US Treasuries

- Thursday’s range for UST 10y: 4.26% – 4.34%, closing at 4.28%

- Treasury curve steepened in afternoon trading as front end outperformed on rate cut expectations

- Fed’s Waller: doesn’t see a case for March rate cut; could see rate cuts after March Fed meeting

- Fed Chairman Powell speaks tomorrow, Friday, 3/7, at 12:30pm EST on the economic outlook

Bloomberg: Bessent Won’t Get Lower Yields With This Many Bills by Simon White

Fed Sentiment in Speeches this week:

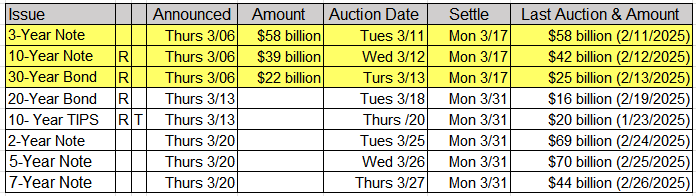

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Jim Bianco Joins Bloomberg to Discuss Global Bond Markets, Tariffs & Inflation

Intraday Commentary from Jim Bianco

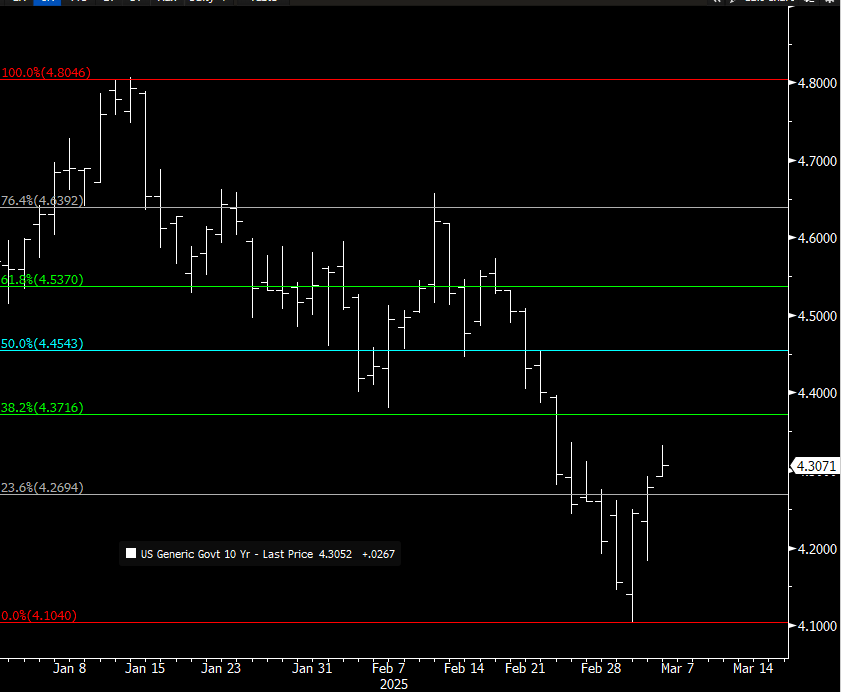

10-year yields dropped to the 50% retracement (cyan line) of the September to January rise.

It closed one day below the 50% retracement and then bounced right back above it.

The .382 retracement (green line) back up from the January high to the low this week is 4.37%.

This is what I’m looking at as the next resistance point.

