US Treasuries

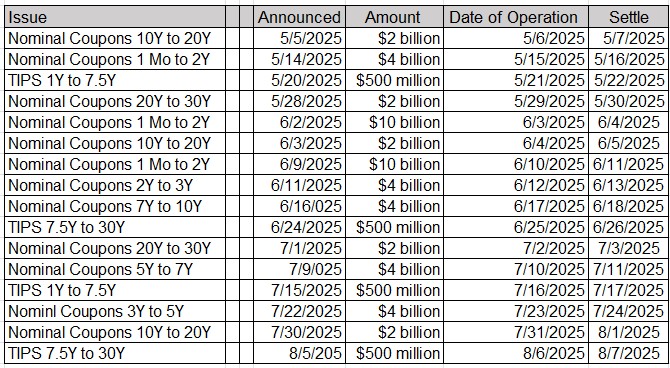

- Thursday’s range for UST 10y: 4.12% – 4.24%, closing at 4.225%

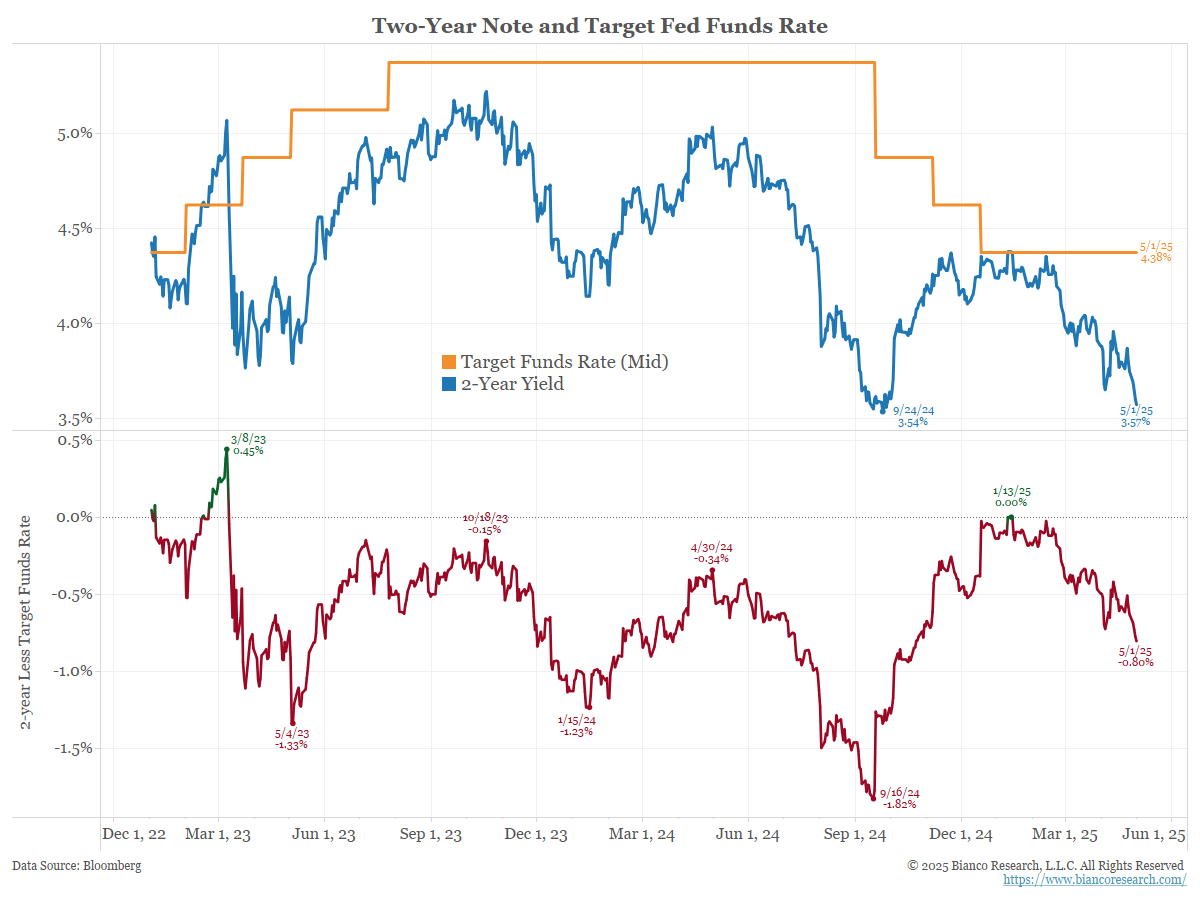

Bloomberg: Bessent Says Two-Year Treasuries Are Signaling Fed Should Cut

Treasury Secretary Scott Bessent said that the US Treasury market is sending a signal that the Federal Reserve ought to lower interest rates.

