Bloomberg: Treasury Explores Whether to Ease Capital

Deputy Treasury Secretary Michael Faulkender said that officials are discussing the supplementary leverage ratio’s application to the $29 trillion Treasuries market, amid calls by market participants to revamp a regulation seen as constricting trading.

Bloomberg: Bessent Says Treasury Has Big Toolkit If Needed for Bonds

Treasury Secretary Scott Bessent played down the recent selloff in the bond market, rejecting speculation that foreign nations were dumping their holdings of US Treasuries, while flagging that his department has tools to address dislocation if needed.

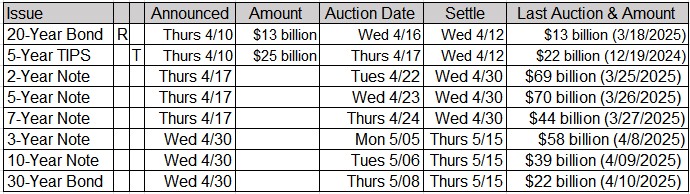

Upcoming US Treasury Supply

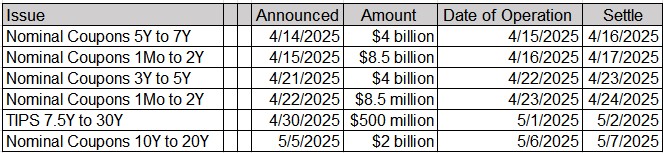

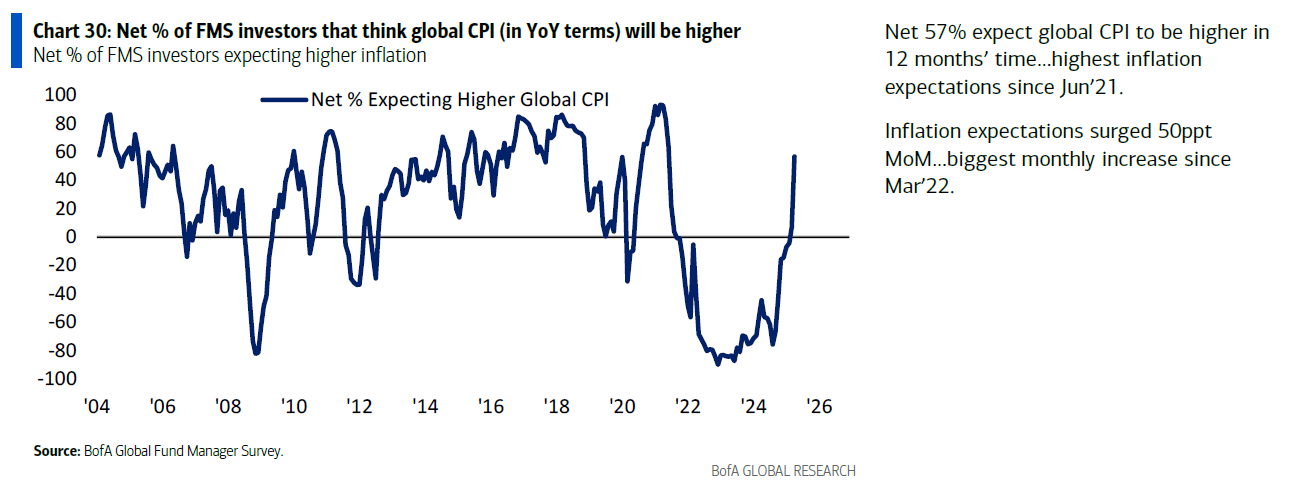

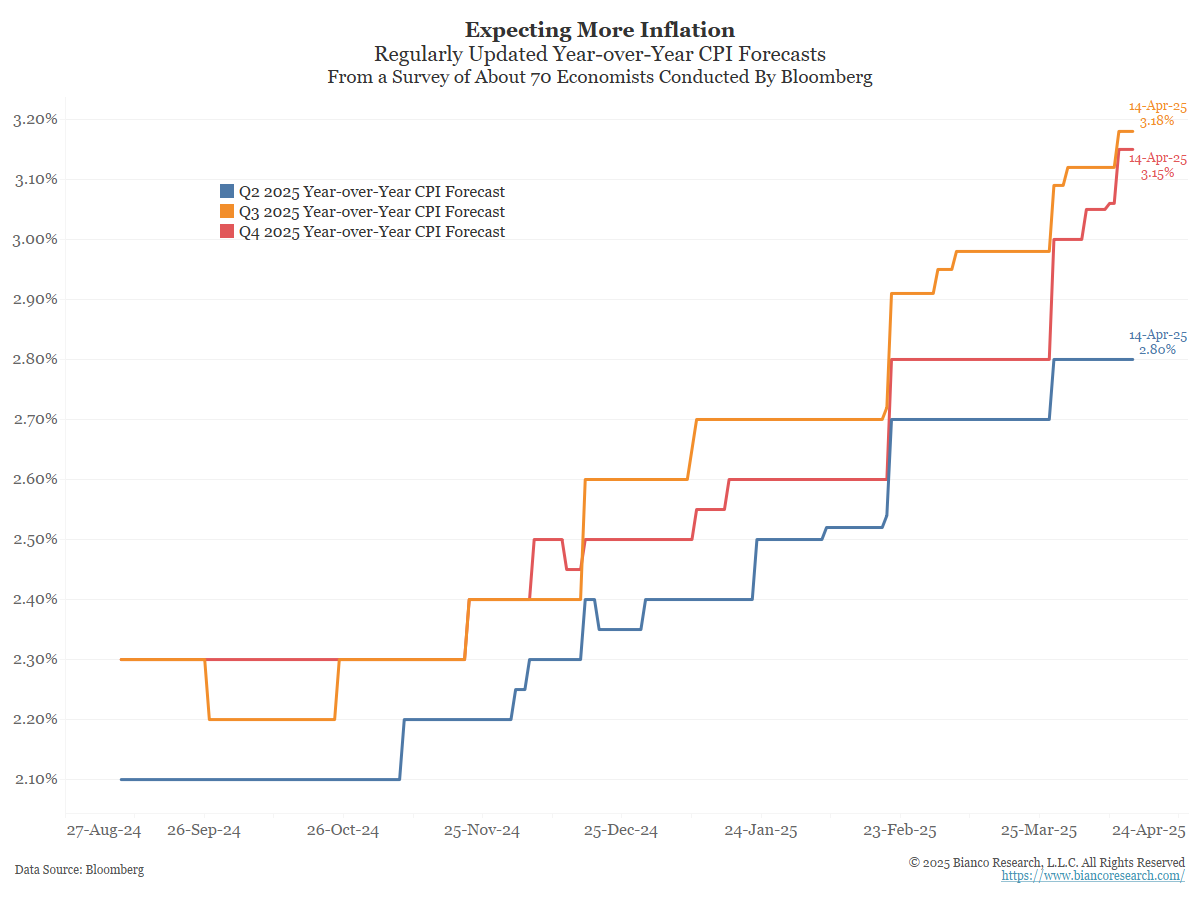

