US Treasuries

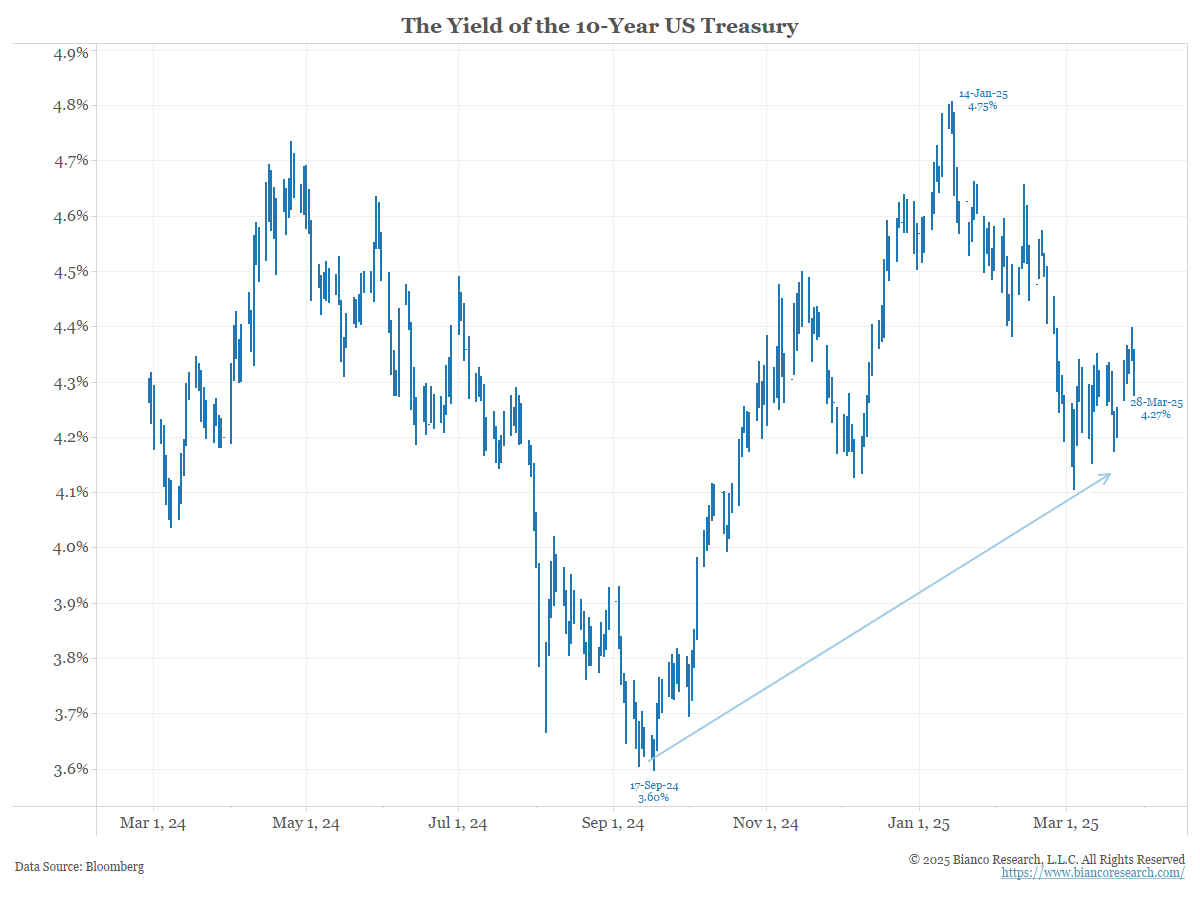

- Friday’s range for UST 10y: 4.25% – 4.35%, closing at 4.255%

- Fed’s Daly: still sees two interest rates cuts this year

WSJ: How to Makes 267% – or Lose 90% on Treasury Bonds

If you’d bought the leading exchange-traded fund investing in long-term U.S. Treasury bonds at its peak in August 2020, you’d have lost 41.3% by now—even after reinvesting your interest income.

Two ETFs that amplify the daily returns on long-term Treasurys make that wild performance look tame.

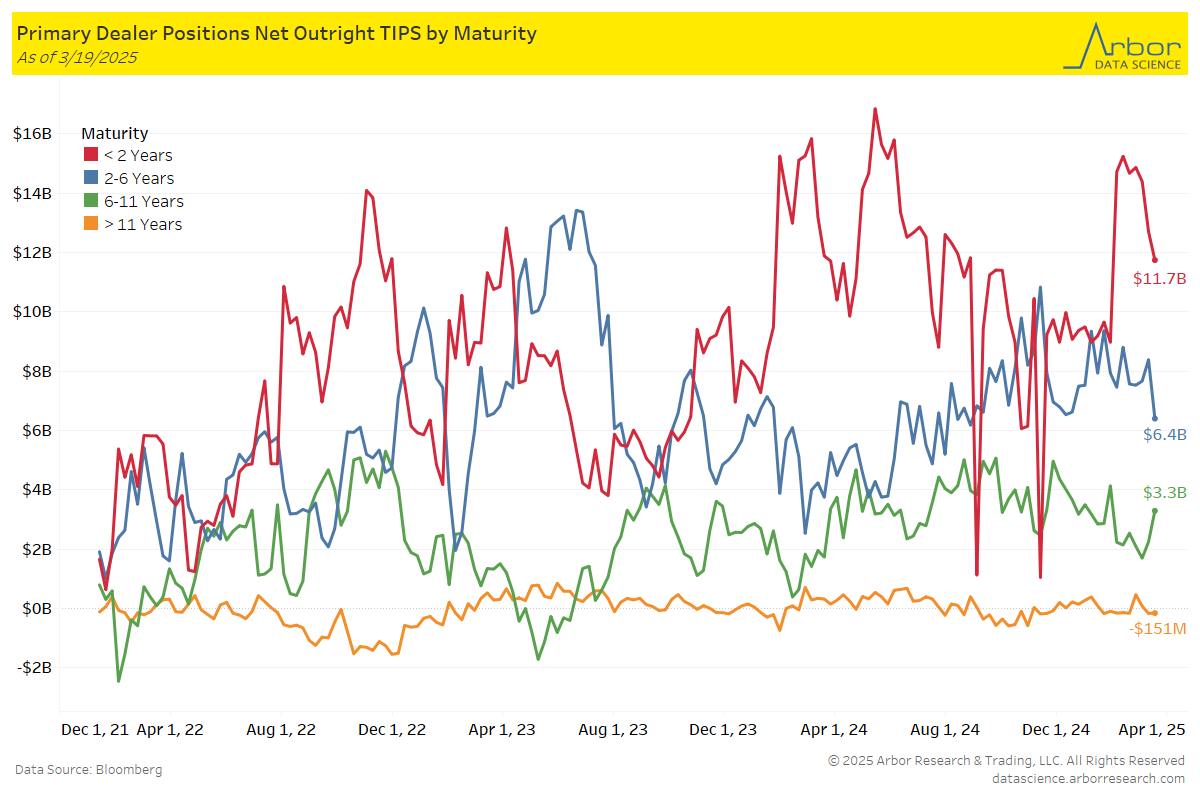

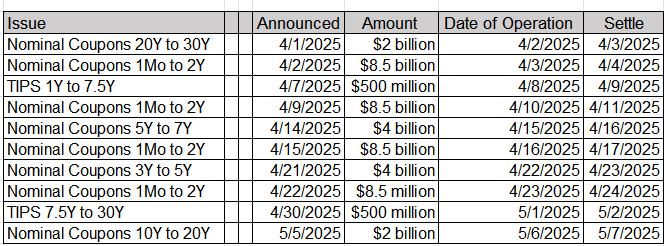

Upcoming US Treasury Supply

- < 2 years: $12.7 Bn on 3/12/25 to $11.7Bn on 3/19/25 = ($1.0 Bn)

- 2 – 6 years: $8.4 Bn on 3/12/25 to $6.4 Bn on 3/19/25 = ($2.0 Bn)

- 6 – 11 years: $2.2 Bn on 3/12/25 to $3.3 Bn on 3/19/25 = $1.1 Bn

- > 11 years: ($164 Mn) on 3/12/25 to ($151 Mn) on 3/19/25 = $13 Mn

Intraday Commentary From Jim Bianco

Regarding PCE, it was not good.

This is why, in September, the 10-year yield was 3.60%, and now it is 4.28%.

Given all the hyperventilation about tariffs, stock market corrections, the end of American Exceptionalism, and rampant recession talk, the 10-year should be lower than last September.

It is not because we have a real inflation problem. It is settling in around 3% to 4%.

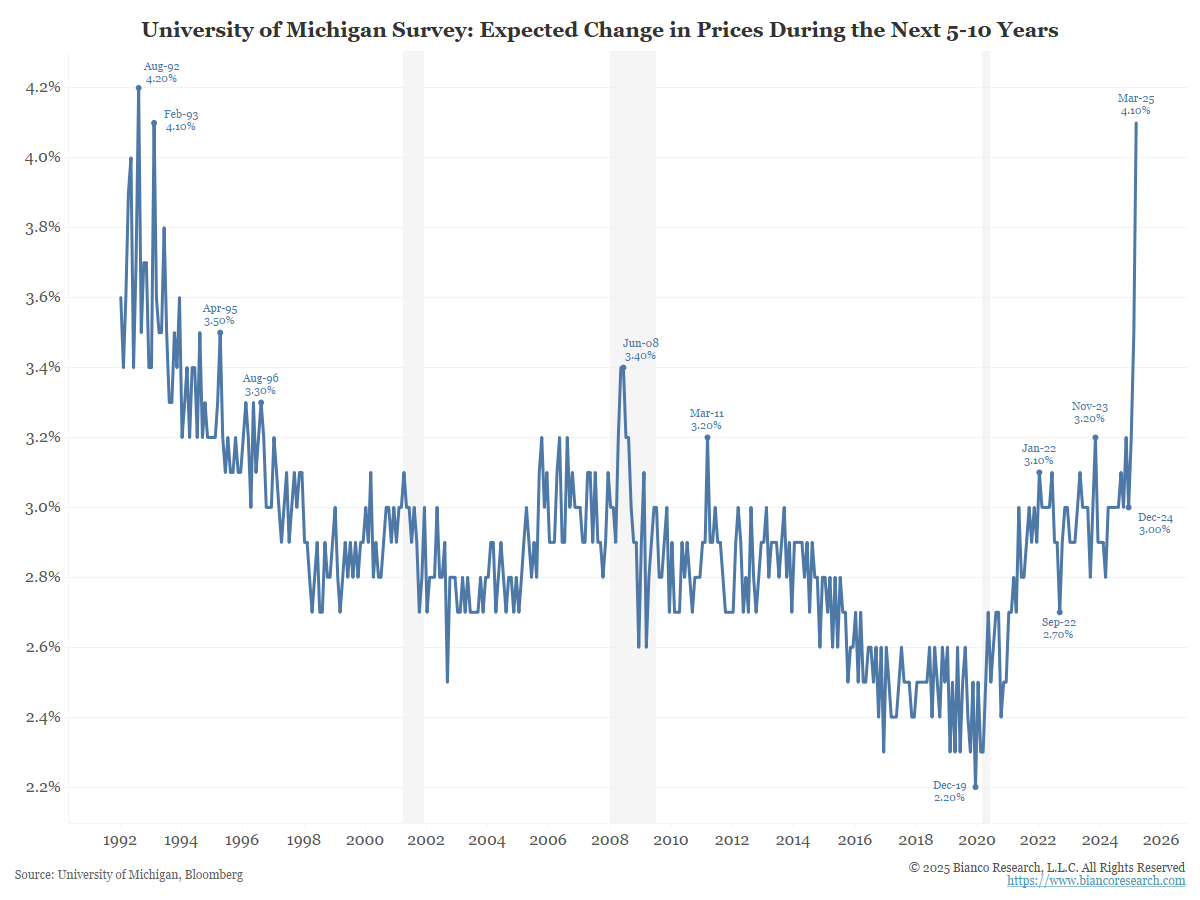

I’m old enough to remember two years ago when the Fed said the University of Michigan was the most important inflation expectation measure.

Now that it is giving an inconvenient reading, they are telling us it is flawed. Implied in this is that it was not flawed two years ago?