Bloomberg: Summers Says It’s Wrong to Say Markets Tell Fed It Should Cut

Former Treasury Secretary Lawrence Summers said that bond-market pricing doesn’t amount to a judgment call on what the Federal Reserve ought to do with interest rates, and that it would be a “very serious error” for policymakers to ease next week.

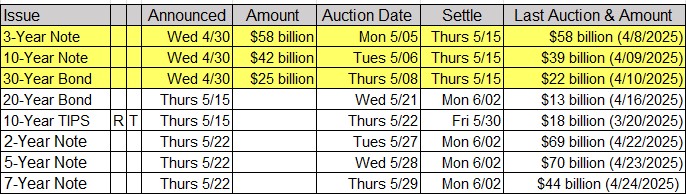

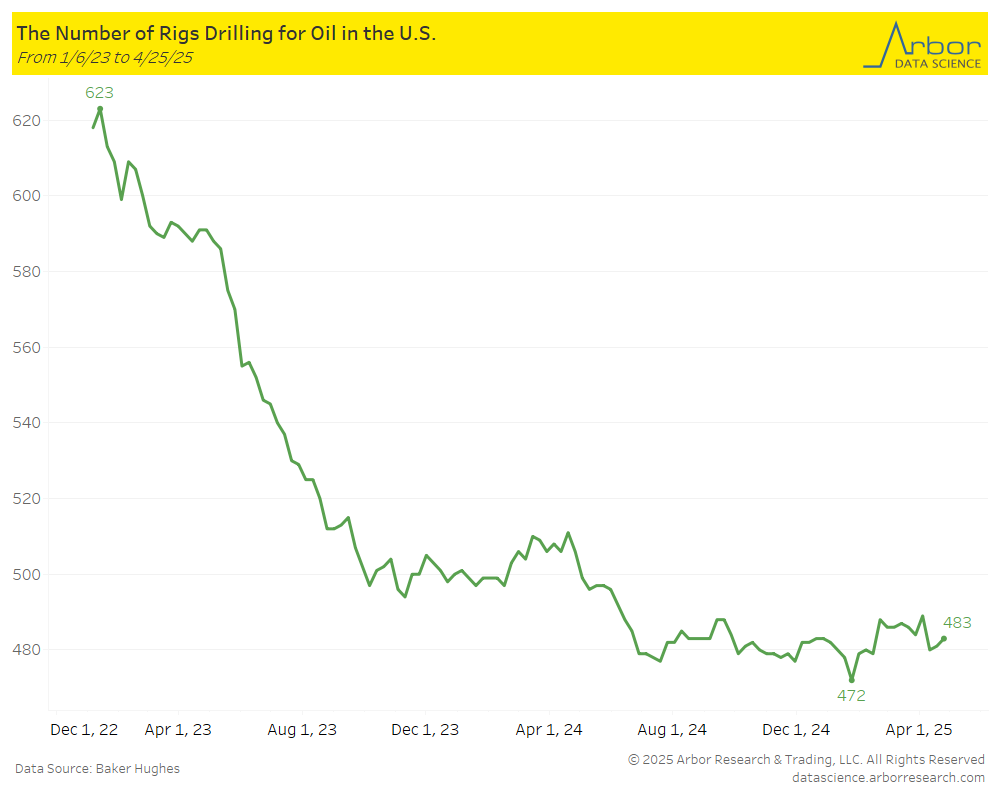

Tentative Schedule of Treasury Buyback Operations

- While “soft data” (surveys and opinions) is predicting economic disaster, “hard data” (actual economic indicators) shows the economy is currently stable.

- There is a debate on whether the Federal Reserve should cut rates in response to recession fears or focus on sticky inflation. This contrasts Wall Street’s preference for rate cuts with Main Street’s concerns about inflation.

- It is important to look at historical instances of negative GDP growth and the Federal Reserve’s response, particularly during the first and second quarters of 2022, when the Fed raised rates despite negative GDP figures due to inflation concerns.

- 50-50 chance of a recession occurring but this could shift dramatically in either direction within the next 90 days due to unusual economic circumstances of realigning the global trade system.

- Tariffs could lead to higher prices and a decrease in consumer spending, which could, in turn, affect GDP growth.

Intraday Commentary From Jim Bianco

However, 10s – 2s has been doing the opposite … steepening.

However, 10s – 2s has been doing the opposite … steepening.

