US Treasuries

- Tuesday’s range for UST 10y: 4.13% – 4.20%, closing at 4.16%

- Fed’s Barkin: says tariffs could reduce jobs and raise inflation

Bloomberg: Pimco Favor Stable Returns From Bonds as Recession Risk Builds

Rising potential for a US recession has Pacific Investment Management Co. touting the attractiveness of “stable sources of returns” in global bonds.

Bloomberg: US Recession Fear Raises ‘Gray Swan’ Risk for Bond Investors

Investors are fretting that a year-long rally in global credit is papering over the risk that US policy uncertainty tips the world’s largest economy into a recession.

Agency Bullets

- We saw trading today in the New TVA 5.25 2/55

- The issue came to market at 60/30s in February; traded to 56/30s; then to 60/30s; now trading at 70/30s

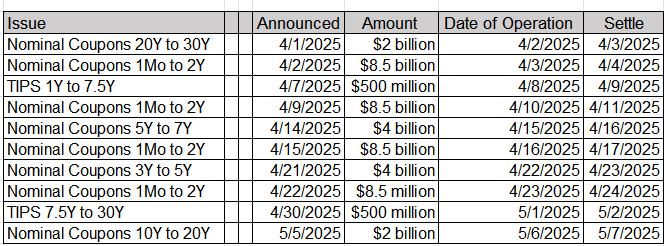

Upcoming US Treasury Supply

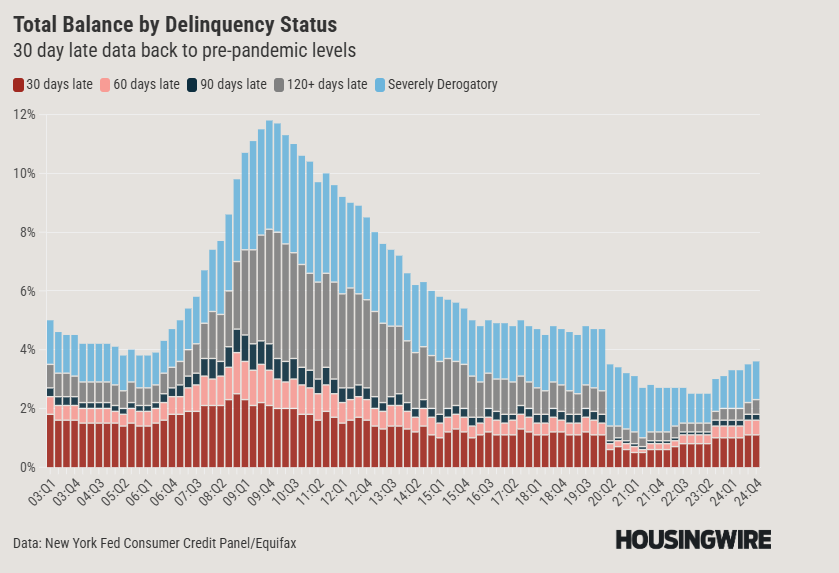

HousingWire: No, homeowner delinquency rates aren’t elevated

Jim Bianco:

