- Monday’s range for UST 10y: 4.18% – 4.255%, closing at 4.24%

Bloomberg: Treasuries Are the Standout Play as Trade War Heats Up

The intensifying global trade war is heightening risks of a sharp growth slowdown in the US and upending investors’ portfolios.

Barron’s: Stocks, Step Aside. Bonds Are the Adult in the Room.

U.S. stocks are feeling the heat from Washington’s tariff policies, with the S&P 500 now on track for its first quarterly decline in over a year, but the bond market has traded in a tight range, showing composure in the face of chaos.

MarketWatch: America needs to keep Treasury bond investors’ trust. Here’s the price if it’s lost.

U.S. institutions must stay strong and credible enough to preserve confidence in both government debt and the U.S. dollar

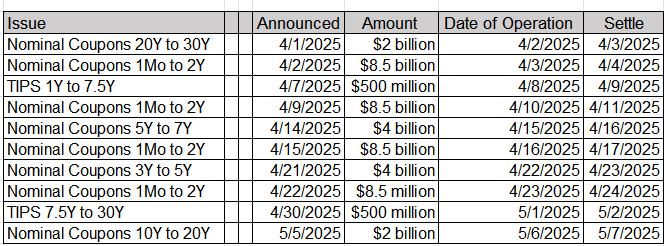

Upcoming US Treasury Supply

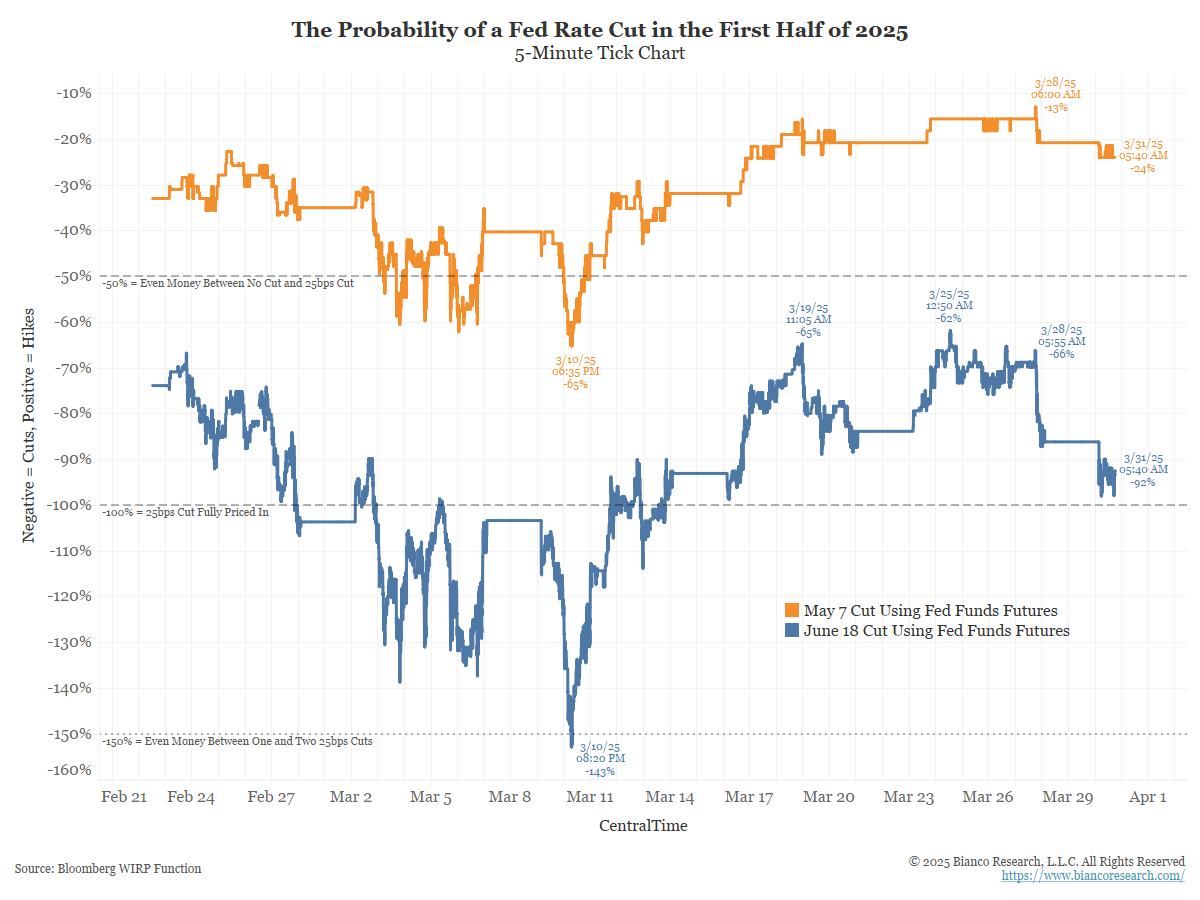

Lots of attention to Goldman raising it’s recession forecast to 35%. Less so about them raising their inflation forecast. Cut rates with rising inflation will be taken badly by the bond market.

