US Treasuries

- Friday’s range for UST 10y: 3.855% – 4.01%, closing at 3.99%

- Fed’s Powell: says tariffs could have persistent inflation impact; Fed obligated to keep inflation expectations anchored; economic impact of tariffs likely larger than expected

- Fed’s Barr: sees banks pushed to adopt AI faster by Fintech Firms

- Fed’s Waller: says he’s a “big advocate” of stablecoins

CNBC: ‘Transitory’ is back as the Fed doesn’t expect tariffs to have long-lasting inflation impacts

The “good ship Transitory,” despite an ominous record, appears ready to sail again for the Federal Reserve.

Bloomberg: Powell Signals Fed Would Respond to Persistent Inflation Shock

Federal Reserve Chair Jerome Powell said the economic impact of new tariffs is likely to be significantly larger than expected, and the central bank must make sure that doesn’t lead to a growing inflation problem.

Axios: Fed’s Powell steady on rates, warns on inflation as Trump demands cut

Powell’s remarks suggest that the Fed will offer no imminent relief from plunging markets and scrambled supply chains.

Agency Bullets

- We saw trading today in the New TVA 5.25 2/55

- The issue came to market at +60 vs ct30s in February

- Started the week trading ~+70 vs ct30’s; Trading today ~+85bps vs ct30s

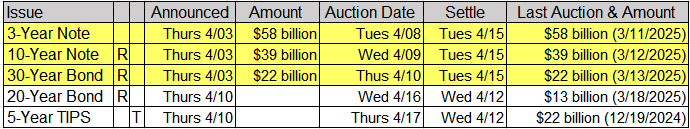

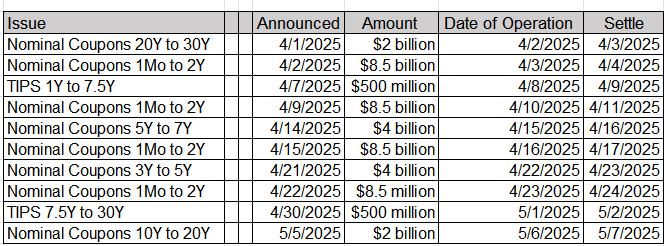

Upcoming US Treasury Supply

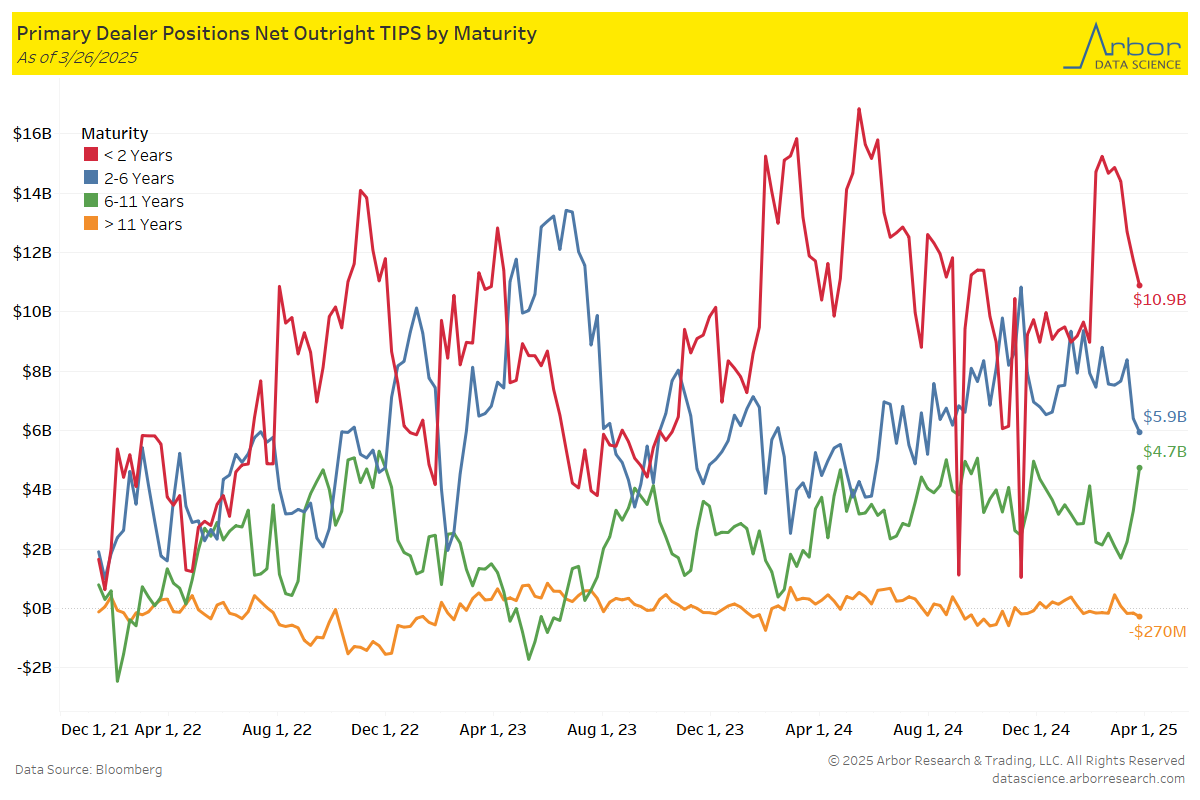

- < 2 years: $11.7 Bn on 3/19/25 to $10.9Bn on 3/26/25 = ($0.8 Bn)