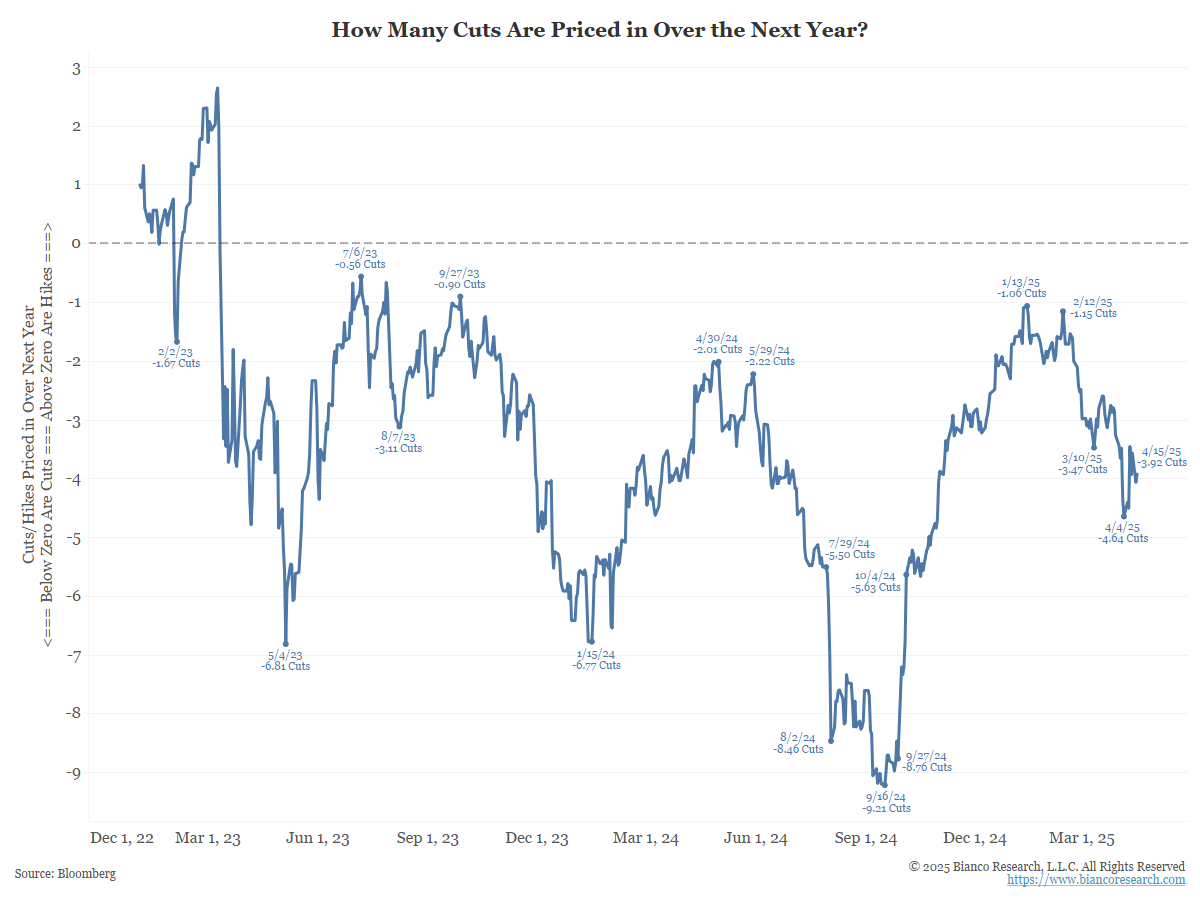

Jim Bianco: Yes, more than ever. See the BofA chart. This would normally get them to inter-meeting cut before May 7. They are not even thinking about that; the probability of a May cut is 20%. Why? Inflation expectations are going up. This will get WORSE by JUNE/JULY, not better.

If inflation collapses by June, it is because Trump totally capitulated on all tariffs, and stocks would be soaring back to the old high. And no, we are not on the verge of an epic collapse in the economy.

Colleague: Why do you think the Fed Funds Futures market is pricing in a cut for June?

Jim Bianco: That is the bias in the market. It wants cuts. You can see it in this chart. This is not very accurate.

- See September 16, 2024 = 9 rate cuts. Got four by Dec and pause.

- See January 15, 2024, expecting 7, did not get the first rate cut until September

- May 2024, expecting 2, got 4

See the spring of 2023 when it was pricing in cuts. The Fed HIKED in July 2023 (last one).

Yesterday: Bessent: Eyeing Sometime in Fall for Discussing Next Fed Chair

—

Powell’s term ends in May 2026. Trump will not reappoint him (that is clear).

Will Trump fire him? This is very messy (and unknown legally).

The alternative, proposed last year by Scott Bessent, was to create a “shadow Fed Chairman.”

That is, appoint Powell’s replacement months earlier. Then, let the nominee regularly go on financial TV (BB, CNBC, FBN, etc.) and “armchair QB” and critique every Powell speech and decision, thereby undermining his authority.

Should we listen to the guy leaving next May (Powell) or the person who will be Fed Chair next May?

Sounds like the Shadow Fed Chair is coming this fall.

