US Treasuries

- Friday’s range for UST 10y: 4.25% – 4.31%, closing at 4.26%

Bloomberg: For Fed’s Powell, Being ‘Mr. Too Late’ Is Better Than Being Wrong

Jerome Powell’s determination to ensure any jump in prices stemming from Donald Trump’s tariffs don’t spread through the economy has earned him the moniker “Mr. Too Late” from the president. For the Federal Reserve chair, that’s better than being Mr. Wrong.

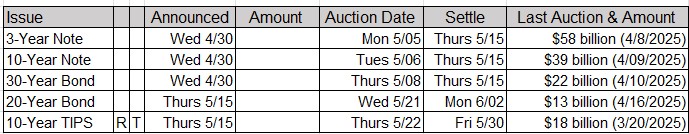

Tentative Schedule of Treasury Buyback Operations

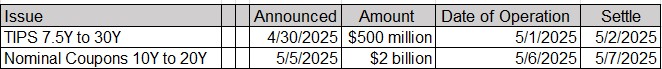

TIPS by Maturity

Data through 4/16/25

Week over Week Changes by Maturity

- < 2 years: $11.3 Bn on 4/09/25 to $12.7 Bn on 4/16/25 = $1.4 Bn

- 2 – 6 years: $10.1 Bn on 4/09/25 to $7.8 Bn on 4/16/25 = ($2.3 Bn)

- 6 – 11 years: $3.4 Bn on 4/09/25 to $3.8 Bn on 4/16/25 = $0.4 Bn

- > 11 years: $361 Mn on 4/09/25 to $279 Mn on 4/16/25 = ($81 Mn)

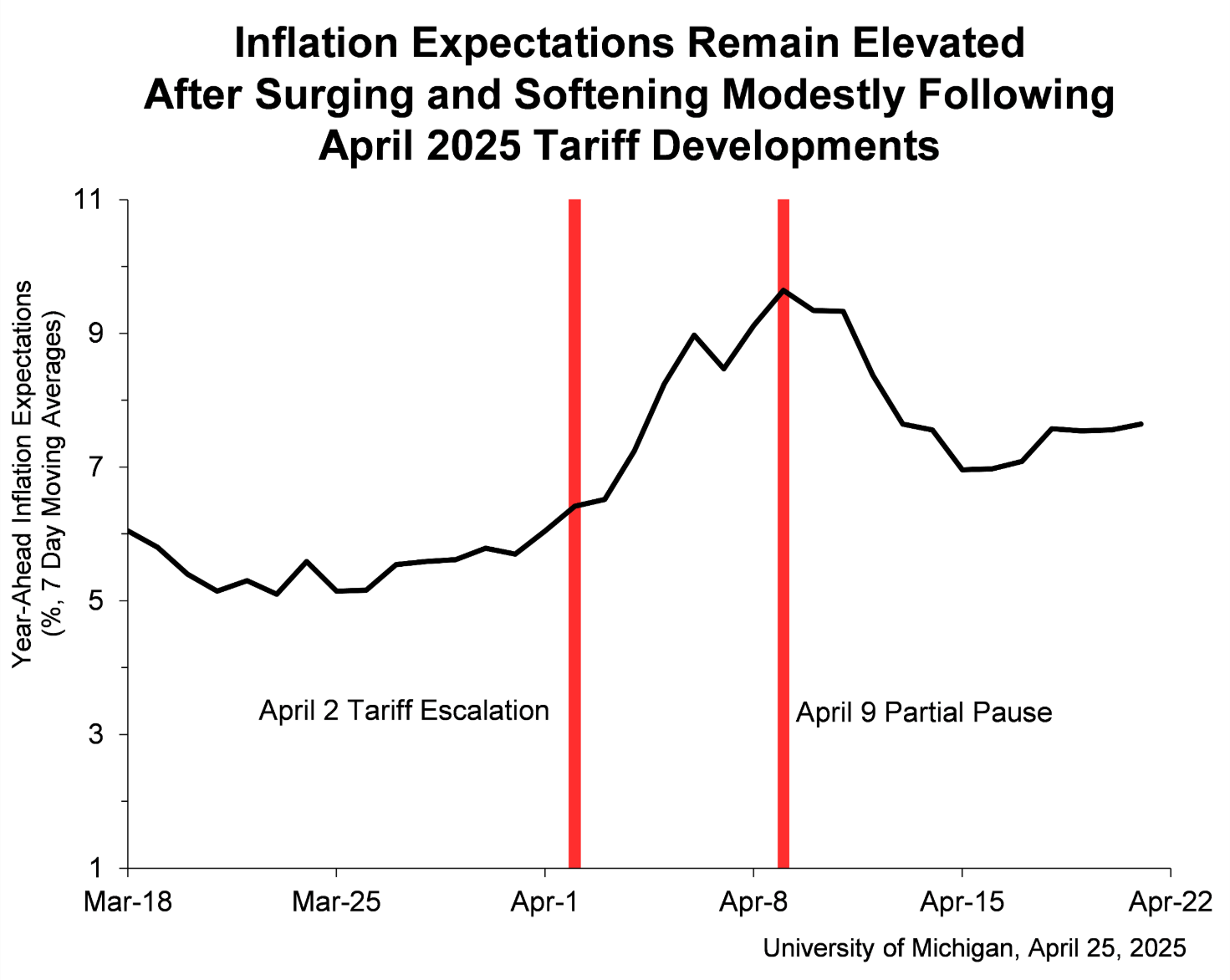

The London Stock Exchange trades a five-times leveraged MAG7 ETF.

The white line in the top panel shows its price. The red annotation shows that it has collapsed by 86%(!) since its December 18, 2024, peak—a complete wipeout.

The bottom panel shows fund flows. Green bars show ETF creations (new money coming in), and the red bars show ETF redemptions (money leaving).

I see a lot of ETF creations (new money coming) into a complete destruction of wealth, including the last three days.

Is this how markets bottom?

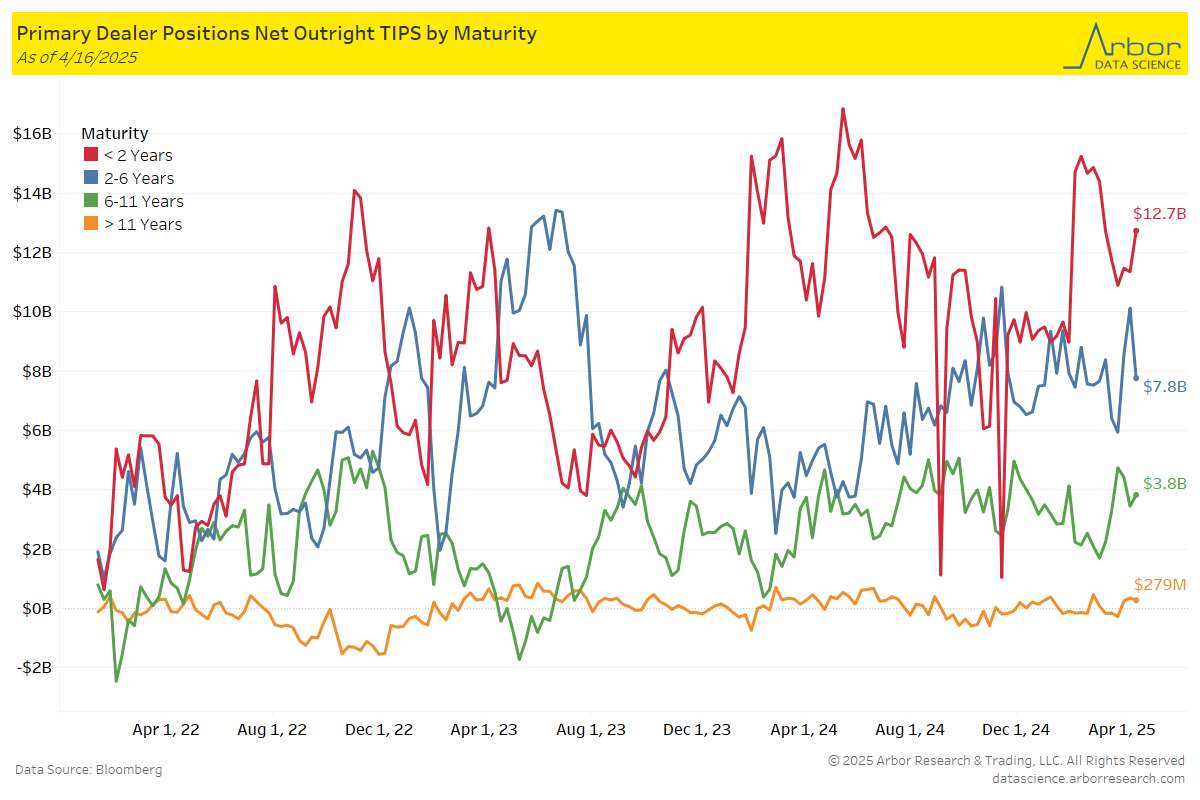

The Umich consumer sentiment survey was just released. Their commentary included this chart, illustrating how the public thinks tariffs are mainly about inflation.

—–

Umich: Year-ahead inflation expectations surged from 5.0% last month to 6.5% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. This month’s rise was seen across all three political affiliations.

As seen in the chart, inflation expectations evolved with major trade policy announcements this month. After the April 9 partial pause in tariff increases, inflation expectations ebbed but remained substantially elevated relative to March. Long-run inflation expectations climbed from 4.1% in March to 4.4% in April, reflecting a particularly large jump among independents.

This highlights the divergence between Main Street and Wall Street. Main Street thinks tariffs are all about inflation and fears a price spike is coming. If the Fed was responding to these fears, they would hold, or HIKE rates.Wall Street thinks tariffs are all about markets, jobs, and growth. It fears both are heading lower. If the Fed were responding to these fears, it would CUT rates soon and hard.—For now, the Fed is following Main Street’s fears of inflation by not cutting rates and giving little indication that a rate cut is coming over the next few months. I think the Fed picked the correct side.

