US Treasuries

- Wednesday’s range for UST 10y: 4.18% – 4.28%, closing at 4.27%

- Fed’s Beige Books shows slight growth, prices climbed moderately, suggests growth scare is overblown

- Yields traded near session highs in the afternoon

- Investors wait for pricing of mammoth $26 billion eight-part Mars deal

Agency Bullets

- We saw trading today in TVA 5.25 2/55

- The issue came to market at 60/30s…traded to 56/30s and is now back at 60/30s

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco in the Media:

Jim Bianco: Is Trump Trying to Wreck the Economy

Intraday Commentary from Jim Bianco

In Other News…

OilPrice: Oil Hits One-Year Low on Tariff Fears, Rising Supply

Oil prices declined for the third consecutive day after U.S. crude oil stocks posted a larger-than-expected build, adding to worries about a looming return of more OPEC+ barrels to the market.

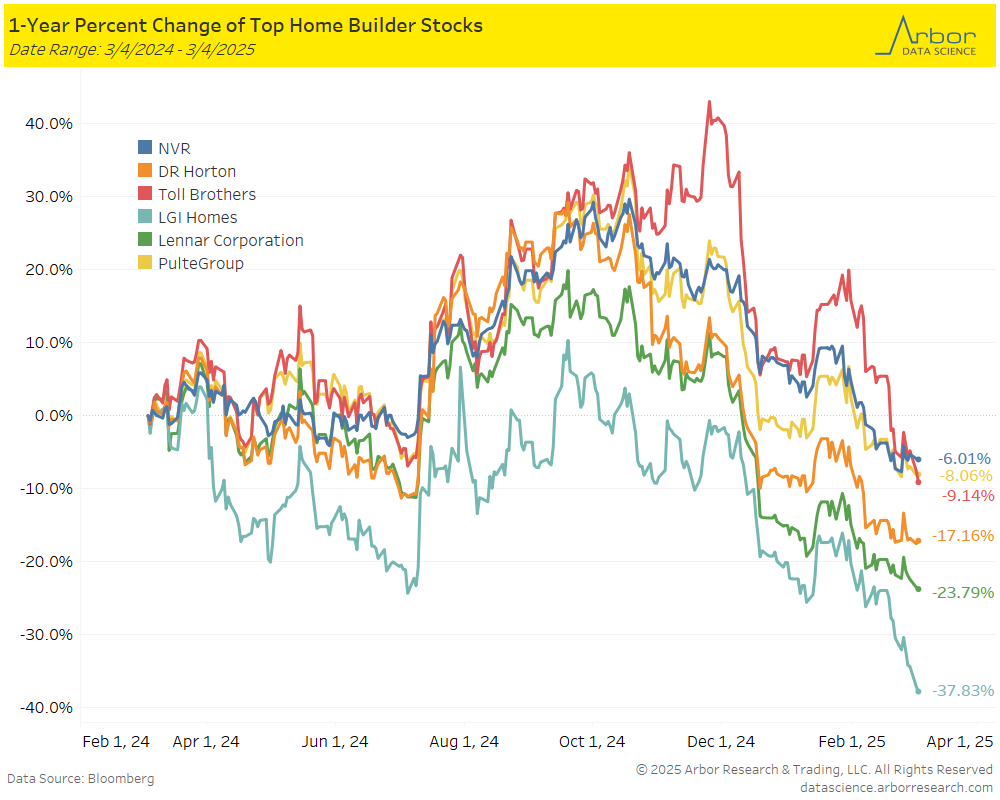

Fast Company: Are ICE raids impacting the housing market? Here’s what homebuilders say

Last month, analysts at John Burns Research and Consulting (JBREC) set out to find out if homebuilders are seeing an impact yet from deportations and arrests.

Arbor Data Science: Home Builders Are Feeling the Pain by Petr Pinkhasov

NBC Los Angeles: How grocery prices will change after Trump tariffs

After tariffs of 25% on goods from Mexico and Canada went into effect Tuesday, Americans including Southern California families will likely feel the impact in a matter of a few days.