- The Bond Market

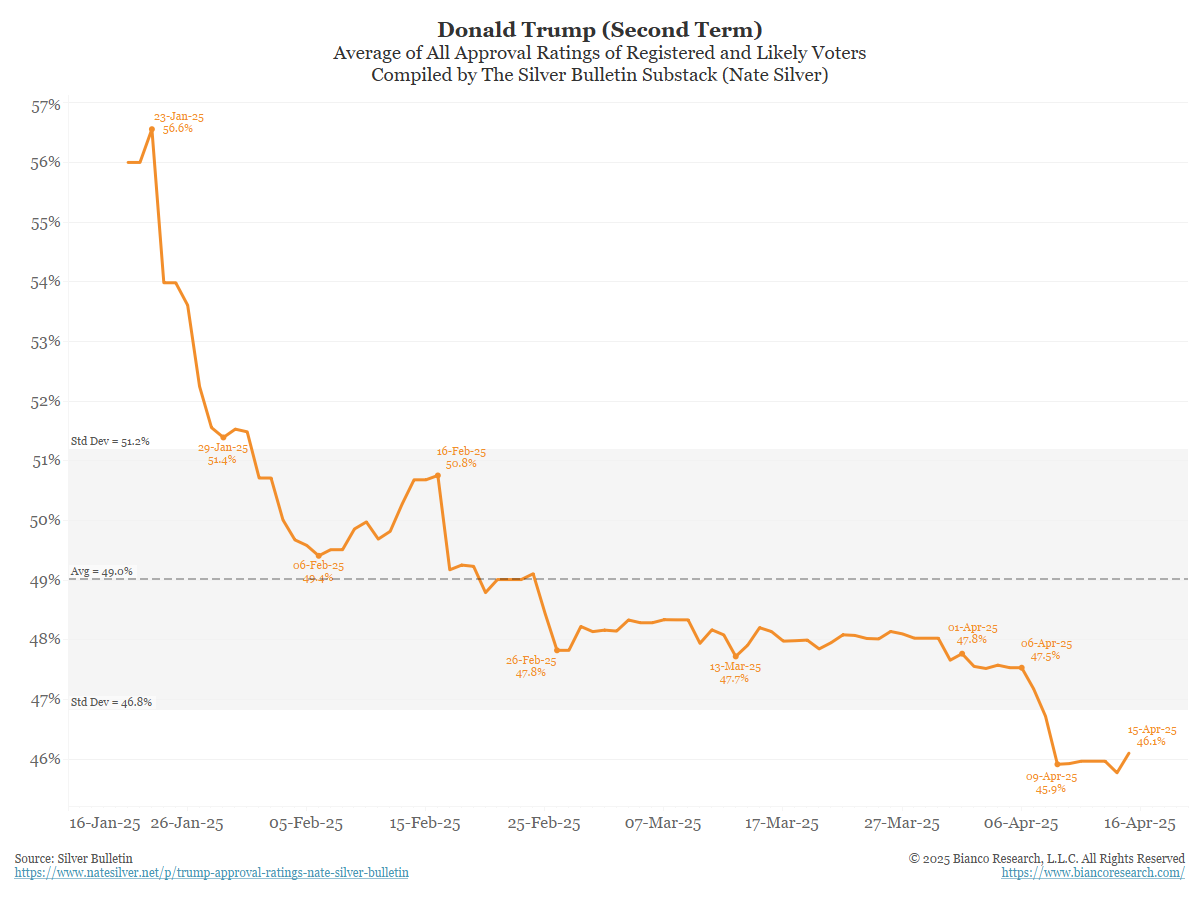

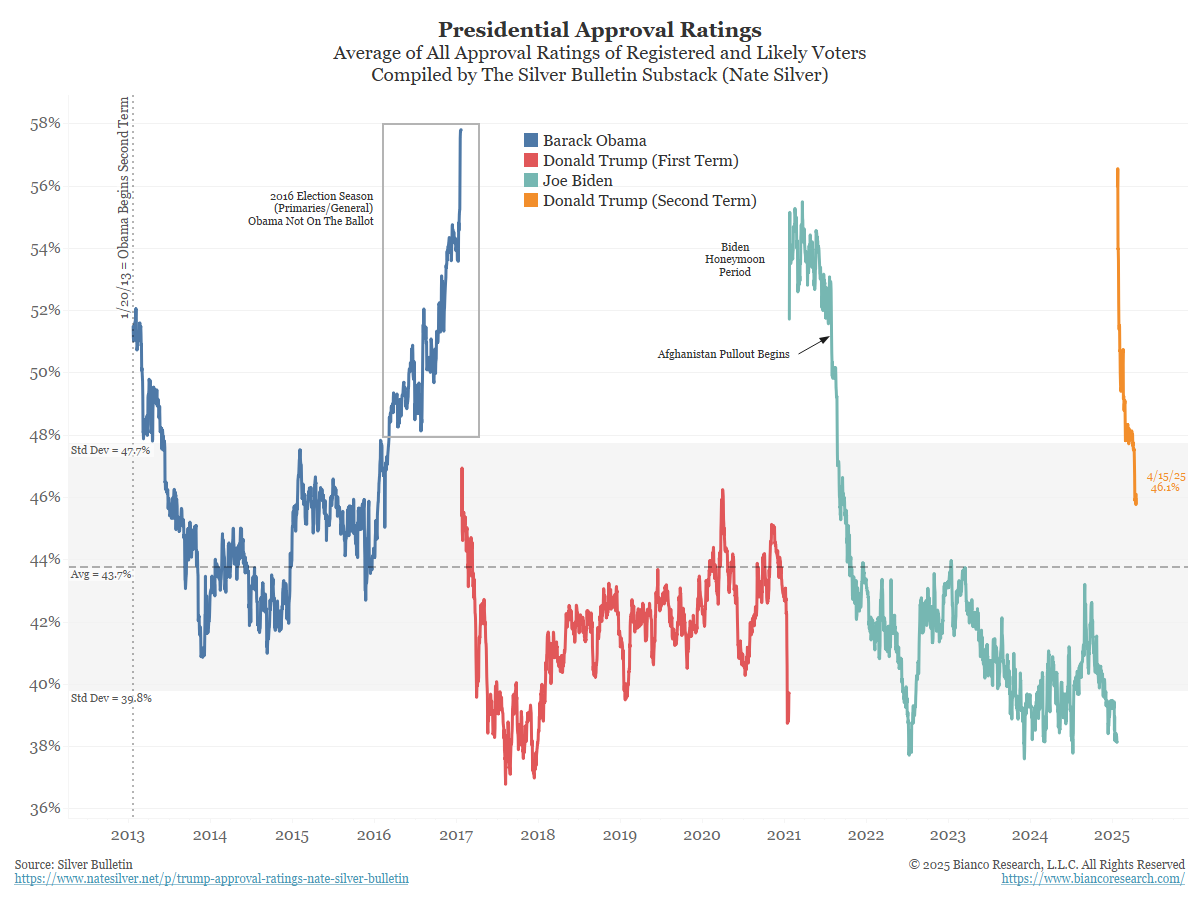

- Approval Rating

- The Stock Market

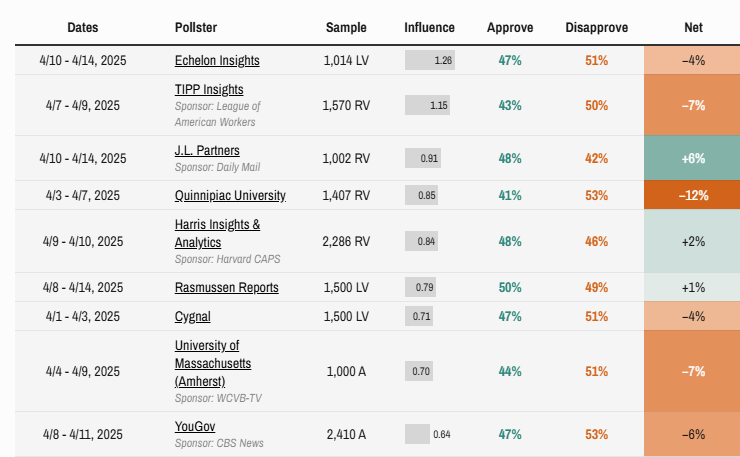

Here are all the polls STARTED since Liberation Day (April 2)

How significant is this decline? Here are the last 13 years of approval rating (since the start of Obama’s second term on January 20, 2013).

Trump’s latest average at 46.1% is above the 13-year average of 43.7%. and it is one of the highest approval ratings if this was Trump 1.0.

