US Treasuries

- Friday’s range for UST 10y: 4.38% – 4.585%, closing at 4.49%

- Fed’s Kashkari: says he is not seeing dislocation that merits intervention

- Fed’s Collins: says US-China tariff hikes ‘extremely concerning’; tariff impact broader than many Americans see

- Fed’s Musalem: flags risk of higher inflation, weaker job market

- Fed’s Williams: says current rate stance remains appropriate

Bloomberg: Treasury Market Rout Is Even Worse for Inflation-Linked Bonds

Inflation-linked bonds are the biggest losers in this month’s violent Treasury market selloff, and that’s only partly due to inflation expectations.

WSJ: The Simple Explanation for This Week’s Treasury Market Mayhem

The Treasury market freaked everyone out this week when yields on longer-term debt shot higher even as stocks were being bludgeoned and the dollar fell. Naturally, traders are wondering why.

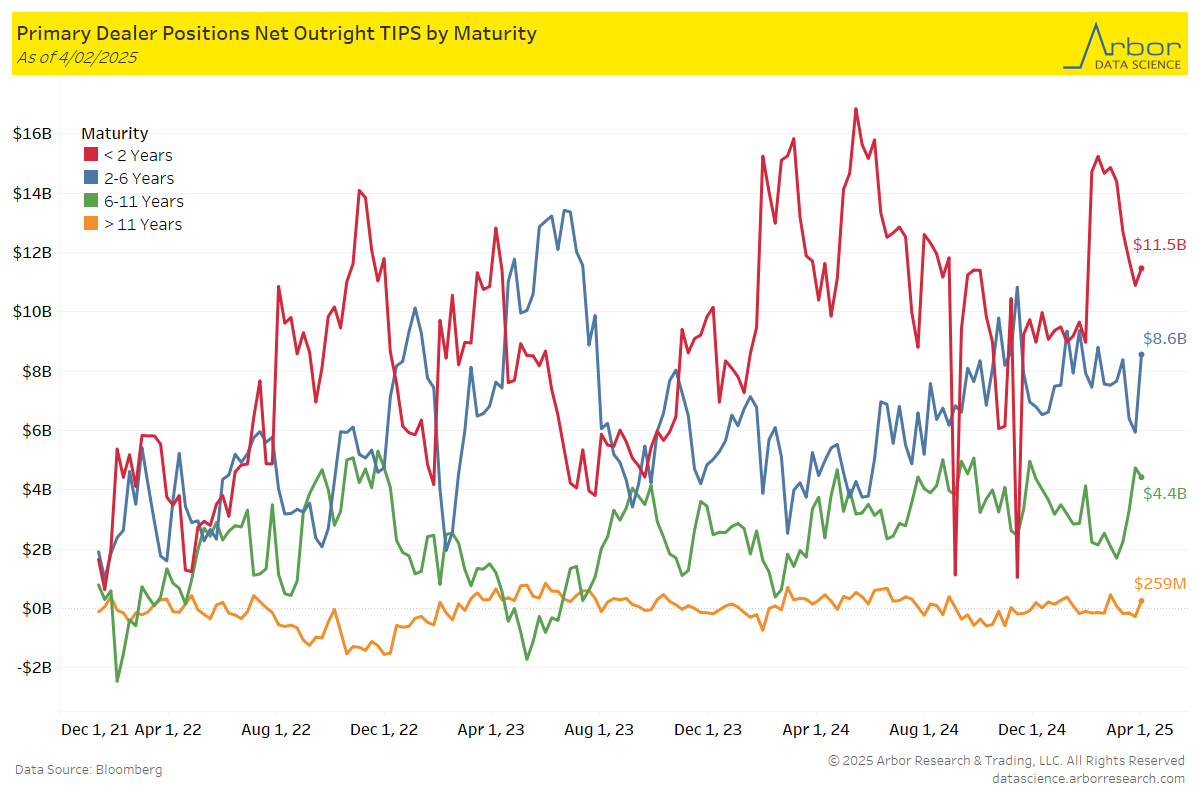

TIPS by Maturity

Data through 4/02/25

Week over Week Changes by Maturity

- < 2 years: $10.9 Bn on 3/26/25 to $11.5 Bn on 4/02/25 = $0.6 Bn

- 2 – 6 years: $5.9 Bn on 3/26/25 to $8.6 Bn on 4/02/25 = $2.7 Bn

- 6 – 11 years: $4.7 Bn on 3/26/25 to $4.4 Bn on 4/02/25 = ($0.3 Bn)