- 2 – 6 years: $6.4 Bn on 3/19/25 to $5.9 Bn on 3/26/25 = ($0.5 Bn)

- 6 – 11 years: $3.3 Bn on 3/19/25 to $4.7 Bn on 3/26/25 = $1.4 Bn

- > 11 years: ($151 Mn) on 3/19/25 to ($270 Mn) on 3/26/25 = ($119 Mn)

Intraday Commentary From Jim Bianco

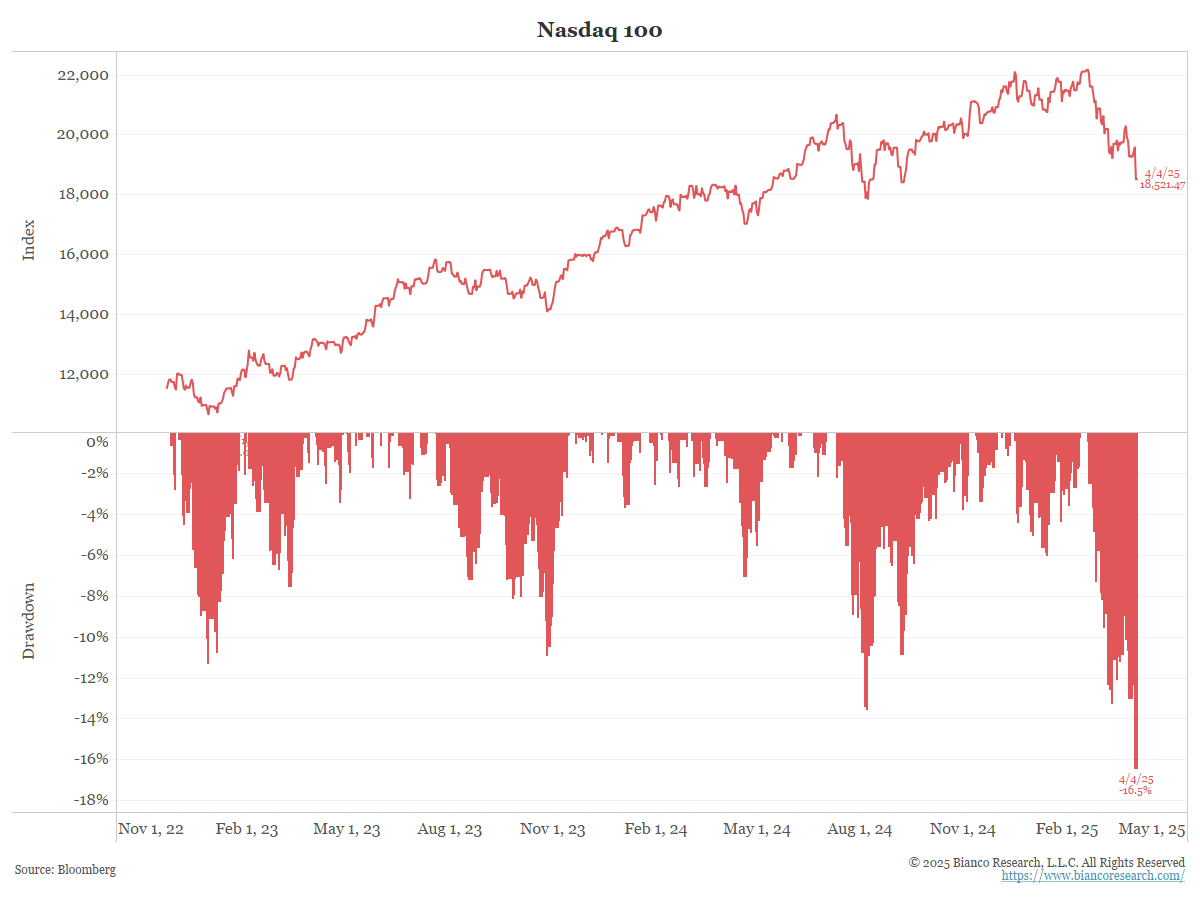

What is a market crash?

It is not unbridled panic to get out at any price.

Instead, it is a hard and fast decline that reaches a point that something “breaks.” It creates forced sellers that must get out of any price, routing the market.

Examples are portfolio insurance in 1987 and LDI in the 30-year Gilt market in 2022.

The S&P fell 5% yesterday. It is now down 6%. Has something broken, creating forced sellers at any price? Is the market close to this level now?

