US Treasuries

- Thursday’s range for UST 10y: 4.26% – 4.40%, closing at 4.40%

- Fed’s Logan: says the Fed must ensure tariffs don’t spark lasting inflation

- Fed’s Schmid: says he is ‘squarely focused’ on inflation risks; growth rate of public debt is not sustainable

- Fed’s Goolsbee: says the bar for Fed Rate action is near term a little higher

Bloomberg: Global Bond Markets Reel From Fallout of Treasuries’ Wild Ride

Global bonds reacted violently to a turbulent day for US Treasuries, with markets rapidly unwinding bets on interest-rate cuts in the wake of US President Donald Trump’s surprise pause on tariffs.

MarketWatch: Why bond-market tumult likely peaked this morning – before Trump’s tariff pause

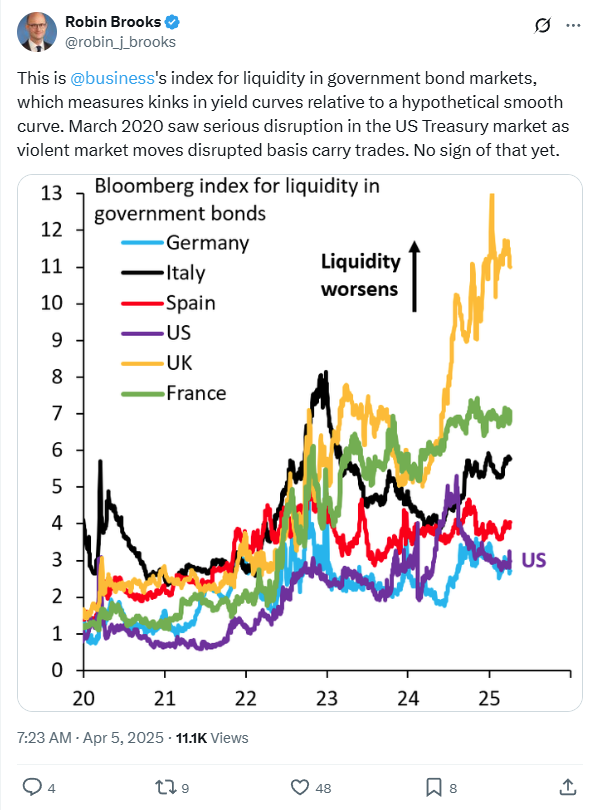

Twitter: @robin_j_brooks

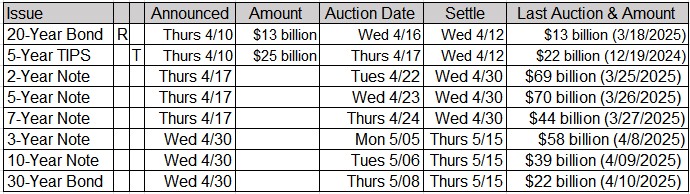

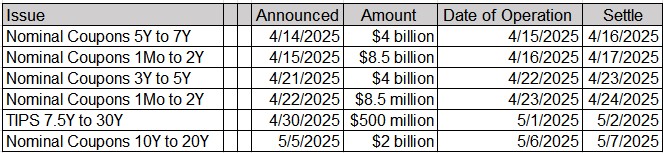

Upcoming US Treasury Supply

Intraday Commentary From Jim Bianco

SPY = The S&P 500 Index Trust. This was the first ETF created in 1993 and is one of the largest at $575 billion.

—-

How stressed are markets? The middle panel is SPY’s Net Asset Value (NAV). The price closed at a 90-basis-point premium to the underlying value of the assets.The last time anything like this happened was 2008. To emphasize, not even in the crazy days of 2020 did its divergence get this big.

VOO = Vanguard S&P 500, $566 billion in assets. At the same time VOO, which is Vanguard’s version of SPY, went out at one of its biggest discounts in years (middle panel).

Finally, IVV iShares Core S&P 500 ETF, $559 billion in assets.IT has been trading at a persistent discount for a few weeks.

So what does this all mean?

SPY is the favorite trading vehicle of degen traders in stocks. VOO and IVV are effectively the same thing but attract a more long-term investor (or allocator) money. Degens plowed so much money into SPY after Trump paused the tariffs late in the day that the APs (market makers) could not keep up, and the price moved to a substantial premium to its NAV.

The APs (Associated Person) shorted VOO and IVV as a hedge, causing their discounts. Collectively, these three funds are worth over $1.6 trillion, and yesterday’s trading was so wild that the APs could not 1keep everything in line.

—

And congratulations to the Degens. Not only did they rush into something with an underlying index (the S&P 500) down 4%, but they paid a huge premium for SPY and are down 5% today. Well done!

The 30-year yield is at the high of the day, This is after the 30-year auction went really well.

*US LEVERAGED-LOAN FUNDS SEE RECORD $6.5 BILLION WEEKLY OUTFLOW

In the News…

ZeroHedge: The Spike In Yields Isn’t China Dumping Treasuries

U.S. Treasury bond yields spiked overnight, leading some to suspect China was dumping Treasury bonds.

