US Treasuries

- Thursday’s range for UST 10y: 3.995% – 4.10%, closing at 4.05%

- Fed’s Kugler: supports holding rates amid higher inflation risks

- Fed’s Jefferson: says no need to hurry to adjust rates

- Fed’s Cook: sees slower growth, stall in inflation amid tariffs

- Tomorrow: [Friday, 4/4/25 at 11:25am EST] Fed’s Powell Speaks on Economic Outlook

Bloomberg: Tariffs Put Fed in Tough Spot, Raise Growth and Price Fears

An aggressive suite of tariffs announced Wednesday by President Donald Trump will significantly complicate the Federal Reserve’s job as it struggles to quash inflation and avoid an economic downturn, likely keeping officials in wait-and-see mode.

Bloomberg: Powell’s Got a Plan to Assess Tariff Inflation. It’s Not Easy

When it comes to the crucial task of gauging the impact of tariffs on inflation, Federal Reserve Chair Jerome Powell has a game plan: Separate the signal from the noise.

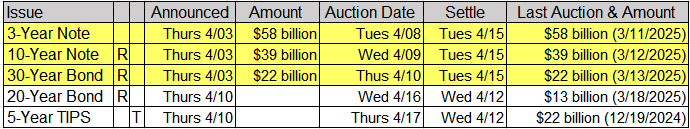

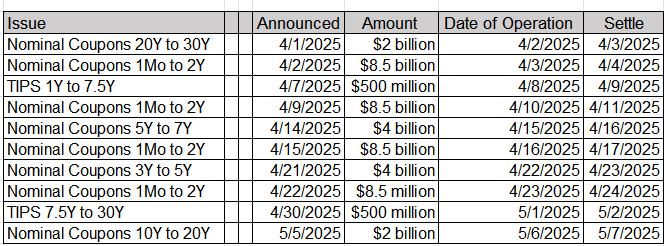

Upcoming US Treasury Supply

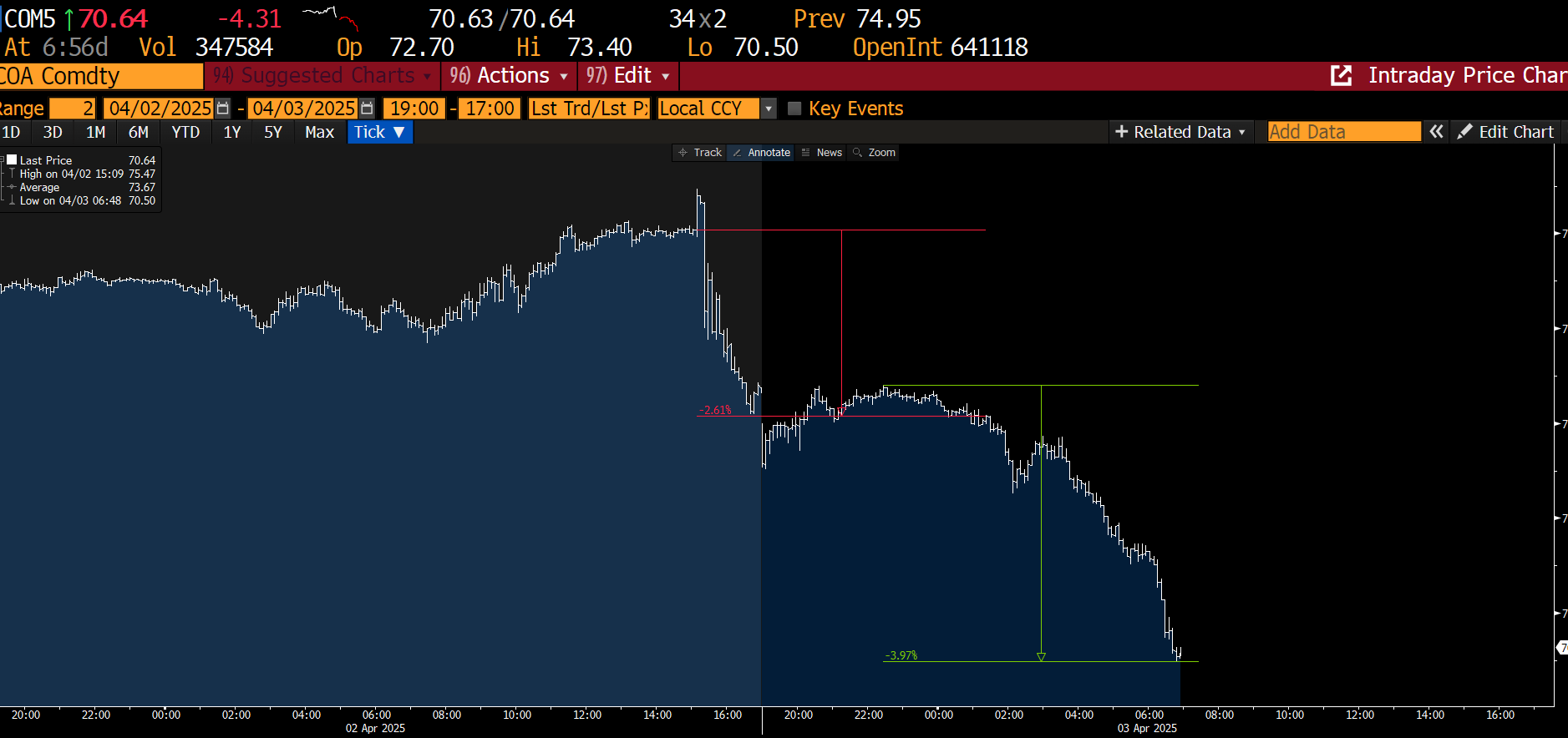

Bloomberg Red Headline: *US OIL FUTURES SLUMP 5% AS TARIFFS THREATEN DEMAND OUTLOOK

This suggests it is a reaction to tariffs (read “Trump’s fault”). But 7 minutes later, this Red Headline:

*OPEC+ AGREES TO MAKE LARGER THAN EXPECTED SUPPLY HIKE IN MAY

Instead, it is a massive unexpected increase in supply.

Everything is viewed through the same lens. Yes, it is a very important lens, but not the only one.

