US Treasuries

- Wednesday’s range for UST 10y: 4.245% – 4.39%, closing at 4.38%

Bloomberg: Are US Treasuries Really Losing Their Safe-Haven Appeal? What to Know

Investors typically flock to US Treasury bonds as a haven from gyrations in financial markets. They rallied during the global financial crisis, on 9/11 and even when America’s own credit rating was cut.

Bloomberg: Trade Worries Dominate Fed’s Beige Book, Activity Little Changed

Uncertainty over President Donald Trump’s heightened use of tariffs on US trading partners loomed large across the country in recent weeks, according to the Federal Reserve’s Beige Book survey of regional contacts.

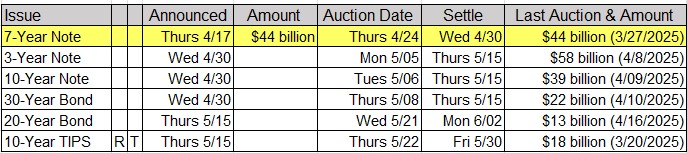

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary From Jim Bianco

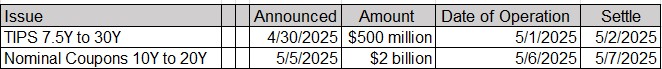

*BUNDESBANK CHIEF NAGEL CAN’T EXCLUDE GERMAN RECESSION IN 2025

As this chart shows, he is merely saying what the market is already pricing. The median 2025 GDP forecast (red line) has been sinking for months and is already down to just 0.10%.

2026 is expected to experience a rebound, but at this point, 20 months from the end of 2026, this is more wishful thinking than a forecast based on any data.

