US Treasuries

- Monday’s range for UST 10y: 4.36% – 4.48%, closing at 4.36%

- Fed’s Waller: says if threat of recession, he would favor rate cuts sooner; if small tariff inflation effect, could cut later this year

Bloomberg: Credit Market Rout Has Ways to Go Before Fed Steps In, UBS says

Credit spreads have widened significantly this month but they remain far from levels that would compel the Federal Reserve to step in, according to UBS.

Bloomberg: Bond Market’s Steepener Bet Gets Turbocharged Amid Tariff Mayhem

A go-to wager in the Treasury market is seeing one of its best runs ever as investors flee long-term US bonds amid President Donald Trump’s escalating trade war.

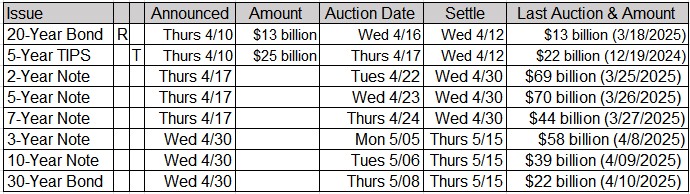

Upcoming US Treasury Supply

Bloomberg: Kashkari Says All the Fed Can Do Is Keep Inflation Anchored

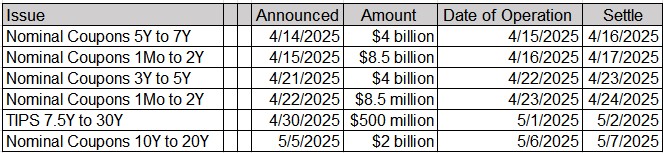

Jim Bianco:

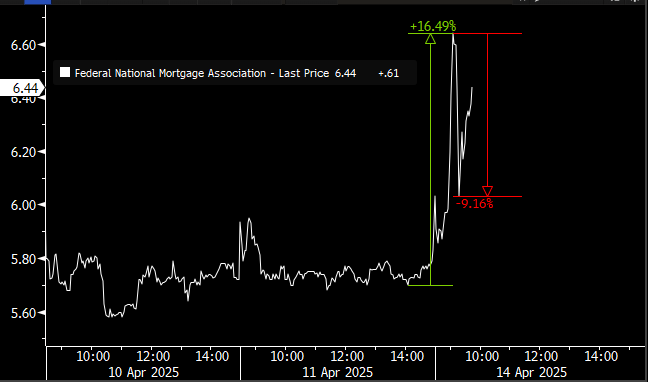

*FANNIE MAE, FREDDIE MAC QUICKLY GAIN, UP 9%

Bill Pulte is the director of the Federal Housing Finance Administration (FHFA). This is the regulator that was set up for Fanny Mae and Freddie Mac.

Fannie Mae and Freddie Mac are publicly traded companies, but also government agencies that are in conservatorship. This happened in 2008 during the financial crisis.

It has been an unworkable situation for the last 17 years. This tweet is leading to people to believe that a plan to allow them to be privatized this coming.

Bill Pulte is the grandson of William Pulte, the founder of Pulte homes, the largest home builder in the country.

He took over as the head of the FHFA on March 18. So barely a month ago.

Now here’s the dark side of the story.

Ever since Fannie Mae and Freddie Mac went into conservatorship, and remained as a public company, their stock price has been horribly depressed. Think of it as a company run by the government.

For the last 15 years, hedge fund managers, and in particular Bill Ackman, have been acquiring Fannie Mae and Freddie Mac shares and spreading money around Washington to try and get them to privatize. When this happens, the stock should soar.

I’ve argued that Fannie Mae and Freddie Mac getting privatized is a good measure of corruption in Washington.

We’re about to find out the details of it.

Fannie Mae’s stock today:

