US Treasuries

- Monday’s range for UST 10y: 3.885% – 4.21%, closing at 4.15%

- Fed’s Kluger: says Inflation more than urgent tariff issue right now

Bloomberg: US Bonds Stumble as Traders Debate Just How Much the Fed Can Cut

Signs of exhaustion are emerging in the US bond market after its biggest weekly rally since August.

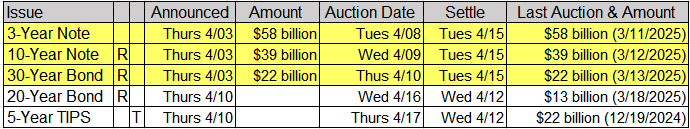

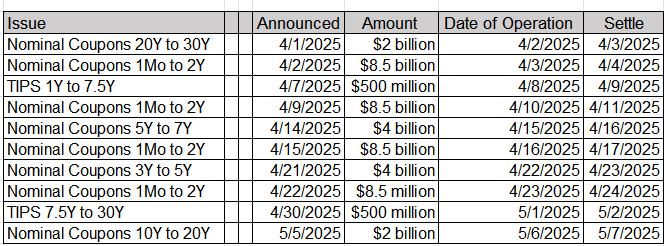

Upcoming US Treasury Supply

Join Us for the Next Conference Call: Thursday, April 10, 2025, Featuring Jim Bianco

Intraday Commentary From Jim Bianco

S&P futures have rallied 200 points, or 3% off the Sunday night lows. Still down 1.5% from Friday’s close.

This was enough to get the 10-year yield back to unchanged at 4%, and the 30-year yield is now up 3 bps at 4.44%.

The only way the bond market rallies is under the CONSTANT threat of the world imploding. The second, it looks like we will live, and it sells off.

