US Treasuries

- Monday’s range for UST 10y: 4.165% – 4.26%, closing at 4.18%

- Fed’s Musalem: says inflation expectations key if Fed’s goals conflict

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco in the Media

Jim Bianco joined Maggie Lake: Is the Correction Panic Overdone?

Jim Bianco joined CNBC: Strong economic expectations have left more room for disappointment, says Jim Bianco

Jim Bianco joined TD Ameritrade: Trump’s Crypto Reserve Plan ‘Could Destroy Crypto’

Intraday Commentary from Jim Bianco

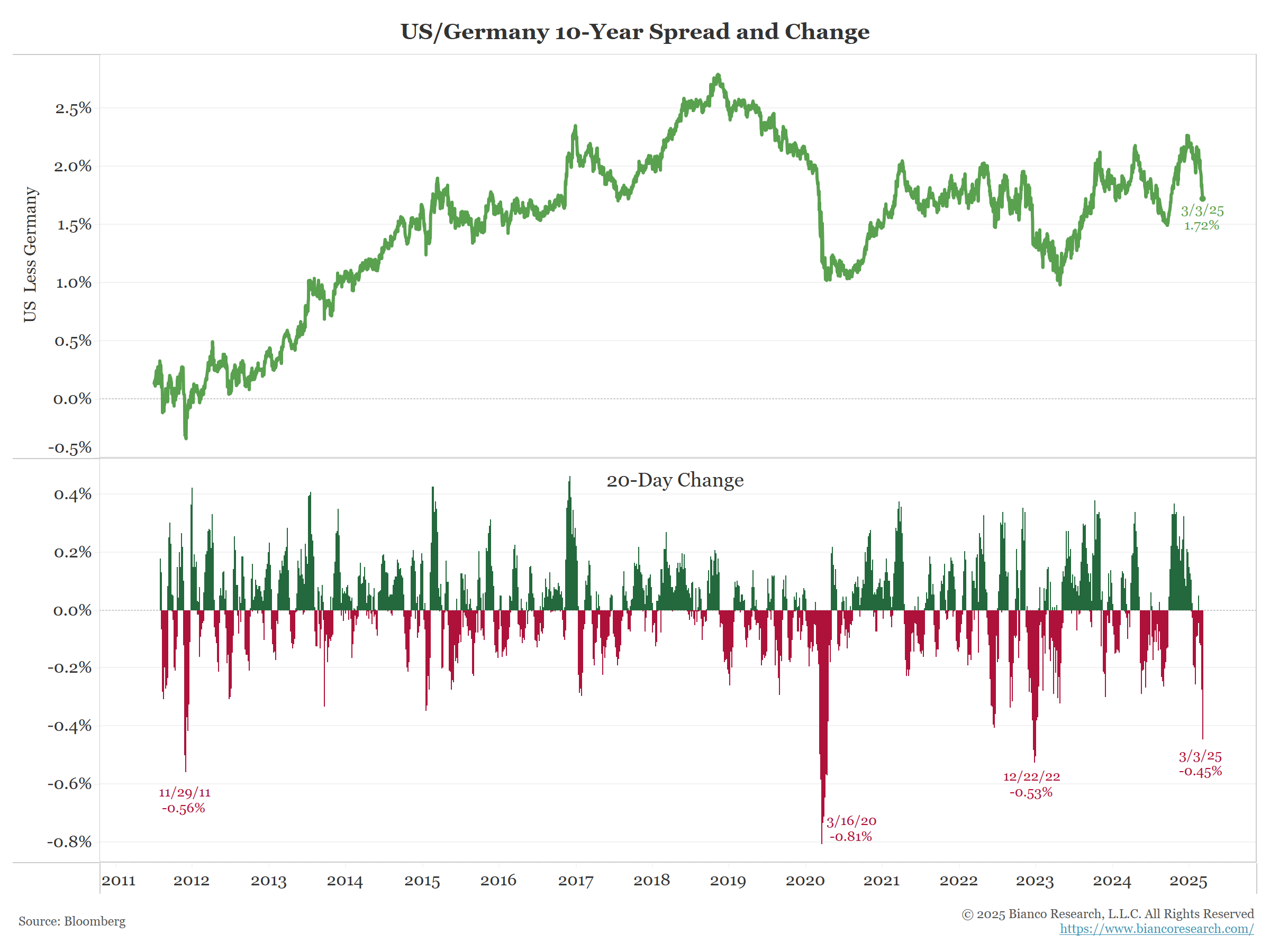

I still think the market is slow to understanding the EU Defense commitments/Announcements.