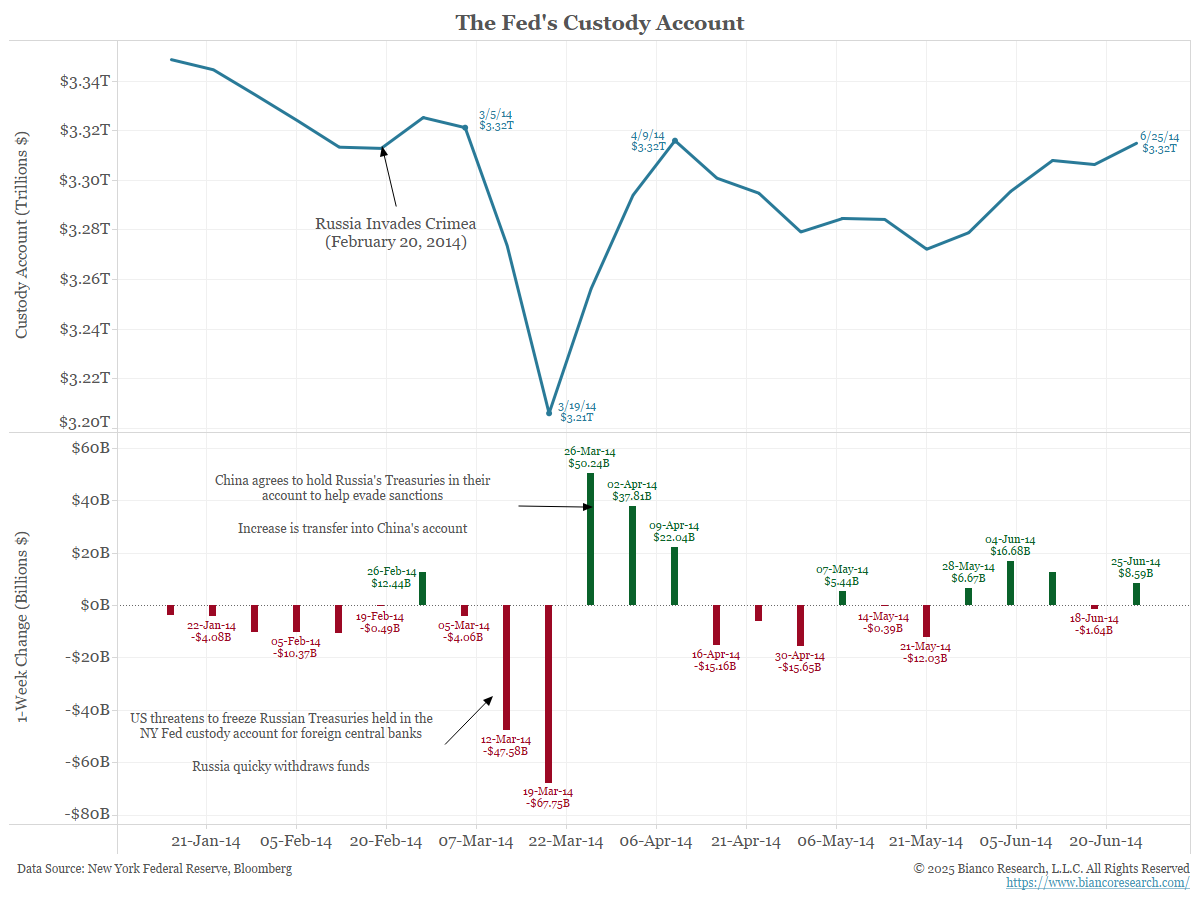

In 2014, Russian-owned Treasuries held in custody at the NY Fed were the ONLY topic of discussion regarding sanctioning or freezing for securities. As pointed out in our post, they were never frozen. Russia yanked them out before the US made a decision on sanctions and parked them back in the account as Chinese.