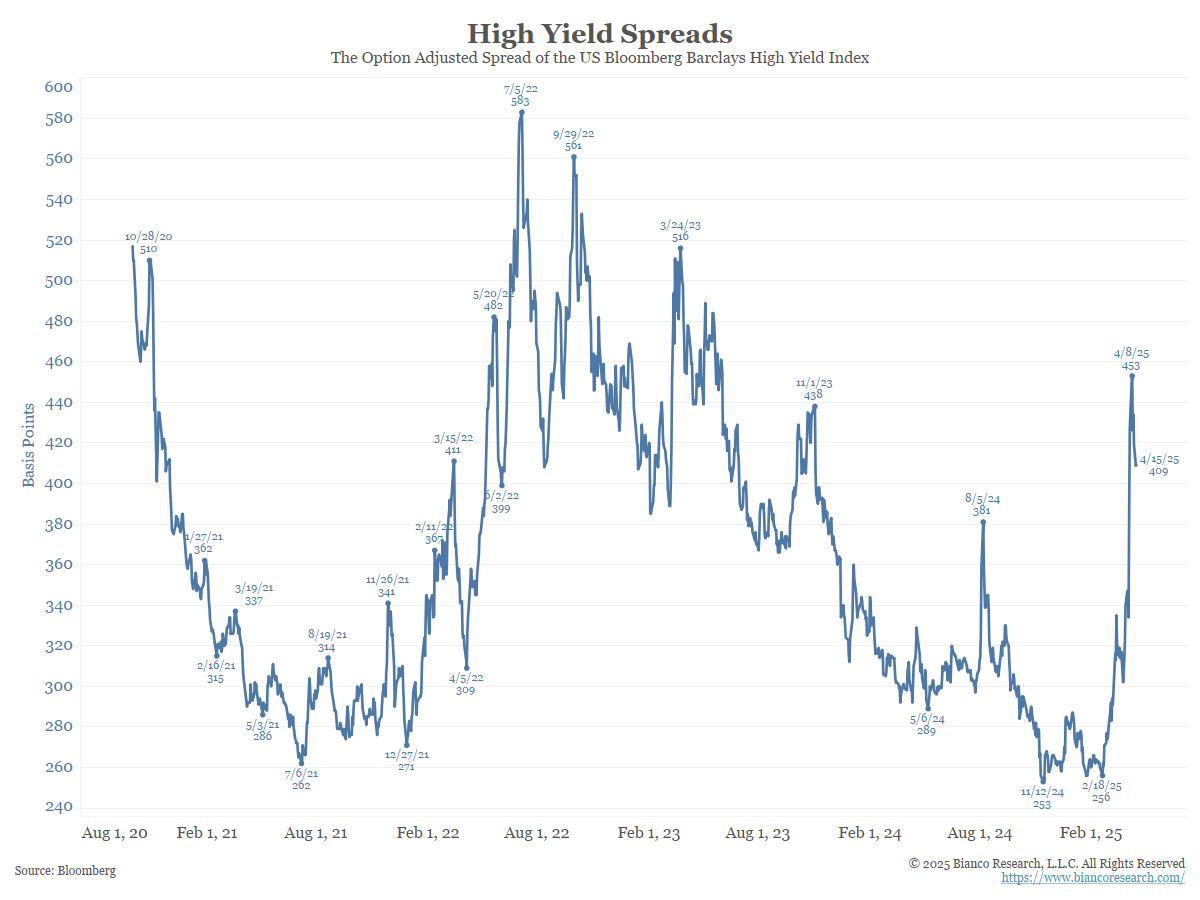

*US JUNK BOND MARKET REOPENS WITH FIRST DEAL IN NEARLY TWO WEEKS

So what happened in the two weeks that did not see any new HY issuance?

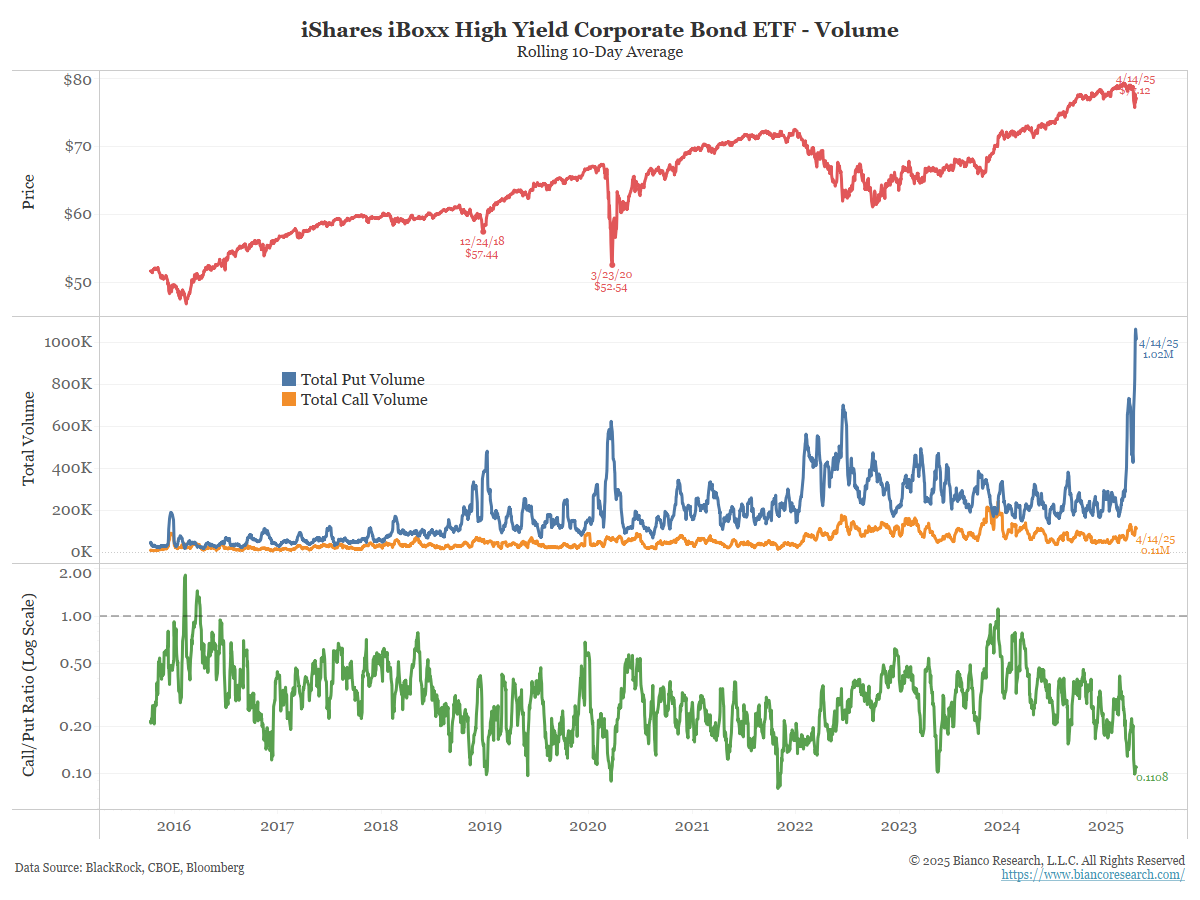

This chart shows the ETF HYG options activity, as a rolling 10-day average (since there has been no issuance over the last two weeks). See the blue line and how the buying went vertical.