- > 11 years: ($270Mn) on 3/26/25 to $259 Mn on 4/02/25 = $529 Mn

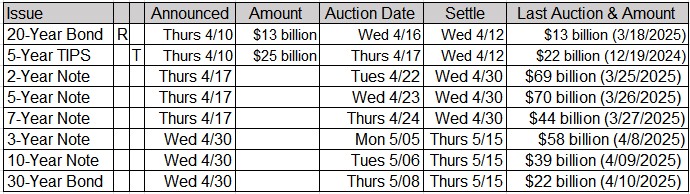

Upcoming US Treasury Supply

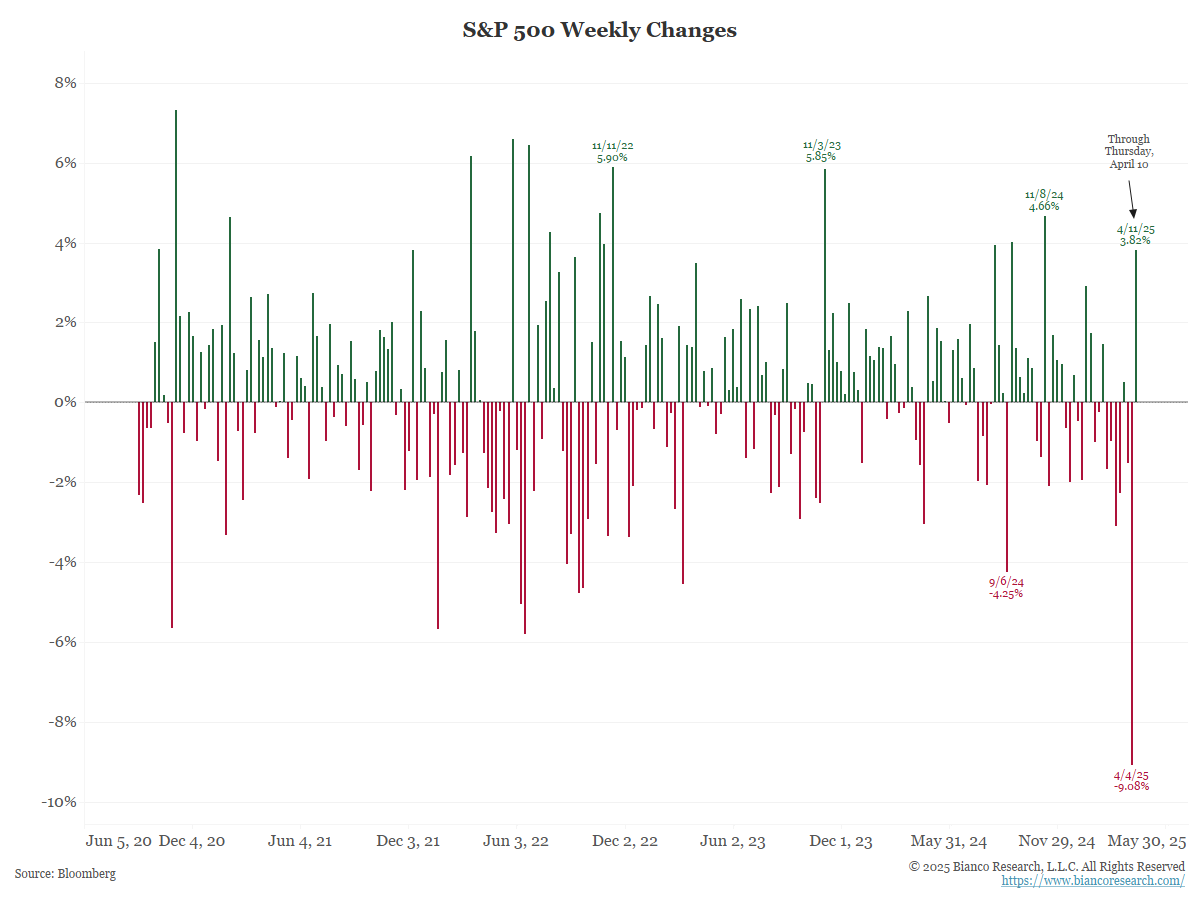

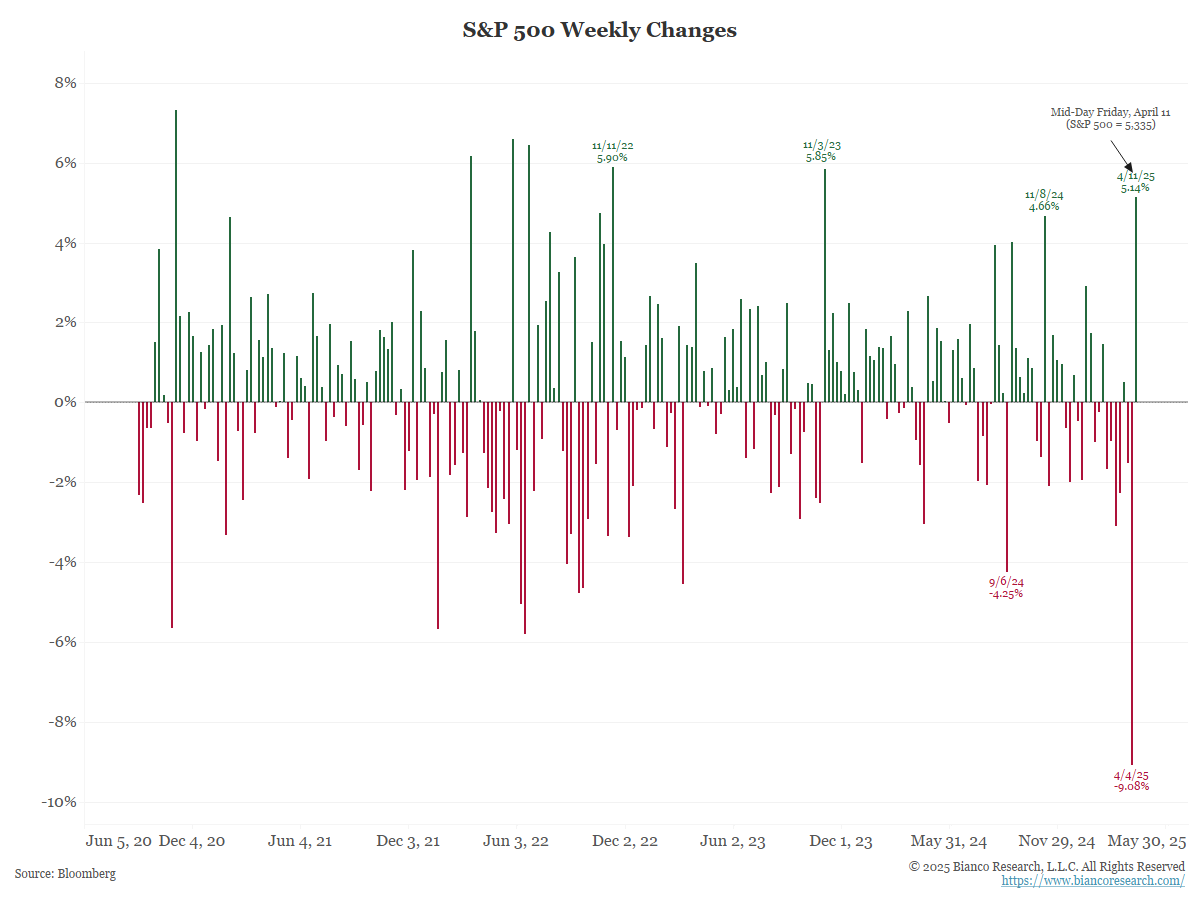

Starting Friday morning, the S&P 500 is up 3.82% for the week. If this holds, this is the best week for stocks since November 8, 2024 (election week).

Raise your hand if you thought this was a good week.