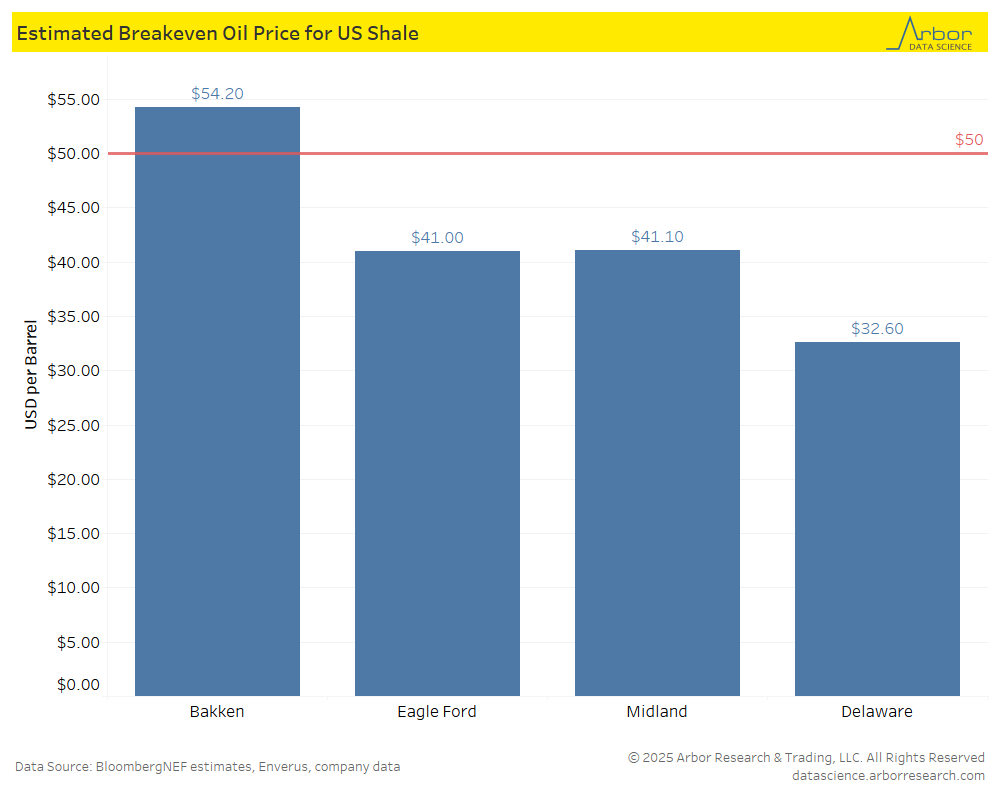

OilPrice: U.S. Shale Faces Toughest Challenge Since the 2020 Oil Price Plunge

The U.S. shale industry is being hit by the crash in oil prices, which have slumped since President Donald Trump’s tariff announcement last week.

Despite the strong relief rally on Wednesday, following President Trump’s 90-day pause of tariff hikes on most countries except China, the U.S. benchmark oil price is now lower than the breakeven for the shale industry to profitably drill a new well.

Preview to tomorrow’s Arbor Data Science Post:

Arbor Data Science: U.S. Shale: To Drill or Not to Drill

Just when you thought egg prices were normalizing….

Just when you thought egg prices were normalizing….

Fast Company: Egg prices hit record $6.23 per dozen despite falling wholesale costs and bird flu outbreaks slowing

U.S. egg prices increased again last month to reach a new record-high of $6.23 per dozen despite President Donald Trump’s predictions, a drop in wholesale prices and no egg farms having bird flu outbreaks.

Upcoming Economic Releases & Fed Speak

- 4/11/2025 at 08:30am EST: PPI Final Demand MoM/ PPI Ex Food and Energy MoM

- 4/11/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM; PPI Final Demand YoY

- 4/11/2025 at 08:30am EST: PPI Ex Food and Energy YoY and PPI Ex Food, Energy, Trade YoY

- 4/11/2025 at 10:00am EST: U. of Mich. Sentiment / U. of Mich. Current Conditions

- 4/11/2025 at 10:00am EST: U. of Mich. Expectations/ U. of Mich. 1 Yr Inflation / U. of Mich. 5 – 10 Yr Inflation

- 4/11/2025 at 10:00am EST: Fed’s Musalem Speaks on U.S. Economy

- 4/11/2025 at 11:00am EST: Fed’s Williams Speaks on Outlook, Monetary Policy

- 4/14/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 4/14/2025 at 06:00pm EST: Fed’s Harker Speaks on Role of Fed

- 4/14/2025 at 07:40am EST: Fed’s Bostic Speaks in Fireside Chat on Policy

- 4/15/2025 at 08:30am EST: Empire Manufacturing

- 4/15/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum & Import Price Index YoY

- 4/15/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY

- 4/16/2025 at 07:00am EST: MBA Mortgage Applications

- 4/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 4/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas

- 4/16/2025 at 08:30am EST: Retail Sales Control Group & New York Fed Services Business Activity

- 4/16/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 4/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 4/16/2025 at 12:00pm EST: Fed’s Hammack Speaks in Moderated Q&A

- 4/16/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 4/16/2025 at 04:00pm EST: Fed’s Schmid Chats with Fed’s Logan on Economy, Banking

- 4/17/2025 at 08:30am EST: Housing Starts /Housing Starts MoM; Building Permits / Building Permits MoM

- 4/17/2025 at 08:30am EST: Initial Jobless Claims

- 4/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 4/17/2025 at 08:30am EST: Initial Claims 4-Wk Moving Avg

- 4/17/2025 at 08:30am EST: Continuing Claims