US Treasuries

- Friday’s range for UST 10y: 4.205% – 4.325%, closing at 4.32%

- Yields climbed higher in the afternoon after Powell spoke (speech highlights below)

- Heavy Investment Grade Issuance expected Monday (approx. $45 billion of new corporate bonds)

- Fed’s Bowman: says economy’s neutral rates has risen since Covid

- Fed’s Williams: says data points to stable inflation expectations; still thinks neutral rate is lower than in 1990s

- Fed’s Kugler: says rate policy likely on hold for some time

- Fed Chairman Powell: says economy is good, Fed doesn’t need to rush

Bloomberg: Fed’s Powell Says Still No Need to Hurry to Consider Rate Moves

“Despite elevated levels of uncertainty, the US economy continues to be in a good place,” Powell said at an event Friday in New York hosted by the University of Chicago Booth School of Business. “We do not need to be in a hurry, and are well positioned to wait for greater clarity.”

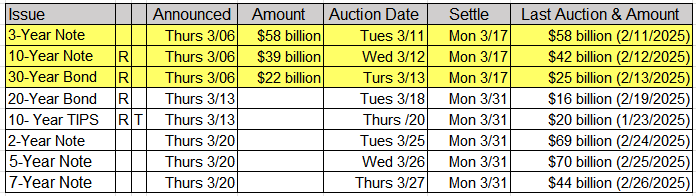

