US Treasuries

- Wednesday’s range for UST 10y: 4.33% – 4.51%, closing at 4.38%

- Fed’s Barkin: says tariff price hikes could start by June

- Fed’s Musalem: sees growth slipping below trend, higher inflation risk

- Fed Minutes: May face difficult tradeoffs if inflation is more persistent

Wall Street Journal: Fed Officials Flagged Risks of “More Persistent” Inflation From Tariffs

Federal Reserve officials highlighted the risks of longer-lasting inflationary pressures from tariffs when they agreed to hold interest rates steady at their meeting last month.

Bloomberg: Treasuries ‘Fire Sale’ Sends Long-Term Yields Soaring Worldwide

The exodus from longer-dated US Treasuries accelerated, fueling the biggest selloff since 2020 in what are supposed to be the world’s safest assets.

Bloomberg: There Isn’t a Practical Alternative to US Treasuries

US government debt is the world’s benchmark for a reason — and that hasn’t changed.

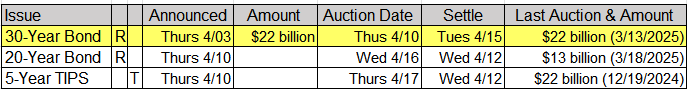

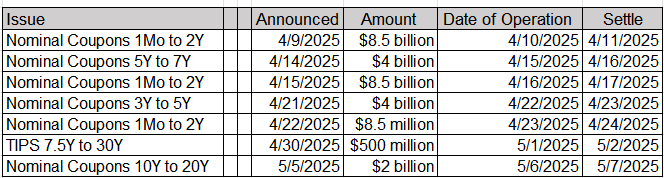

Upcoming US Treasury Supply

Join Us for the Next Conference Call: Tomorrow, April 10, 2025, Featuring Jim Bianco