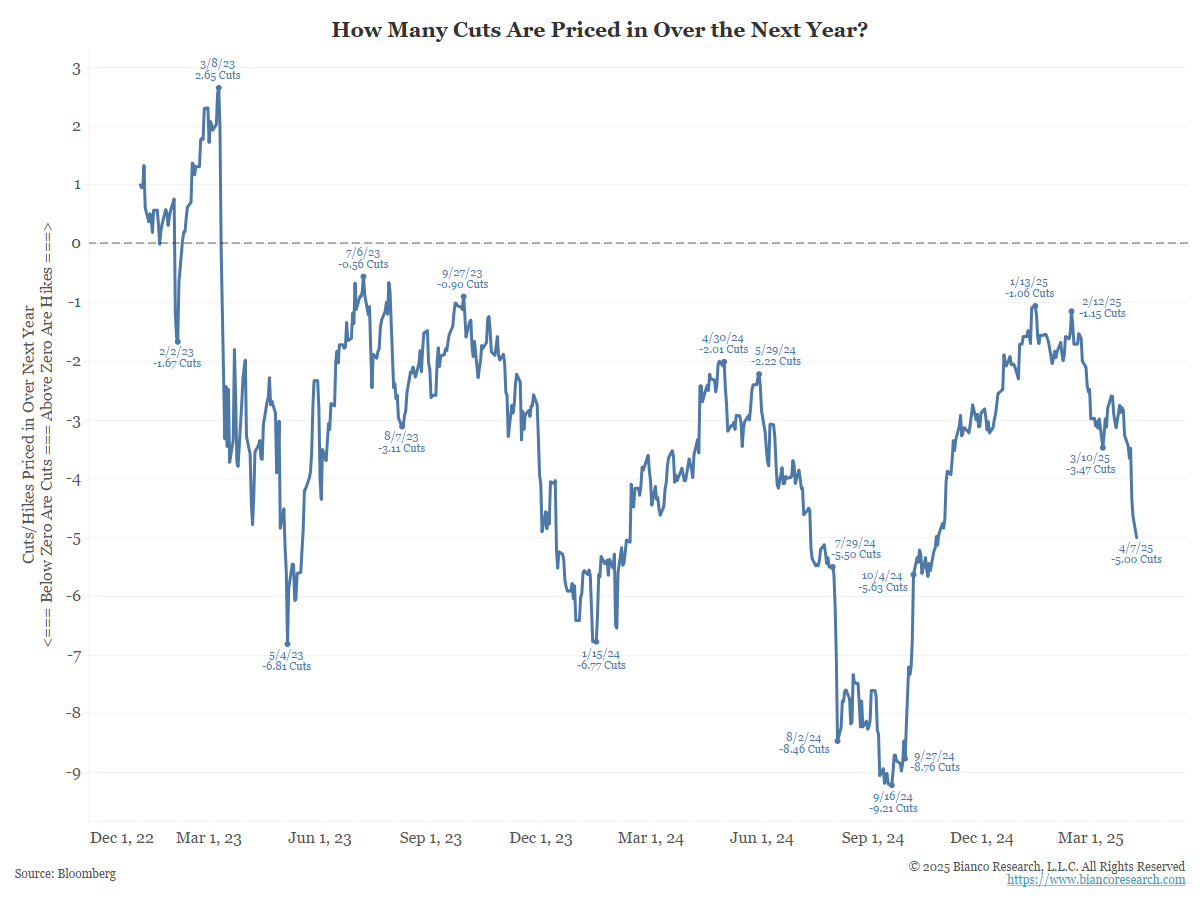

This headline is wrong. The fed fund futures market is not pricing five cuts in 2025, but five cuts over the next year (through April 2026). This distinction includes the first three meetings of 2026.

*TRADERS FULLY PRICE FIVE FED INTEREST-RATE CUTS THROUGH 2025

Also, this measure has a terrible track record.