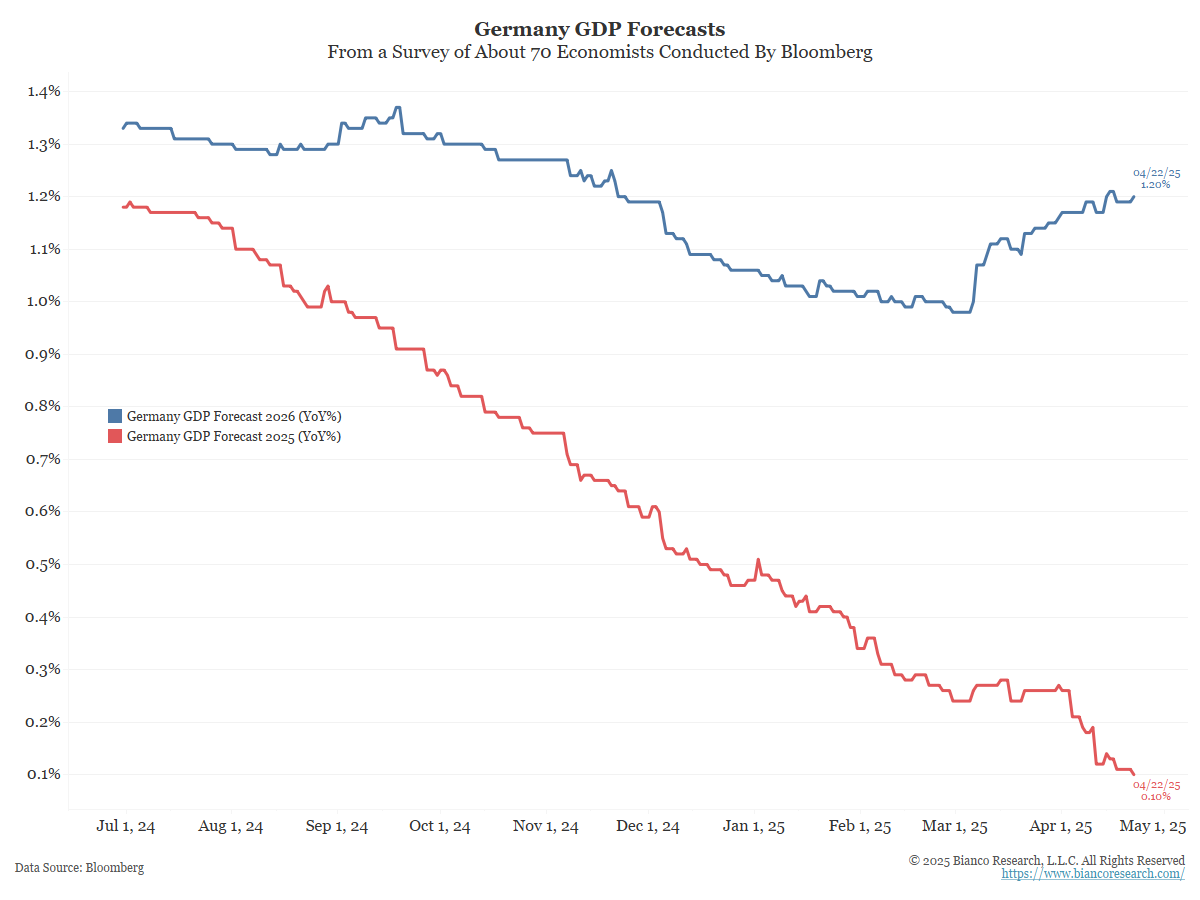

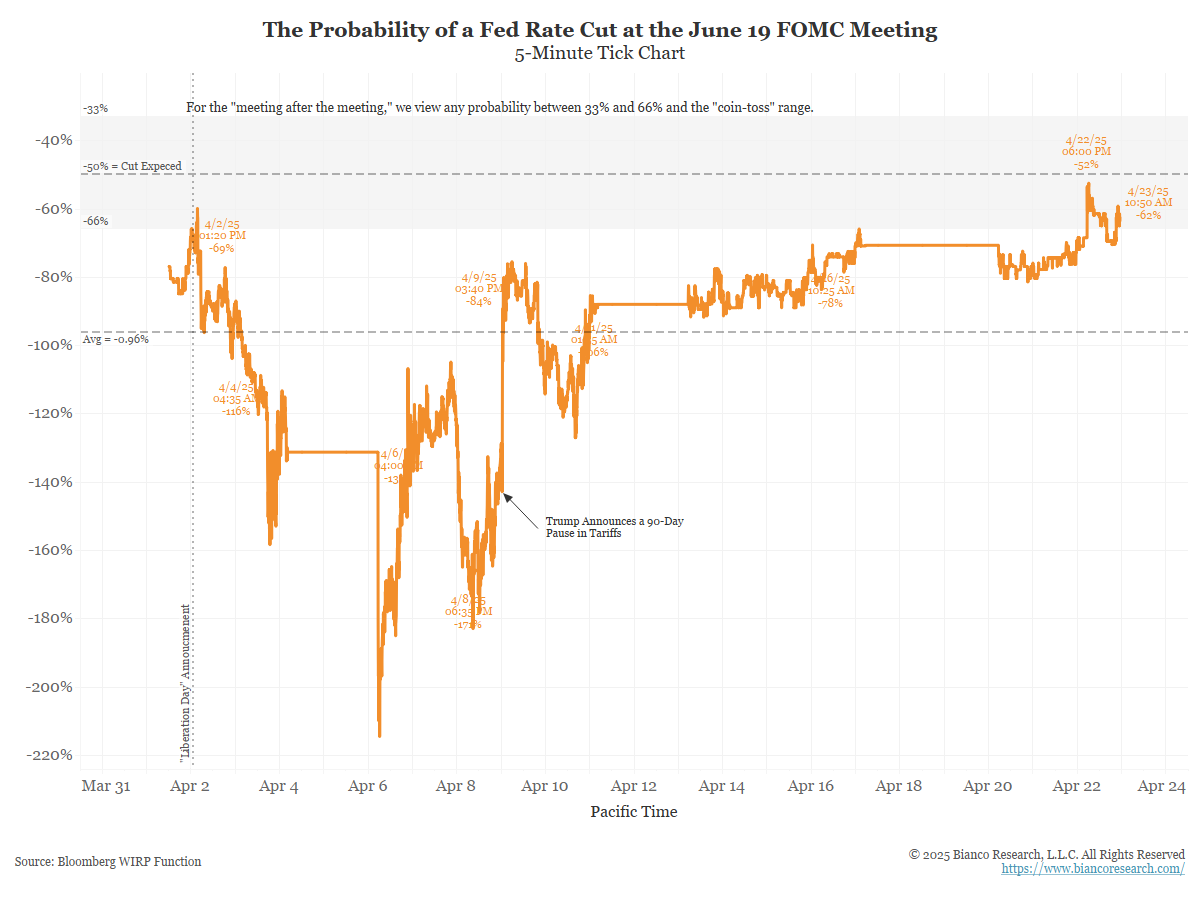

Probability of a May 7 rate cut, starting on Liberation Day (April 2).

Now just 8%

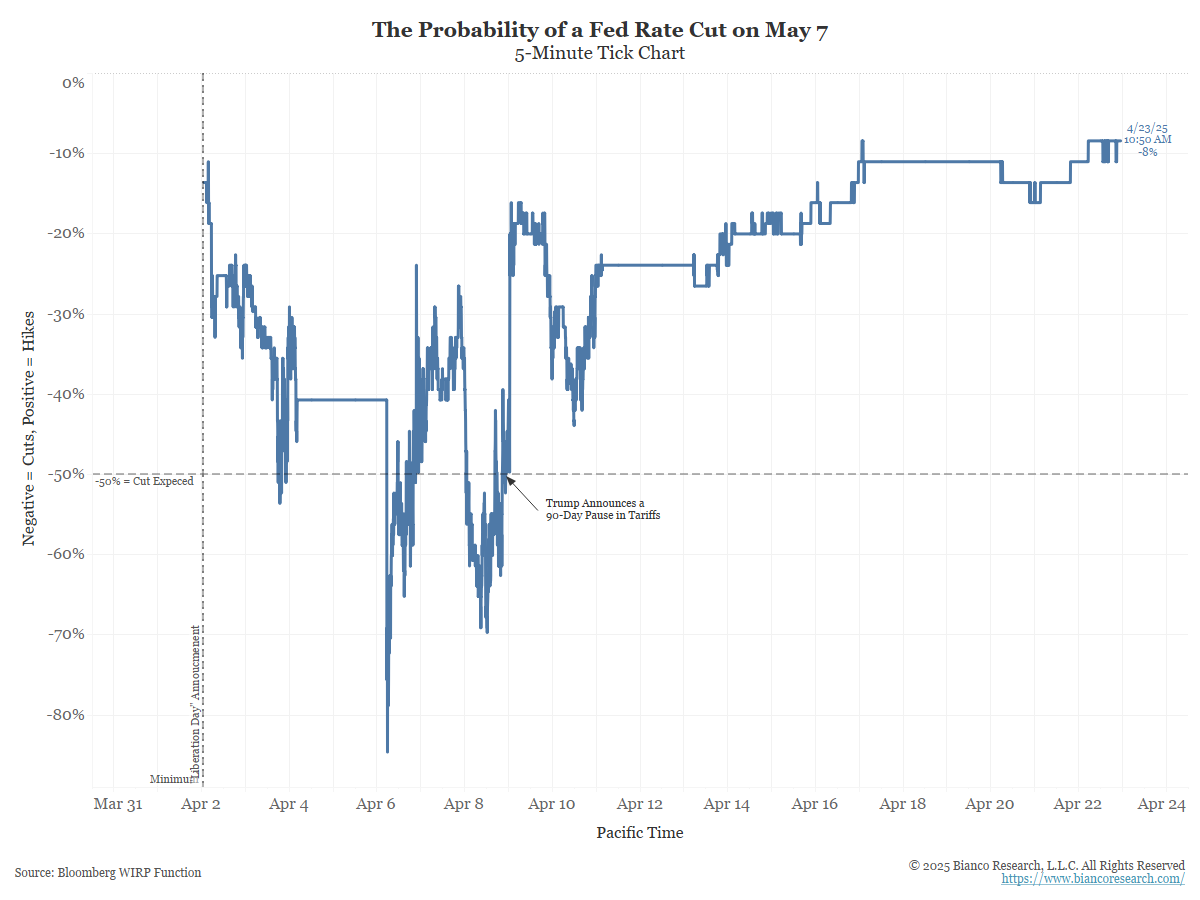

The probability of a June 19 rate starting on Liberation Day.