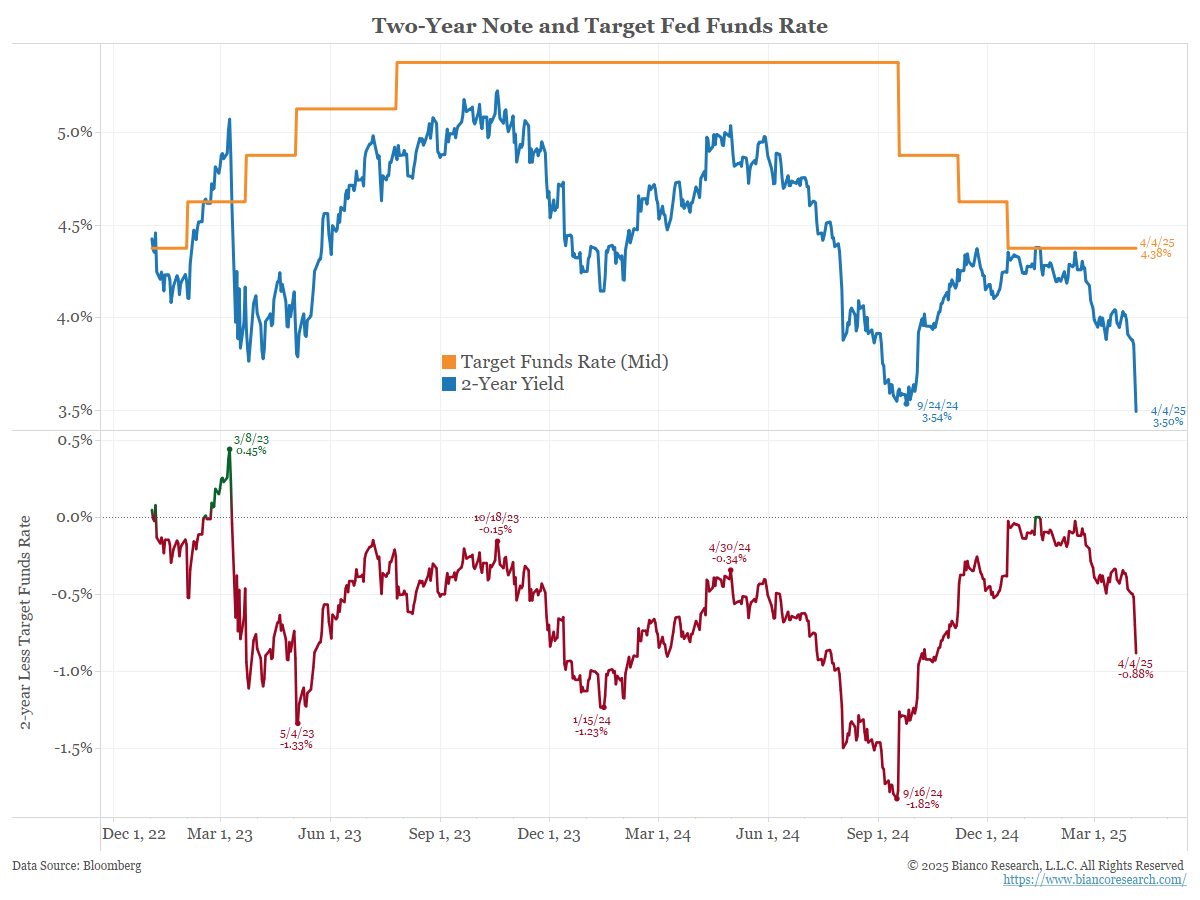

*US 2-YEAR YIELD FALLS TO 3.498%, LOWEST SINCE SEPTEMBER 2022

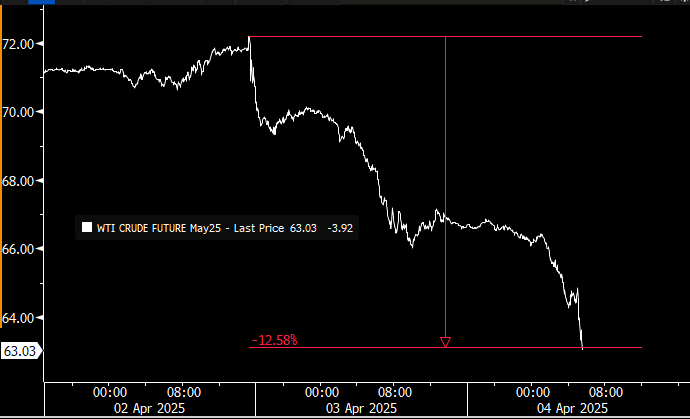

Crude Oil down 12% in less than 48 hours.