This highlights the divergence between Main Street and Wall Street. Main Street thinks tariffs are all about inflation and fears a price spike is coming. If the Fed was responding to these fears, they would hold, or HIKE rates.Wall Street thinks tariffs are all about markets, jobs, and growth. It fears both are heading lower. If the Fed were responding to these fears, it would CUT rates soon and hard.

—

For now, the Fed is following Main Street’s fears of inflation by not cutting rates and giving little indication that a rate cut is coming over the next few months. I think the Fed picked the correct side.

OilPrice: Oilfield Services Giants to Warn of Gloomier Outlook

The world’s biggest oilfield services provider, SLB (NYSE: SLB), flagged heightened uncertainties about upstream oil and gas investment amid fears of economic slowdown, fluctuating oil prices, and unknown tariff talks outcomes and impacts.

Back to Work?

CNBC: Google forcing some remote workers to come back 3 days a week or lose their jobs

Five years removed from the onset of the Covid pandemic, Google is demanding that some remote employees return to the office if they want to keep their jobs and avoid being part of broader cost cuts at the company.

The Hill: Remote work is a new battlefield for unions

Remote work has erupted into one of the fiercest battlefields in modern labor relations. Unions representing employees at both private companies and government agencies are waging determined campaigns to keep telework options on the table, rejecting the notion that flexible schedules and location independence are merely perks to be rolled back at will.

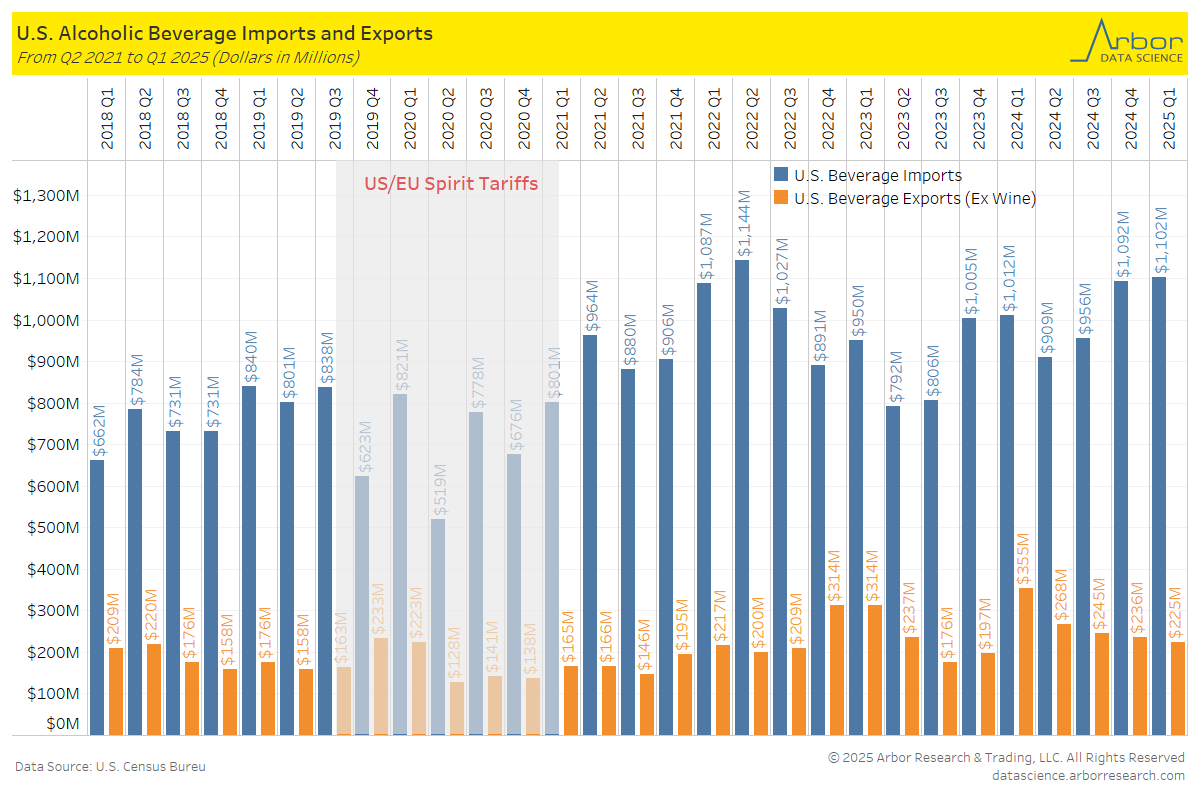

Arbor Data Science: Tapping Into the Price of Alcohol With Potential Tariffs on the Horizon

CNBC: Amazon and Nvidia say AI data center demand is not slowing down

Amazon and Nvidia executives said Thursday that the construction of artificial intelligence data centers is not slowing down, as recession fears have some investors questioning whether tech companies will pull back on some of their plans.

Upcoming Economic Releases & Fed Speak