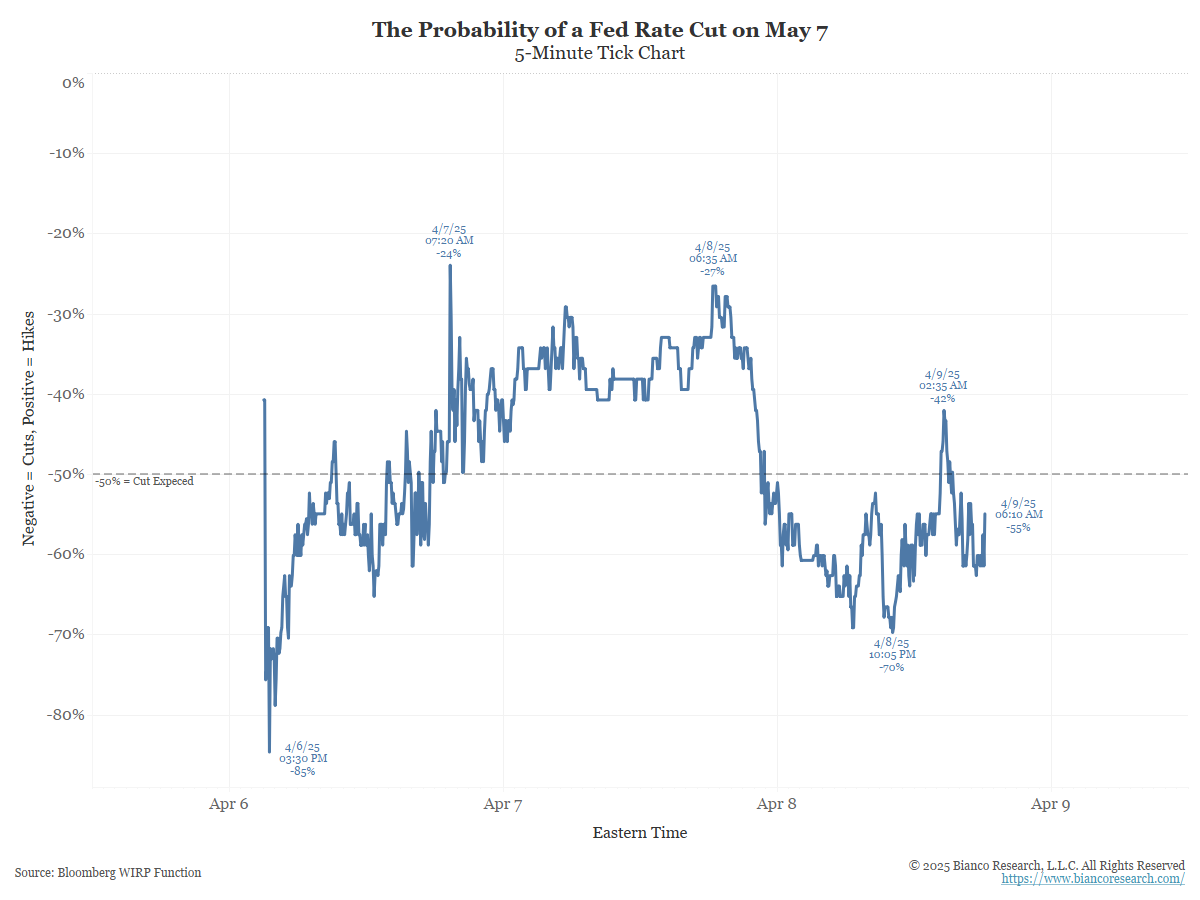

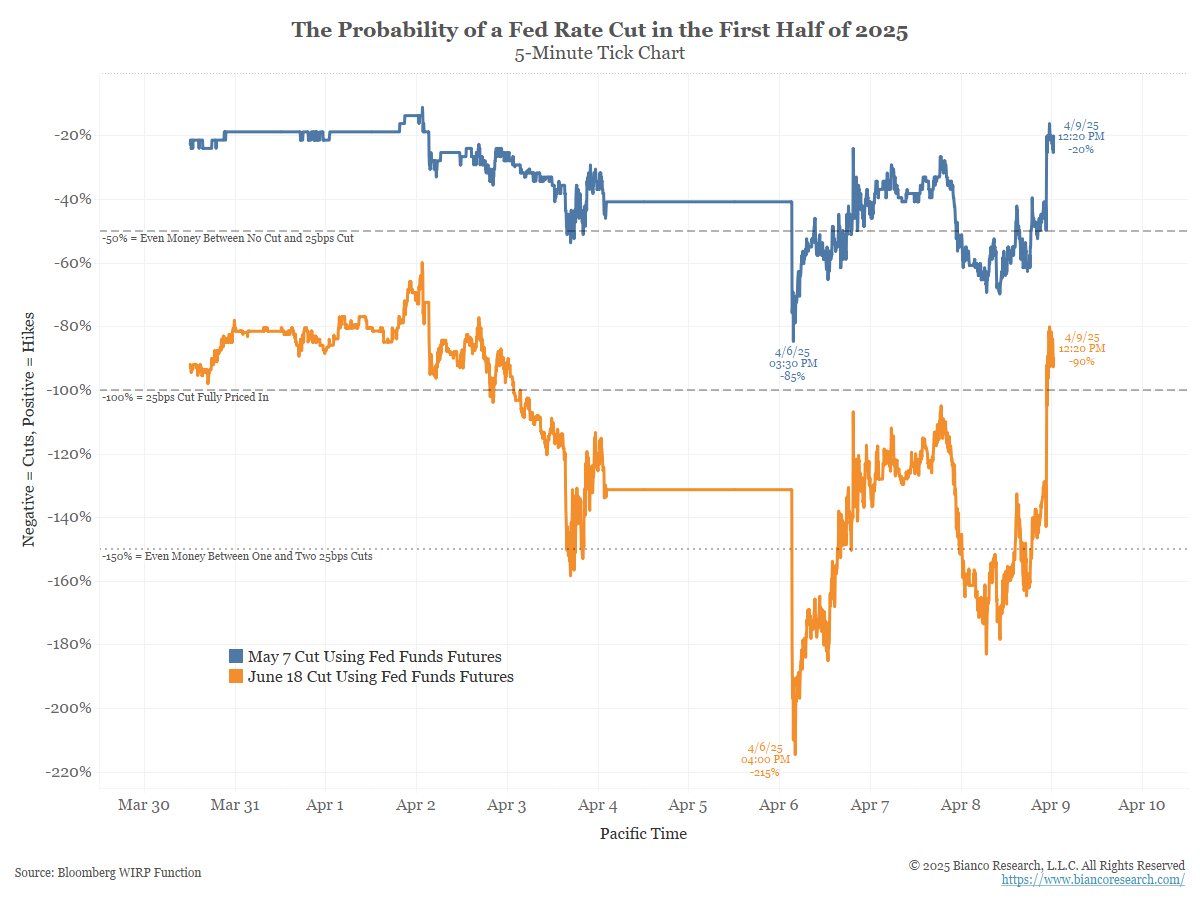

Why is it only 55% that the Fed will cut rates in 4 weeks? Should it be 90% of an intraday cut TODAY?!

Answer … the market is telling you a rate cut will not make a difference. So, it is not demanding one.

Why isn’t it demanding one?

The fear of tariff-driven inflation. Stimulating an economy when a big rise in CPI is expected could be disastrous.

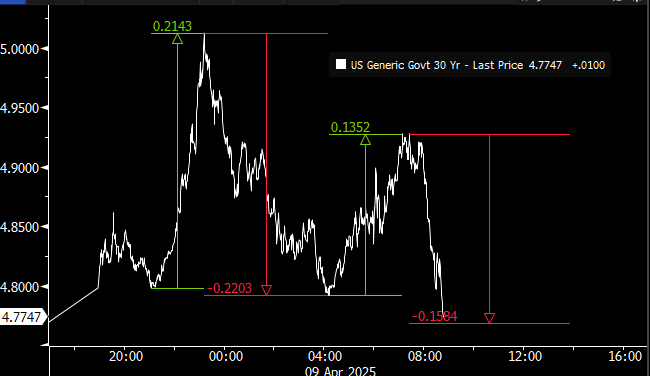

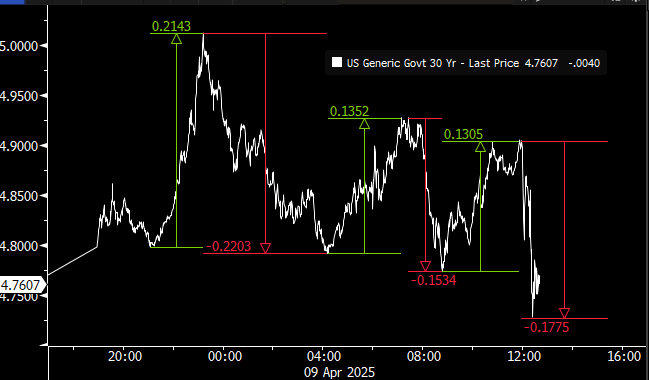

Look at the 30-year yield swings since the NYSE close yesterday!

This would be a big quarter, let alone 14 hours.

Five swings in the 30-year yield of at least 13 bps TODAY!

Now six moves of at least 13 bps TODAY!

If it wasn’t for COVID, 5 years ago, this would be unprecedented. Now it is the second time we’ve seen markets like this.

May 7 Fed cut now 20%

June 18 Fed cut now 90%

In the News…

OilPrice: Oil Prices Crash Below $60 as Tariff War Reaches Boiling Point

Oil markets are reeling as the U.S.-China trade war escalates into a full-blown economic firestorm. China’s latest retaliatory tariffs—slapped on top of Trump’s tit-for-tat measures—have sent shockwaves through global commodity markets, driving oil prices to their lowest since 2021.