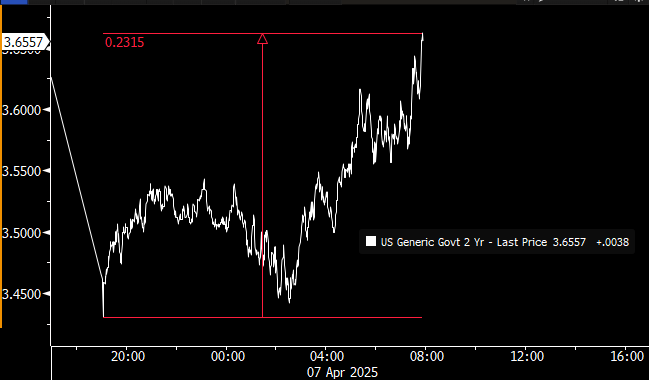

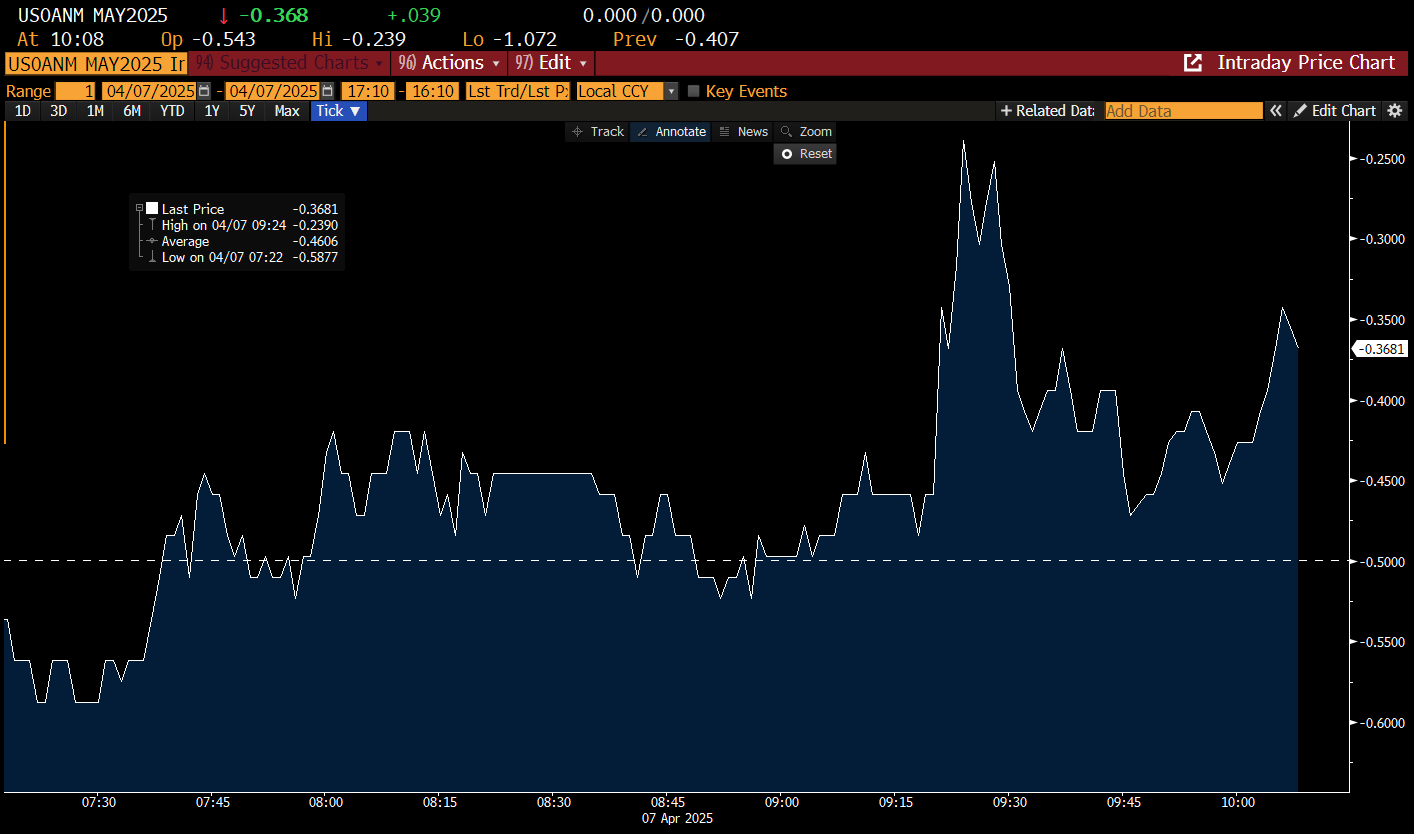

2-year one-day tick chart

Stocks are back down 4%, and 10- and 30-year yields are still up on the day.

Are stocks trading over the inability of bonds to rally as much as they are on tariffs?

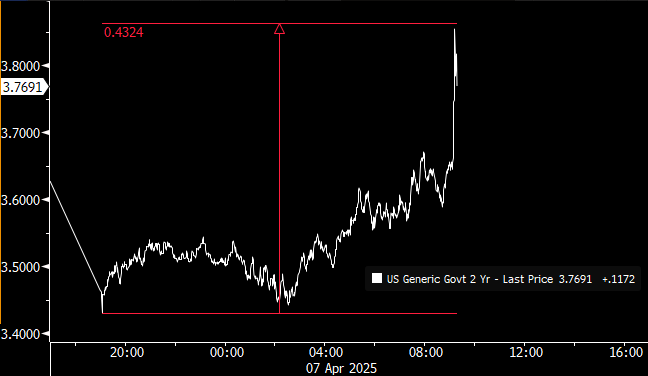

One-day tick chart of the 2-year yield: Up 44 bps from last night’s low. That used to be a good month.

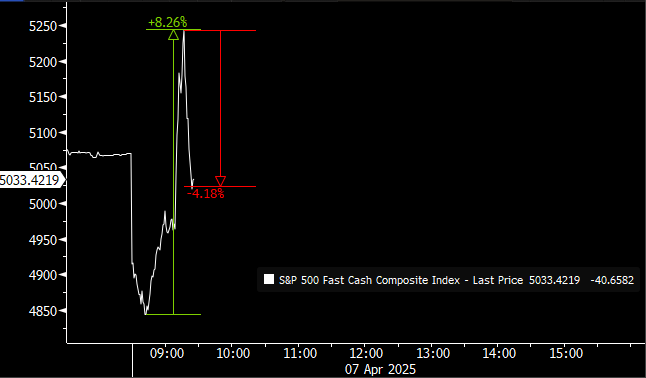

In the last 45 minutes … the S&P rallied more than 8% and then decline over 4%.

This started it …HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA

And it is only Monday morning!!

Update

Green annotation

HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA

Red annotation

Eamon Javers on CNBC: Nobody here at the White House is aware of any plans of any 90 day pause.

WHITE HOUSE TELLS CNBC 90-DAY PAUSE ON TARIFFS IS ‘FAKE NEWS’

5 1/2 hours of trading left today.

Probability of a May 7 cut over the last three hours.

From 60% cut, to 21%, to 45% and now 36%

And the meeting is one month from today!

In the News…

The Mirror: Banks close 272 locations across the US as closures to break historic low in next five years

At least 272 bank locations in the United States filed for store closures within the first quarter of the year, according to the Office of the Comptroller of the Currency. The data comes after a study from Self Financial found figures suggest this year’s bank closures will surpass last year’s bloodbath when over 1,000 stores shuttered.

According to the study, bank outposts could fall below 16,000 by 2030, which would be a historic low not seen since 1965.

OilPrice: Goldman Sachs Slashes Oil Price Forecast to Below $60 in 2026

Higher risks of recessions and higher-than-expected OPEC+ production prompted Goldman Sachs to slash again its oil price forecasts for 2026, days after it had already cut its price outlook in the wake of the U.S. tariffs announcement last week.

Bloomberg: Tariffs Are Dragging Down Even Companies Without US Exports

It’s been a historic Monday across Asian markets, as Japanese and South Korean exporters plummeted, Taiwan Semiconductor Manufacturing Co. fell by the daily limit in Taipei, and even China’s biggest names took huge hits.