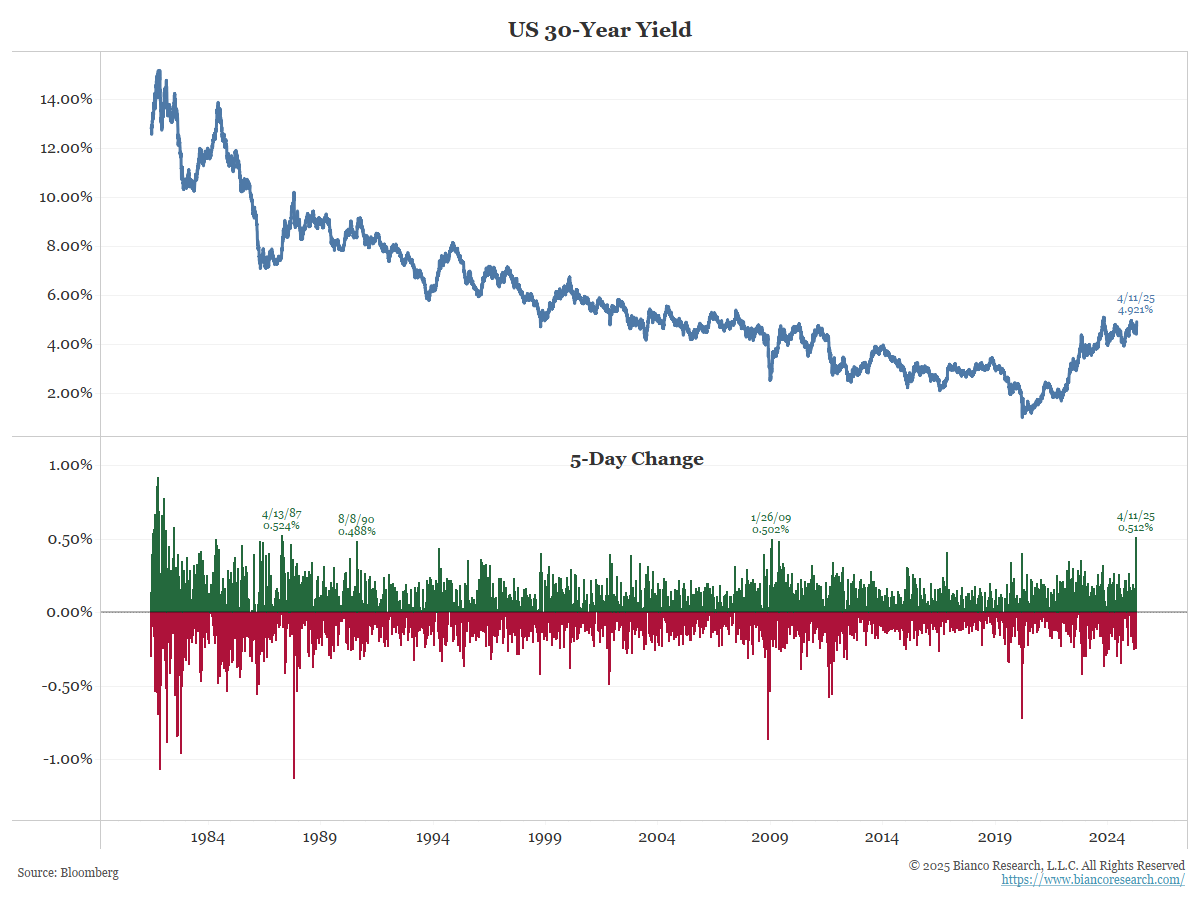

Over the last five days, the 30-year yield has risen 51 bps. This is the largest five-day rise since April 1987, when yields were near 10%.

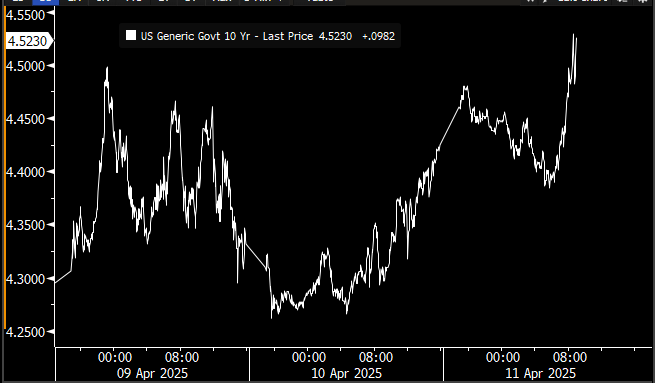

The 10-year continues to get crushed … just trading at 4.54%.