Crude oil for May delivery (next month) is down 5% on tariffs reducing demand. If that were true, which it is not, then stocks should be down about 25% today. However, crude for May delivery is down 5% because OPEC+ will swamp the market with unexpected supply in May makes sense.

—

My point, again, is EVERYTHING is being viewed through the tariff lens. This is how errors are made.

Two-day tick chart of Brent crude oil. About half (or a little less) of Brent’s move from “pre-liberation announcement” to overnight. Then stabilized. (red annotation)

But since the OPEC+ meeting started AM Europe, Brent has started to decline again (green annotation) by a greater amount.

In the News…

New York Post: Stellantis laying off 900 workers at US plants after Trump tariffs

Stellantis said on Thursday it was temporarily laying off 900 workers at five U.S. facilities after President Donald Trump’s tariffs were announced, and temporarily pausing production at an assembly plant in Mexico and one in Canada.

The Budget Lab: Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2

The Budget Lab modeled the effect of both the April 2nd tariff announcement in isolation and all US tariffs implemented in 2025.

OilPrice: Oil Prices Crash 7% on Trump Tariffs, OPEC Ramp-Up

The price of WTI crude oil dropped more than 7% on Thursday as President Donald Trump’s Liberation Day tariffs blitzed markets and OPEC+ threw an unexpected production curveball.