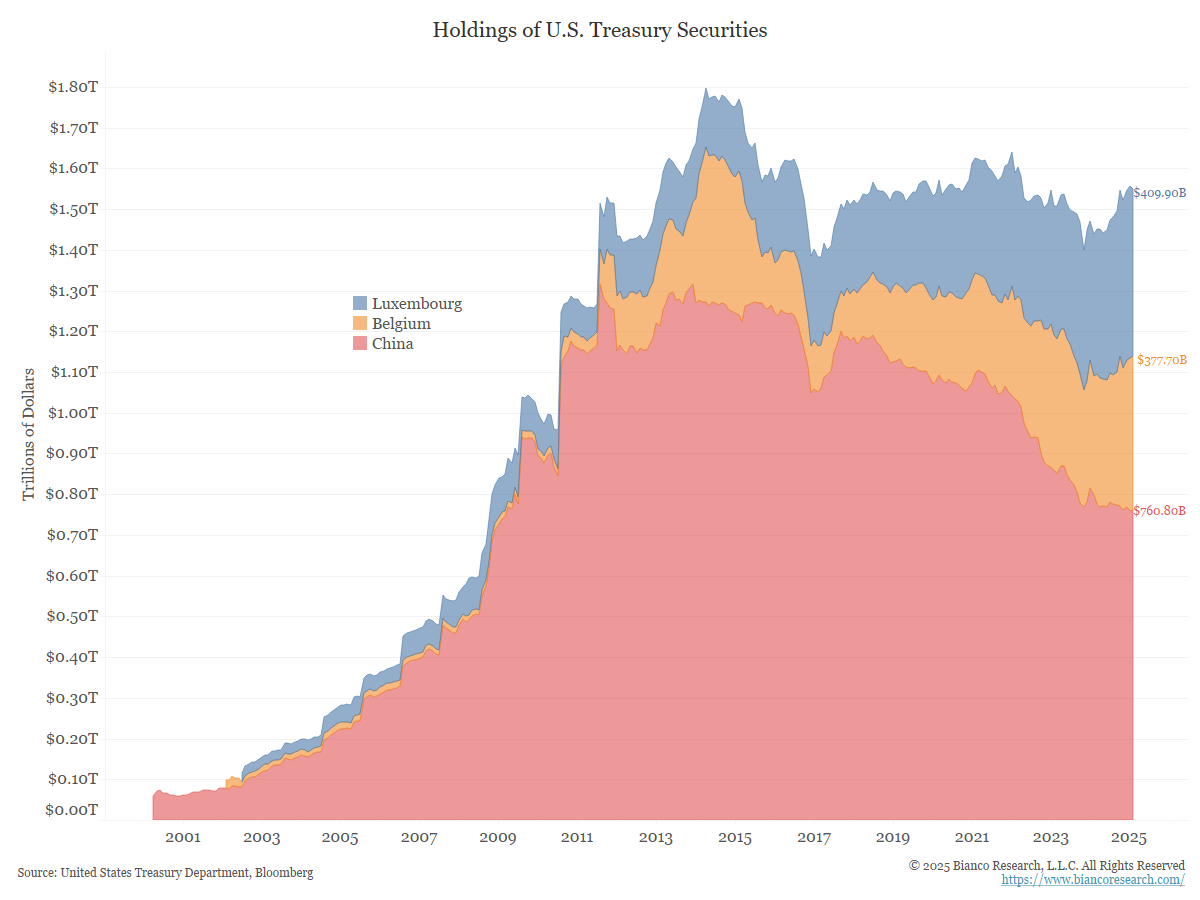

Here is the annotated chart:

This event showed Russia and China that they must diversify their holdings from places the U.S. can sanction. This helps explain why Belgium (home of Euroclear) and Luxembourg (home of Clearstream) saw growth in their Treasury holdings around 2014. These holdings are considered outside of U.S. reach.

Unfortunately, April TIC data will not detail official foreign flows in Treasuries until mid-June. There are many reasons U.S. yields are rising while European yields are falling, but it is possible Chinese flows may be contributing to this.

China is thought to hold hundreds of billions of U.S. Treasuries in Belgium (orange) and Luxembourg (blue).Not all of Belgium’s or Luxembourg’s holdings are Chinese, but these countries’ holdings are generally considered outsized relative to the size of their respective economies.

Conclusion: The larger point was that the selling came from Europe. Treasury yields were up, European Sovereign yields were down, and the Euro soared against the Dollar.

This is classic action if a large seller is moving out of the US and into Europe. Given all the talk that China was selling, I was trying to explain why so many of their holdings are in Europe.