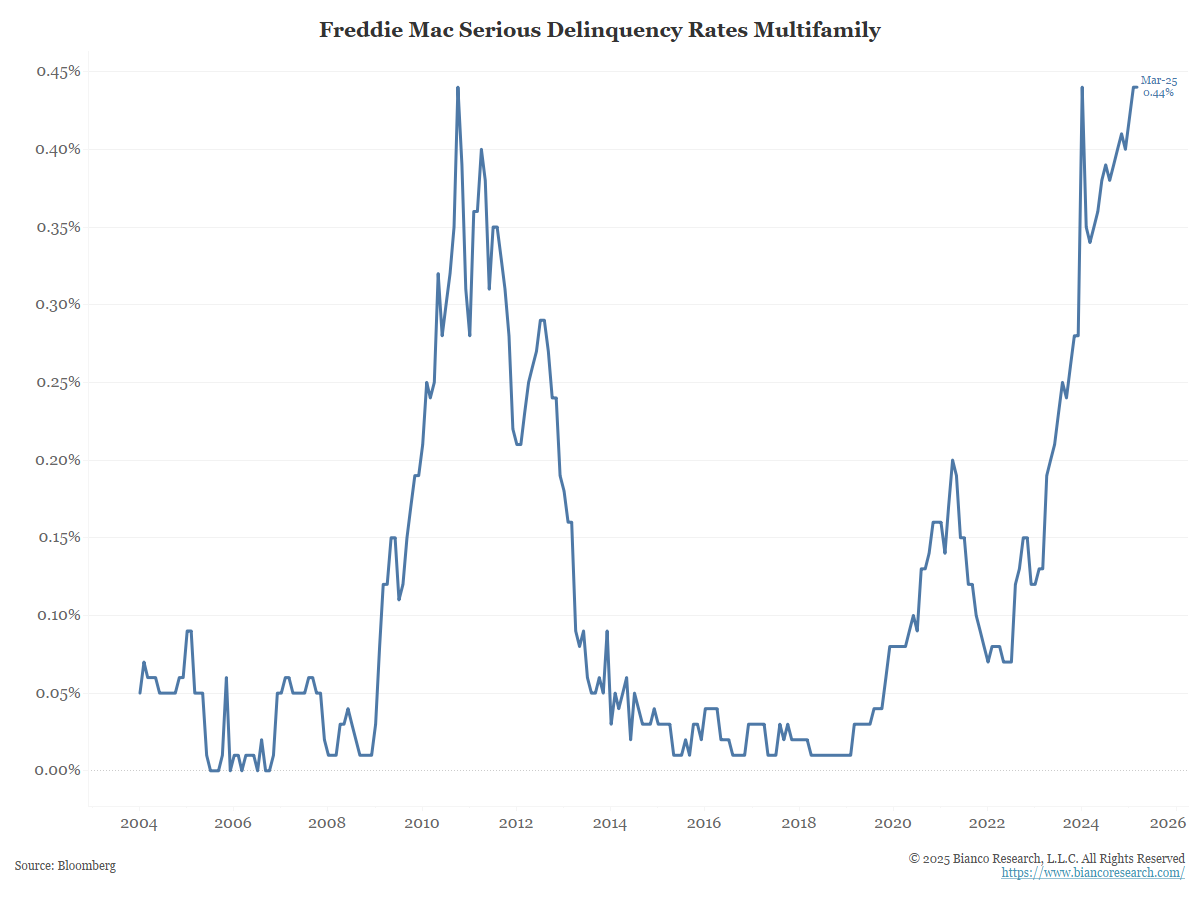

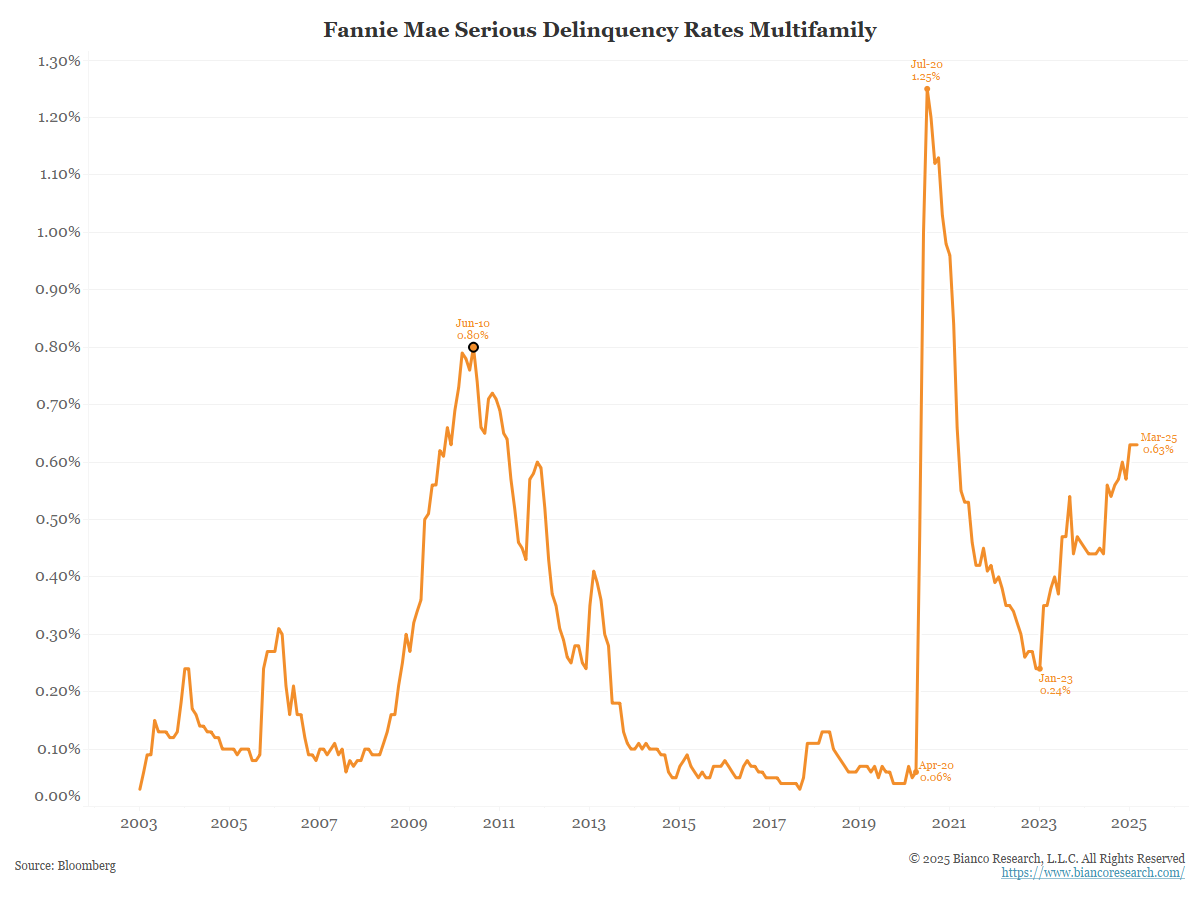

These loans pertain to multifamily mortgages, which are used for commercial properties with five or more units, such as apartment buildings.

Notably, the rate of multifamily delinquencies currently stands at under 1%, but it is at levels above the 2008 recession. However, there is a big difference between apartment lending and homeowners who have a 30-year fixed-rate mortgage.

Some people are trying to imply that we have major stress in homeowner data. But as we can see in the chart below, the data clearly identifies these as multifamily loans.

Above is FREDDIE MAC data. FANNIE MAE data paints a different picture.

It’s notable that total credit stress data for loans listed as severe derogatory has not yet recovered to even pre-COVID-19 levels.