Consider …. *GERMAN 30-YEAR BOND YIELD RISES 10BPS ON DEFENSE SPENDING TALK

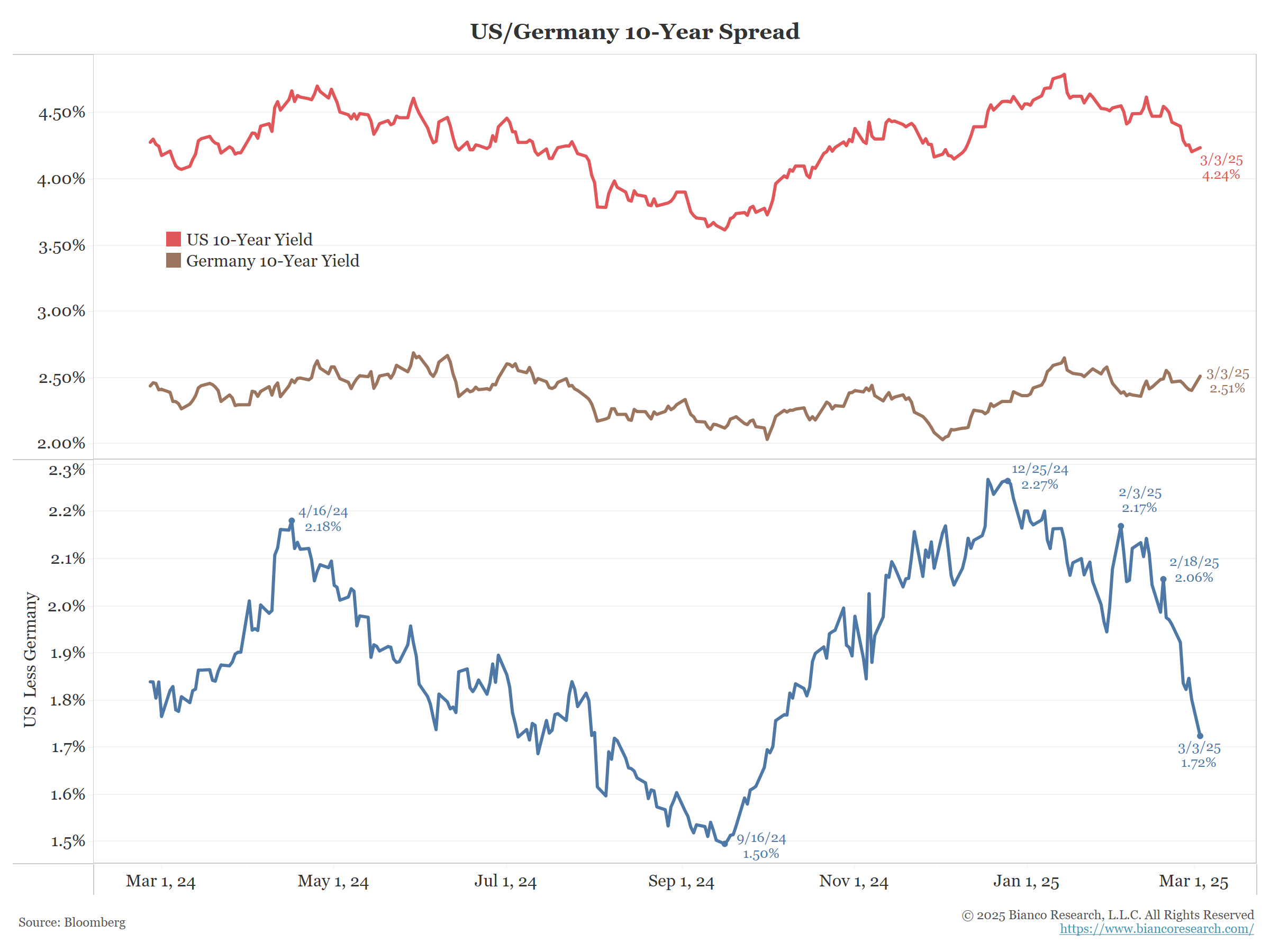

US yields are going down and German yields are going up. The result is the spread is collapsing.