It is the least it has been since this date.

The shaded area is 33% to 66%. I term this range for the “meeting after the meeting” coin-toss area.

So, the June probability is now starting to disappear.

Bottom line, the Fed is done, the rate-cutting cycle ended in December.

In the News…

Gurufocus.com: Credit Card Giants Brace for Economic Downturn Amid Rising Delinquencies

Major credit card companies are gearing up for a potential economic downturn, as recent earnings reports indicate a rise in customer delinquencies returning to pre-pandemic levels. Industry leaders like JPMorgan Chase (JPM), Citigroup (C, Financial), Synchrony (SYF), and U.S. Bancorp (USB) are taking various measures to mitigate potential risks.

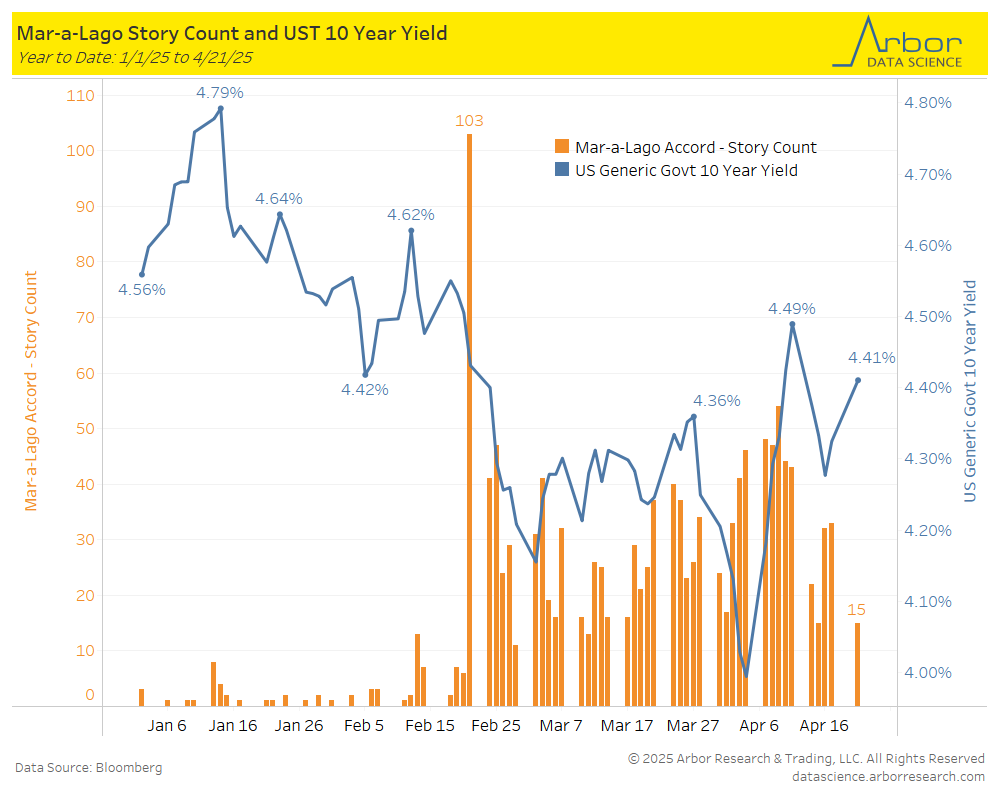

Arbor Data Science: U.S. Treasury Yields and News Coverage of Mar-a-Lago Accord

Business Insider: Trailer park treasure

Americans are buying up mobile homes — and flipping them for big profits

This is mobile home investing, an unsexy, little-known sector that happens to be recession-proof, meeting a nearly bottomless demand, and earning some of the best returns in the housing industry.

Upcoming Economic Releases & Fed Speak