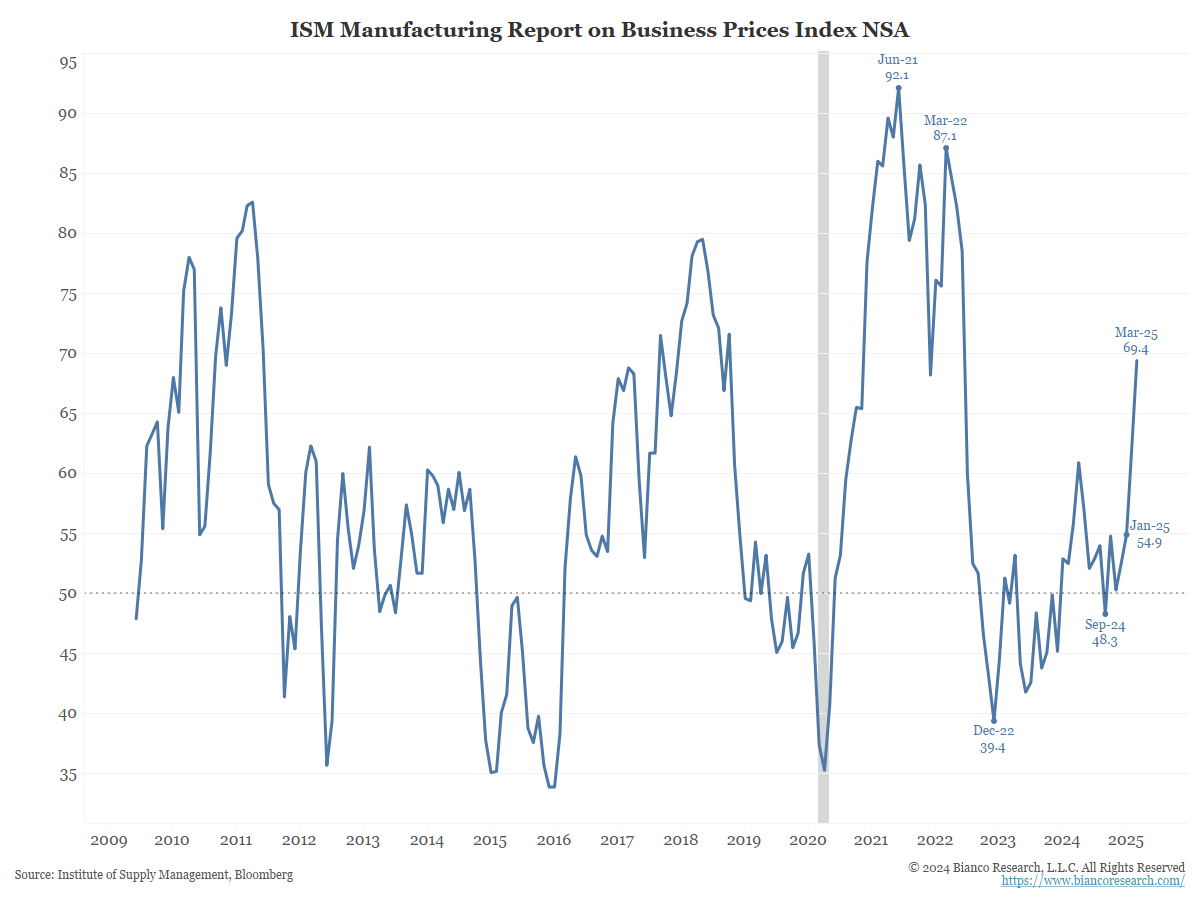

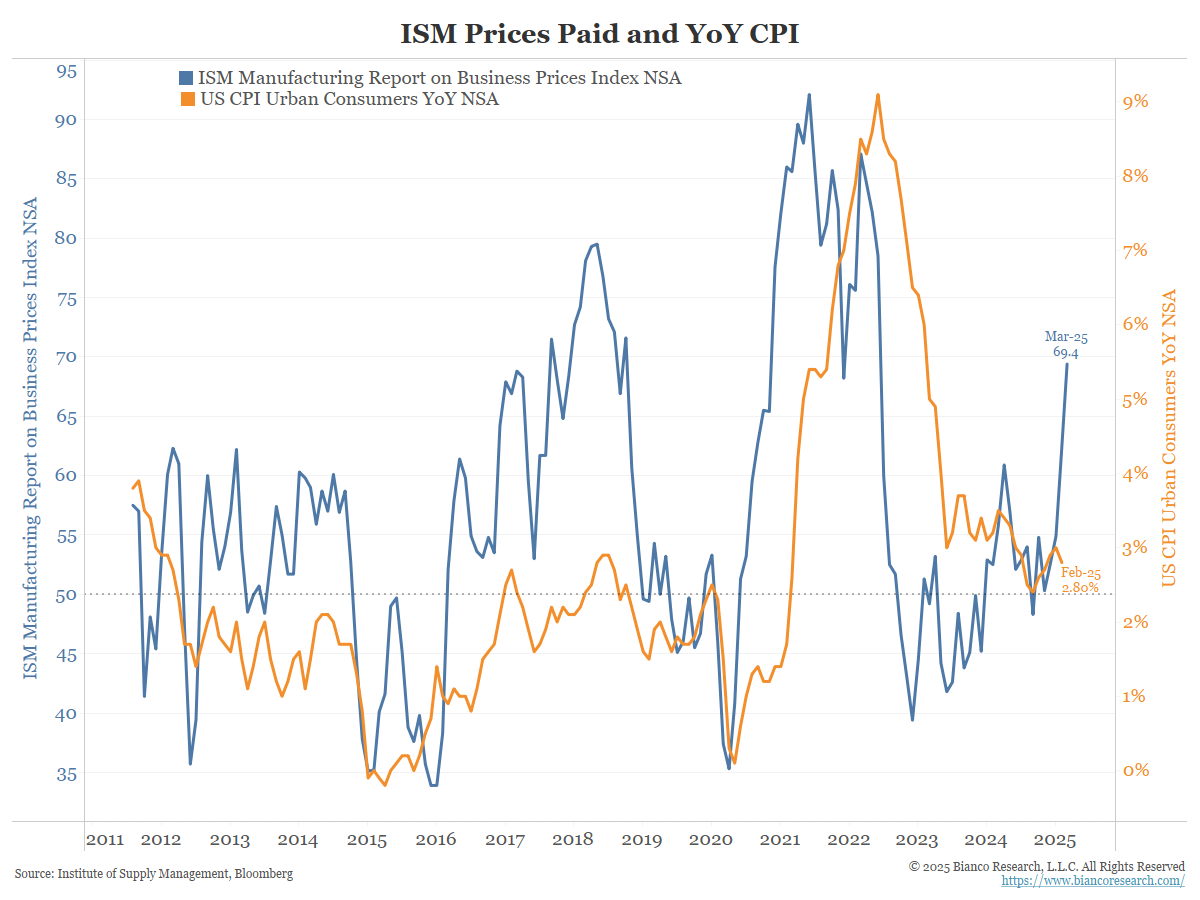

Bad ISM Prices Paid report today

It leads CPI

In the News…

OilPrice: OPEC+ To Increase Oil Production in May: Report

OPEC+ is expected to agree on a plan that would see production for the group increase in May, OPEC+ sources told Reuters on Tuesday.