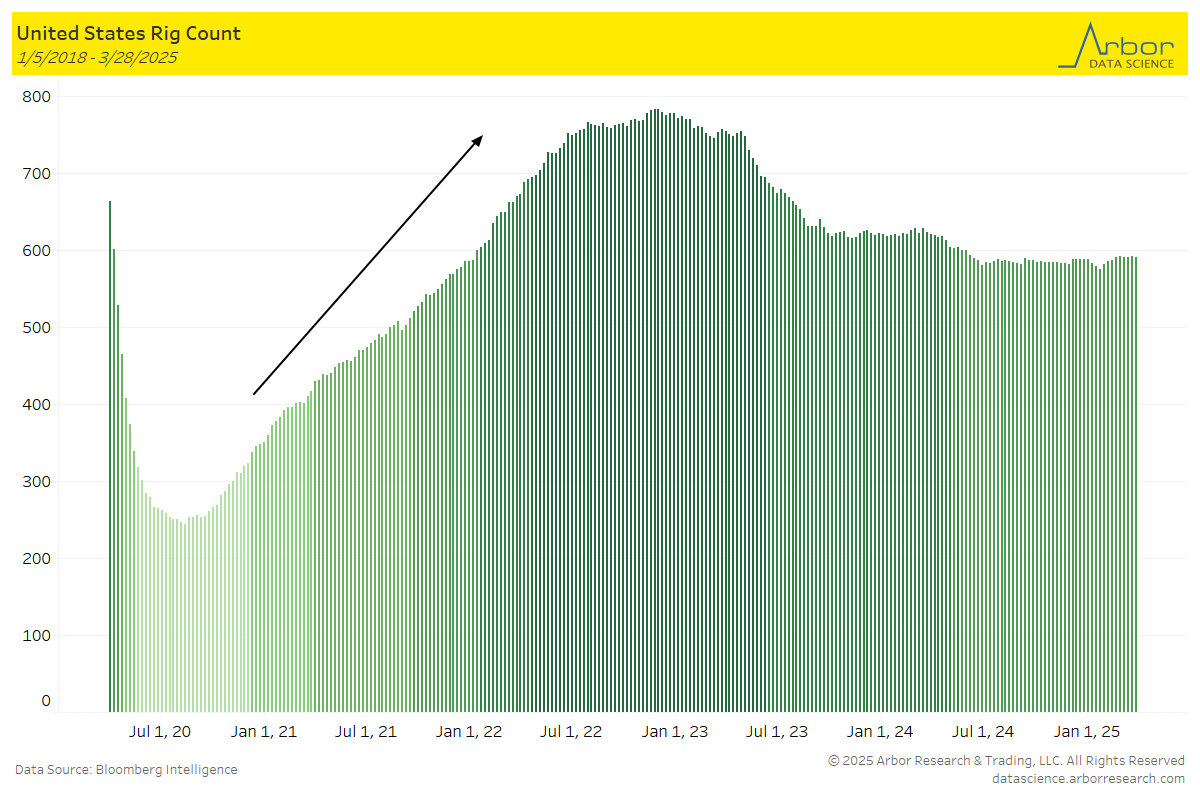

Arbor Data Science: A Rigged Oil Market by Sam Rines

CNBC: Family offices are moving money out of the U.S. on tariff, economic fears

Even before President Donald Trump’s bombshell tariff announcement Wednesday afternoon, family offices were rethinking their investments in the U.S.

Upcoming Economic Releases & Fed Speak

- 4/04/2025 at 08:30am EST: Change in Nonfarm Payrolls & Change in Private Payrolls

- 4/04/2025 at 08:30am EST: Change in Manufact. Payrolls & Two-Month Payroll Net Revision

- 4/04/2025 at 08:30am EST: Unemployment Rate & Labor Force Participation Rate

- 4/04/2025 at 08:30am EST: Underemployment Rate

- 4/04/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY & Average Weekly Hours All Employees

- 4/04/2025 at 11:25am EST: Fed’s Powell Speaks on Economic Outlook

- 4/04/2025 at 12:00pm EST: Fed’s Barr Speaks on AI and Banking

- 4/04/2025 at 12:45pm EST: Fed’s Waller Speaks on Payments

- 4/07/2025 at 03:00pm EST: Consumer Credit

- 4/08/2025 at 06:00am EST: NFIB Small Business Optimism

- 4/08/2025 at 02:00pm EST: Fed’s Daly Speaks in Discussion on Economic Outlook

- 4/09/2025 at 07:00am EST: MBA Mortgage Applications

- 4/09/2025 at 10:00am EST: Wholesale Trade Sales MoM & Whole Inventories MoM

- 4/09/2025 at 11:00am EST: Fed’s Barkin Speaks to Economic Club of Washington DC

- 4/09/2025 at 02:00pm EST: FOMC Meeting Minutes

- 4/10/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI Index NSA

- 4/10/2025 at 08:30am EST: Real Average Hourly Earnings & Real Average Weekly Earnings

- 4/10/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/10/2025 at 09:30am EST: Fed’s Logan Gives Welcome Remar

- 4/10/2025 at 12:00pm EST: Fed’s Goolsbee Speaks at Economic Club of NY

- 4/10/2025 at 12:30pm EST: Fed’s Harker Speaks on Fintech

- 4/10/2025 at 02:00pm EST: Federal Budget Balance