Higher than Tuesday’s peak of 4.51%

*US 10-YEAR YIELD HITS HIGHEST SINCE FEBRUARY AS SELLOFF RESUMES

Where is the selling coming from? Answer Europe

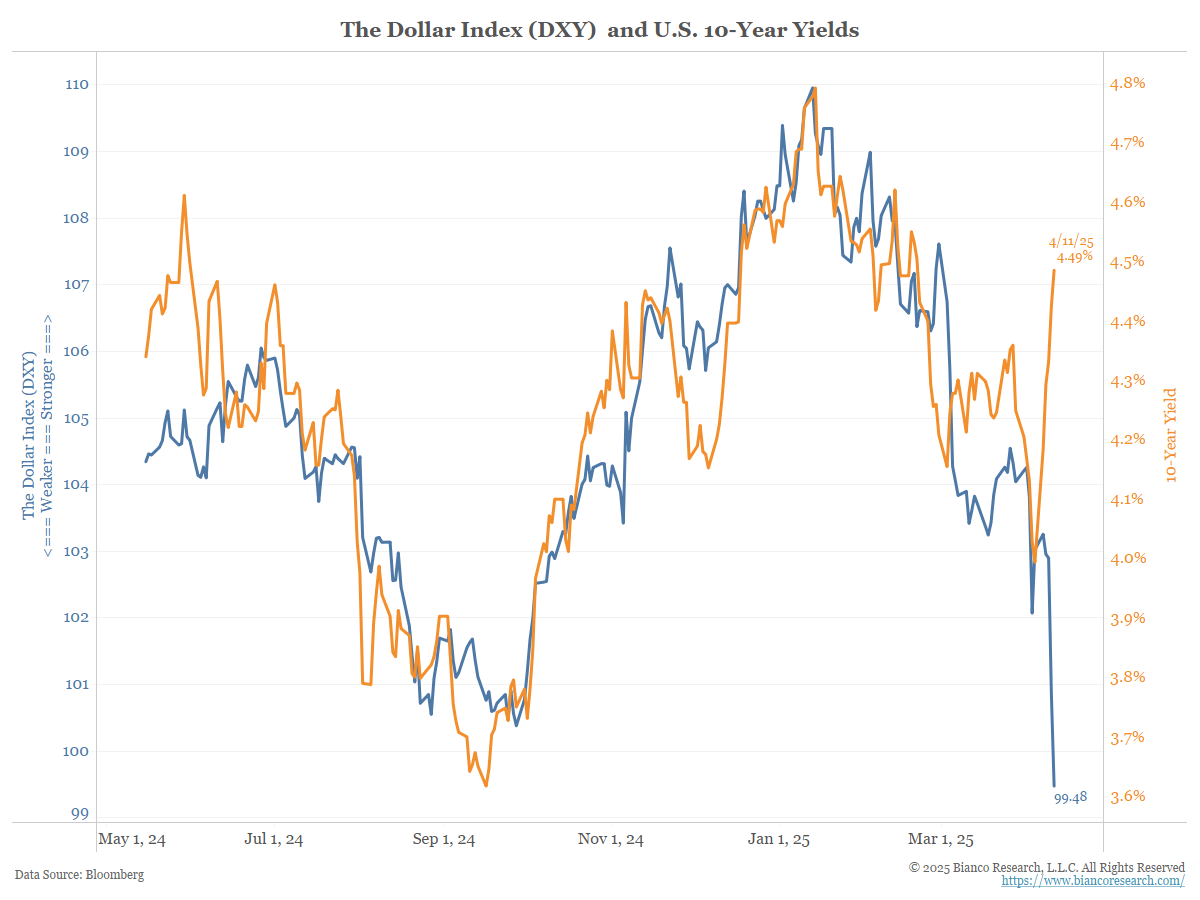

The dollar is going straight down and US yields are going straight up as this chart shows.

Over the last 3 days, US yields are going straight up and European yields are going straight down.

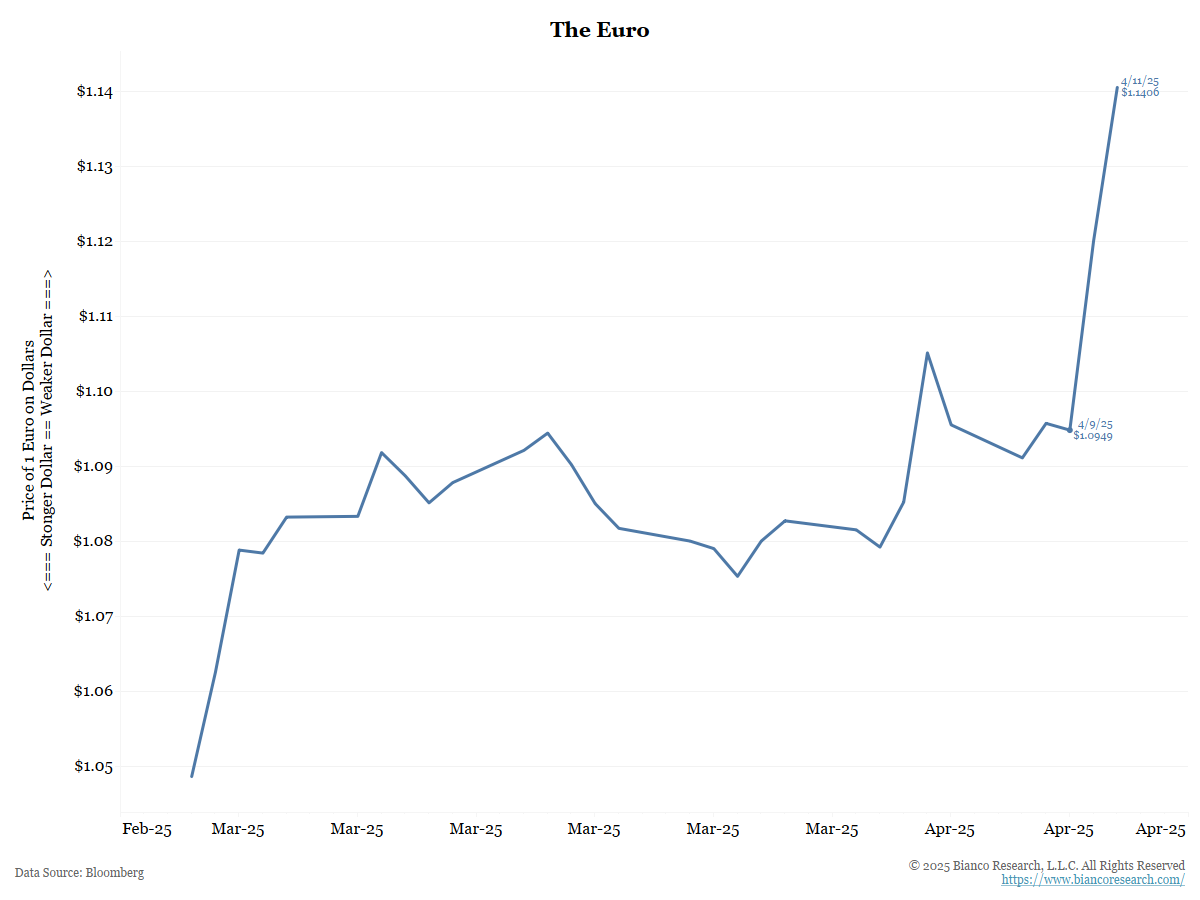

The Euro is going vertical

Which Europeans are selling US Treasuries to buy European Sovereigns? That cannot be determined right now.