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

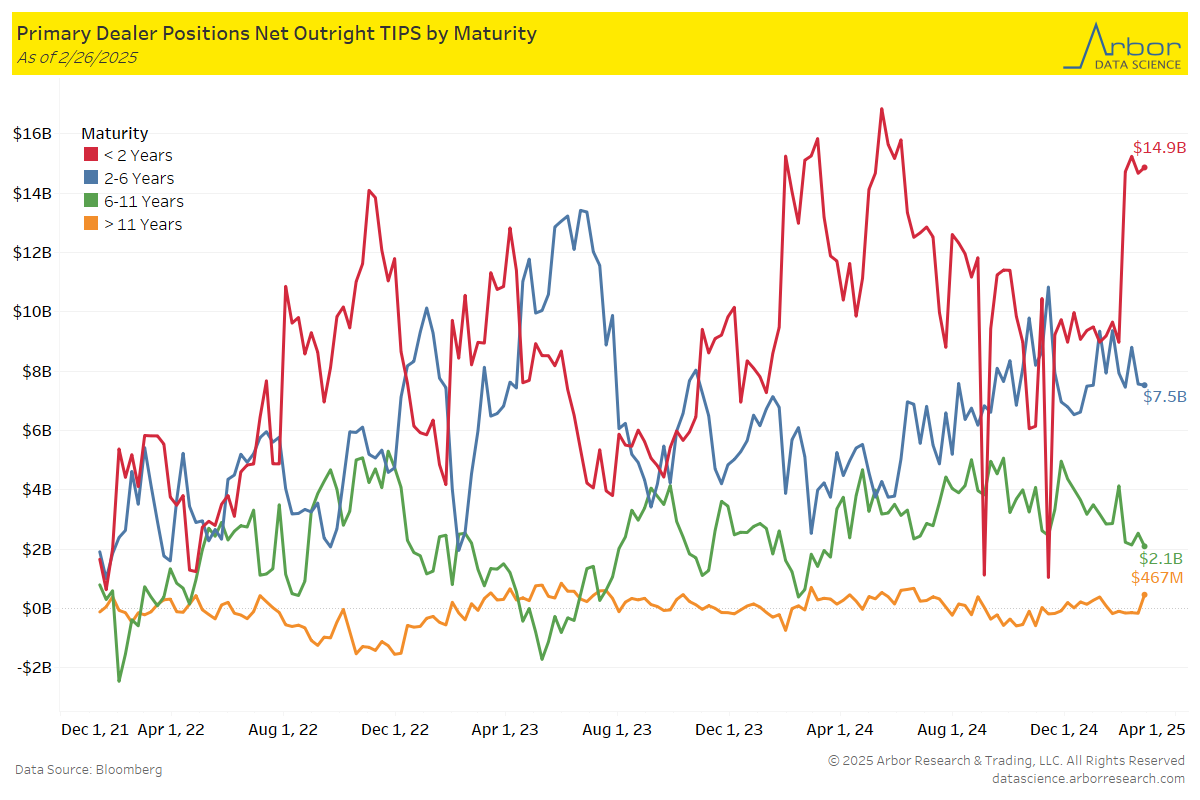

TIPS by Maturity

Week over Week Changes by Maturity

Data through 2/26/25

- < 2 years: $14.7 Bn on 2/19/25 to $14.9 Bn on 2/26/25 = $0.2 Bn

- 2 – 6 years: $7.6 Bn on 2/19/25 to $7.5 Bn on 2/26/25 = ($0.1 Bn)

- 6 – 11 years:$2.5 Bn on 2/19/25 to $2.1 Bn on 2/26/25 = ($0.4 Bn)

- > 11 years: ($158 Mn) on 2/19/25 to $467 Mn on 2/26/25 = $625 Mn

Intraday Commentary from Jim Bianco

10-year yields are falling 4.23% now. I don’t think it is about the payroll report.

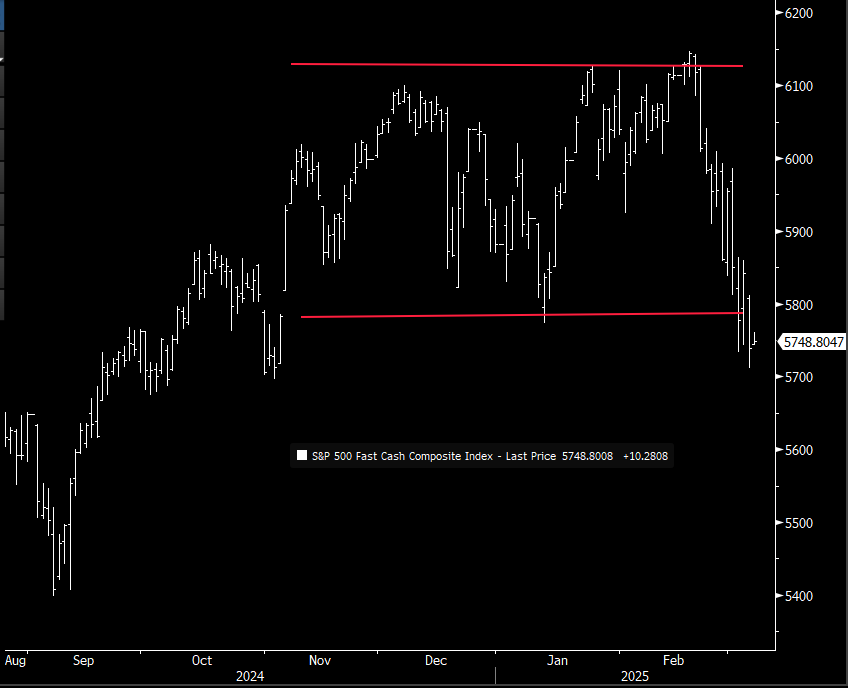

As the chart shows, stocks had a terrible day yesterday, broke the bottom of the post-election range. Earlier this AM, S&P futures were pointing toward a rebound, up 0.5%. Now they are giving up that bounce, effectively unchanged on the day.

In other words, my guess is the bond market has moved on from payrolls 20 minutes after the release and is now focusing on risk-on markets, stocks falling and widening credit spreads.