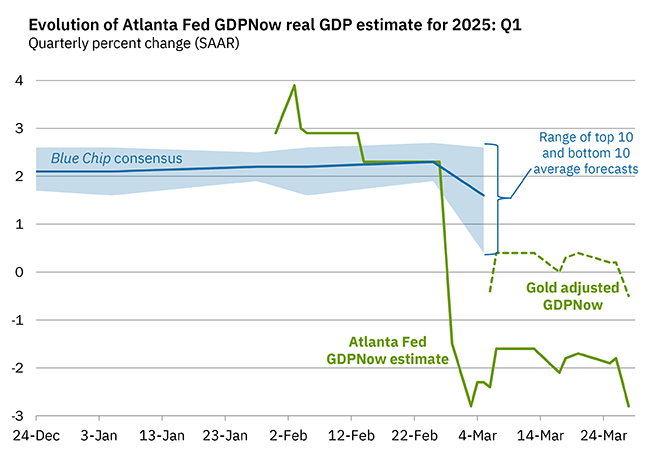

About Atlanta Fed GDPnow

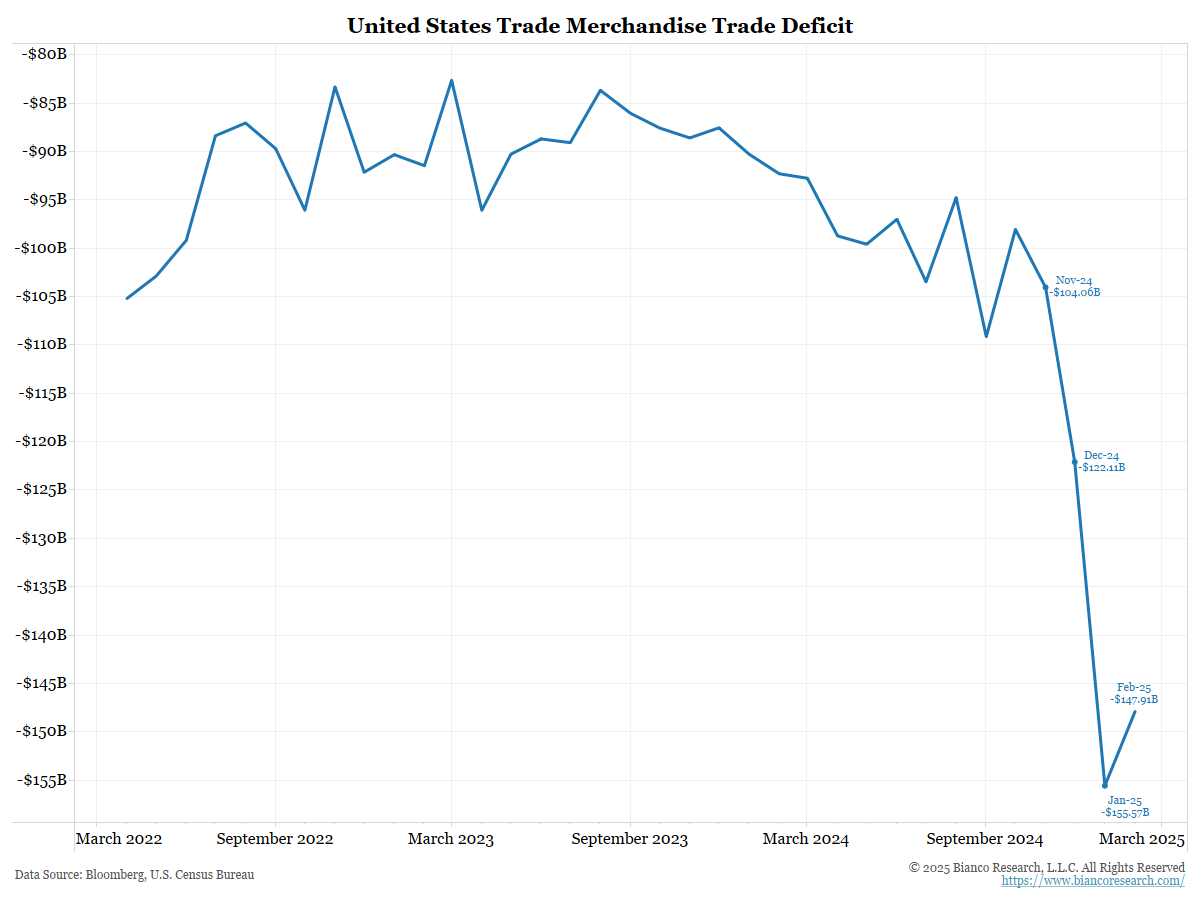

The Q1 GDPnow estimate is -2.8%, net exports subtract 4.79% from GDP. So GDPnow without net exports is +1.99%, a reasonably quarter, and in line with most of the other GDP trackers,

If gold imports are removed

The Q1 GDPnow estimate is 0.5%, net exports subtract 2.53%, meaning again, GDPnow without net exports is +2.03%, a reasonably quarter and in line with most of the other GDP trackers.

Why are net exports a drag on GDP?

A negative net export means more imports than exports. Imports are considered “lost GDP,” as the item was not made in the US (so there is no GDP in the US to make it).