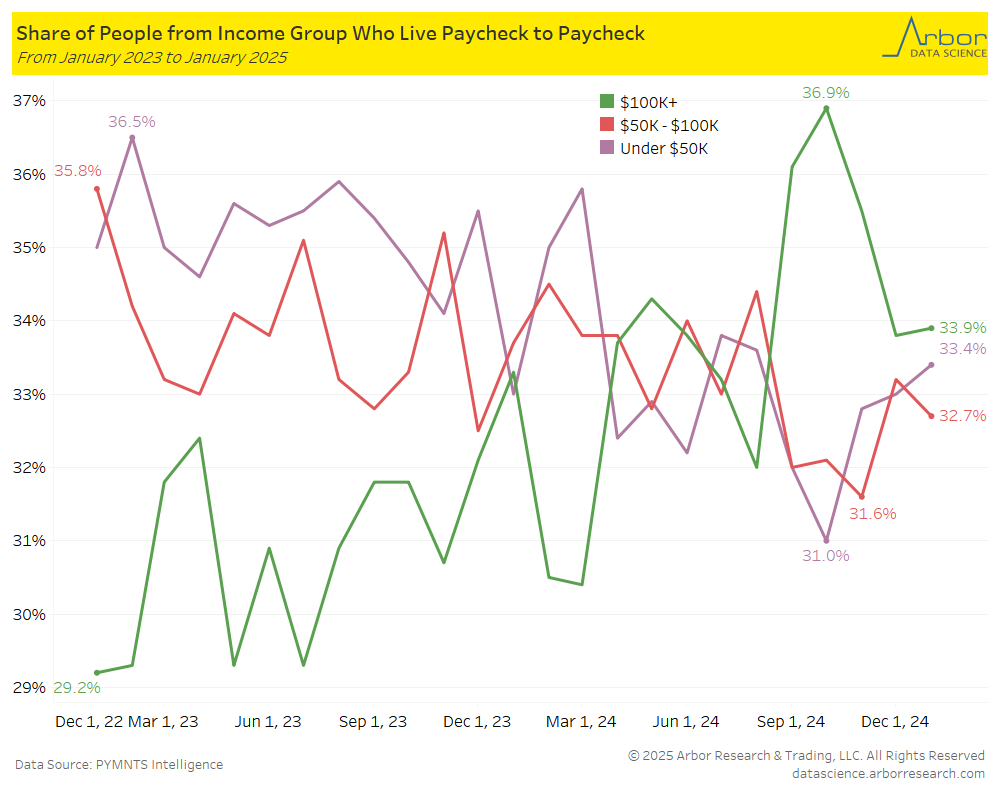

Arbor Data Science: Consumers Living Paycheck-to-Paycheck in America

ZeroHedge: “We’re Monitoring Carefully”: Emergency 401(k) Early Withdraws Rise Above Historic Norms

ZeroHedge: “We’re Monitoring Carefully”: Emergency 401(k) Early Withdraws Rise Above Historic Norms

Financial emergencies have driven more Americans to tap into their 401(k) accounts—a trend already underway before President Trump took office.

Axios: Facing a crisis, Americans do their thing and shop

When the going gets tough, Americans go shopping. With high tariffs about to engulf the country, they’re doing it again.

Upcoming Economic Releases & Fed Speak

- 4/10/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy MoM

- 4/10/2025 at 08:30am EST: CPI Index NSA

- 4/10/2025 at 08:30am EST: Real Average Hourly Earnings & Real Average Weekly Earnings

- 4/10/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 4/10/2025 at 09:30am EST: Fed’s Logan Gives Welcome Remark

- 4/10/2025 at 10:00am EST: Fed’s Schmid Speaks on Economy, Policy

- 4/10/2025 at 12:00pm EST: Fed’s Goolsbee Speaks at Economic Club of NY

- 4/10/2025 at 12:30pm EST: Fed’s Harker Speaks on Fintech

- 4/10/2025 at 02:00pm EST: Federal Budget Balance

- 4/11/2025 at 08:30am EST: PPI Final Demand MoM/ PPI Ex Food and Energy MoM

- 4/11/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM; PPI Final Demand YoY

- 4/11/2025 at 08:30am EST: PPI Ex Food and Energy YoY and PPI Ex Food, Energy, Trade YoY

- 4/11/2025 at 10:00am EST: U. of Mich. Sentiment / U. of Mich. Current Conditions

- 4/11/2025 at 10:00am EST: U. of Mich. Expectations/ U. of Mich. 1 Yr Inflation / U. of Mich. 5 – 10 Yr Inflation

- 4/11/2025 at 10:00am EST: Fed’s Musalem Speaks on U.S. Economy

- 4/11/2025 at 11:00am EST: Fed’s Williams Speaks on Outlook, Monetary Policy

- 4/14/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 4/14/2025 at 06:00pm EST: Fed’s Harker Speaks on Role of Fed

- 4/14/2025 at 07:40am EST: Fed’s Bostic Speaks in Fireside Chat on Policy

- 4/15/2025 at 08:30am EST: Empire Manufacturing

- 4/15/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum & Import Price Index YoY

- 4/15/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY

- 4/16/2025 at 07:00am EST: MBA Mortgage Applications

- 4/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas

- 4/16/2025 at 08:30am EST: Retail Sales Control Group & New York Fed Services Business Activity

- 4/16/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 4/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 4/16/2025 at 12:00pm EST: Fed’s Hammack Speaks in Moderated Q&A

- 4/16/2025 at 4:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 4/16/2025 at 4:00pm EST: Fed’s Schmid Chats with Fed’s Logan on Economy, Banking