Remember the reaction to the rate cuts in September?

Given all the hyperventilation right now, the market only puts a 24% probability of a rate cut on May 7th, 75% of no move (orange). 92% of a cut in June, 8% of hold.

May 7 is the most important Fed meeting of the year. If the Fed cannot find a reason to cut next month, they will not find a reason this year. June’s probability will head to zero if they hold on May 7.

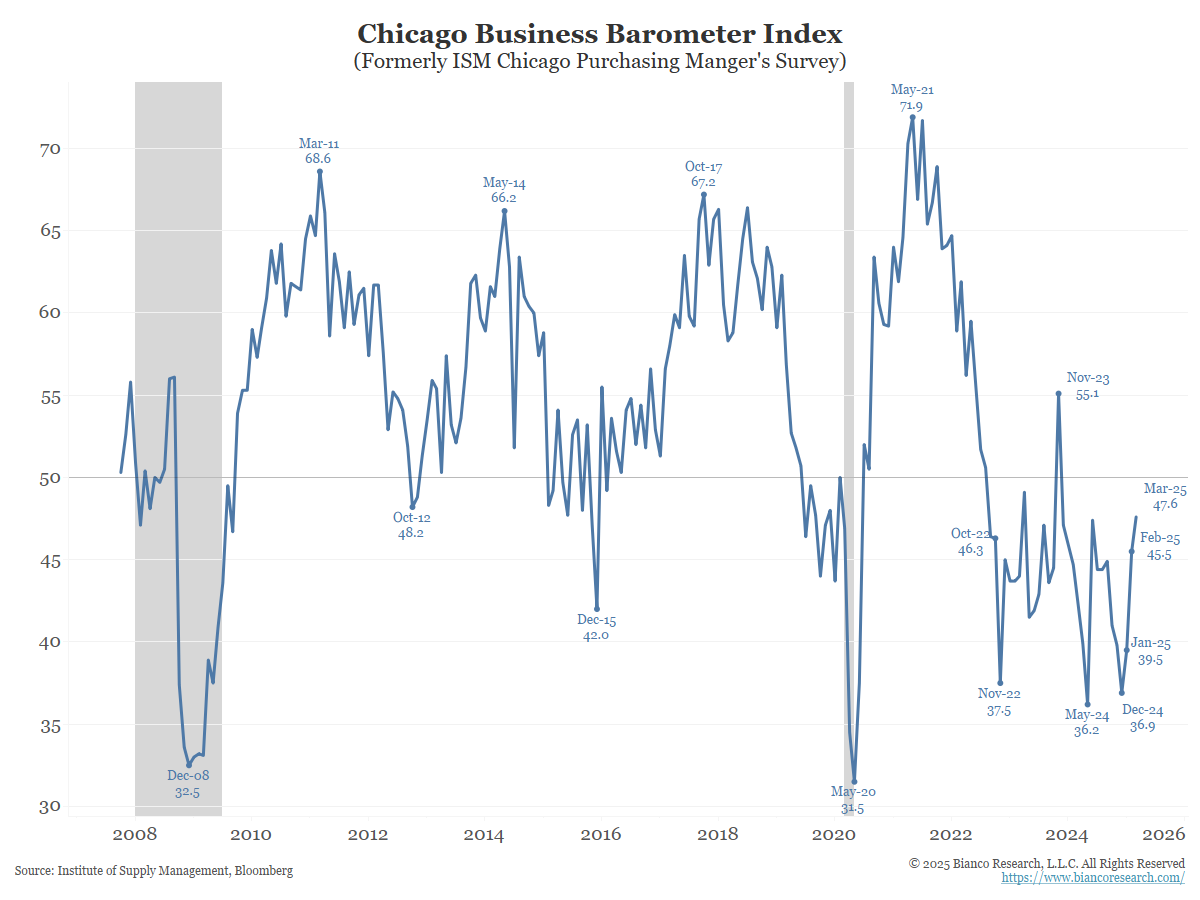

Chicago ISM (known as the “Chicago Business Barometer”) was released this morning.

It rose again, to the highest level since November 2023. This is an example of STRONG soft data (it’s a survey)

In the News…

Bloomberg: ETF Bonanza Hits Overdrive With 1,000 New Funds Seen for 2025

This year’s whiplash headlines and thrashing in equity markets have done little to slow down the ETF industry.