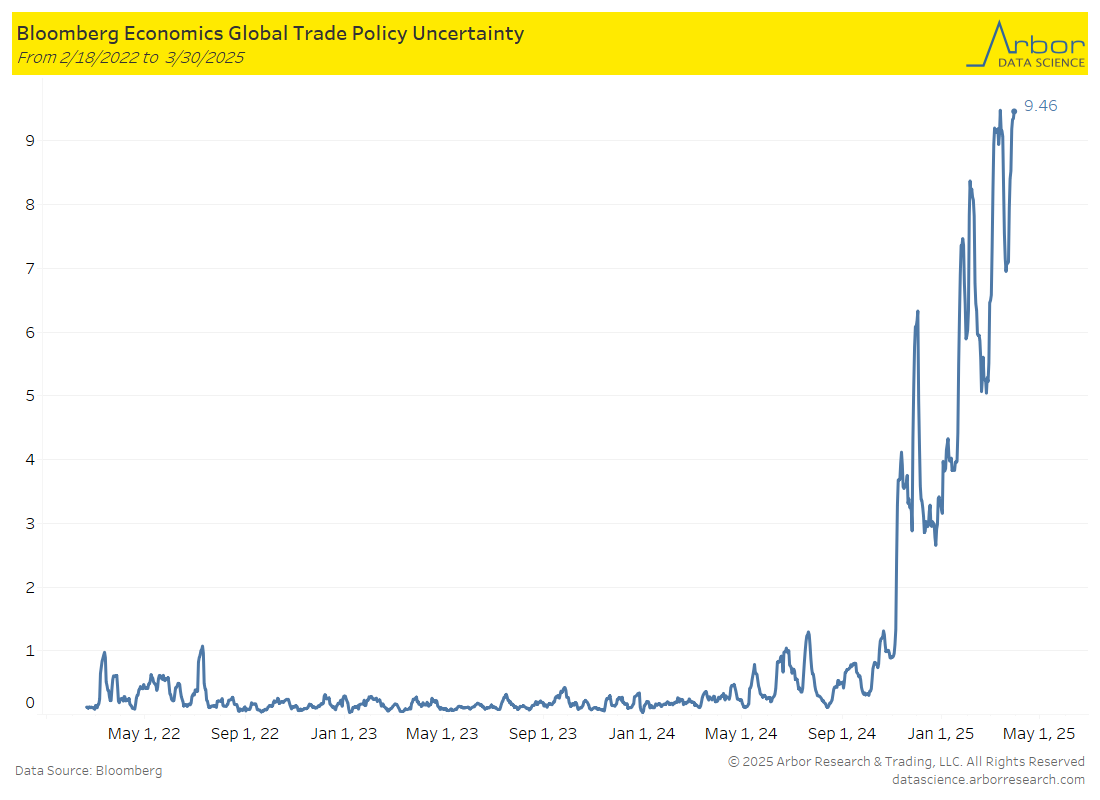

Arbor Data Science: Steeling for Liberation Day by Sam Rines

USAFacts: Is there a shortage of air traffic controllers?

The Federal Aviation Administration (FAA) controls 290 air control facilities. And as of September 2023, nearly half of them were understaffed.

SupplyChainBrain: USDA Reports ‘Fully Stocked Shelves’ as Egg Shortage Eases

The U.S. Department of Agriculture (USDA) says that supply chain issues for eggs at grocery stores have “greatly improved,” as wholesale prices have fallen ahead of the Easter holiday.

Upcoming Economic Releases & Fed Speak

- 4/02/2025 at 07:00am EST: MBA Mortgage Applications

- 4/02/2025 at 08:15am EST: ADP Employment Change

- 4/02/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Transportation

- 4/02/2025 at 10:00am EST: Durable Goods Orders / Durable Goods Ex Transportation

- 4/02/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air

- 4/02/2025 at 04:30pm EST: Fed’s Kugler Speaks on Inflation Expectations

- 4/03/2025 at 07:30am EST: Challenger Job Cuts YoY

- 4/03/2025 at 08:30am EST: Trade Balance

- 4/03/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/03/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 4/03/2025 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 4/03/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 4/03/2025 at 12:00pm EST: Fed’s Jefferson Gives Keynote on Communication

- 4/03/2025 at 02:30pm EST: Fed’s Cook Speaks on Economic Outlook

- 4/04/2025 at 08:30am EST: Change in Nonfarm Payrolls & Change in Private Payrolls

- 4/04/2025 at 08:30am EST: Change in Manufact. Payrolls & Two-Month Payroll Net Revision

- 4/04/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate

- 4/04/2025 at 08:30am EST: Underemployment Rate

- 4/04/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY & Average Weekly Hours All Employees

- 4/04/2025 at 11:25am EST: Fed’s Powell Speaks on Economic Outlook

- 4/04/2025 at 12:00pm EST: Fed’s Barr Speaks on AI and Banking

- 4/04/2025 at 12:45pm EST: Fed’s Waller Speaks on Payments

- 4/07/2025 at 03:00pm EST: Consumer Credit

- 4/08/2025 at 06:00am EST: NFIB Small Business Optimism