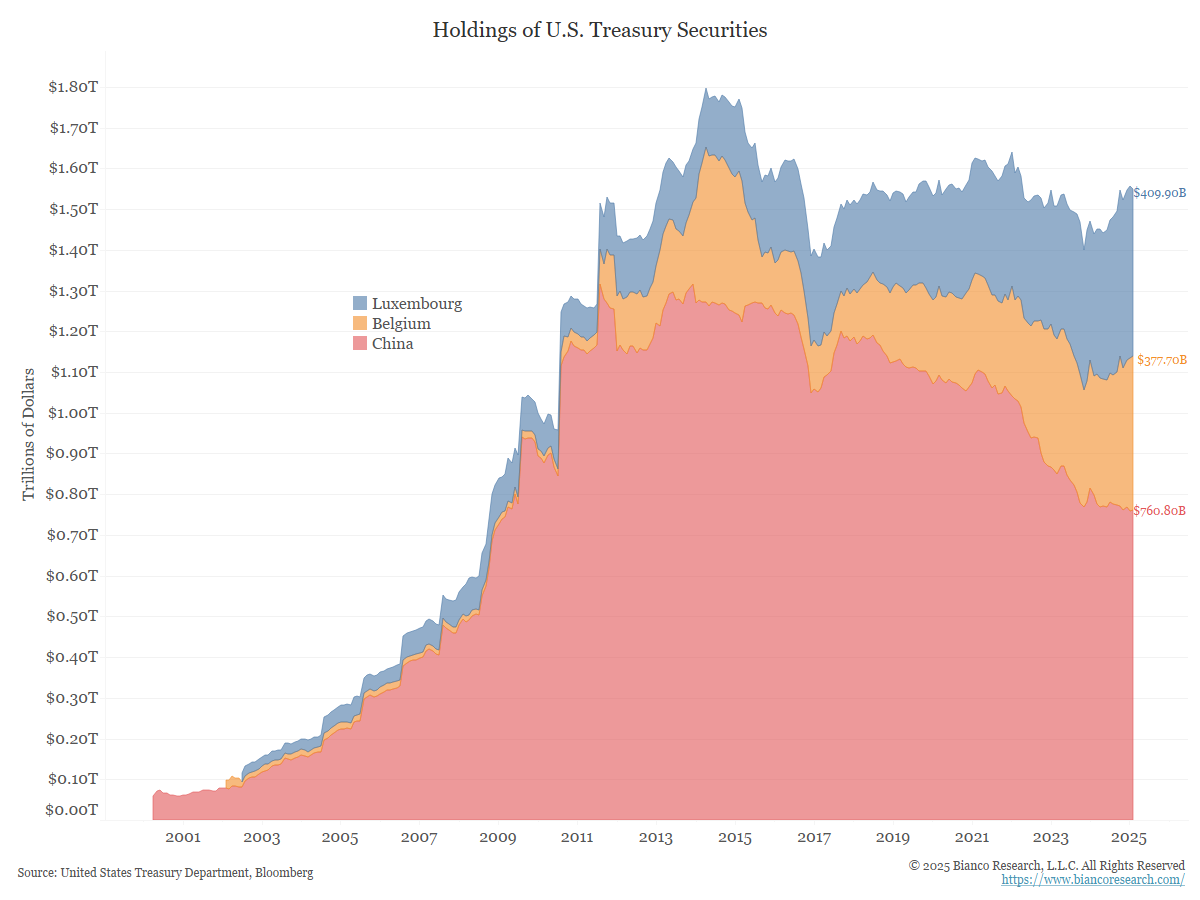

That said, China is thought to hold several hundred billion in US Treasury securities in Belgium and Luxembourg.

Bloomberg: Einhorn Says Tariffs to Force More Fed Cuts This Year

Greenlight Capital’s David Einhorn called tariffs “a regressive tax” that will force the US Federal Reserve to act, as President Donald Trump’s higher-than-expected global tariffs shocked investors and sent markets tumbling.

Jim Bianco:

It’s hard to stop thinking that all that matters is growth and, if necessary, the Fed can cut to zero and print money.

Things have to get A LOT WORSE for this to come into play.

As I like to say, stop thinking this is 2019!

Earlier I wrote …It’s hard to stop thinking that all that matters is growth, and the Fed can cut to zero and print money if necessary.

Things have to get A LOT WORSE for this to come into play. As I like to say, stop thinking this is 2019!

It seems Mr. Dimon is saying exactly this … it is going to get a lot worse. So much worse that all inflation fears will be erased and the Fed can cut and print.

—-

“There will be a kerfuffle in the Treasury markets because of all the rules and regulations,” Dimon said Friday on an earnings call. When that happens, the Fed will step in — but not until “they start to panic a little bit,” he added.

Bloomberg: Dimon Predicts Treasury Market ‘Kerfuffle’ Where Fed Steps In

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said he expects “a kerfuffle” in the US Treasury market that prompts a Federal Reserve intervention.

Jim Bianco: Remember the line, I can stop panicking when the central bank (the Fed) starts to panic.

No panic here.

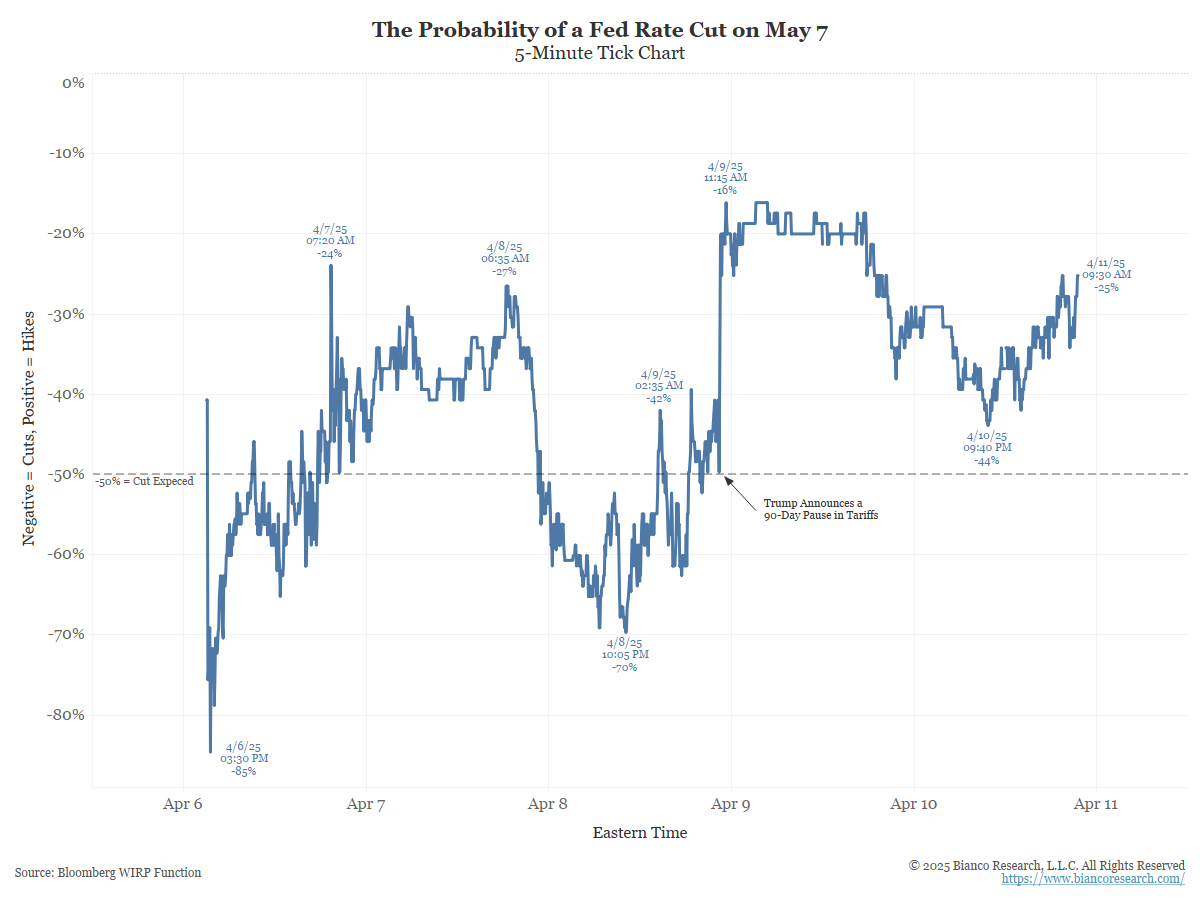

I don’t understand the Wall Street argument that this is bad, so the June probability is 95%.Restated, this isn’t good, and will act IN NINE WEEKS!

Either it is bad or not bad.

Right now the chart above screams it is not bad.

The last six hours of 10-year trading.

Up 2bps from yesterday’s close. Ho-hum, nothing to see here.

Update …. If the S&P 500 closes at 5,335 (the level as I write mid-day Friday), this would be the best week in 18 months. Does it feel this way?

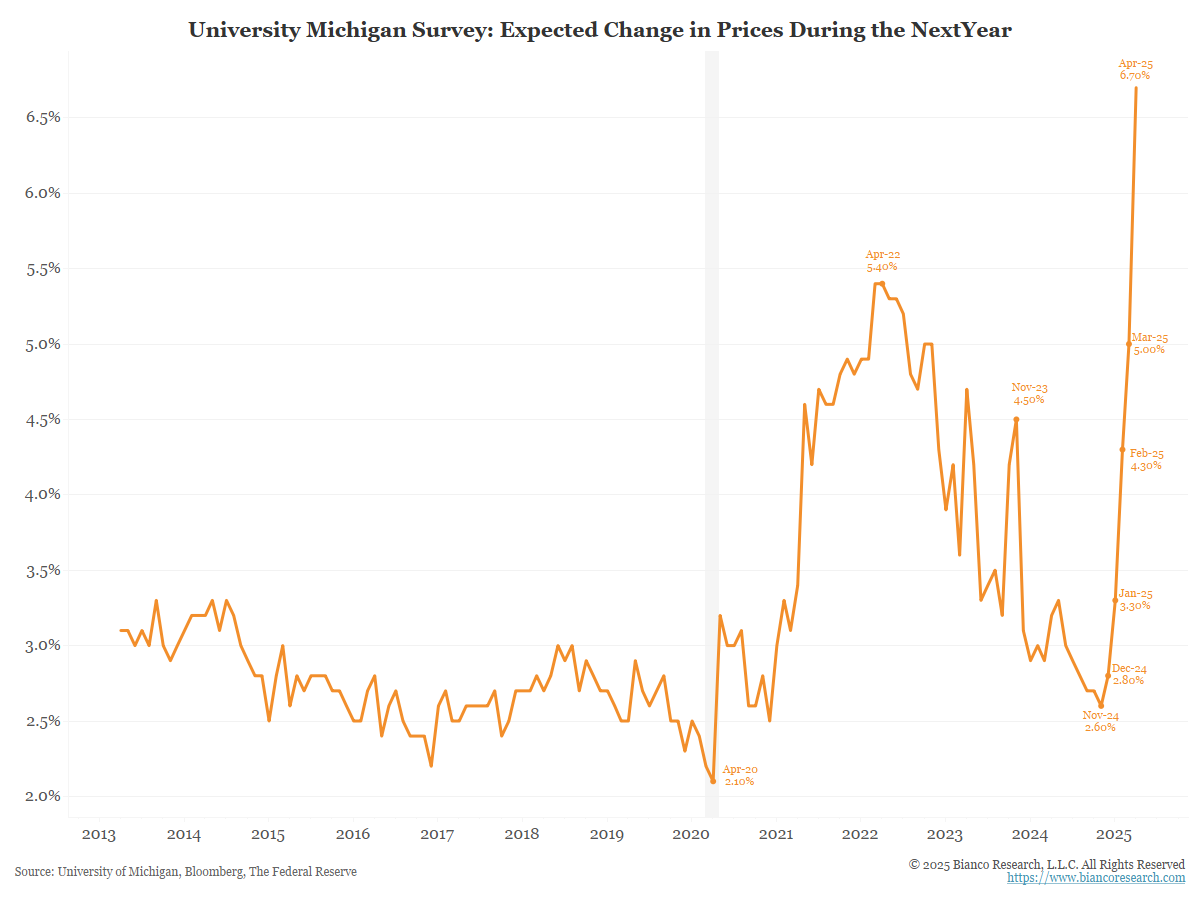

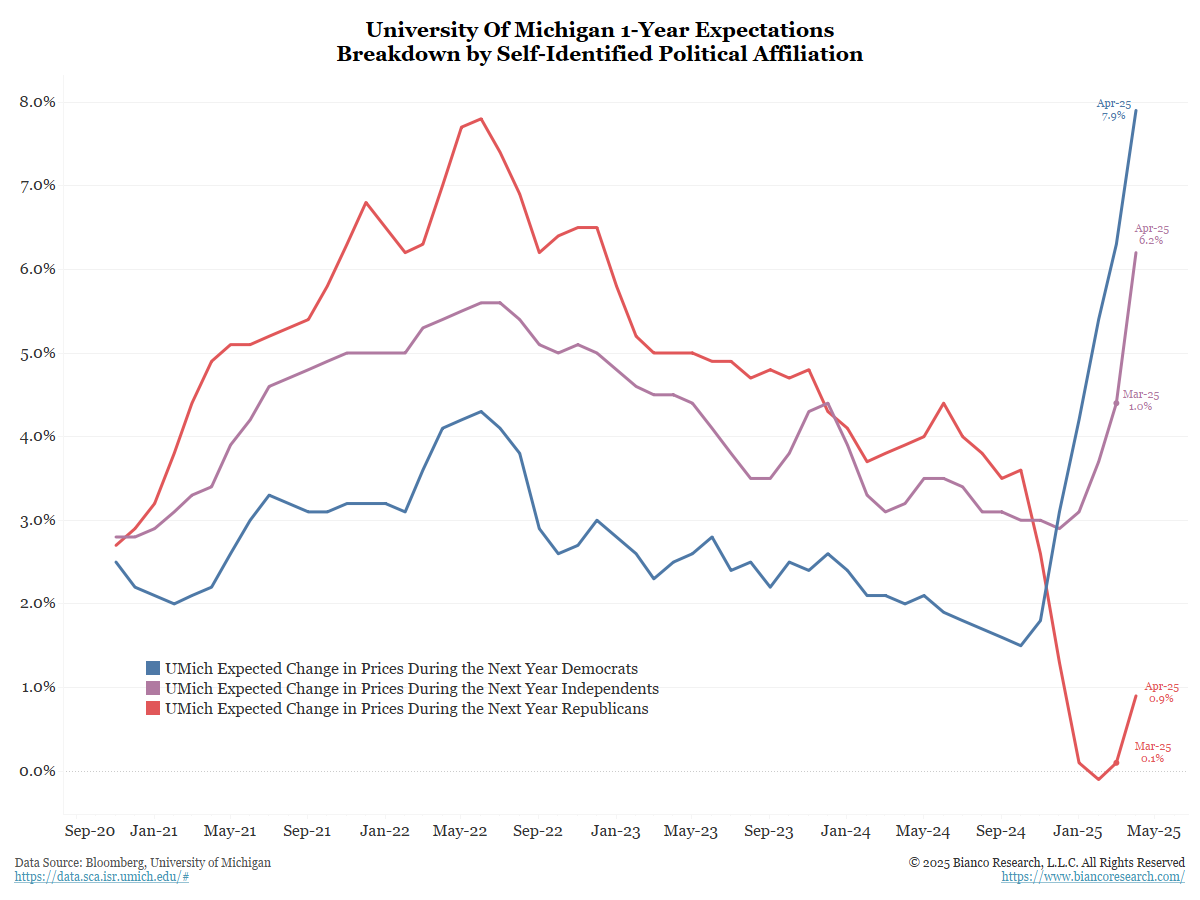

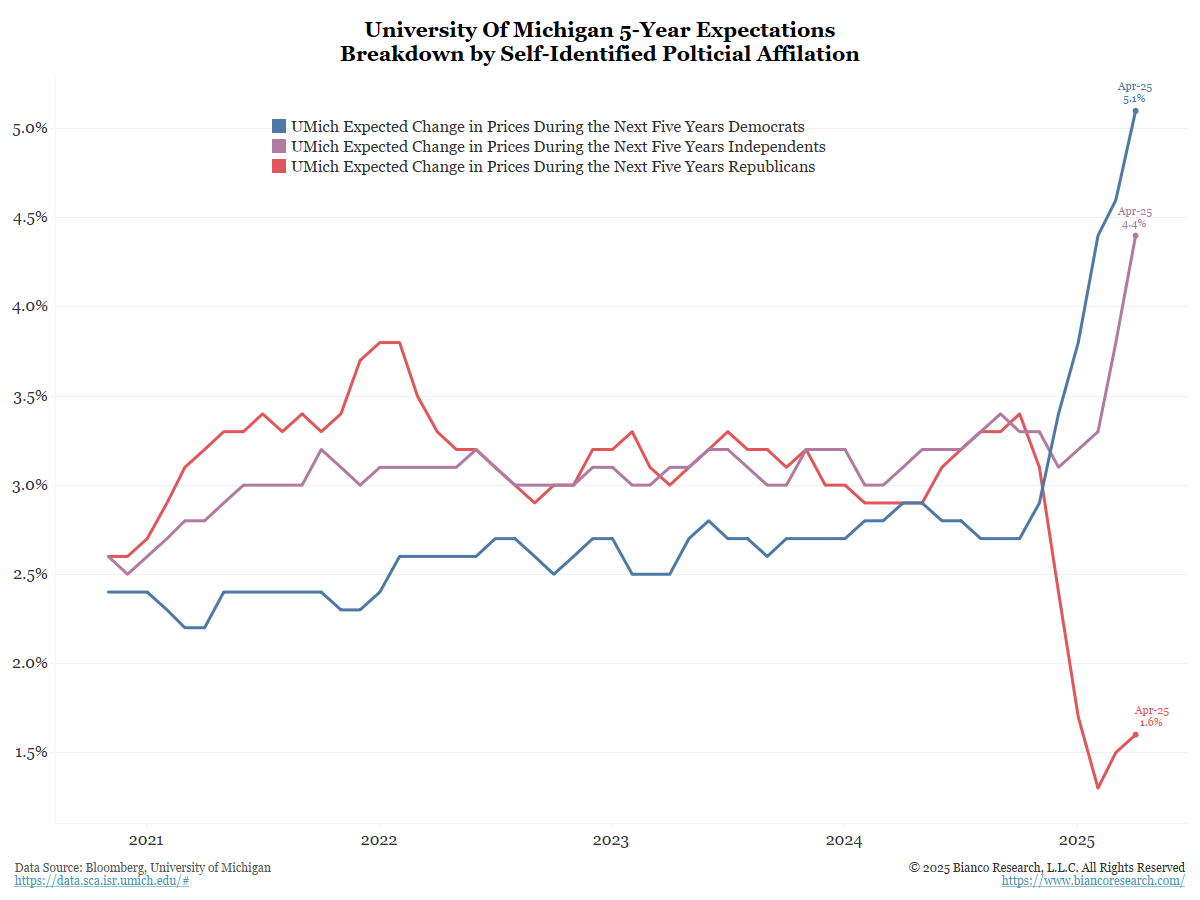

Expectations of big tariff inflation are coming.

What changed was that Republicans (red) and Independents (purple) are expected to support tariff inflation.

Democrats (blue) are expecting Zimbabwe.

