US Treasuries

- Thursday’s range for UST 10y: 4.30% – 4.365%, closing at 4.305%

- Fed’s Hammack: says it is too soon to consider rate move in May; June rate cut is possible

- Fed’s Waller: says he would support cuts if tariffs drive job losses

Bloomberg: Fed’s Waller Says He’d Support Rate Cuts If Tariffs Drive Job Losses

Bloomberg’s Simon White on LinkedIn:

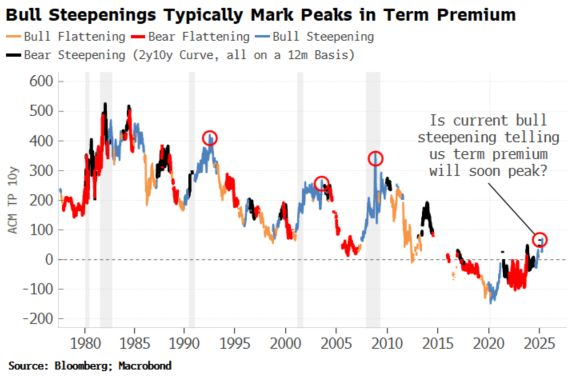

Term premium has been rising as bond holders demand more compensation for holding longer-term debt.

inflation, supply, foreign demand and rising rate volatility are all pushing term premium higher.

Term premium is an inferred quantity and is therefore of little practical use for traders. But we can show that it is functionally no different from a souped-up version of the yield curve (don’t get sucked into over-complicated explanations and derivations).

Then if we look at how term premium behaves depending on what the yield curve is doing, we get the chart below – the line is 10y ACM term premium colour-coded for what the 2s10s curve is doing on a trailing 12-month basis.

2s10s is currently bull flattening on that basis. As the chart shows, that often marks the peaks of term premium.

So we may be in the last innings of the yield move, unfortunately there’s no way to know for sure how big or small that is. But given the multiple risks facing Treasuries, there’s plenty of fuel for a larger rise.

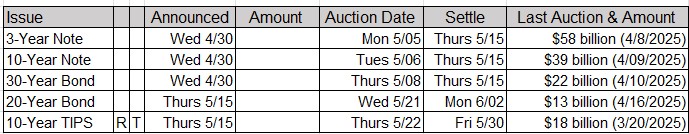

Tentative Schedule of Treasury Buyback Operations

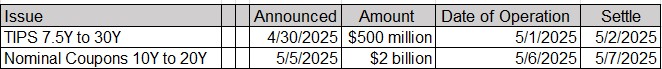

Intraday Commentary From Jim Bianco

3-day tick chart of the 10-year yield. What direction will the next 15 bps move be in the 10-year yield?