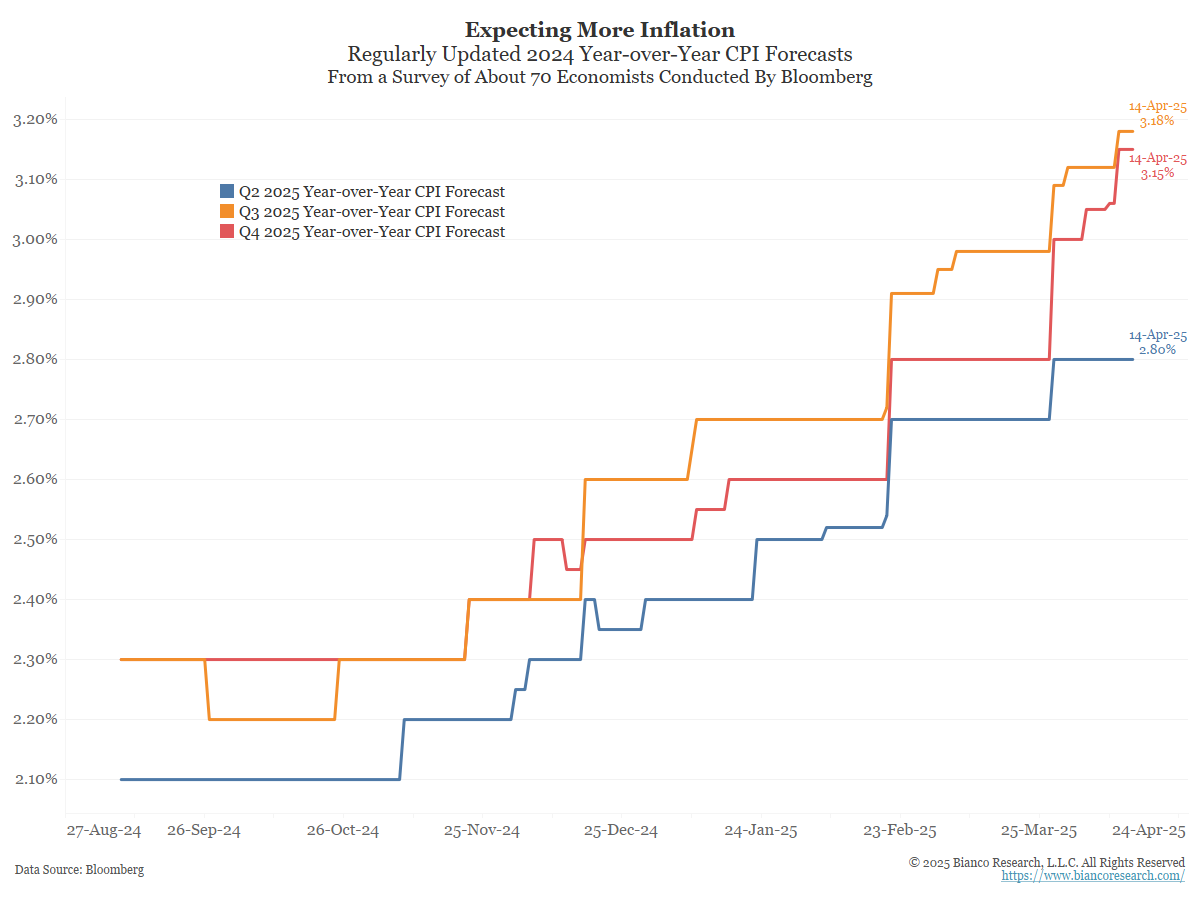

From Bloomberg’s regularly updated survey of about 70 economists.

They are expecting tariff driven inflation.

In the News…

OilPrice: Oil Outlook Takes a Beating from Trade War Jitters

Crude oil is set to end another week with substantial losses as markets reel from President Trump’s tariff offensive, despite the fact he pulled the punch at the last second. With one notable exception: China. As Beijing and Washington take turns to up the ante, the outlook for oil and energy in general has gone from bright to really dim.

OilPrice: China’s Oil Imports Hit 20-Month High as Iran and Russia Flows Rebound

Chinese crude oil imports topped 12 million barrels per day (bpd) in March, the highest volume since August 2023, as flows of Iranian and Russian crude rebounded from the lows seen early this year with the U.S. sanctions.

Axios: Why U.S. oil production could even go into reverse

The prospect of U.S. oil production growth not just stalling but going into reverse is edging into the picture.

FastCompany: Housing market affordability is so stretched that home turnover hits a 40-year low

U.S. existing-home sales totaled just 4.06 million in 2024—the lowest annual level since 1995, according to the National Association of Realtors. That’s far below the 5.3 million in pre-pandemic 2019.

Arbor Data Science:

Investment News: The ‘magic number’ for retirement is down to $1.3M, but Americans are still concerned

Northwestern Mutual’s latest research finds more than half see a likelihood that they’ll outlive their nest egg, with Gen X and Millennials feeling most at risk.

PCMag: Thanks to AI, Data Centers Will Drive Half of Electricity Demand Growth in the US

Fueled by the rise of AI, data centers will account for nearly half of electricity demand growth in the US between now and 2030, according to a new report from the International Energy Agency.

Upcoming Economic Releases & Fed Speak

- 4/15/2025 at 08:30am EST: Empire Manufacturing

- 4/15/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum & Import Price Index YoY

- 4/15/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY

- 4/16/2025 at 07:00am EST: MBA Mortgage Applications

- 4/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 4/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas

- 4/16/2025 at 08:30am EST: Retail Sales Control Group & New York Fed Services Business Activity

- 4/16/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 4/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 4/16/2025 at 12:00pm EST: Fed’s Hammack Speaks in Moderated Q&A

- 4/16/2025 at 01:30pm EST: Fed’s Powell Speaks on Economic Club of Chicago

- 4/16/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 4/16/2025 at 04:00pm EST: Fed’s Schmid Chats with Fed’s Logan on Economy, Banking

- 4/17/2025 at 08:30am EST: Housing Starts /Housing Starts MoM; Building Permits / Building Permits MoM

- 4/17/2025 at 08:30am EST: Initial Jobless Claims

- 4/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 4/17/2025 at 08:30am EST: Initial Claims 4-Wk Moving Avg

- 4/17/2025 at 08:30am EST: Continuing Claims

- 4/17/2025 at 11:45am EST: Fed’s Barr Speaks in Fireside Chat

- 4/18/2025 at 11:00am EST: Fed’s Daly Speaks in Moderated Conversation

- 4/21/2025 at 10:00am EST: Leading Index