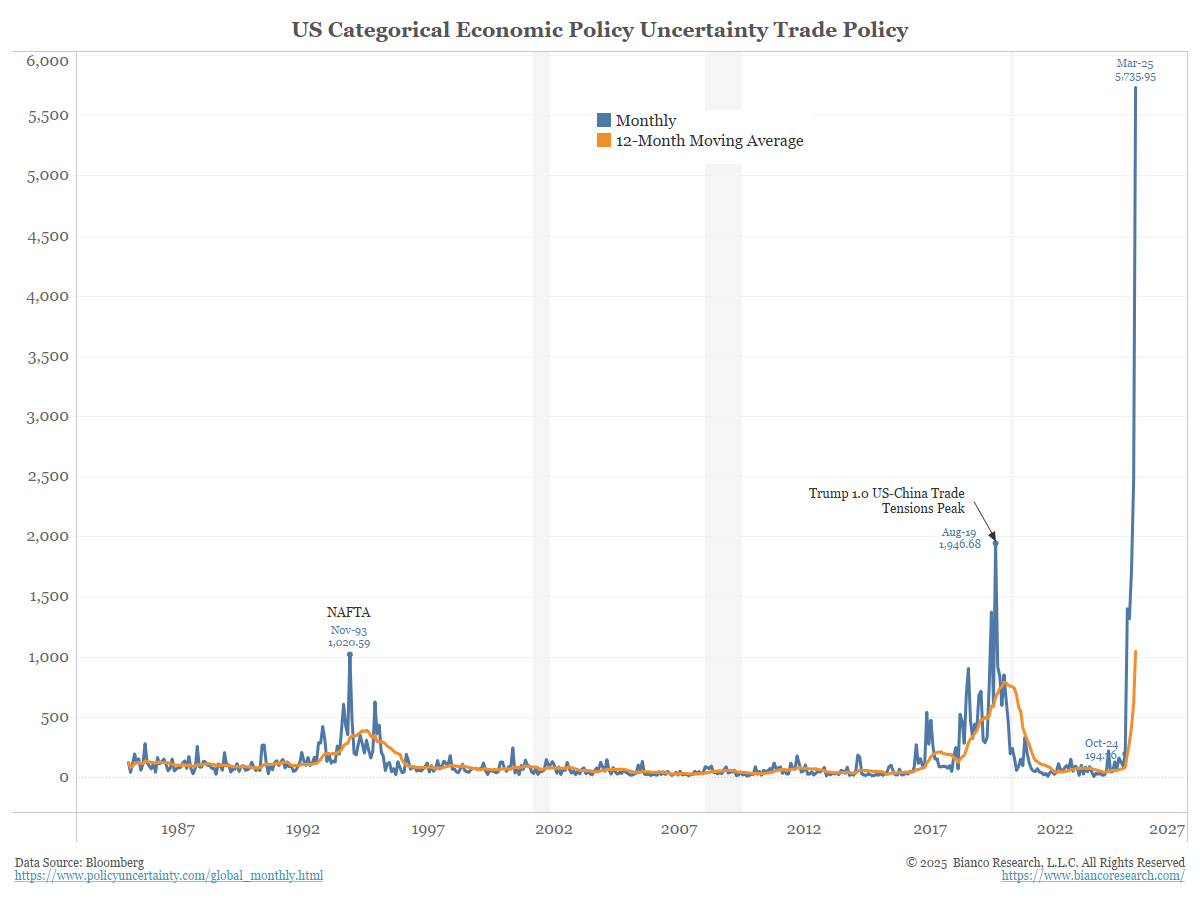

Speaking of uncertainty

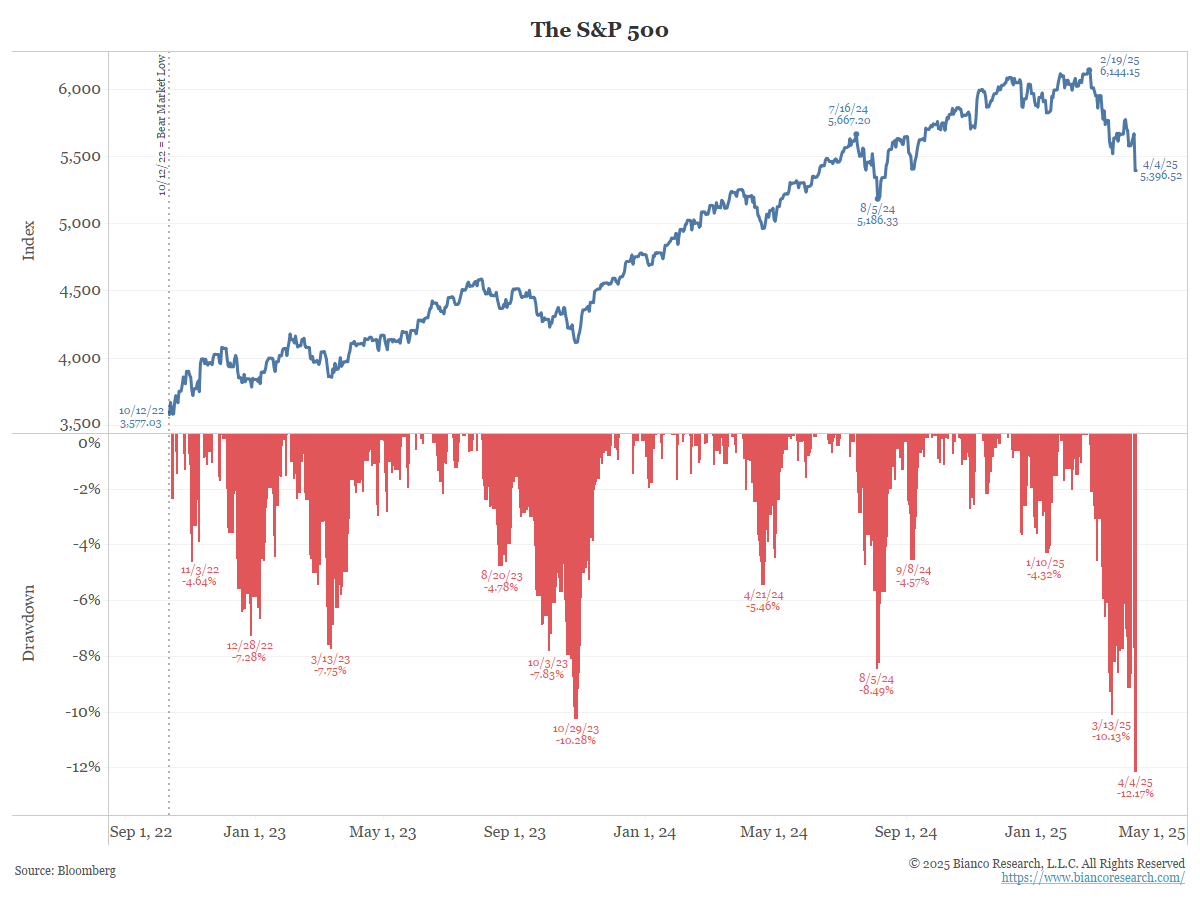

This chart starts on October 12, 2022 … the bottom of the 2022 sell-off, with the S&P 500 down 25%

Down 12% through yesterday’s close. Futures are down another 3% today.