This is most likely dealers and issuers, fearing even lower prices (higher yields), attempting to protect themselves from even lower prices.

See the green line, the call/put ratio. Over the last 10 days, it was just 0.11 (11 calls traded for every 100 puts traded), one of the most extreme readings in the last 10 years.

So what is the problem?

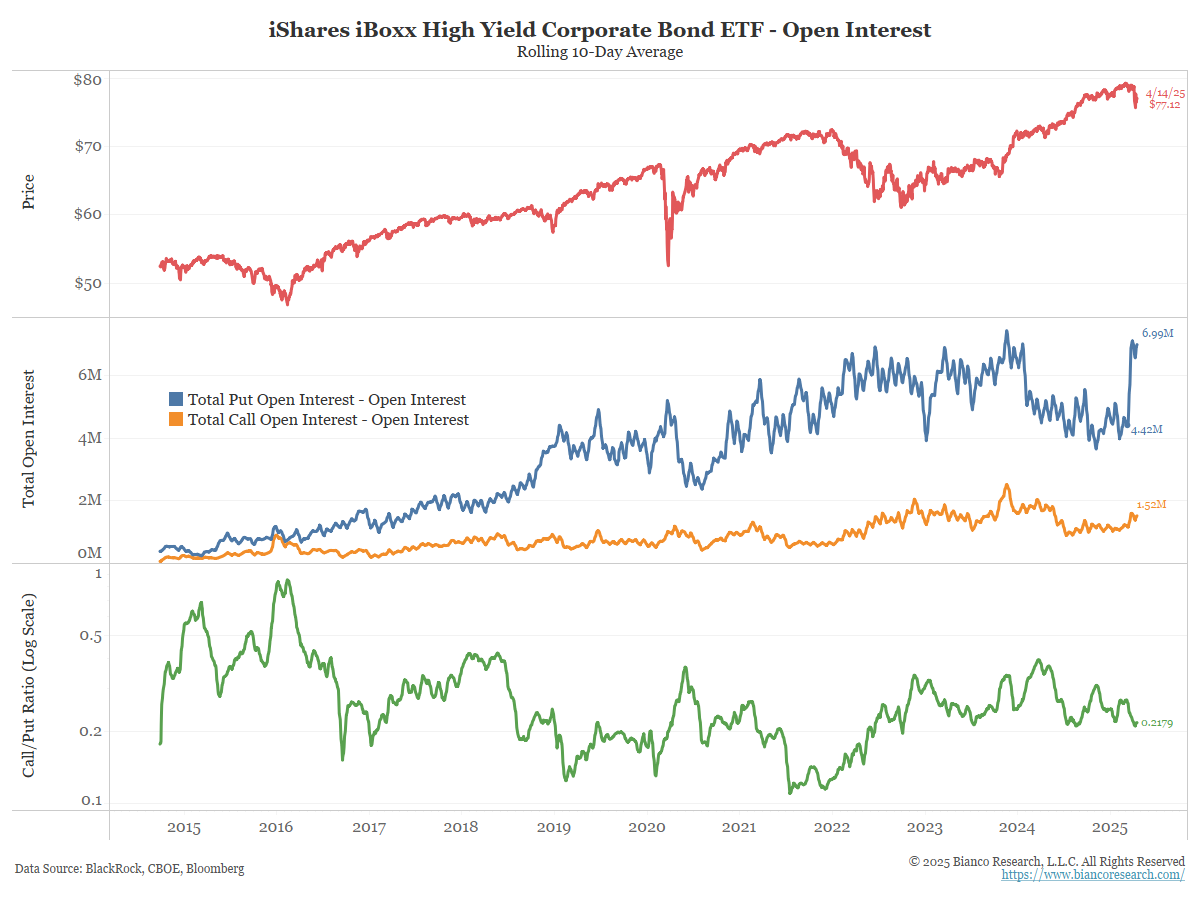

This chart is the same as the one above except for open interest.

About 10 million puts traded in the last two weeks (blue line, chart above), leading to a 2.5 million increase in put open interest (blue line below).

These hedges are now losing money as the market rallies. Unwinding this, put selling, could lead to a massive short squeeze.

Is this what is happening? A short squeeze? If so, does this rally have “legs?” Or, does it die out once the put hedges are reversed?

In the News…

Bloomberg: Crypto’s Newest Stablecoin Is Inflation-Linked Bond Alternative

A new cryptocurrency aims to occupy the final frontier of investor safety — cash that doesn’t lose purchasing power to inflation.

OilPrice: Lower Oil Prices Threaten Permian Basin Growth

US oil producers are struggling to defend margins at $60 WTI due to additional corporate costs that raise the all-in breakeven price.

Fast Company: The Florida housing market is so weak that this giant builder is cutting prices

KB Home CEO Jeffrey Mezger says the start of the housing market’s 2025 spring selling season is ‘more muted’ than usual.