Below is the spread is blue in the top panel. The bottom panel is the 20-day rate of change. It is not the one of the biggest since in the last 15 years (the largest is the height of the COVID panic) and the spread collapsing is still accelerating.

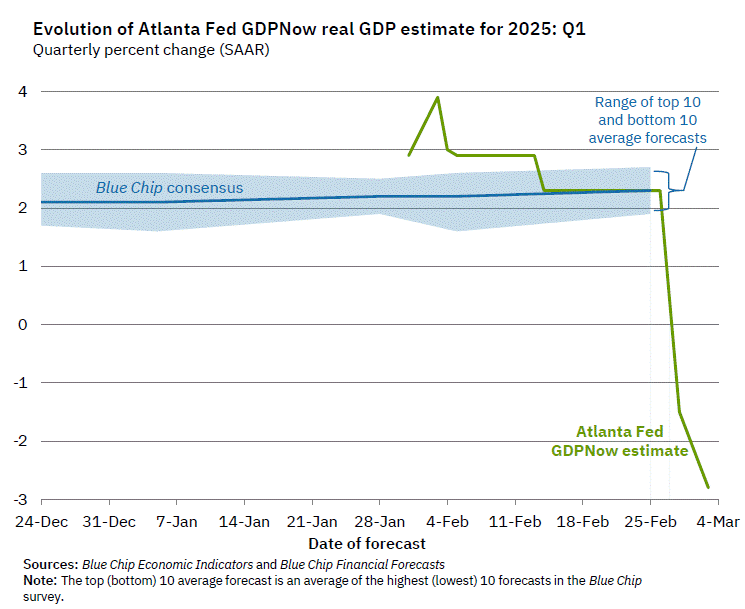

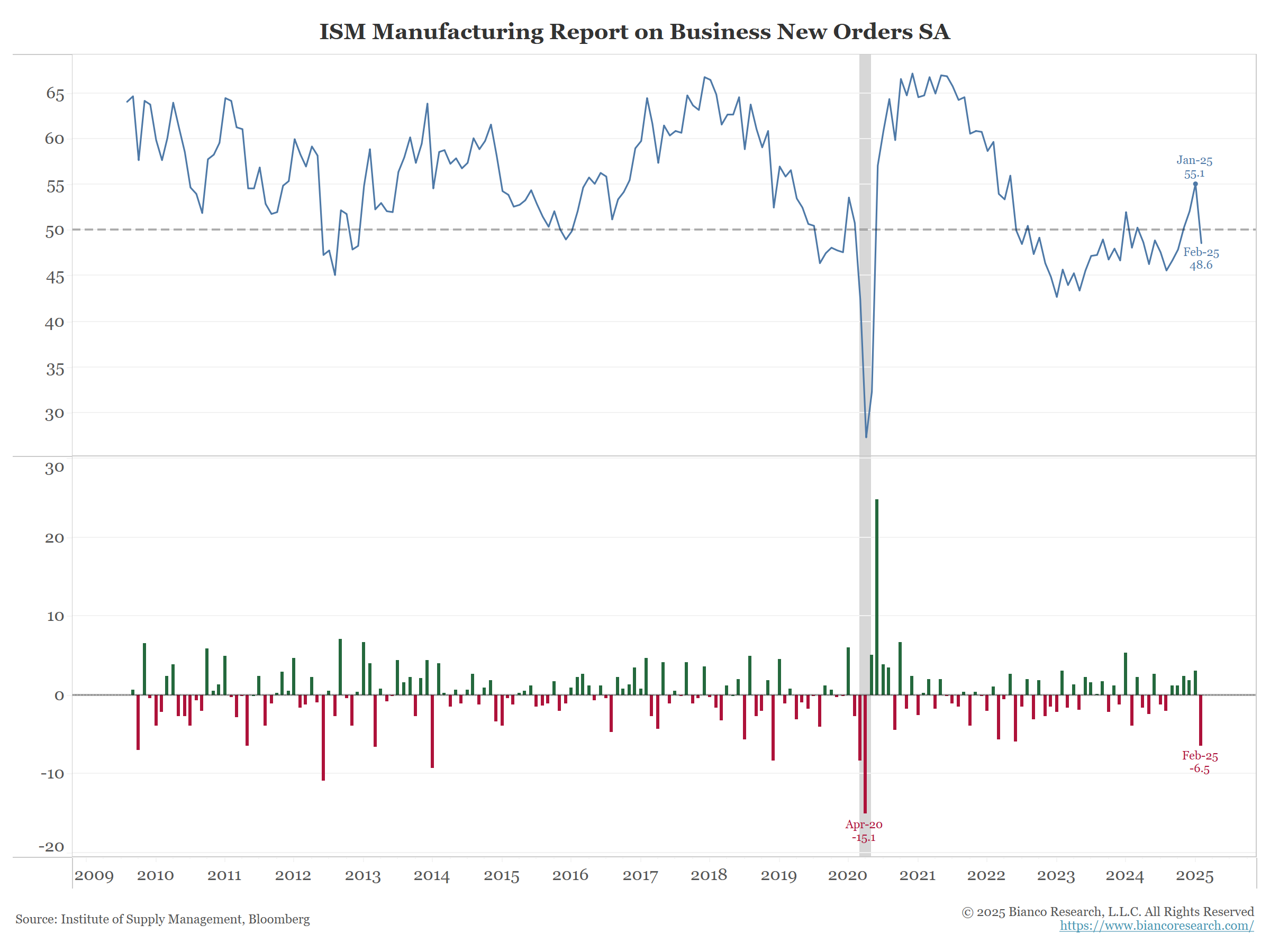

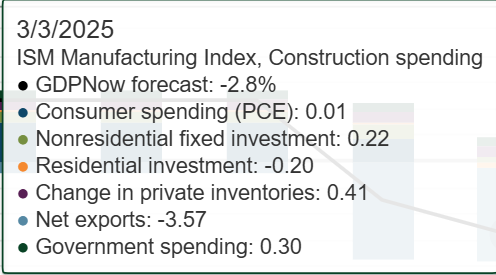

On the Atlanta Fed GDPnow decline … again it appears to be more tariff related. ISM new orders declined 6.5 in a month (bottom panel). Most since COVID.ISM new orders gets figured into their GDPnow estimate.

Net exports are now dragging down GDP by 3.57%, more than the overall estimate of -2.8%. New orders are down because of tariffs.

The surge of imports and lack of new orders will eventually rebound. And with it will GDPnow. If the bond market REALLY thought this was a signal of a recession, 10-year will be 3.5%, not 4.20% down less than 1 bps on the day.

