with multiple impacts on the United States.” The news comes less than two weeks after an unusual and brief tropical disturbance in the Atlantic Ocean signaled that hurricane season isn’t all that far away.

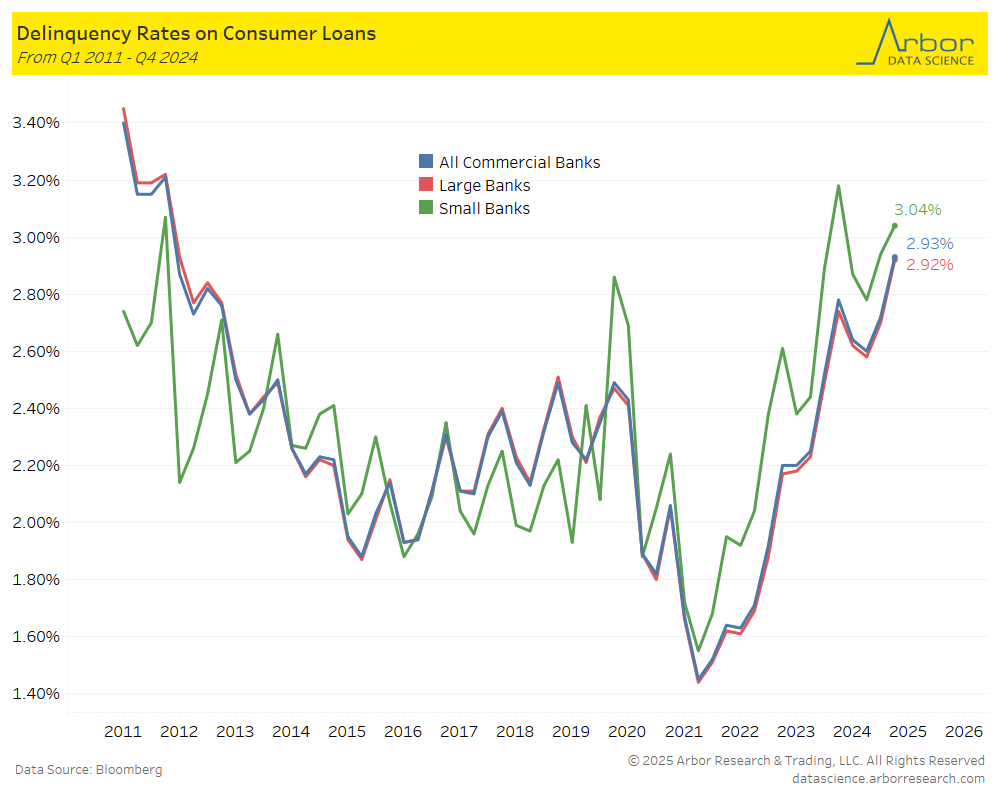

Bloomberg: Car Repossessions Surged Last Year to Highest Level Since 2009

In 2024, roughly 1.73 million vehicles were seized, according to data from Cox Automotive, up 16% from the year prior and 43% compared with 2022. The last time repos hit this level the US economy was reeling from the financial crisis.

Arbor Data Science: Examining U.S. Banks in Charts

SupplyChainBrain: FDA Delays Food Traceability Rules as Foodborne Illnesses Surge

The Food and Drug Administration (FDA) is delaying implementation of new food traceability rules by 30 months, to give companies more time to bring their supply chains into compliance, it announced March 20.

Upcoming Economic Releases & Fed Speak

- 3/27/2025 at 08:30am EST: GDP Annualized QoQ & Wholesale Inventories MoM

- 3/27/2025 at 08:30am EST: Personal Consumption & GDP Price Index

- 3/27/2025 at 08:30am EST: Core PCE Price Index QoQ & Advance Goods Trade Balance

- 3/27/2025 at 08:30am EST: Initial Jobless Claims & Retail Inventories MoM & Continuing Claims

- 3/27/2025 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 3/27/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 3/27/2025 at 04:30pm EST: Fed’s Barkin Gives Speech, Q&A

- 3/27/2025 at 04:30pm EST: Fed’s Collins Speaks in Fireside Chat on Economy

- 3/28/2025 at 08:30am EST: Personal Income & Personal Spending & Real Personal Spending

- 3/28/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 3/28/2025 at 10:00am EST: Bloomberg March United States Economic Survey

- 3/28/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions

- 3/28/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 3/28/2025 at 11:00am EST: Kansas City Fed Services Activity

- 3/28/2025 at 12:15pm EST: Fed’s Barr Gives Speech on Banking Policy

- 3/28/2025 at 03:30pm EST: Fed’s Bostic Moderates Panel on Housing Finance

- 3/31/2025 at 09:45am EST: MNI Chicago PMI

- 3/31/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 4/01/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 4/01/2025 at 10:00am EST: Construction Spending MoM

- 4/01/2025 at 10:00am EST: JOLTS Job Openings & JOLTS Job Openings Rate

- 4/01/2025 at 10:00am EST: JOLTS Quits Level & JOLTS Quits Rate

- 4/01/2025 at 10:00am EST: JOLTS Layoffs Level & JOLTS Layoffs Rate

- 4/01/2025 at 10:00am EST: ISM Manufacturing & ISM Prices Paid

- 4/01/2025 at 10:00am EST: ISM New orders & ISM Employment

- 4/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 4/01/2025: Wards Total Vehicle Sales

- 4/02/2025 at 07:00am EST: MBA Mortgage Applications

- 4/02/2025 at 08:15am EST: ADP Employment Change

- 4/02/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Transportation

- 4/02/2025 at 10:00am EST: Durable Goods Orders / Durable Goods Ex Transportation

- 4/02/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air