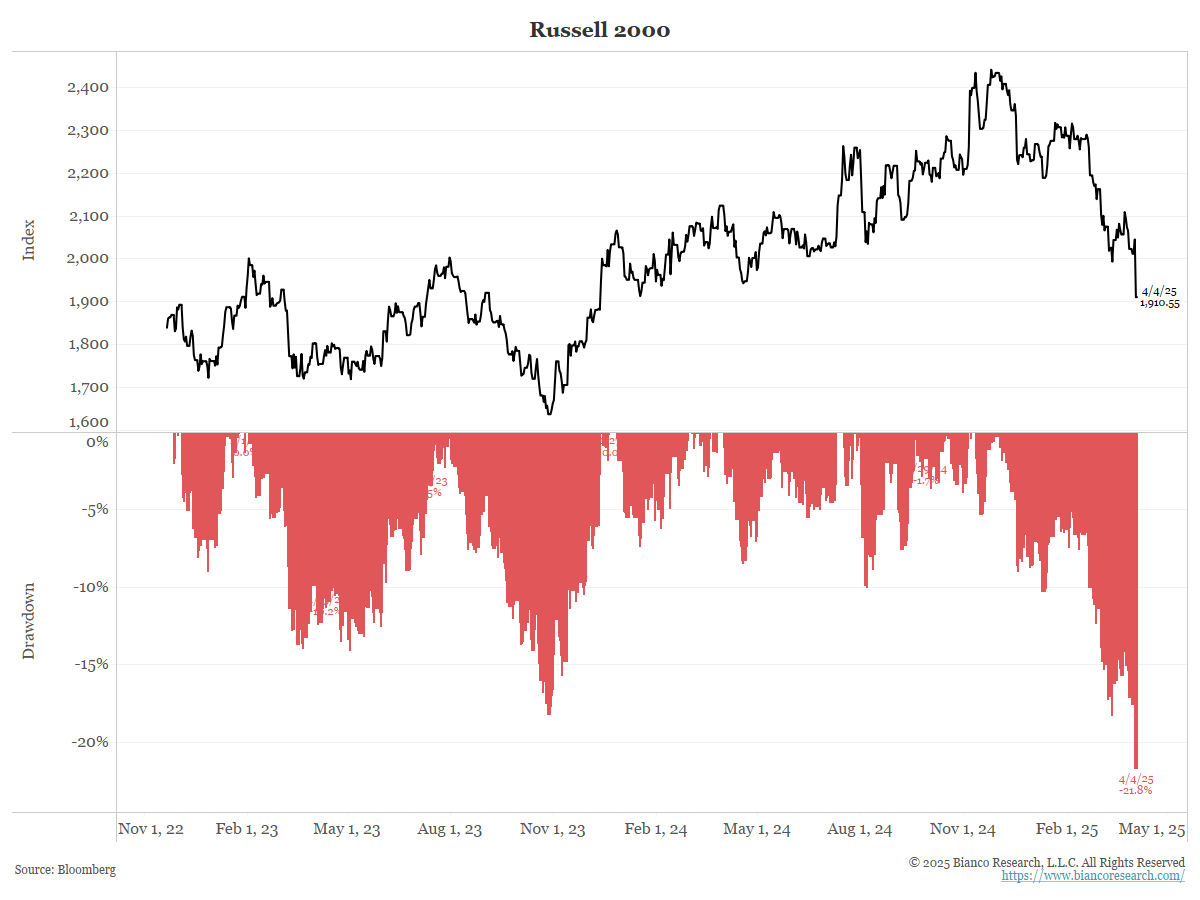

The same construction as the chart above.

Yesterday, the small-cap Russell 2000 was a media-defined bear market. R2000 futures down another 4%