National Retail Federation: Consumers to Spend $23.6 Billion on Easter

Consumers plan to spend a total of $23.6 billion on Easter this year, according to the annual survey released today by the National Retail Federation and Prosper Insights & Analytics. The amount is above last year’s $22.4 billion, and approaching the record $24 billion spent in 2023.

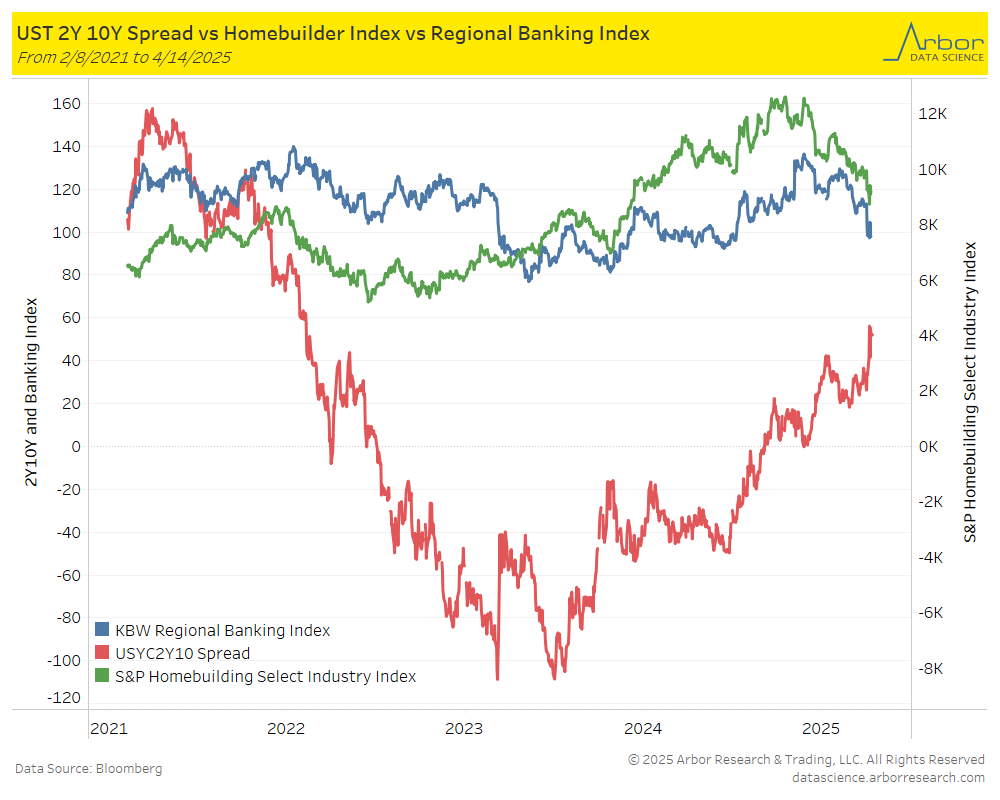

Arbor Data Science: A Steep(ener) Cost to Hedge

Upcoming Economic Releases & Fed Speak

- 4/16/2025 at 07:00am EST: MBA Mortgage Applications

- 4/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 4/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas

- 4/16/2025 at 08:30am EST: Retail Sales Control Group & New York Fed Services Business Activity

- 4/16/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 4/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 4/16/2025 at 12:00pm EST: Fed’s Hammack Speaks in Moderated Q&A

- 4/16/2025 at 01:30pm EST: Fed’s Powell Speaks on Economic Club of Chicago

- 4/16/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 4/16/2025 at 04:00pm EST: Fed’s Schmid Chats with Fed’s Logan on Economy, Banking

- 4/17/2025 at 08:30am EST: Housing Starts /Housing Starts MoM; Building Permits / Building Permits MoM

- 4/17/2025 at 08:30am EST: Initial Jobless Claims

- 4/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 4/17/2025 at 08:30am EST: Initial Claims 4-Wk Moving Avg

- 4/17/2025 at 08:30am EST: Continuing Claims

- 4/17/2025 at 11:45am EST: Fed’s Barr Speaks in Fireside Chat

- 4/18/2025 at 11:00am EST: Fed’s Daly Speaks in Moderated Conversation

- 4/21/2025 at 10:00am EST: Leading Index

- 4/22/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 4/22/2025 at 09:00am EST: Fed’s Jefferson Speaks at Economic Mobility Summit

- 4/22/2025 at 09:30am EST: Fed’s Harker Speaks at Economic Mobility Summit

- 4/22/2025 at 10:00am EST: Richmond Fed Manufacturing Index

- 4/22/2025 at 10:00am EST: Richmond Fed Business Conditions