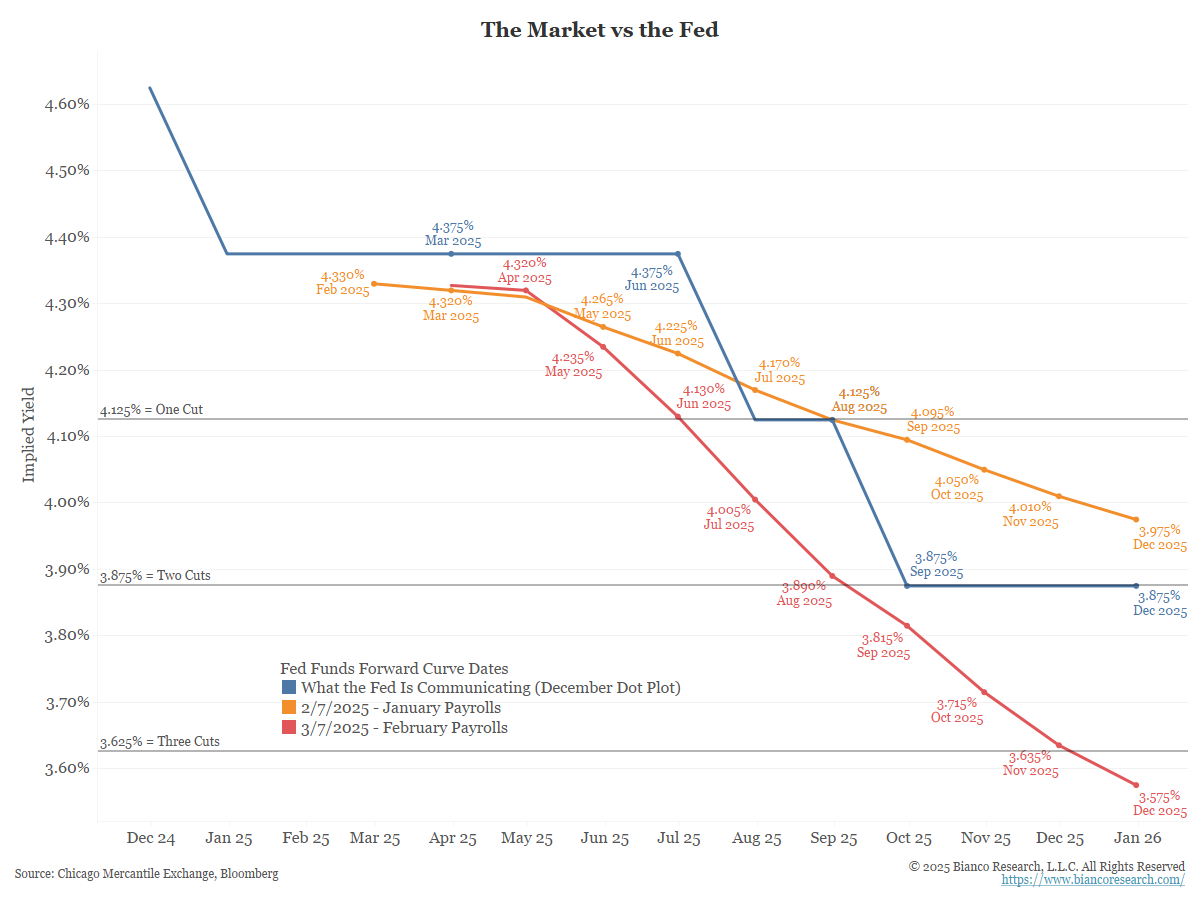

How much Fed expectations have changed in the last month … all driven by the risk-on market sell-off (see the chart above).

In Other News…

OilPrice: Oil Prices Begin to Recover After a Turbulent Week

After what has been a rollercoaster of a week for oil markets, oil prices started to recover some of their losses on Friday morning.

Less than half (47%) of newly built apartments completed in the third quarter of 2024 were rented within three months. That’s tied with the fourth quarter of 2023 for the lowest share on record aside from the start of the pandemic.

Axios: Auto Loan 60+ Day Delinquency Index

Americans are missing their car payments at the highest rate in decades, according to Finch Ratings data.

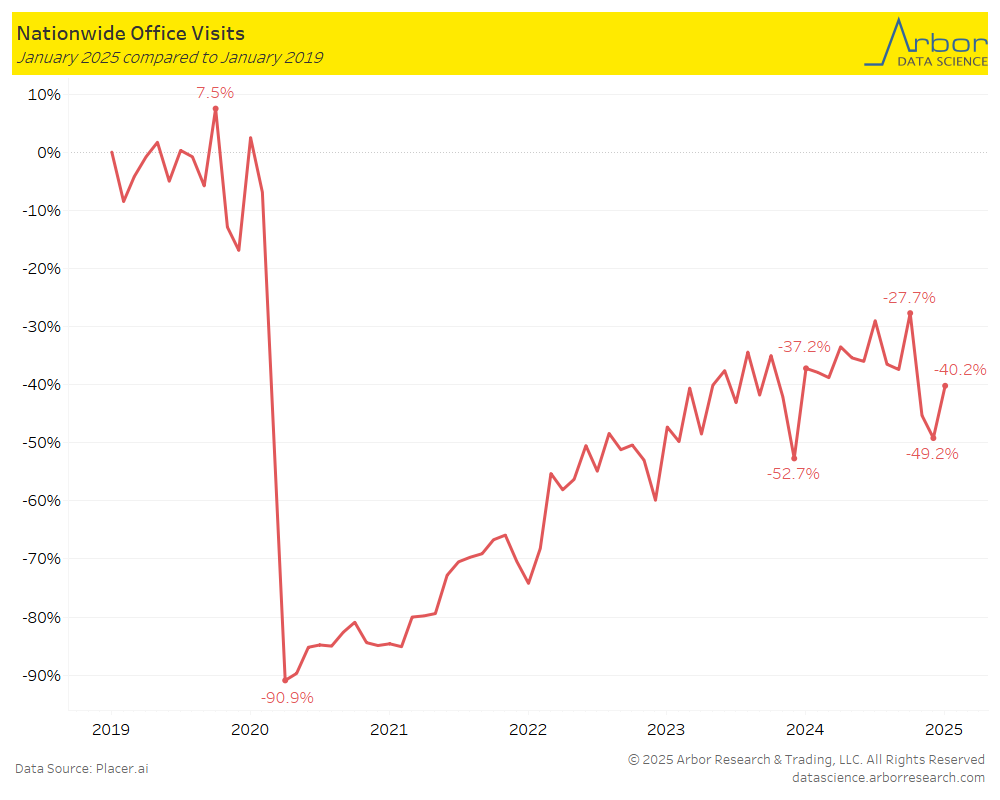

efinancialcareers: As Goldman Sachs fires underperforming VPs, time in office is a criteria

As Goldman decides who to trim, sources at the bank say multiple criteria are being evaluated. Those criteria include standard measures like performance and productivity, but we understand that they also include time spent in the office.

Arbor Data Science: Return to the Office Trends

Upcoming Economic Releases & Fed Speak

- 3/08/2025 – 3/20/2025: Fed’s External Communications Blackout

- 3/10/2025 at 03:00pm EST: NY Fed 1-Yr Inflation Expectations

- 3/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 3/11/2025 at 10:00am EST: JOLTS Job Openings/Job Openings Rate