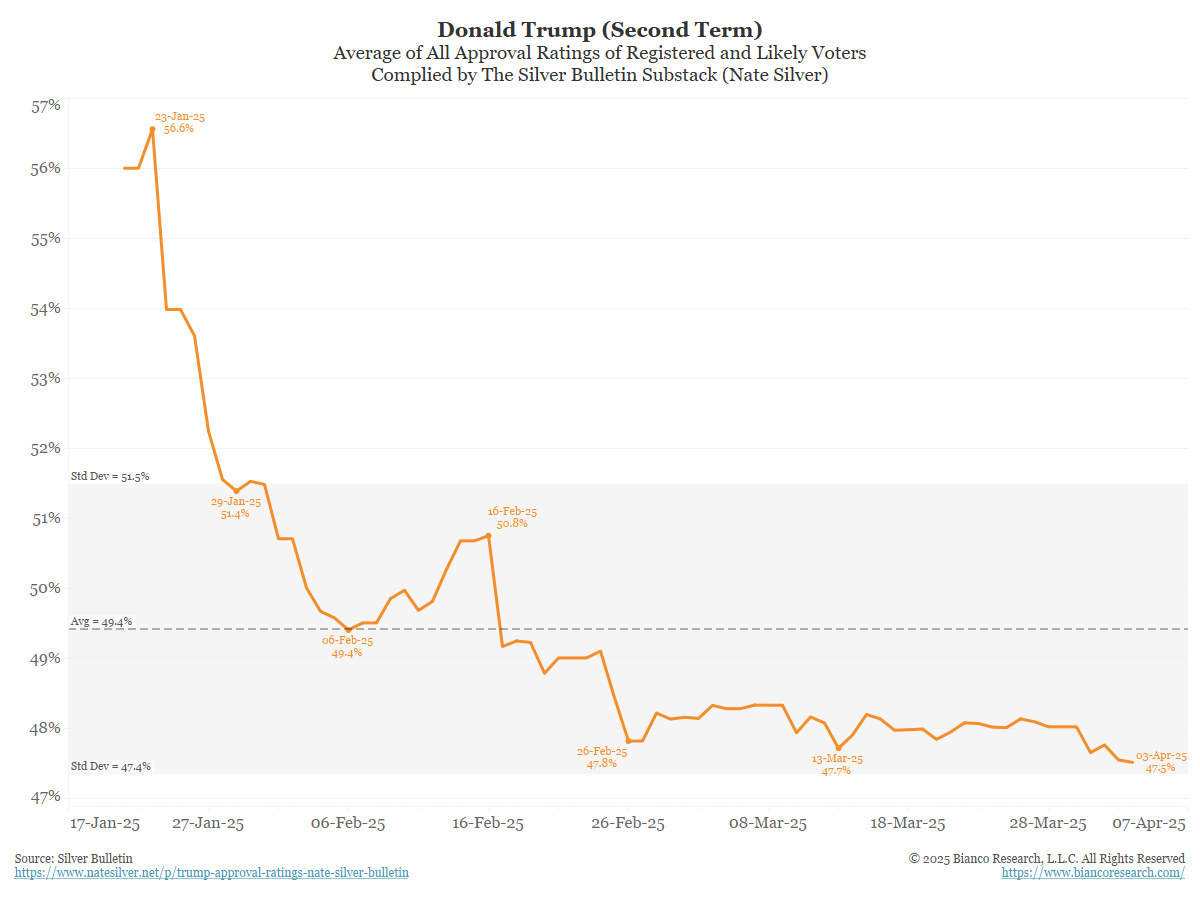

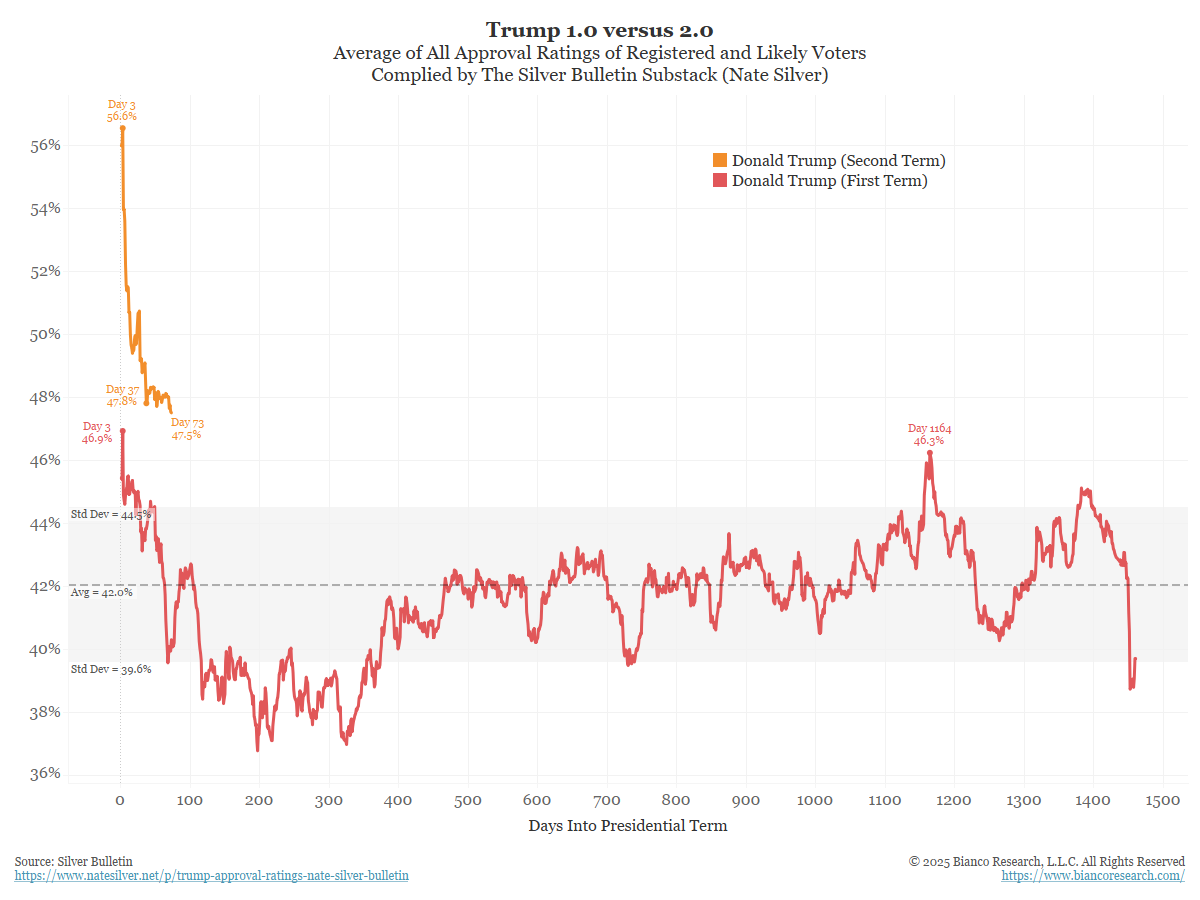

Question about Trump’s approval rating.