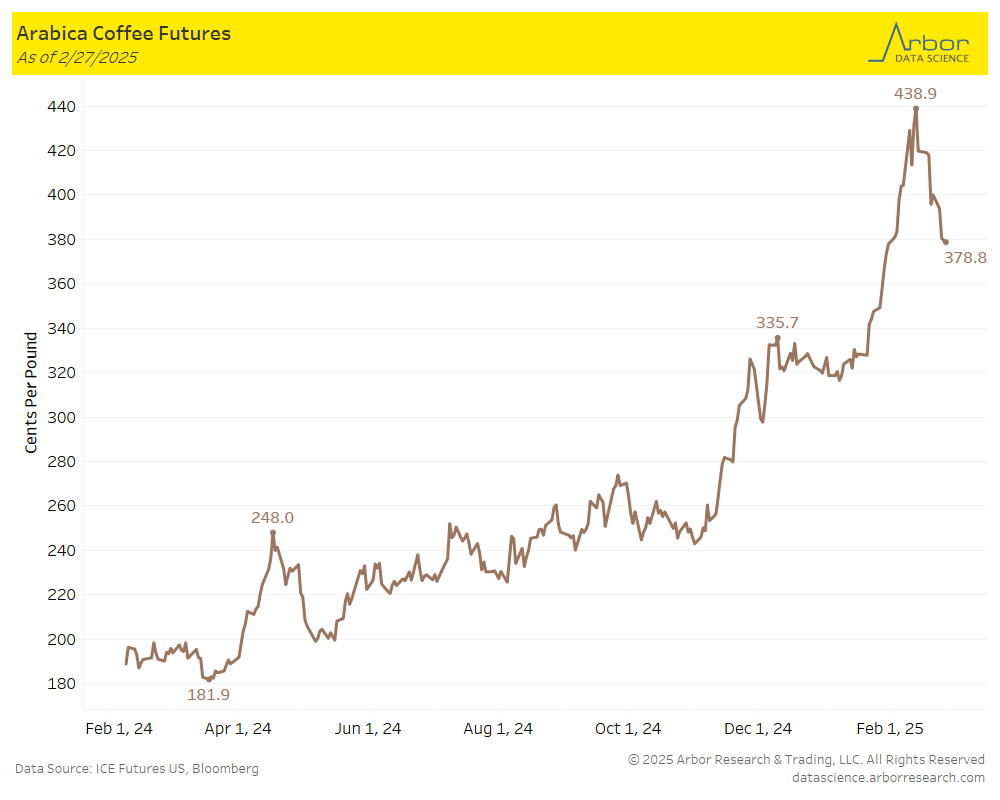

Bloomberg: Brazil Coffee Firms Seeks Bankruptcy Protection as Prices Surge

Brazilian coffee exporters owned by Montesanto Tavares Group Participações SA filed for bankruptcy protection after extreme market volatility left the companies cash strapped.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 3/05/2025 at 07:00am EST: MBA Mortgage Applications

- 3/05/2025 at 08:15am EST: ADP Employment Change

- 3/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 3/05/2025 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 3/05/2025 at 10:00am EST: Durable Goods Orders & Durables Ex Transportation

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Index

- 3/05/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air & ISM Services Prices Paid