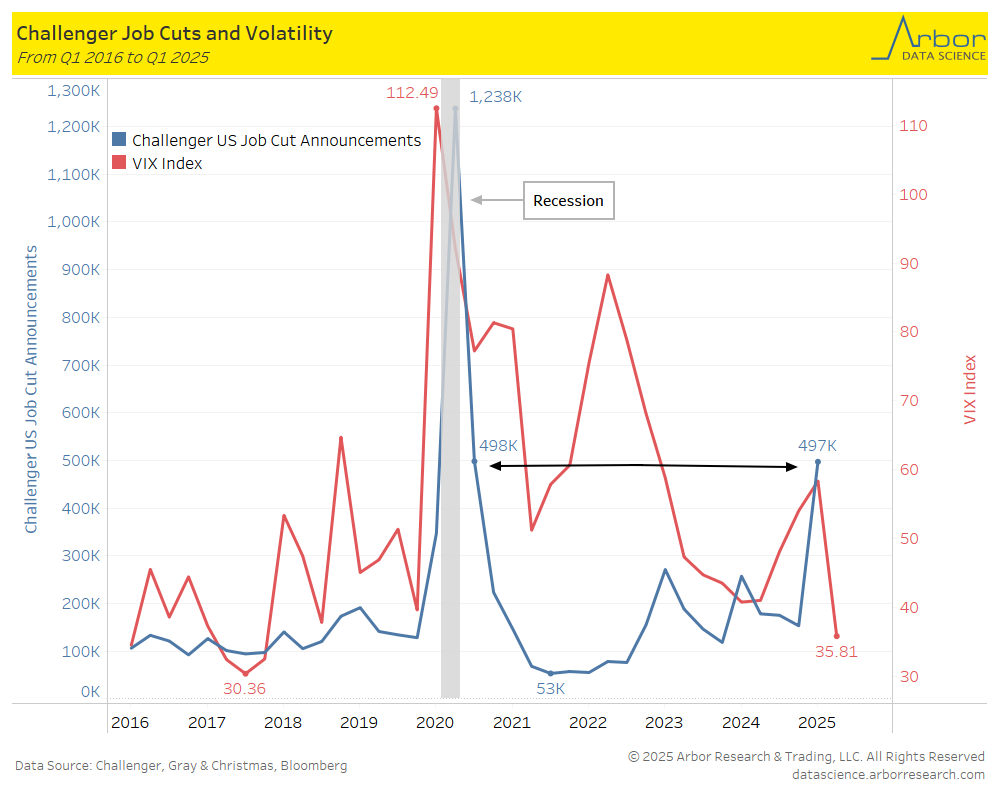

Arbor Data Science: Measuring Job Cuts, Financial Well-Being and Consumer Stress

Upcoming Economic Releases & Fed Speak

- 4/08/2025 at 06:00am EST: NFIB Small Business Optimism

- 4/08/2025 at 02:00pm EST: Fed’s Daly Speaks in Discussion on Economic Outlook

- 4/09/2025 at 07:00am EST: MBA Mortgage Applications

- 4/09/2025 at 10:00am EST: Wholesale Trade Sales MoM & Whole Inventories MoM

- 4/09/2025 at 11:00am EST: Fed’s Barkin Speaks to Economic Club of Washington DC

- 4/09/2025 at 02:00pm EST: FOMC Meeting Minutes

- 4/10/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI Index NSA

- 4/10/2025 at 08:30am EST: Real Average Hourly Earnings & Real Average Weekly Earnings

- 4/10/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/10/2025 at 09:30am EST: Fed’s Logan Gives Welcome Remark

- 4/10/2025 at 10:00am EST: Fed’s Schmid Speaks on Economy, Policy

- 4/10/2025 at 12:00pm EST: Fed’s Goolsbee Speaks at Economic Club of NY

- 4/10/2025 at 12:30pm EST: Fed’s Harker Speaks on Fintech

- 4/10/2025 at 02:00pm EST: Federal Budget Balance

- 4/11/2025 at 08:30am EST: PPI Final Demand MoM/ PPI Ex Food and Energy MoM

- 4/11/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM; PPI Final Demand YoY

- 4/11/2025 at 08:30am EST: PPI Ex Food and Energy YoY and PPI Ex Food, Energy, Trade YoY

- 4/11/2025 at 10:00am EST: U. of Mich. Sentiment / U. of Mich. Current Conditions

- 4/11/2025 at 10:00am EST: U. of Mich. Expectations/ U. of Mich. 1 Yr Inflation / U. of Mich. 5 – 10 Yr Inflation

- 4/11/2025 at 10:00am EST: Fed’s Musalem Speaks on U.S. Economy

- 4/11/2025 at 11:00am EST: Fed’s Williams Speaks on Outlook, Monetary Policy

- 4/14/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 4/14/2025 at 06:00pm EST: Fed’s Harker Speaks on Role of Fed

- 4/14/2025 at 07:40am EST: Fed’s Bostic Speaks in Fireside Chat on Policy