Newsweek: Map Shows Bank Closures Across US in 2025 So Far

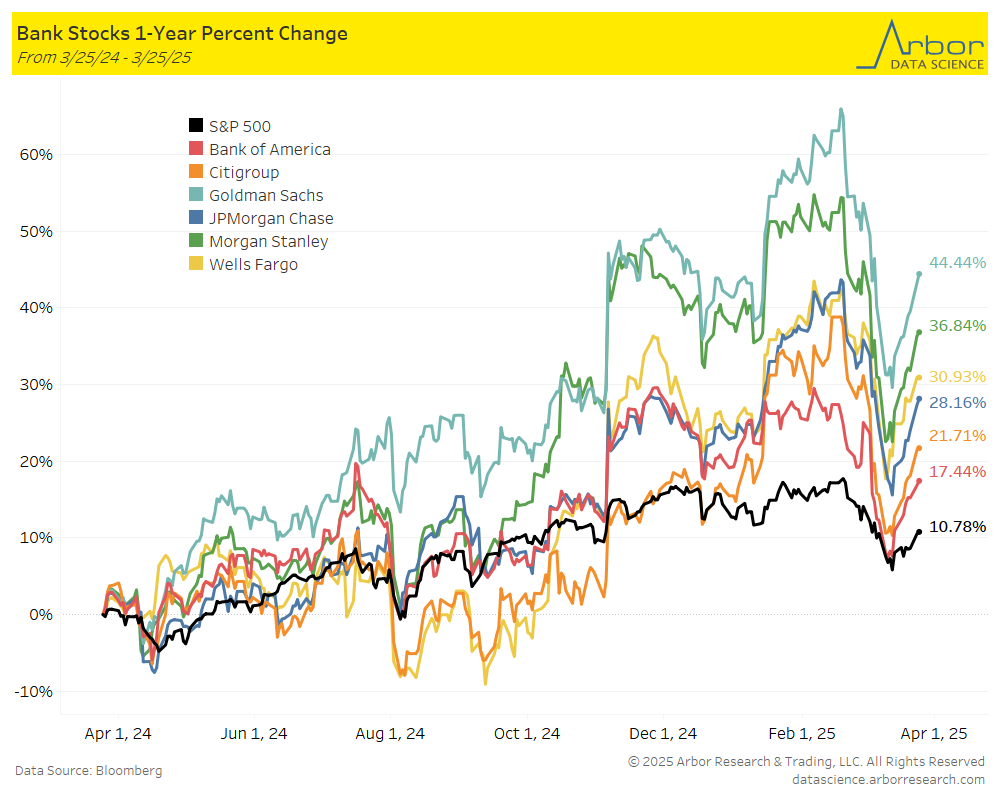

Banks across the U.S. have proposed more than 300 branch closures in the first three months of 2025, data from the Office of the Comptroller of the Currency (OCC) shows.

Major financial institutions—including Wells Fargo, Bank of America, JPMorgan Chase and Flagstar—are planning to close numerous branches this year, reflecting an ongoing shift in the industry toward digital services.

Arbor Data Science: Examining U.S. Banks in Charts

Fast Company: Homebuilder inventory hits 2009 levels: These are the housing market where you can find deal

In February 2025, the number of unsold completed new single-family homes in the U.S. hit the highest level since summer 2009.

CNN: How Trump’s car tariffs will impact Americans, in 3 charts

That’s because a 25% tariff across all cars that the United States imports is set to take effect on April 3. And not long after, a 25% tariff on most foreign-made car parts is set to take effect.

Upcoming Economic Releases & Fed Speak

- 4/01/2025 at 09:00am EST: Fed’s Barkin Discusses Policy, Economic Outlook

- 4/01/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 4/01/2025 at 10:00am EST: Construction Spending MoM

- 4/01/2025 at 10:00am EST: JOLTS Job Openings & JOLTS Job Openings Rate

- 4/01/2025 at 10:00am EST: JOLTS Quits Level & JOLTS Quits Rate

- 4/01/2025 at 10:00am EST: JOLTS Layoffs Level & JOLTS Layoffs Rate

- 4/01/2025 at 10:00am EST: ISM Manufacturing & ISM Prices Paid

- 4/01/2025 at 10:00am EST: ISM New orders & ISM Employment

- 4/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 4/01/2025: Wards Total Vehicle Sales

- 4/02/2025 at 07:00am EST: MBA Mortgage Applications

- 4/02/2025 at 08:15am EST: ADP Employment Change

- 4/02/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Transportation

- 4/02/2025 at 10:00am EST: Durable Goods Orders / Durable Goods Ex Transportation

- 4/02/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air

- 4/02/2025 at 04:30pm EST: Fed’s Kugler Speaks on Inflation Expectations

- 4/03/2025 at 07:30am EST: Challenger Job Cuts YoY

- 4/03/2025 at 08:30am EST: Trade Balance

- 4/03/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/03/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 4/03/2025 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 4/03/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 4/03/2025 at 12:00pm EST: Fed’s Jefferson Gives Keynote on Communication

- 4/03/2025 at 02:30pm EST: Fed’s Cook Speaks on Economic Outlook

- 4/04/2025 at 08:30am EST: Change in Nonfarm Payrolls & Change in Private Payrolls

- 4/04/2025 at 08:30am EST: Change in Manufact. Payrolls & Two-Month Payroll Net Revision

- 4/04/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate

- 4/04/2025 at 08:30am EST: Underemployment Rate

- 4/04/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY & Average Weekly Hours All Employees

- 4/04/2025 at 11:25am EST: Fed’s Powell Speaks on Economic Outlook

- 4/04/2025 at 12:00pm EST: Fed’s Barr Speaks on AI and Banking

- 4/04/2025 at 12:45pm EST: Fed’s Waller Speaks on Payments

- 4/07/2025 at 03:00pm EST: Consumer Credit