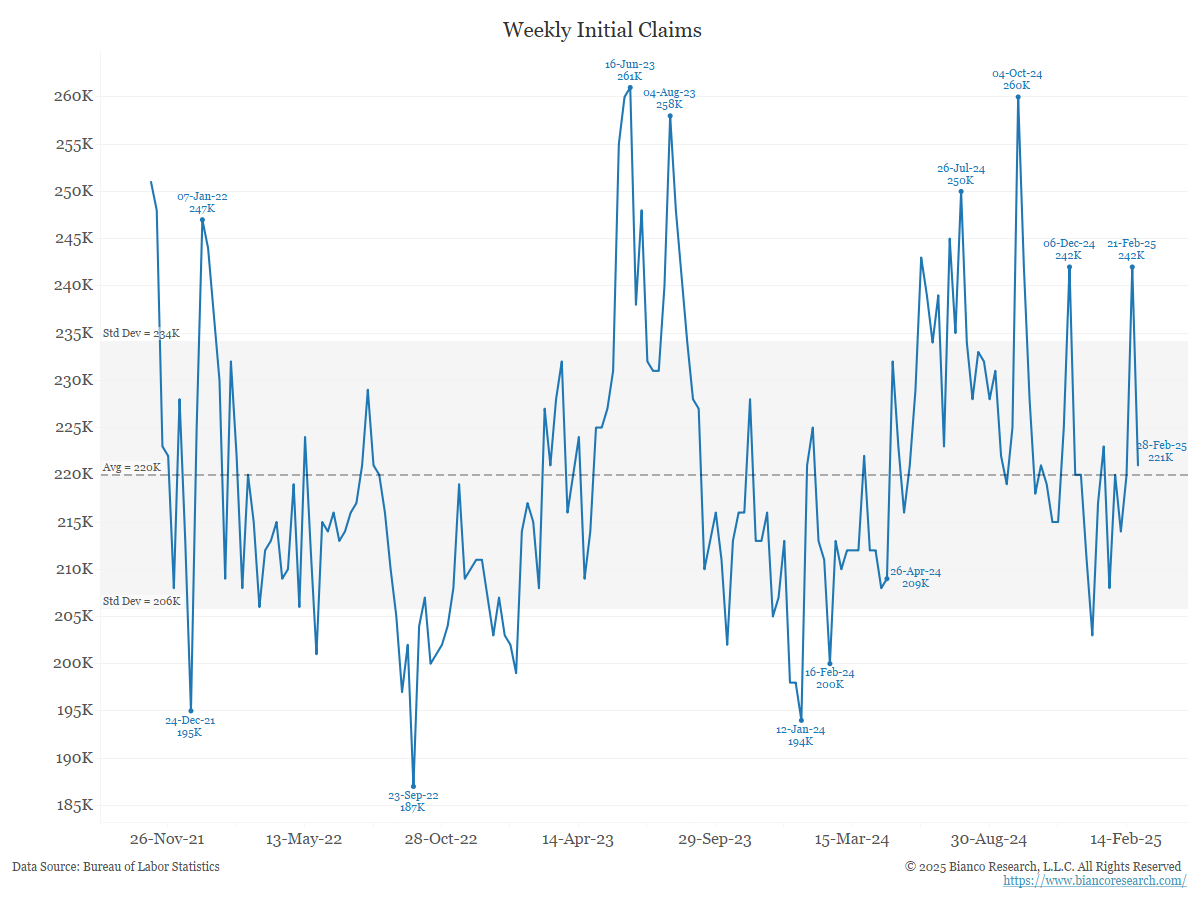

Claims came back down this week. No signs here (yet???) of labor stress.

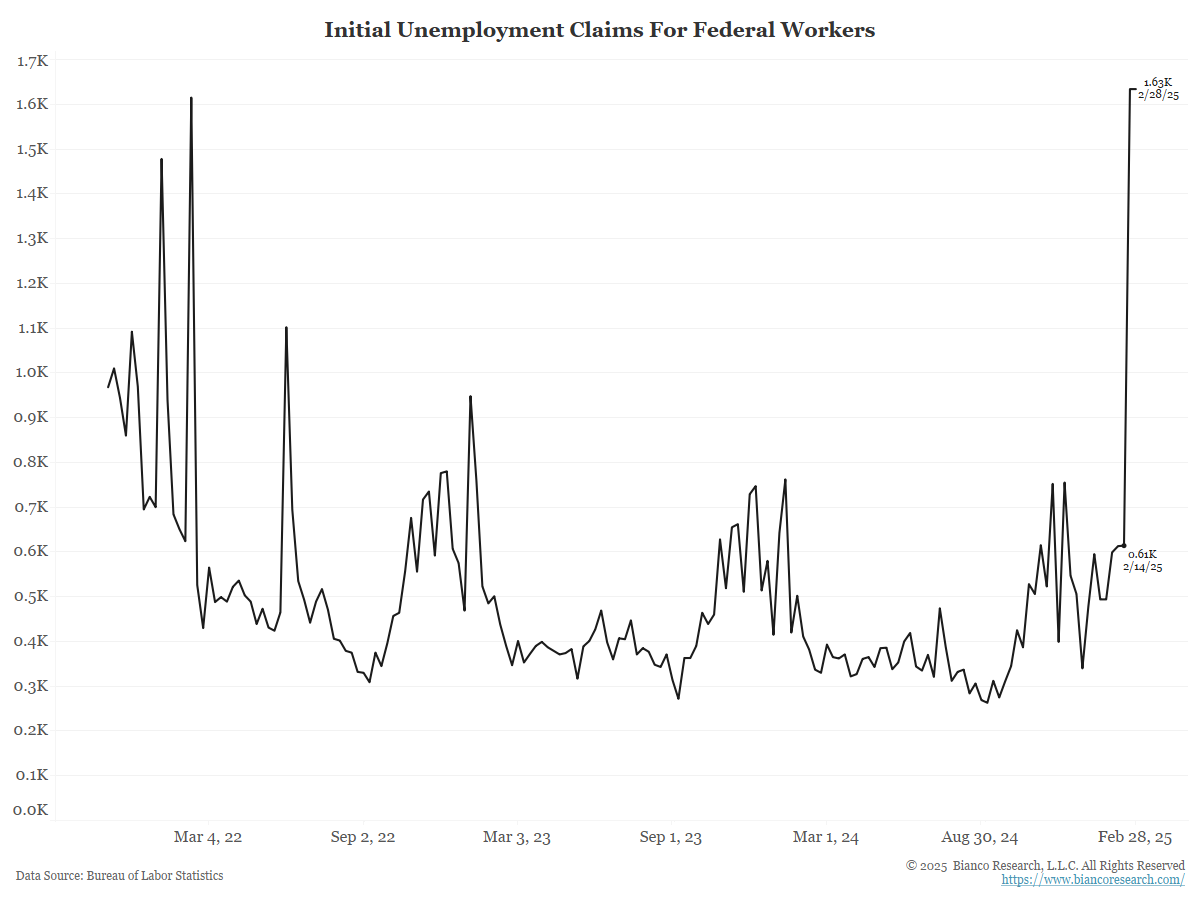

There is a series that aggregates federal workers filing for claims. This has jumped in the week ending Feb 21 (the latest reporting period, week behind overall claims which are the week of February 28).

Most laid off workers are getting severance, so they cannot file until that ends.

In Other News…

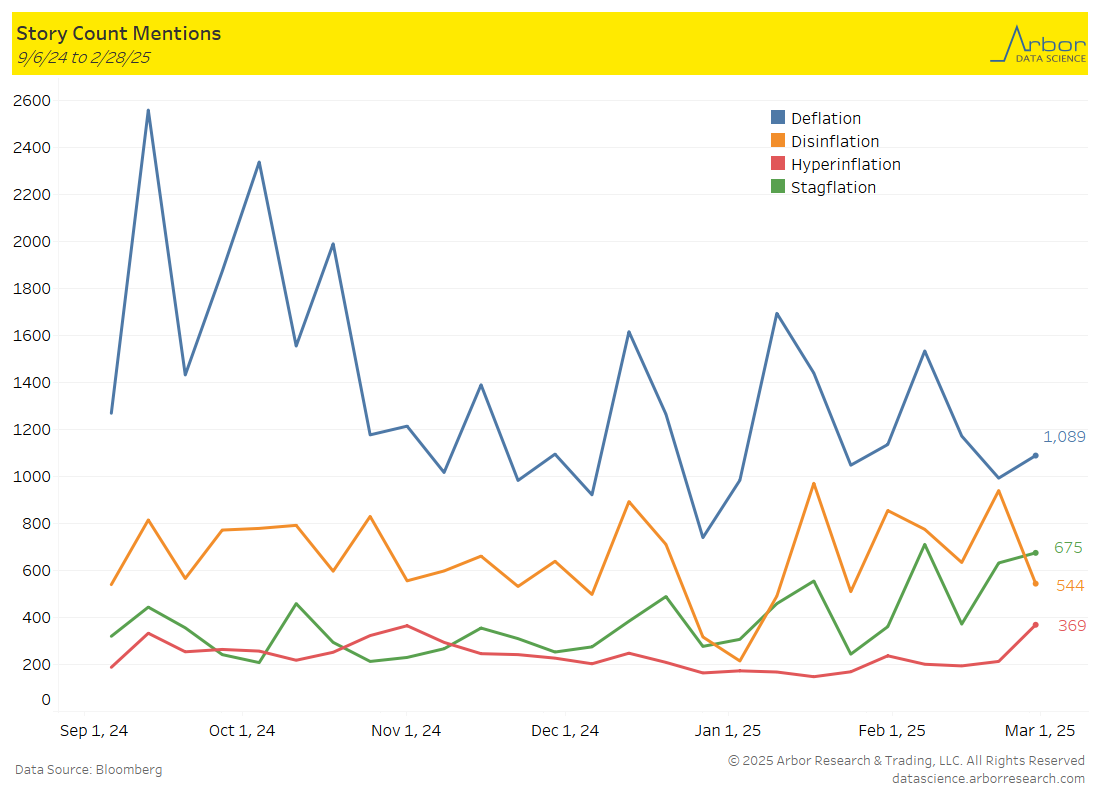

CNBC: Stagflation fears bubble up as Trump tariffs take effect and the economy slows

A growth scare in the economy has accompanied worries over a resurgence in inflation, in turn potentially rekindling an ugly condition that the U.S. has not seen in 50 years.

Arbor Data Science:

SupplyChainBrain: Japanese Firms Boost Exports to U.S. to Get Ahead of Tariffs

Overall, Japanese exports to the U.S. jumped 8.1% in January to ¥1.5 trillion ($10 billion), the highest for the month in at least 19 years. The U.S. eclipsed China as Japan’s largest export market last year, according to the finance ministry.

Bloomberg: Americans Fall Behind on Car Payments at Highest Rates in Decades

Car owners are missing their monthly payments at the highest rate in more than 30 years.

WorldPropertyJournal: Overall U.S. Mortgage Delinquency Rates Dip in December

According to CoreLogic’s latest Loan Performance Insights Report for December 2024, 3.1% of all U.S. mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure).

Upcoming Economic Releases & Fed Speak

- 3/07/2025 at 08:30am EST: Change in Nonfarm Payrolls & Two-Month Payroll Net Revision

- 3/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufact. Payrolls

- 3/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly YoY & Average Weekly Hours All Employees

- 3/07/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate & Underemployment Rate

- 3/07/2025 at 10:15am EST: Bowman Speaks on Policy Transmission

- 3/07/2025 at 10:45am EST: Williams Speaks on Panel on Policy Transmission

- 3/07/2025 at 12:20pm EST: Kugler Speaks on Rebalancing Labor Markets

- 3/07/2025 at 12:30pm EST: Powell Speaks on the Economic Outlook

- 3/07/2025 at 01:00pm EST: Kugler Appears on Panel Discussion

- 3/07/2025 at 03:00pm EST: Consumer Credit

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations

- 3/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 3/11/2025 at 10:00am EST: JOLTS Job Openings/Job Openings Rate

- 3/11/2025 at 10:00am EST: JOLTS Quits Level/Quits Rate

- 3/11/2025 at 10:00am EST: JOLTS Layoffs Level/Layoffs Rate

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth