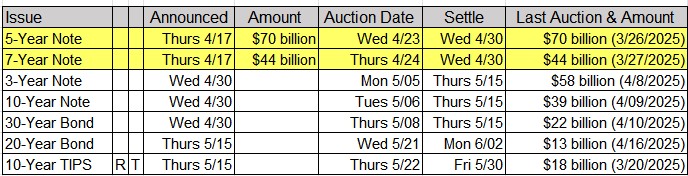

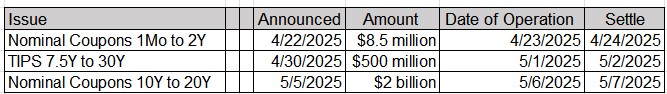

US Treasuries

- Tuesday’s range for UST 10y: 4.37% – 4.43%, closing at 4.39%

- Fed’s Jefferson: says economic mobility can make the Fed’s policy more effective

- Fed’s Harker: says the Fed’s credibility is its most precious resource

- Fed’s Kashkari: says Federal job cuts are not making a big dent in the economy; says Fed must ensure tariff inflation is not persistent

Bloomberg: US Bonds Have Never Been Risk-Free, and Never Will Be

Practically every financial meltdown or crisis can be traced back to a misunderstanding of which assets are “risk-free.” Investors think they have a risk-free asset — it could be a mortgage-backed security, shares in a Bernie Madoff fund, Greek debt — and are surprised when it turns out not to be.

Tentative Schedule of Treasury Buyback Operations

In the News…

ZeroHedge: Air Cargo Faces $22BN Revenue Hit When China Tariff Exemption Ends

The Cirrus Global Advisors model shows the airfreight industry revenue could contract $22 billion if the White House maintains tariffs at 125% for a substantial period of time, based on assumptions about lower consumer demand, excess airline capacity and downward pressure on yields.

FarmPolicyNews: Farm Bankruptcies on the Rise Again 2025

Family farm bankruptcies increased by 55% last year compared to 2023 and are trending even higher this year as farmers continue to grapple with depressed agricultural commodity prices and high input costs.

Tampa Bay Times: ‘Perfect storm.’ Hundreds of Florida condos now on secret mortgage blacklist

A secretive quasi-governmental condo blacklist is growing exponentially, making it difficult for owners in scores of troubled buildings in Miami and South Florida to sell or get loans for repairs even as their associations face a fiscal and time crunch to meet stringent new state safety regulations.

ABC News: 5 million student loan borrowers face mandatory collections starting May 5

Some 5 million Americans with defaulted student loan payments will have their loans sent for collections on May 5, the Department of Education announced on Monday.

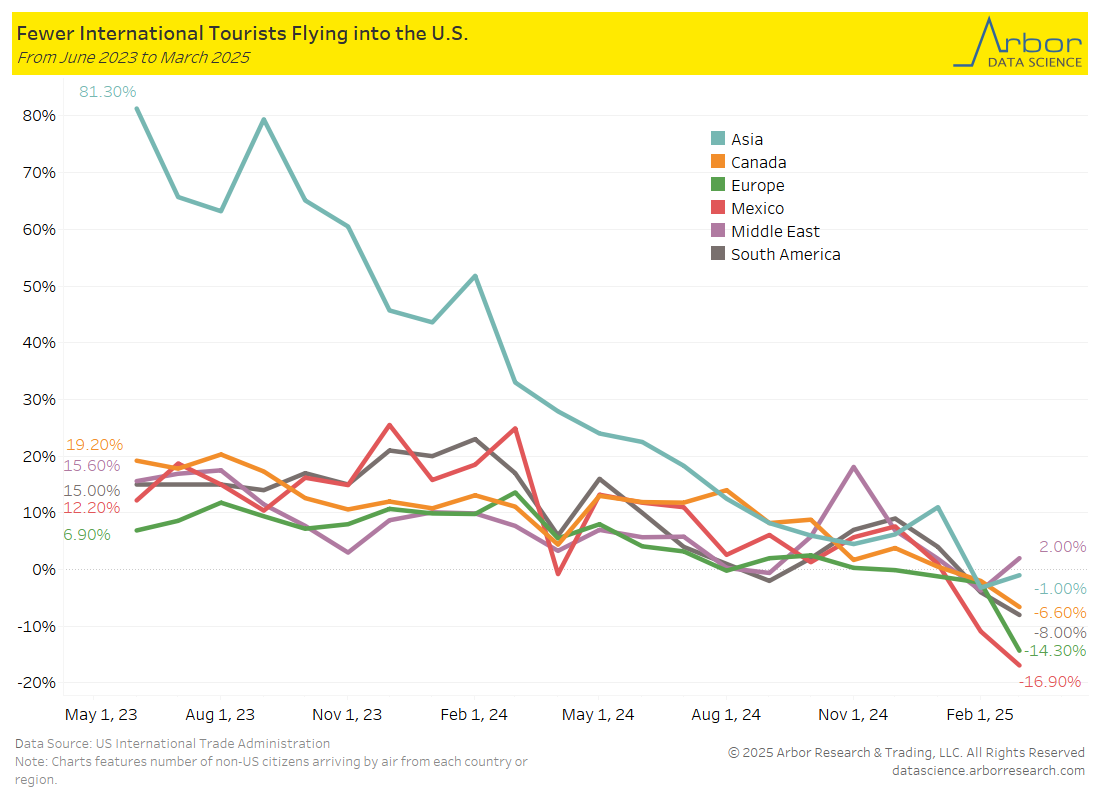

Arbor Data Science: Travel Insights by Sam Rines

MarketWatch: Wealthier borrowers are getting behind on their debts, a warning shot for the economy

A recent snapshot of quarterly household credit showed an uptick in seriously delinquent auto loans, credit cards and home-equity lines of credit at the end of 2024, according to the New York Federal Reserve.

Upcoming Economic Releases & Fed Speak