- 3/11/2025 at 10:00am EST: JOLTS Quits Level/Quits Rate

- 3/11/2025 at 10:00am EST: JOLTS Layoffs Level/Layoffs Rate

- 3/12/2025 at 07:00am EST: MBA Mortgage Applications

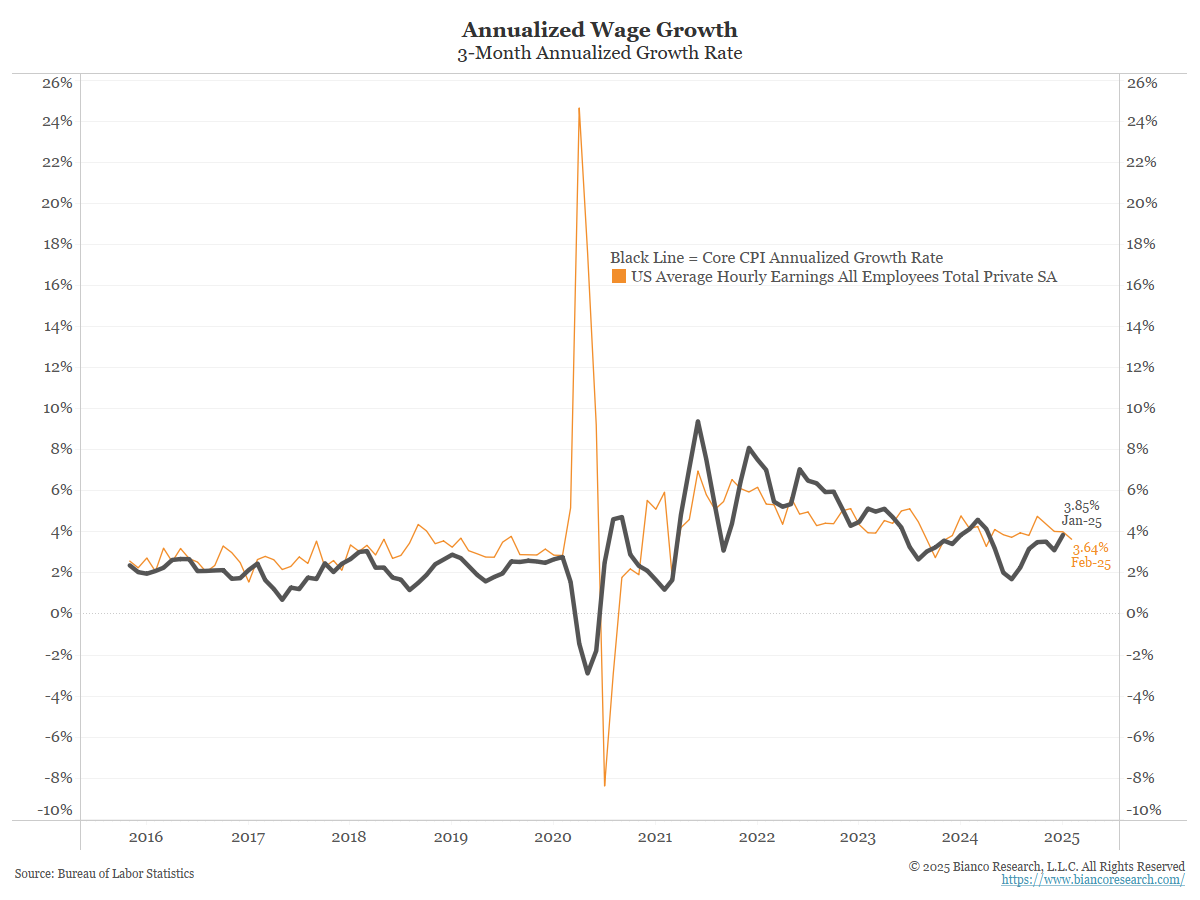

- 3/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 3/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 3/12/2025 at 08:30am EST: CPI Index SA

- 3/12/2025 at 08:30am EST: Real Average Hourly Earnings YoY & Real Average Weekly Earnings YoY

- 3/12/2025 at 02:00pm EST: Federal Budget Balance

- 3/13/2025 at 08:30am EST: PPI Final Demand MoM; PPI Ex Food and Energy MoM

- 3/13/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY

- 3/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY

- 3/13/2025 at 08:30am EST: Initial Jobless Claims and Continuing Claims

- 3/13/2025 at 12:00pm EST: Household Change in Net Worth

- 3/14/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 3/14/2025 at 10:00am EST: U. of Mich. 1 Yr- Inflation & U. of Mich. 5-10 Yr Inflation