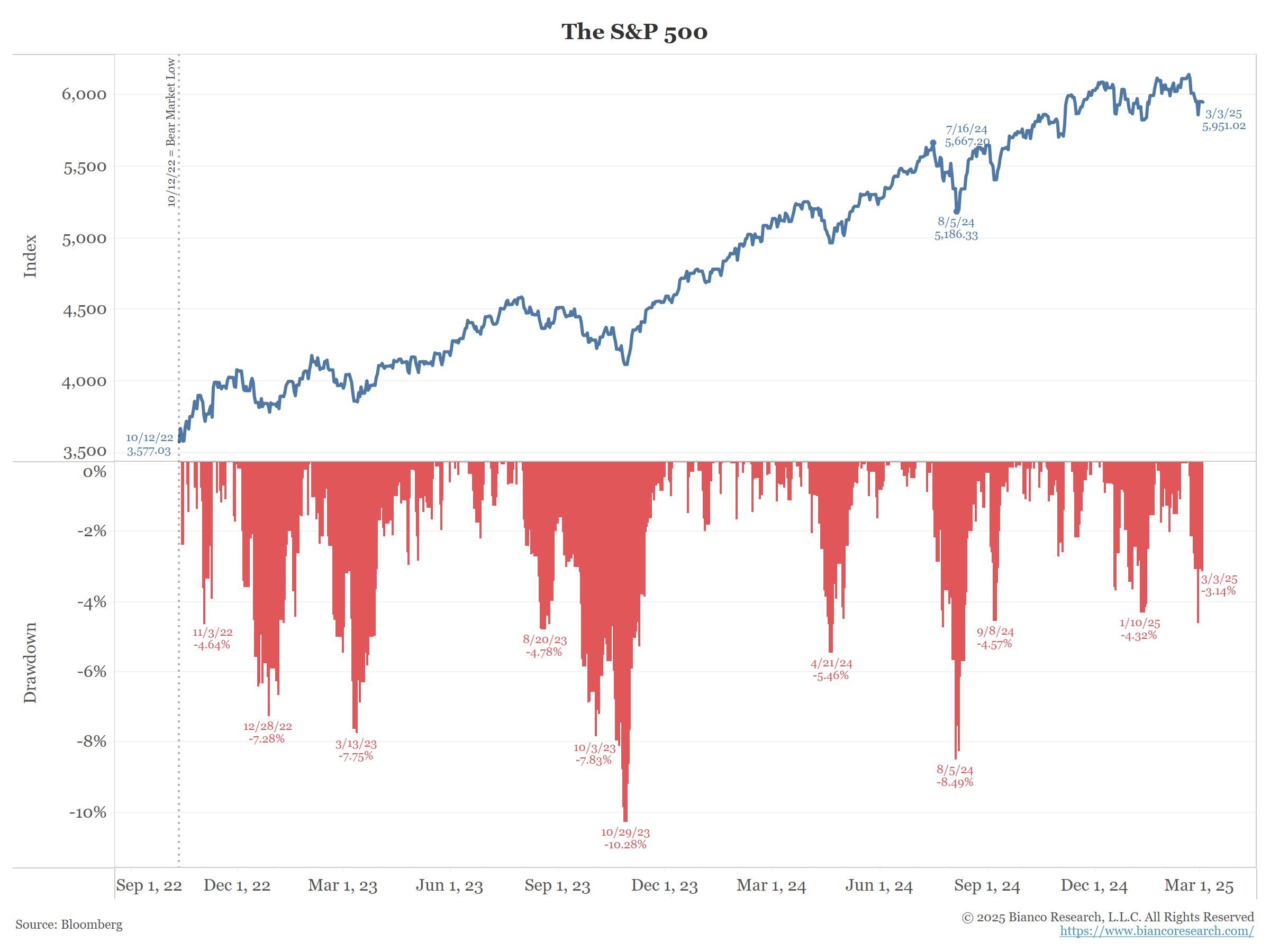

If we are really having a recession, the S&P 500 would be down more than just 3%.

In Other News…

EIA: Refinery closures and rising consumption will reduce U.S. petroleum inventories in 2026

In 2026, we forecast that inventories of the three largest transportation fuels in the United States—motor gasoline, distillate fuel oil, and jet fuel—will fall to their lowest levels since 2000 in our February Short-Term Energy Outlook.

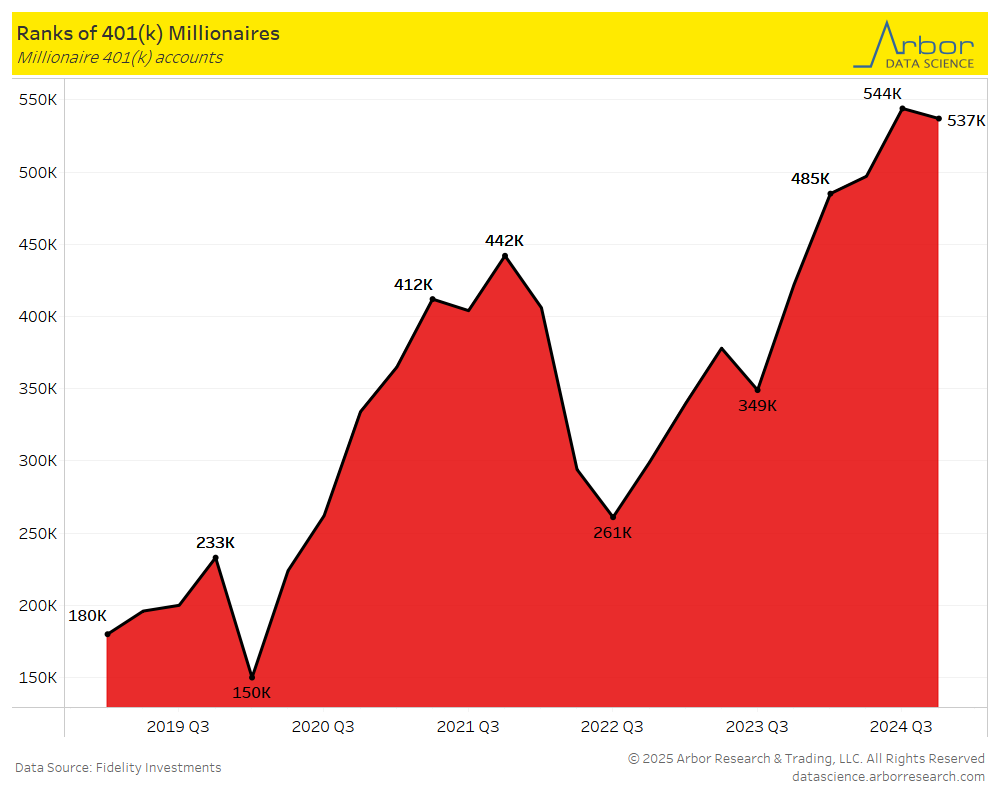

Apollo: There Is a Significant Need for Retirement Savings in the US

Arbor Data Science: The Number of 401(K) Millionaires with Retirement Accounts at Fidelity

Fast Company: Housing market map: How much home insurance is expected to rise by 2055

Home insurance premiums are projected to rise by 634% in Orleans Parish and 590% in Miami-Dade County between 2025 and 2055.

Financial Times: Americans delay home improvements in latest blow to US Housing Market

High interest rates and uncertainty surrounding President Donald Trump’s plans for tariffs and mass deportations are biting into demand for US home improvements, the latest signs of a tepid housing market.

Upcoming Economic Releases & Fed Speak

- 3/04/2025 at 02:20pm EST: Williams Speaks at Bloomberg Invest Forum

- 3/04/2025: Barkin Repeats Speech on Inflation

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00am EST: Federal Reserve Releases Beige Book

- 3/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 3/06/2025 at 08:30am EST: Trade Balance; Nonfarm Productivity; Unit Labor Costs

- 3/06/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/06/2025 at 10:00am EST: Wholesale Inventories MoM and Wholesale Trade Sales MoM

- 3/06/2025 at 07:00pm EST: Bostic speaks on Economy

- 3/07/2025 at 08:30am EST: Change in Nonfarm Payrolls % Two-Month Payroll Net Revision

- 3/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufact. Payrolls

- 3/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly YoY & Average Weekly Hours All Employees

- 3/07/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate & Underemployment Rate

- 3/07/2025 at 10:15am EST: Bowman Speaks on Policy Transmission

- 3/07/2025 at 10:45am EST: Williams Speaks on Panel on Policy Transmission

- 3/07/2025 at 12:20am EST: Kugler Speaks on Rebalancing Labor Markets

- 3/07/2025 at 12:30am EST: Powell Speaks on the Economic Outlook

- 3/07/2025 at 01:00pm EST: Kugler Appears on Panel Discussion

- 3/07/2025 at 03:00pm EST: Consumer Credit

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations