US Treasuries

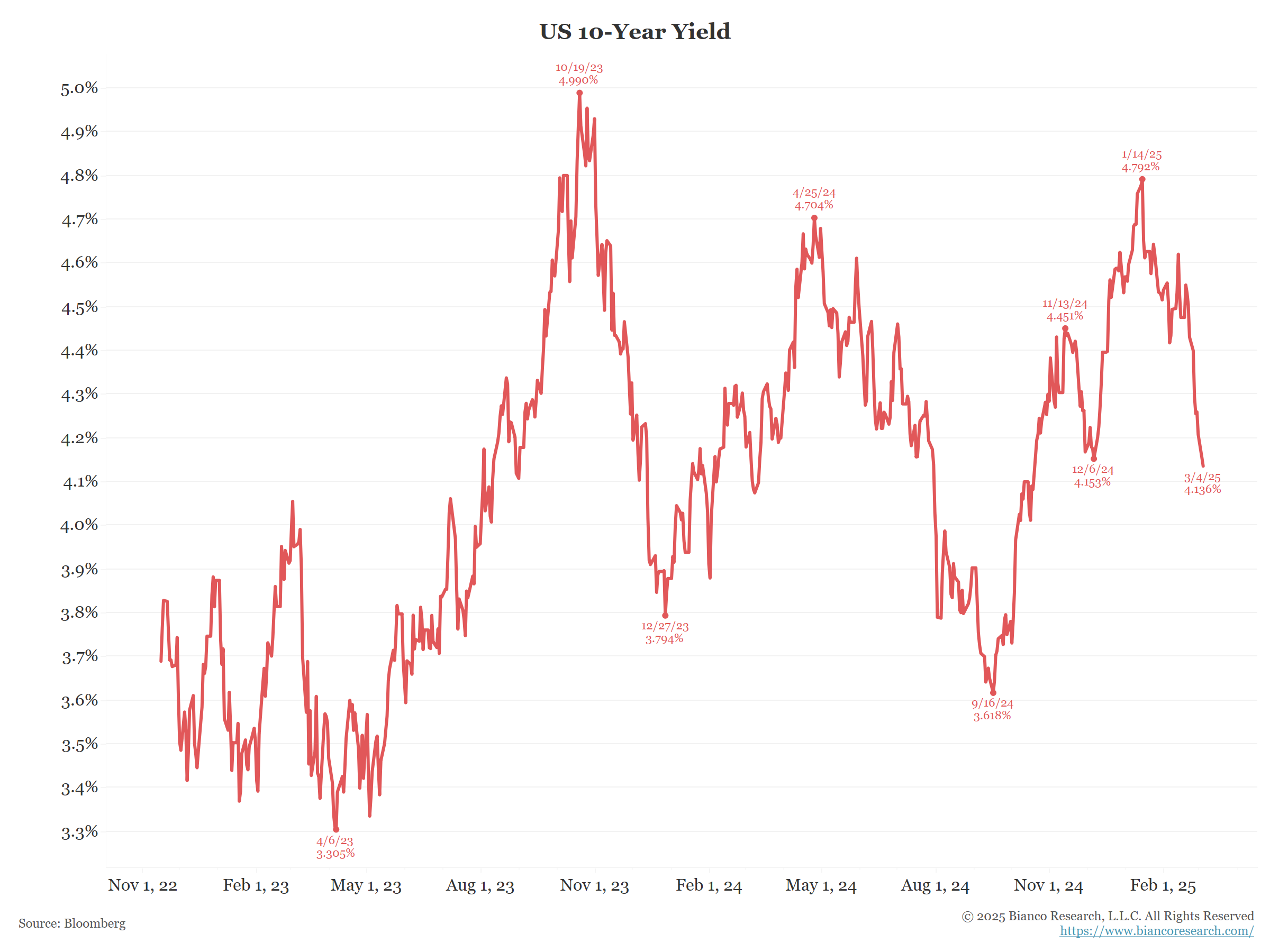

- Tuesday’s range for UST 10y: 4.10% – 4.21%, closing at 4.20%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco in the Media

Markets Tank: Fed Predicts Economic Crash, Will Chaos Continue?

Intraday Commentary from Jim Bianco

As this chart shows, the larger trend is still sideways. Current level of 10s is the same as early December. Did not prevent 4.80% a month later.

