US Treasuries

- Wednesday’s range for UST 10y: 4.11% – 4.22%, closing at 4.19%

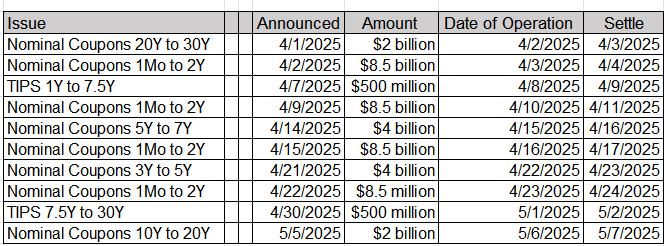

Upcoming US Treasury Supply

Contrarian buy signal?

Bloomberg: Wall Street Trading Desks Warn S&P 500 Selloff Will Get Worse

Wall Street trading desks disagree on many things, but there’s one view they now seem to share: President Donald Trump’s looming tariff announcement will likely exacerbate the S&P 500 Index selloff, at least in the near term.

Jim Bianco:

Wall Street trading desks disagree on many things, but there’s one view they now seem to share: President Donald Trump’s looming tariff announcement will likely exacerbate the S&P 500 Index selloff, at least in the near term.

Many Wall Street firms — including Goldman Sachs Group Inc. and Bank of America Corp. — expect Wednesday’s highly anticipated trade measures to raise stock market volatility and deepen the slide in the benchmark US equity gauge, which just came off its worst quarter since 2022.

*ADP US MARCH PRIVATE EMPLOYMENT RISES 155,000; EST. +120K

Yes, it has a zero correlation to Friday’s payroll number. But it is a “hard” data metric showing that the jobs market is not weakening. Initial Claims shows the same.

To date, all of this FUD (fear, uncertainty, doubt) is about people freaking out about tariffs, what is now commonly called “soft” data. Maybe because the media is constantly hyperventilating about them (form of TDS).

The actual (“hard”) data do not show much evidence of slowing the economy. However, the hard data does show real signs that inflation has bottomed well above 2% and is potentially turning higher. This happened BEFORE tariffs were instituted, so this is not a “transitory” inflation move.

Of course, you can argue that soft data leads to hard data. History shows the opposite: typically, soft data lags the hard data. That is, the economy moves first and the mood then reflects it.

Maybe this is the time that works the other way around. We scare ourselves into a recession when it is not necessary. I’ll take the other side of this trade.

In the News…

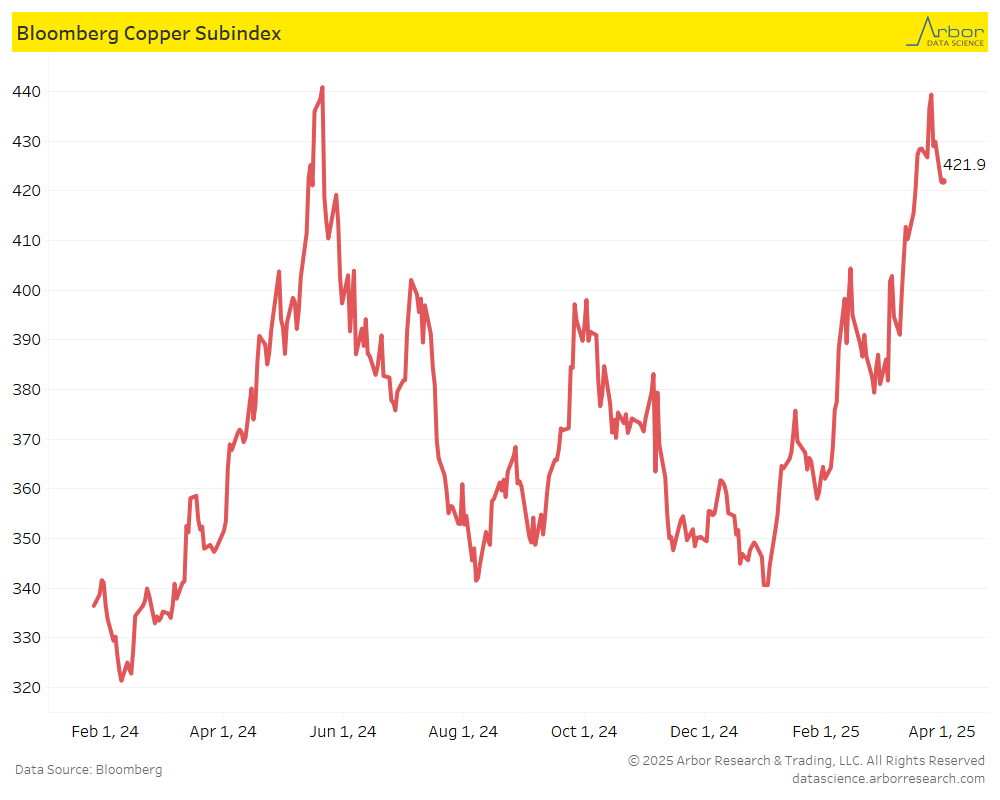

Mining Journal: Copper prices hit dip after bull run

Potential sooner-than-expected tariffs stir markets

Arbor Data Science: The Predictive Power of Copper by Petr Pinkhasov

SupplyChainBrain: Port of Houston ‘Hit Hard’ by Foggy Weather in February

Port Houston saw a 29% reduction in channel availability in February, after foggy weather disrupted the movement of cargo through the area for half the month.