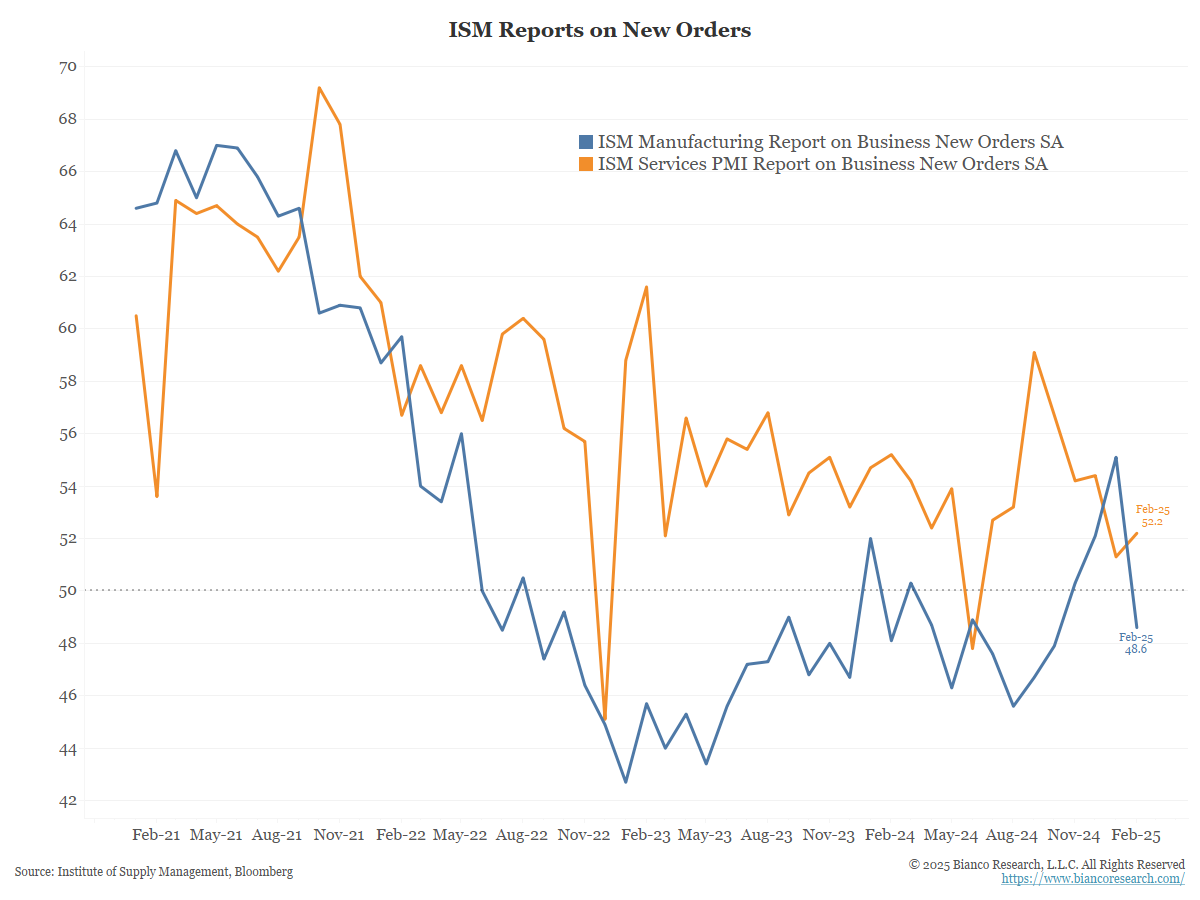

- 3/05/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 3/05/2025 at 02:00am EST: Federal Reserve Releases Beige Book

- 3/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 3/06/2025 at 08:30am EST: Trade Balance; Nonfarm Productivity; Unit Labor Costs

- 3/06/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/06/2025 at 08:45am EST: Harker gives speech on Economic Education

- 3/06/2025 at 10:00am EST: Wholesale Inventories MoM and Wholesale Trade Sales MoM

- 3/06/2025 at 03:30am EST: Waller speaks on the Economic Outlook

- 3/06/2025 at 07:00pm EST: Bostic speaks on Economy

- 3/07/2025 at 08:30am EST: Change in Nonfarm Payrolls % Two-Month Payroll Net Revision

- 3/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufact. Payrolls

- 3/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly YoY & Average Weekly Hours All Employees

- 3/07/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate & Underemployment Rate

- 3/07/2025 at 10:15am EST: Bowman Speaks on Policy Transmission

- 3/07/2025 at 10:45am EST: Williams Speaks on Panel on Policy Transmission

- 3/07/2025 at 12:20am EST: Kugler Speaks on Rebalancing Labor Markets

- 3/07/2025 at 12:30am EST: Powell Speaks on the Economic Outlook

- 3/07/2025 at 01:00pm EST: Kugler Appears on Panel Discussion

- 3/07/2025 at 03:00pm EST: Consumer Credit

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations

- 3/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 3/11/2025 at 10:00am EST: JOLTS Job Openings/Job Openings Rate

- 3/11/2025 at 10:00am EST: JOLTS Quits Level/Quits Rate

- 3/11/2025 at 10:00am EST: JOLTS Layoffs Level/Layoffs Rate

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 2/19) were up 12.97bln @107.05bln

- Dealer positions <2yrs TIPS (as of 2/19) were down 573mln @14.66bln.

- Dealer positions in 2-6yrs TIPS (as of 2/19) were down 1.24bln @7.56bln.

- Dealer positions in 6-11yrs TIPS (as of 2/19) were up 396mln @2.54mln.

- Dealer positions > 11yrs TIPS (as of 2/19) were down 20mln @-158mln.

- Dealer positions in < 2yrs Coupons (as of 2/19) were up 3.68bln @60.44bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 2/19) were up 4.15bln @27.10bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 2/19) were down 5.34bln @79.52bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 2/19) were down 9.10bln @32.12bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 2/19) were down 5.13bln @27.97bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 2/19) were up 986mln @27.04bln.

- Dealer positions in > 21 years Coupons (as of 2/19) were up 1.04bln @43.35bln.