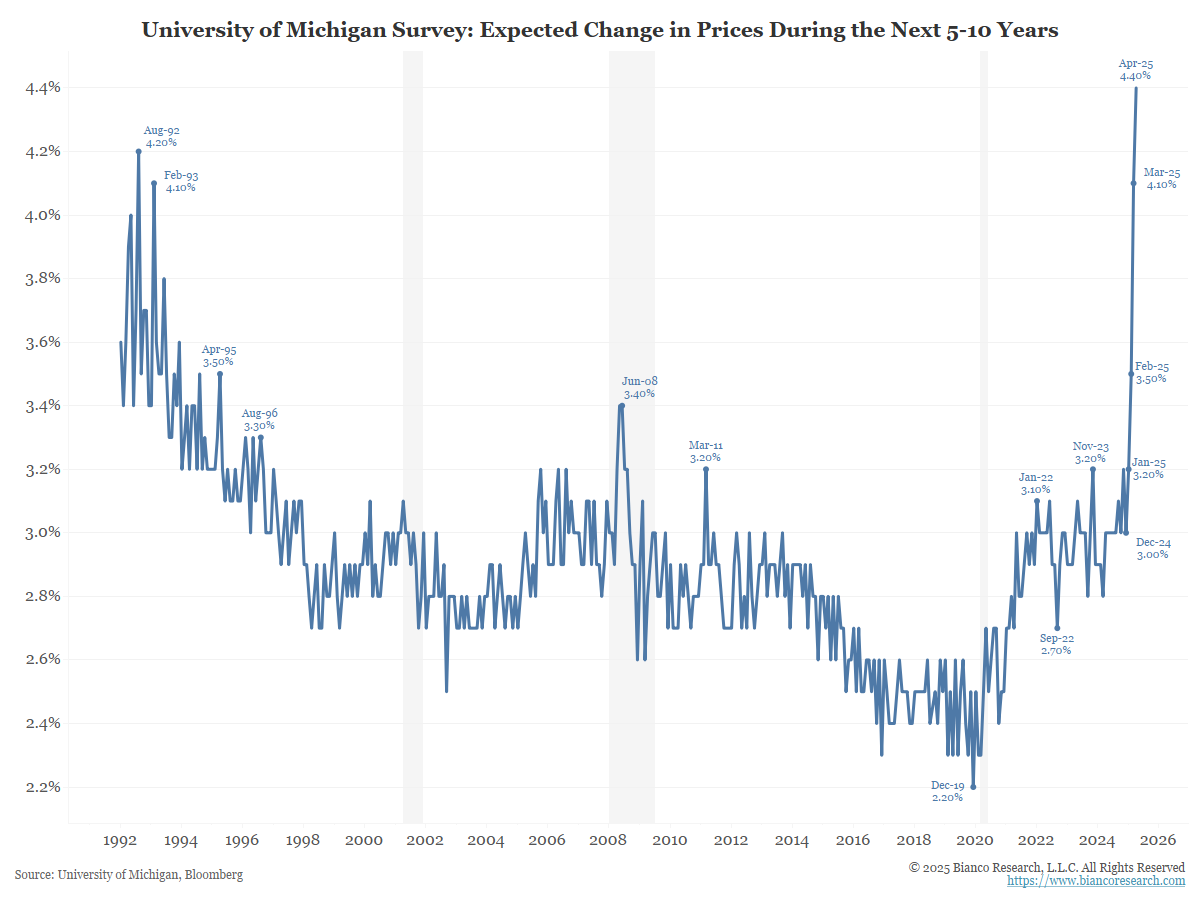

Tariff-inflation is expected to stay for years.

In the News…

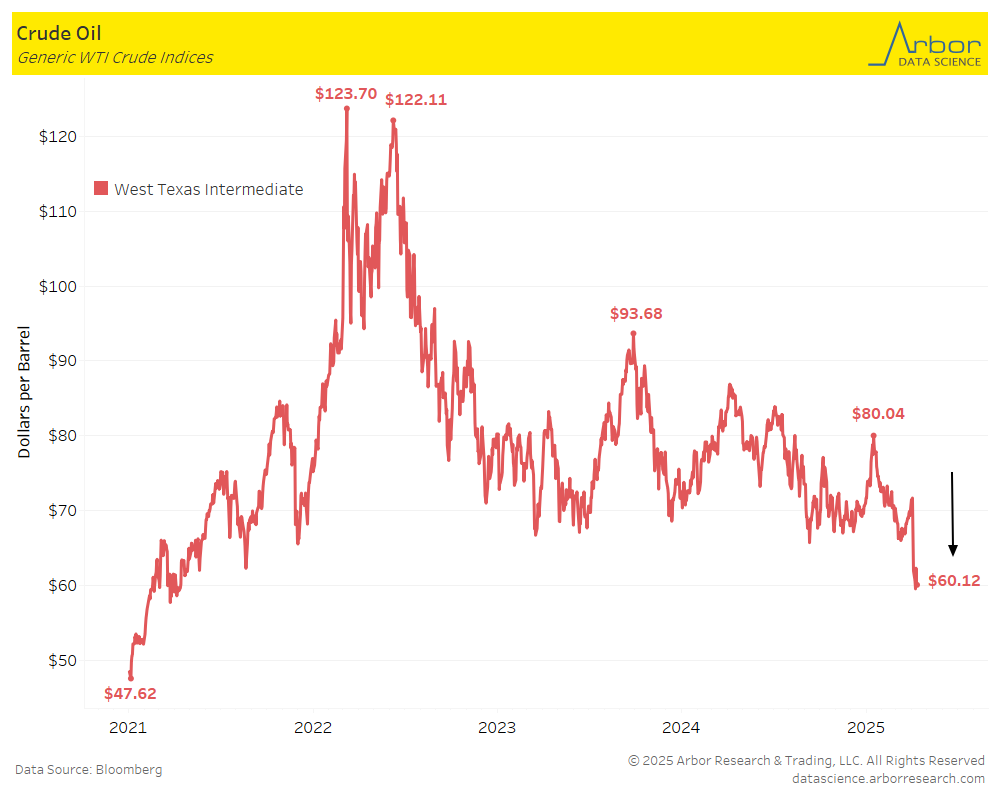

OilPrice: Oil Nations Scramble to Avert Economic Crisis After Prices Crash

The April market rout, which crashed oil prices into the low $60s per barrel, is creating additional fiscal challenges to petrostates and oil-producing countries heavily dependent on oil revenues, on top of any tariff-related hardships.

Bloomberg: $50-a-Barrel Oil Is a Problem for US Trade Deficit

Here’s an economic truth that fossil fuel detractors rarely talk about: The US oil industry has done more to reduce its country’s trade deficit than any other.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 4/14/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 4/14/2025 at 06:00pm EST: Fed’s Harker Speaks on Role of Fed

- 4/14/2025 at 07:40am EST: Fed’s Bostic Speaks in Fireside Chat on Policy

- 4/15/2025 at 08:30am EST: Empire Manufacturing

- 4/15/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum & Import Price Index YoY

- 4/15/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY

- 4/16/2025 at 07:00am EST: MBA Mortgage Applications

- 4/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 4/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas

- 4/16/2025 at 08:30am EST: Retail Sales Control Group & New York Fed Services Business Activity

- 4/16/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 4/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 4/16/2025 at 12:00pm EST: Fed’s Hammack Speaks in Moderated Q&A

- 4/16/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 4/16/2025 at 04:00pm EST: Fed’s Schmid Chats with Fed’s Logan on Economy, Banking

- 4/17/2025 at 08:30am EST: Housing Starts /Housing Starts MoM; Building Permits / Building Permits MoM

- 4/17/2025 at 08:30am EST: Initial Jobless Claims

- 4/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 4/17/2025 at 08:30am EST: Initial Claims 4-Wk Moving Avg

- 4/17/2025 at 08:30am EST: Continuing Claims

- 4/17/2025 at 11:45am EST: Fed’s Barr Speaks in Fireside Chat

- 4/18/2025 at 11:00am EST: Fed’s Daly Speaks in Moderated Conversation