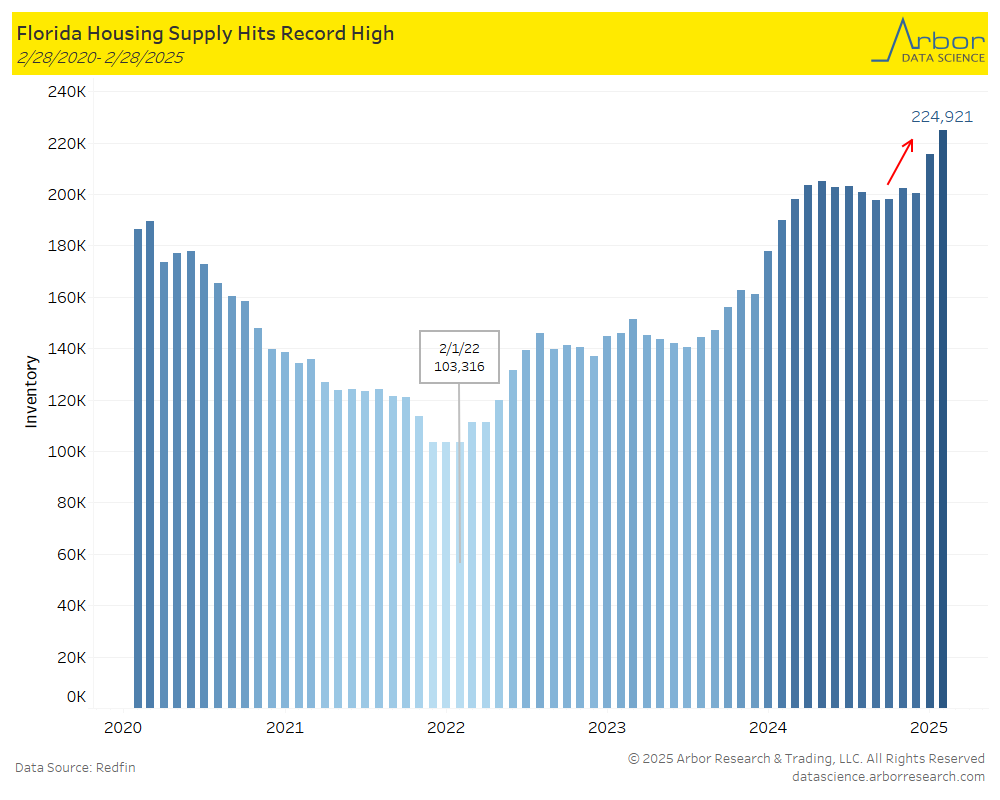

Axios: Canadian snowbirds are selling their U.S. homes

America’s northern neighbors make up 11% of foreign homebuyers on average over the past decade, according to National Association of Realtors data shared with Axios.

Florida attracts the most Canadian buyers, followed by Arizona and California.

Arbor Data Science: Read more tomorrow (Thursday, 4/3/25) on Florida’s Rising Housing Supply

Upcoming Economic Releases & Fed Speak

- 4/03/2025 at 07:30am EST: Challenger Job Cuts YoY

- 4/03/2025 at 08:30am EST: Trade Balance

- 4/03/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/03/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 4/03/2025 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 4/03/2025 at 10:00am EST: ISM Services New Orders & ISM Services Employment

- 4/03/2025 at 12:00pm EST: Fed’s Jefferson Gives Keynote on Communication

- 4/03/2025 at 02:30pm EST: Fed’s Cook Speaks on Economic Outlook

- 4/04/2025 at 08:30am EST: Change in Nonfarm Payrolls & Change in Private Payrolls

- 4/04/2025 at 08:30am EST: Change in Manufact. Payrolls & Two-Month Payroll Net Revision

- 4/04/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate

- 4/04/2025 at 08:30am EST: Underemployment Rate

- 4/04/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY & Average Weekly Hours All Employees

- 4/04/2025 at 11:25am EST: Fed’s Powell Speaks on Economic Outlook

- 4/04/2025 at 12:00pm EST: Fed’s Barr Speaks on AI and Banking

- 4/04/2025 at 12:45pm EST: Fed’s Waller Speaks on Payments

- 4/07/2025 at 03:00pm EST: Consumer Credit

- 4/08/2025 at 06:00am EST: NFIB Small Business Optimism

- 4/09/2025 at 07:00am EST: MBA Mortgage Applications

- 4/09/2025 at 10:00am EST: Wholesale Trade Sales MoM & Whole Inventories MoM

- 4/09/2025 at 11:00am EST: Fed’s Barkin Speaks to Economic Club of Washington DC

- 4/09/2025 at 02:00pm EST: FOMC Meeting Minutes