The rolling average of all polls is holding at 47%

Still higher than anything from Trump 1.0

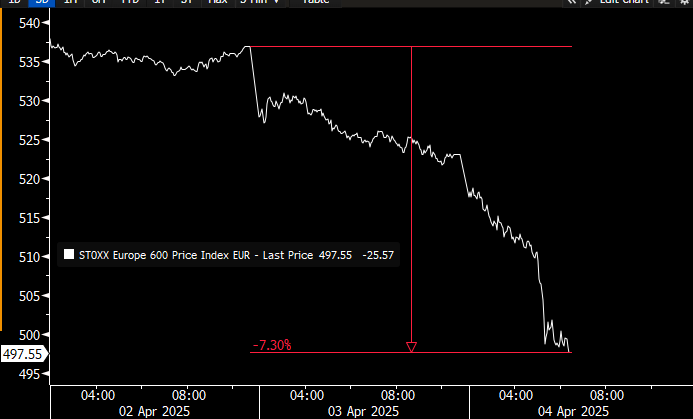

*STOXX EUROPE 600 INDEX FALLS 5.2%, MOST SINCE MARCH 2020

The last 48 hours

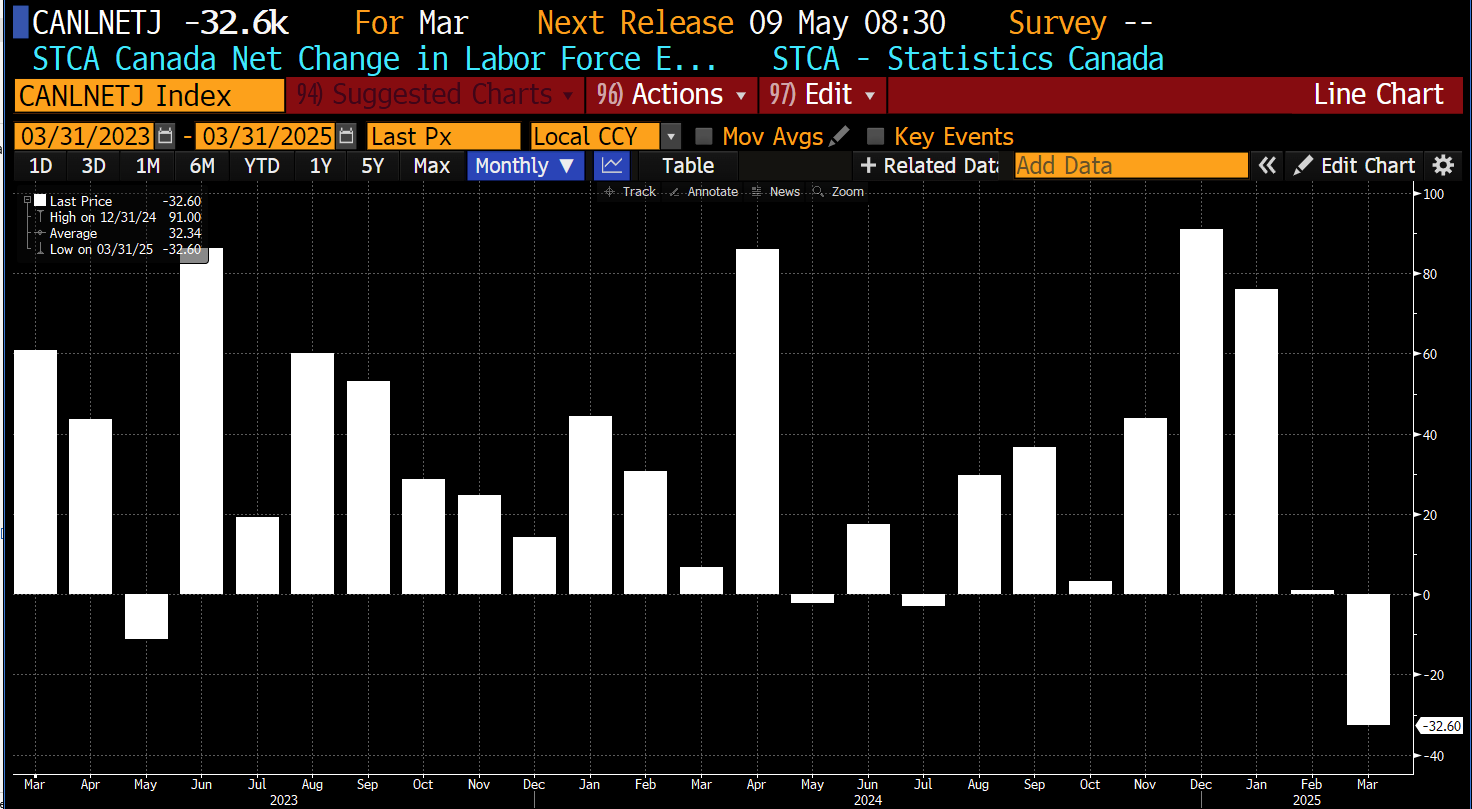

Canadian Payrolls … see the last two months (Feb and Mar) since tariff talk turned white hot.

Who is really under the gun to deal?