In Other News…

SupplyChainBrain: Airbus Tells U.S. Airlines They’ll Need to Pay Their Own Tariffs

Airbus SE said it won’t cover the cost of tariffs on its planes imported by U.S. airlines, setting up a clash with carriers unwilling to shoulder surcharges imposed by President Donald Trump.

OilPrice: OPEC Plot Twist? Bloomberg Survey Shows Production Drop in April

OPEC just pulled a plot twist. Instead of raising production as planned, the cartel’s April output dropped by 200,000 barrels per day (bpd) to 27.24 million bpd, according to a new Bloomberg survey published on Thursday.

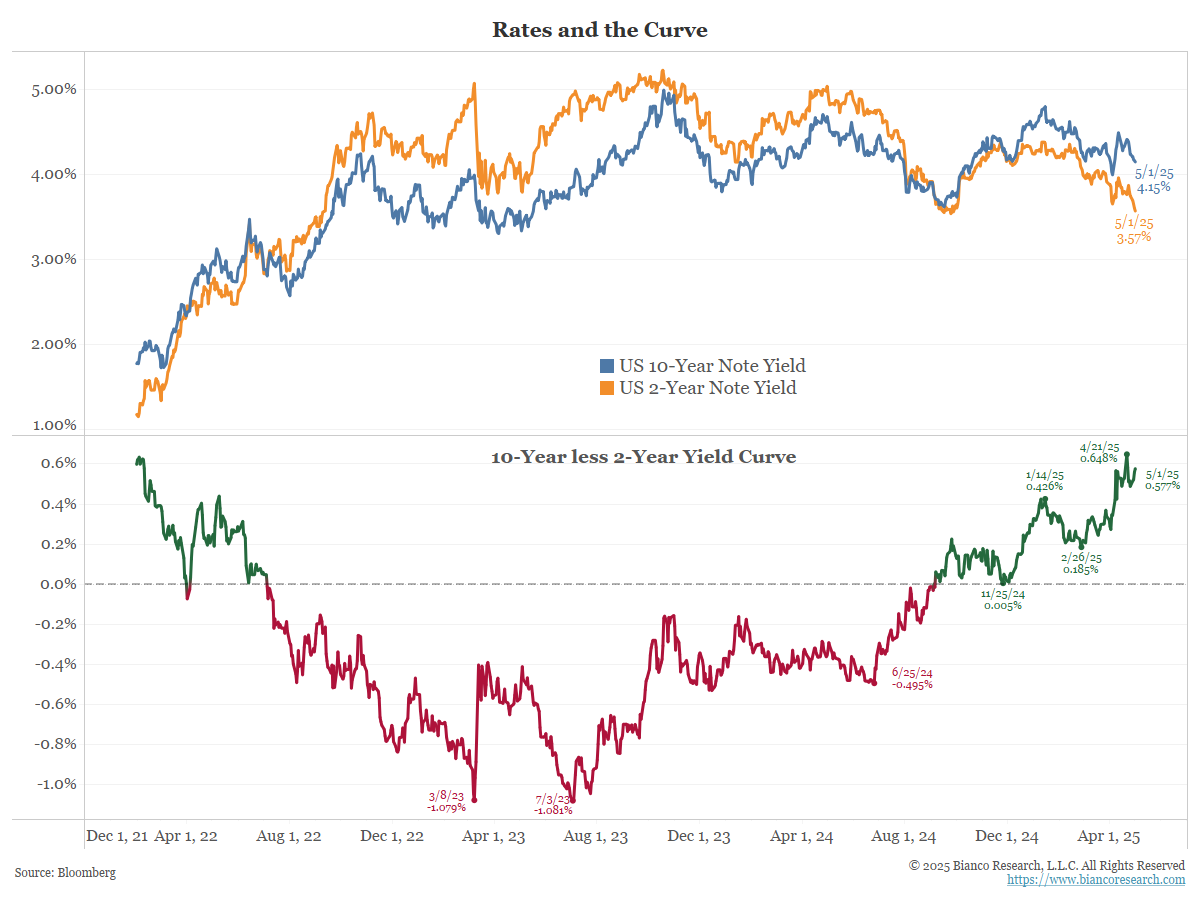

Arbor Data Science: Drilling Down by Sam Rines

Business Insider: BNY calls workers back to the office 4 days a week.

Bank of New York Mellon Corp., known for helping financial clients clear and custody securities, is the latest bank to rein in remote work. In a memo to staff, the firm’s executive committee announced that it was asking employees to return to the office four days a week.

Upcoming Economic Releases & Fed Speak