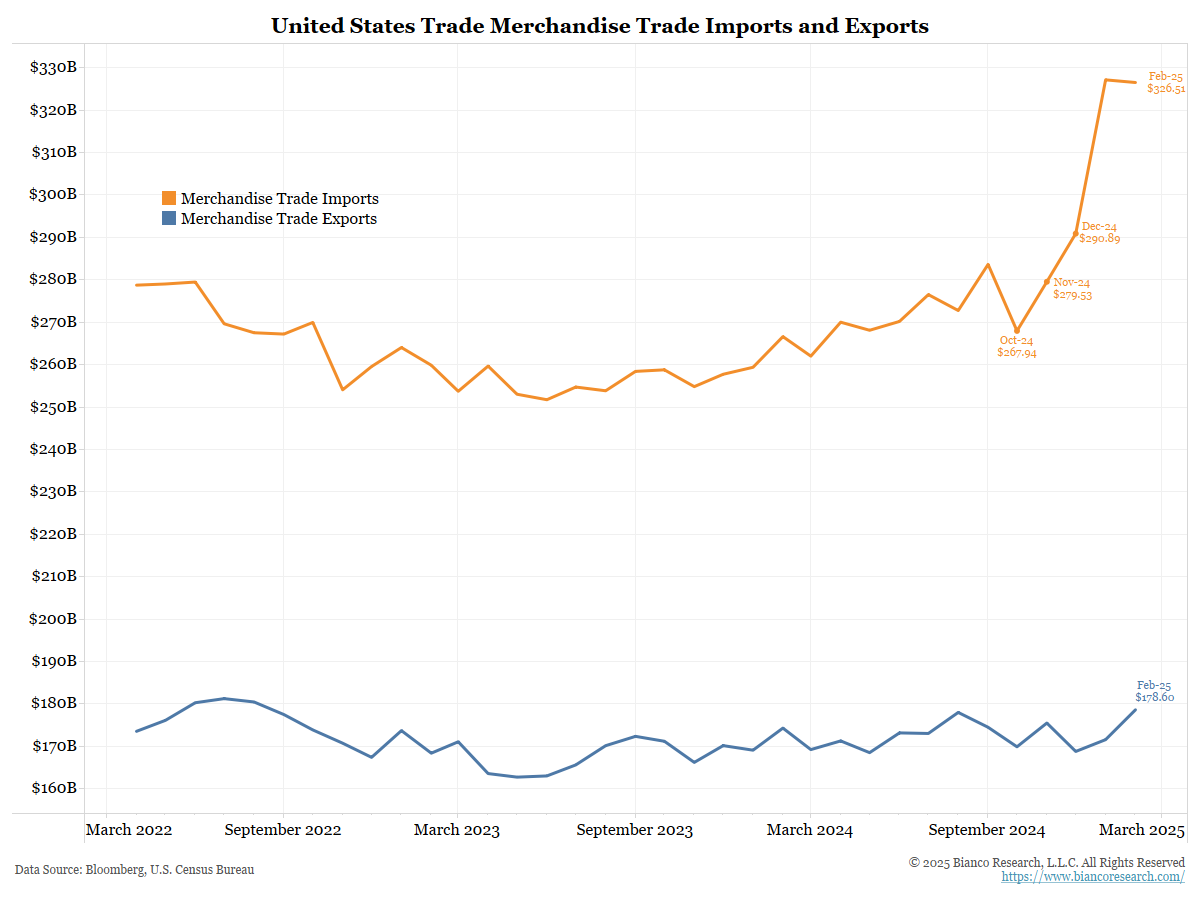

As this chart shows, imports (orange) began to surge, relative to exports (blue).

and net exports dove to a huge negative

In the News…

CNBC: America’s appetite for gold is ‘sucking’ bullion out of other countries

Strong U.S. demand for gold is “sucking” bullion out of some countries as traders try to stockpile it before U.S. President Donald Trump’s tariffs on Canada and Mexico kick into high gear.

Freightwaves: Trucking, copper, cocoa: Volatility roils commodities

The ongoing geopolitical realignment and escalating trade tensions are sending shockwaves through global commodity markets, reshaping long-established trade routes and supply chains.