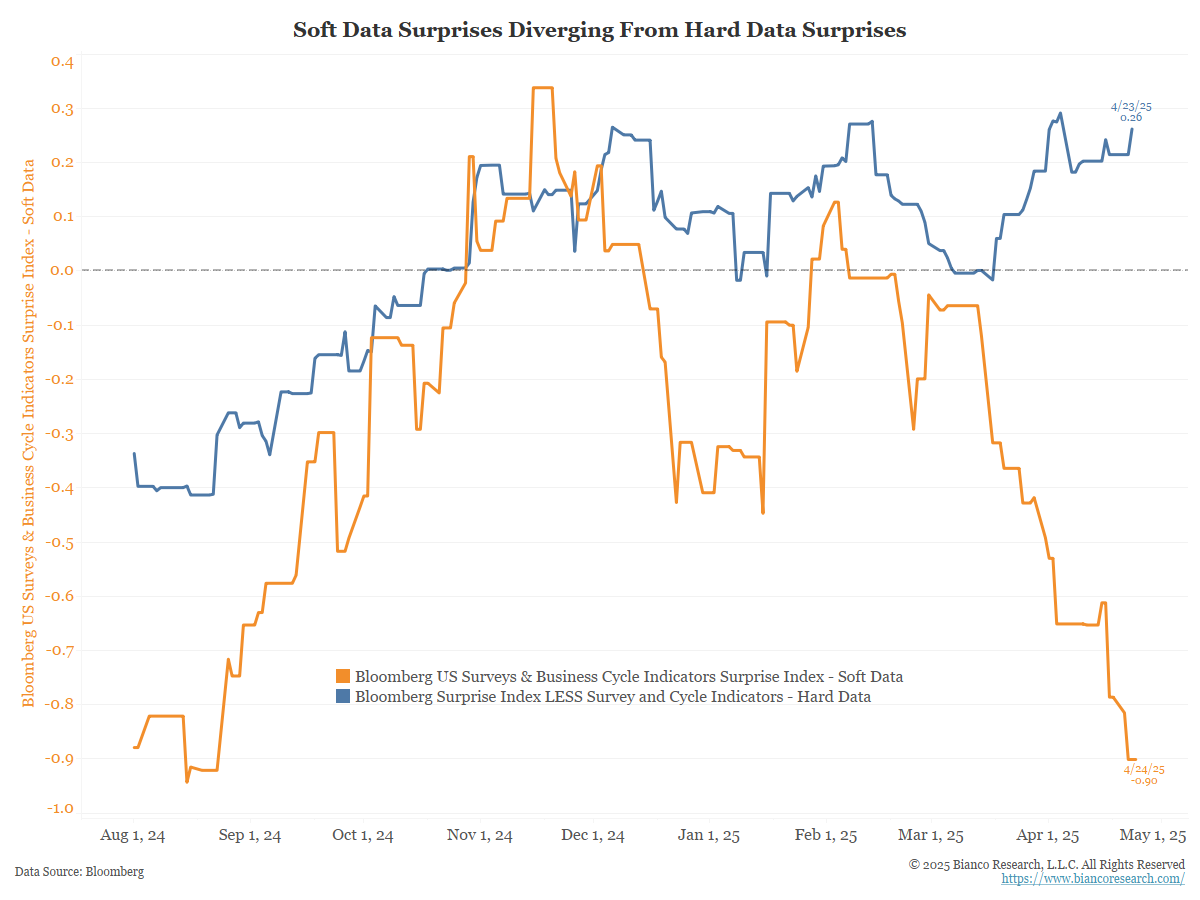

Update … Soft or survey data (orange) continues to go straight down, as respondents fear what tariffs mean is coming next. However, hard or actual data (blue) is not weakening … yet?

As of April 24 (today), the economy is fine. There are few signs of trouble in the hard data.

However, the expectation is that this will no longer be true as of July 24 (three months from today). This is what the soft data is suggesting.

How much of the soft data expectations will be correct, and how, is the question before us.

In the News…

Axios: The world reckons with a risky dollar

The dollar smile — the longstanding dynamic where the dollar would rally in good times and bad — has been turned upside down.

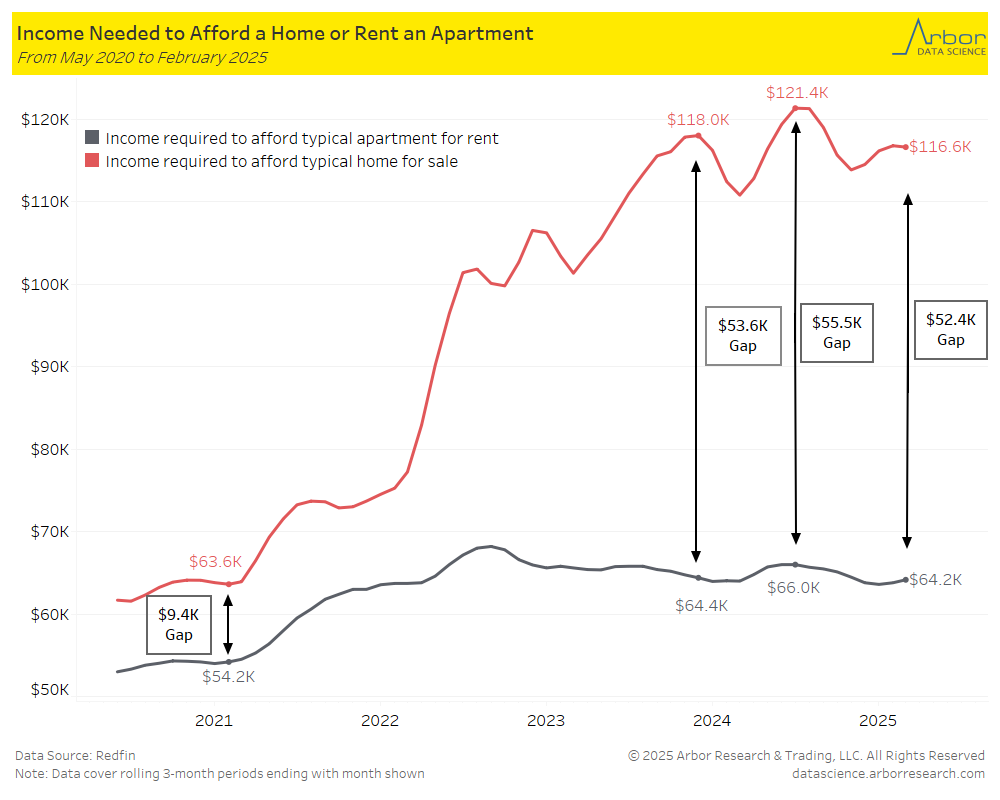

Arbor Data Science: The Affordability Squeeze for Homebuyers

TechCrunch: A comprehensive list of 2025 tech layoffs

The tech layoff wave is still kicking in 2025. Last year saw more than 150,000 job cuts across 549 companies, according to independent layoffs tracker Layoffs.fyi.

Transport Topics: Walmart Amps Up Discounts to Lure Cost-Conscious Customers

Walmart Inc. is doubling down on discounts, a move to drum up demand and grow market share in the face of macroeconomic uncertainty.

Upcoming Economic Releases & Fed Speak