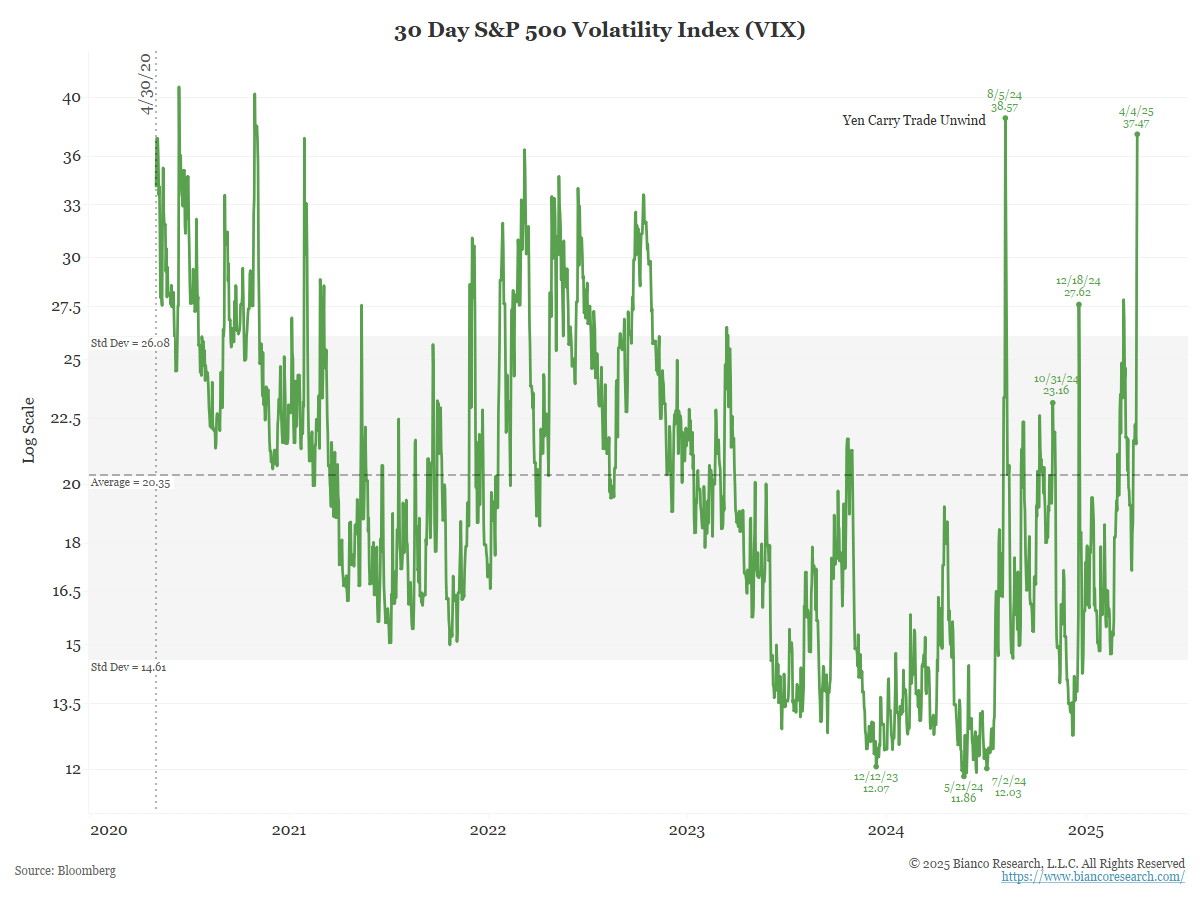

VIX since COVID

The VIX hit 45 intraday earlier this AM

In the News…

Visual Capitalist: Mapped: Which U.S. States Import the Most from China?

Cox Automotive: New Auto Tariffs Are Now in Place, Driving the Industry into Uncharted Territory

It’s on! As our Chief Economist Jonathan Smoke feared, the “unthinkable” has happened.

Upcoming Economic Releases & Fed Speak

- 4/07/2025 at 03:00pm EST: Consumer Credit

- 4/08/2025 at 06:00am EST: NFIB Small Business Optimism

- 4/08/2025 at 02:00pm EST: Fed’s Daly Speaks in Discussion on Economic Outlook

- 4/09/2025 at 07:00am EST: MBA Mortgage Applications

- 4/09/2025 at 10:00am EST: Wholesale Trade Sales MoM & Whole Inventories MoM

- 4/09/2025 at 11:00am EST: Fed’s Barkin Speaks to Economic Club of Washington DC

- 4/09/2025 at 02:00pm EST: FOMC Meeting Minutes

- 4/10/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI Index NSA

- 4/10/2025 at 08:30am EST: Real Average Hourly Earnings & Real Average Weekly Earnings

- 4/10/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/10/2025 at 09:30am EST: Fed’s Logan Gives Welcome Remar

- 4/10/2025 at 12:00pm EST: Fed’s Goolsbee Speaks at Economic Club of NY

- 4/10/2025 at 12:30pm EST: Fed’s Harker Speaks on Fintech

- 4/10/2025 at 02:00pm EST: Federal Budget Balance

- 4/11/2025 at 08:30am EST: PPI Final Demand MoM/ PPI Ex Food and Energy MoM

- 4/11/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM; PPI Final Demand YoY

- 4/11/2025 at 08:30am EST: PPI Ex Food and Energy YoY and PPI Ex Food, Energy, Trade YoY

- 4/11/2025 at 10:00am EST: U. of Mich. Sentiment / U. of Mich. Current Conditions

- 4/11/2025 at 10:00am EST: U. of Mich. Expectations/ U. of Mich. 1 Yr Inflation / U. of Mich. 5 – 10 Yr Inflation

- 4/11/2025 at 10:00am EST: Fed’s Musalem Speaks on U.S. Economy

- 4/11/2025 at 11:00am EST: Fed’s Williams Speaks on Outlook, Monetary Policy