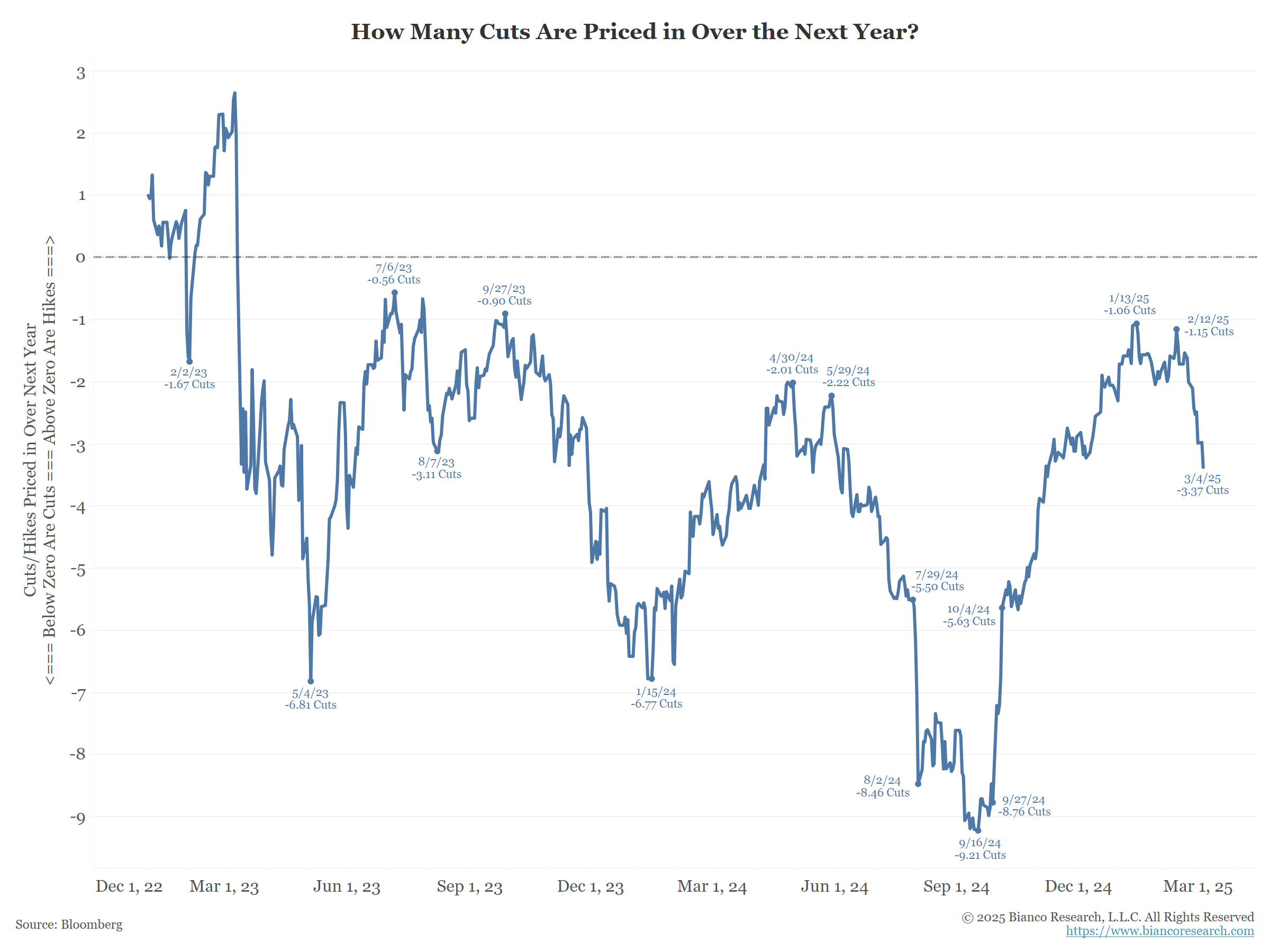

*TRADERS ADD TO FED EASING BETS, FULLY PRICE THREE CUTS IN 2025

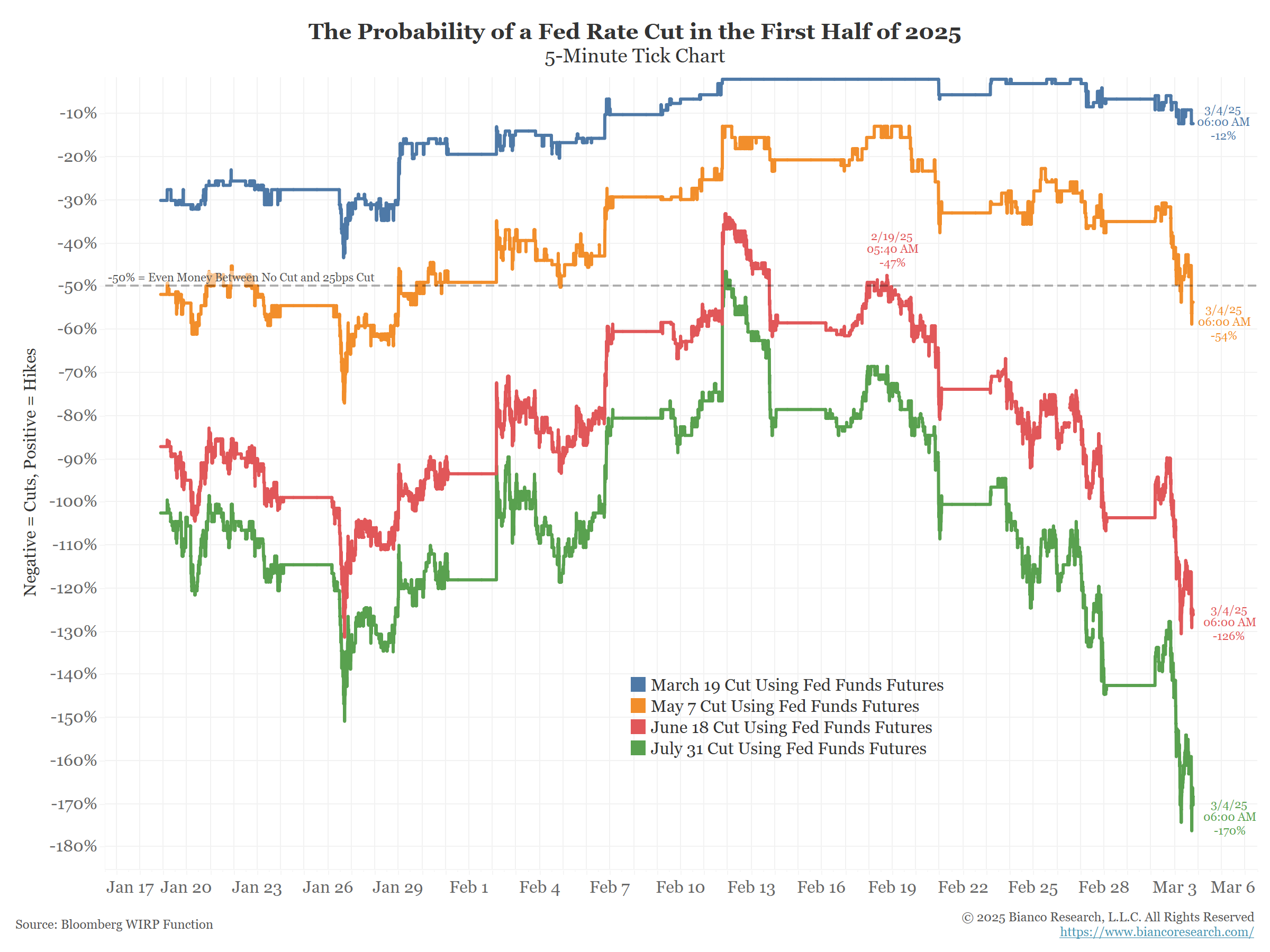

March 19 rate cut (blue) just 12% (88% of no cut).

May 7 rate cut (orange) now back to 54% (46% for not cut) for the first time in a month (it was exactly 50% on Feb 2).

Getting interesting now…

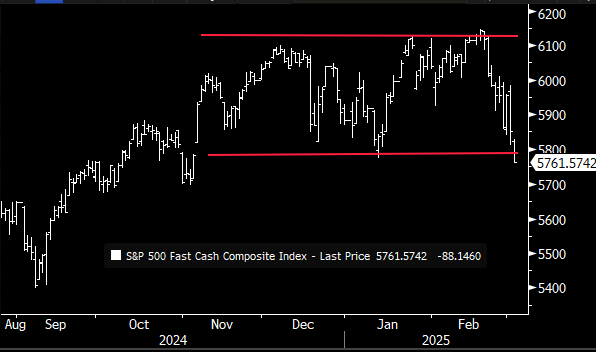

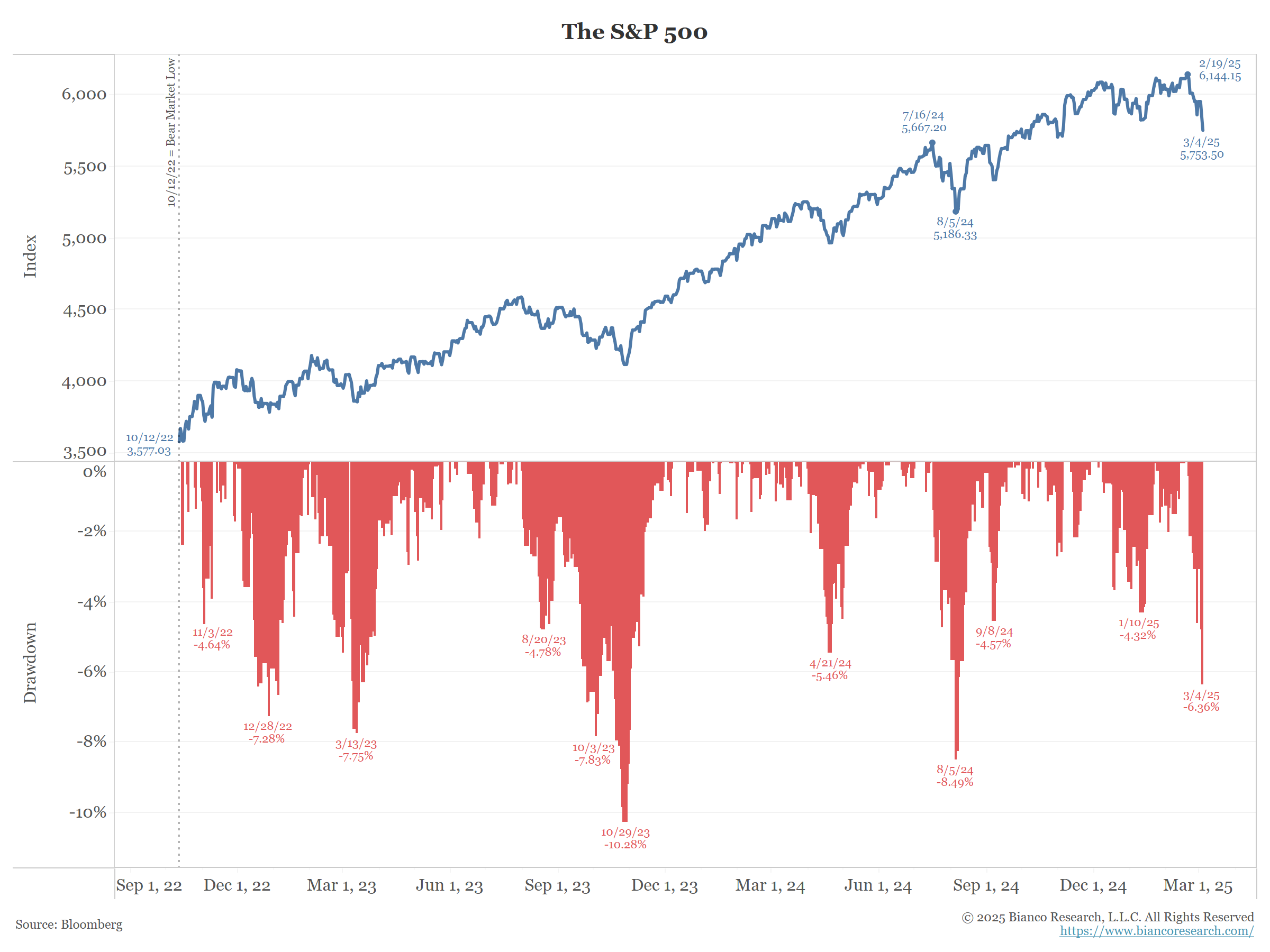

*S&P 500 ERASES ELECTION GAIN, WIPING OUT $3.4 TRILLION IN VALUE

(FYI – Bloomberg ran the same headline on January 13, the other date that touches the red line.)

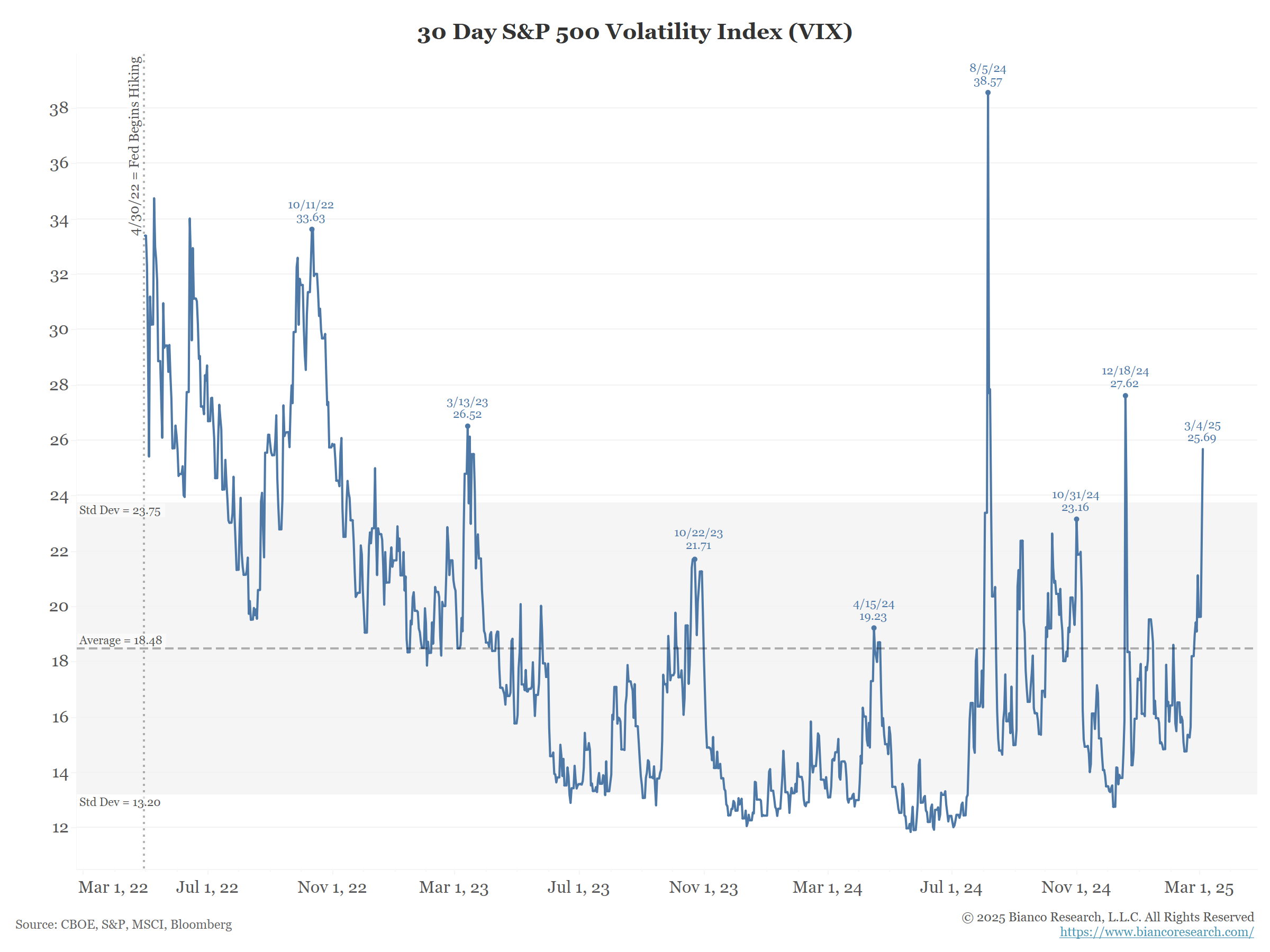

The VIX Index, the fear index is again reaching extreme levels

March 13, 2023 = SVB Failure

August 5 = Yen Carry Trade Unwind/Scare

December 18 = FOMC meeting (last cut)

In Other News…

Globest.com: Multifamily Loan Crisis Looms as Community Bank Delinquencies Soar to $6.1B

Community banks’ multifamily have shown a “dramatic rise in delinquent loans and realized losses,” including a 12-year delinquency high of $6.1 billion, according to a CRED iQ analysis.

SupplyChainBrain: The Focus on Supply Chain Increases Dramatically at America’s Top Companies

This latest study analyzes the S&P 500 annual reports from 2020 to 2023. As shown in Figure 1, mentions of “supply chain” nearly tripled from 2019 to 2022, largely driven by the COVID-19 pandemic, which put supply chains in the spotlight as companies faced widespread disruptions.

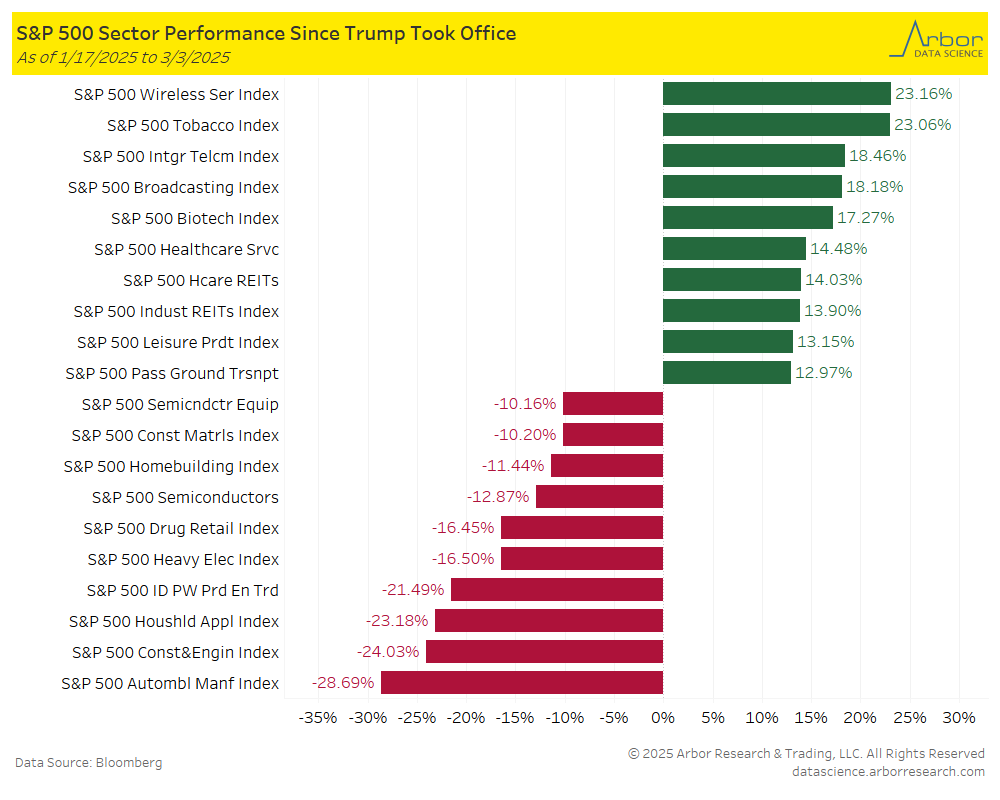

Arbor Data Science: Best and Worst S&P 500 Sector Performance Since Trump Took Office

Upcoming Economic Releases & Fed Speak

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00am EST: Federal Reserve Releases Beige Book

- 3/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 3/06/2025 at 08:30am EST: Trade Balance; Nonfarm Productivity; Unit Labor Costs

- 3/06/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/06/2025 at 08:45am EST: Harker gives speech on Economic Education

- 3/06/2025 at 10:00am EST: Wholesale Inventories MoM and Wholesale Trade Sales MoM

- 3/06/2025 at 03:30am EST: Waller speaks on the Economic Outlook

- 3/06/2025 at 07:00pm EST: Bostic speaks on Economy

- 3/07/2025 at 08:30am EST: Change in Nonfarm Payrolls % Two-Month Payroll Net Revision

- 3/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufact. Payrolls

- 3/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly YoY & Average Weekly Hours All Employees

- 3/07/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate & Underemployment Rate

- 3/07/2025 at 10:15am EST: Bowman Speaks on Policy Transmission

- 3/07/2025 at 10:45am EST: Williams Speaks on Panel on Policy Transmission

- 3/07/2025 at 12:20am EST: Kugler Speaks on Rebalancing Labor Markets

- 3/07/2025 at 12:30am EST: Powell Speaks on the Economic Outlook

- 3/07/2025 at 01:00pm EST: Kugler Appears on Panel Discussion

- 3/07/2025 at 03:00pm EST: Consumer Credit

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations

- 3/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 3/11/2025 at 10:00am EST: JOLTS Job Openings/Job Openings Rate

- 3/11/2025 at 10:00am EST: JOLTS Quits Level/Quits Rate

- 3/11/2025 at 10:00am EST: JOLTS Layoffs Level/Layoffs Rate