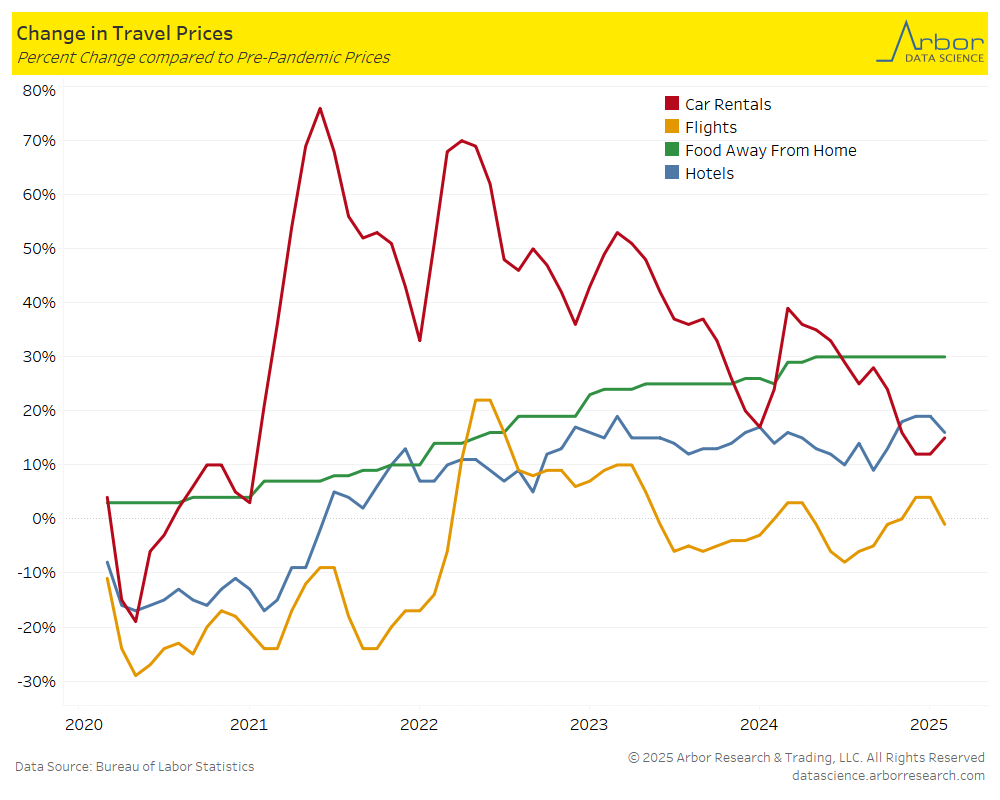

Arbor Data Science: Flying Low by Sam Rines

Upcoming Economic Releases & Fed Speak

- 3/31/2025 at 09:45am EST: MNI Chicago PMI

- 3/31/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 4/01/2025 at 09:00am EST: Fed’s Barkin Discusses Policy, Economic Outlook

- 4/01/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 4/01/2025 at 10:00am EST: Construction Spending MoM

- 4/01/2025 at 10:00am EST: JOLTS Job Openings & JOLTS Job Openings Rate

- 4/01/2025 at 10:00am EST: JOLTS Quits Level & JOLTS Quits Rate

- 4/01/2025 at 10:00am EST: JOLTS Layoffs Level & JOLTS Layoffs Rate

- 4/01/2025 at 10:00am EST: ISM Manufacturing & ISM Prices Paid

- 4/01/2025 at 10:00am EST: ISM New orders & ISM Employment

- 4/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 4/01/2025: Wards Total Vehicle Sales

- 4/02/2025 at 07:00am EST: MBA Mortgage Applications

- 4/02/2025 at 08:15am EST: ADP Employment Change

- 4/02/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Transportation

- 4/02/2025 at 10:00am EST: Durable Goods Orders / Durable Goods Ex Transportation

- 4/02/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air

- 4/02/2025 at 04:30pm EST: Fed’s Kugler Speaks on Inflation Expectations

- 4/03/2025 at 07:30am EST: Challenger Job Cuts YoY

- 4/03/2025 at 08:30am EST: Trade Balance

- 4/03/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/03/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 4/03/2025 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 4/03/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 4/03/2025 at 12:00pm EST: Fed’s Jefferson Gives Keynote on Communication

- 4/03/2025 at 02:30pm EST: Fed’s Cook Speaks on Economic Outlook

- 4/04/2025 at 08:30am EST: Change in Nonfarm Payrolls & Change in Private Payrolls

- 4/04/2025 at 08:30am EST: Change in Manufact. Payrolls & Two-Month Payroll Net Revision

- 4/04/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate

- 4/04/2025 at 08:30am EST: Underemployment Rate

- 4/04/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY & Average Weekly Hours All Employees

- 4/04/2025 at 11:25am EST: Fed’s Powell Speaks on Economic Outlook

- 4/04/2025 at 12:00pm EST: Fed’s Barr Speaks on AI and Banking

- 4/04/2025 at 12:45pm EST: Fed’s Waller Speaks on Payments