US Treasuries

- Friday’s range for UST 10y: 4.385% – 4.44%, closing at 4.43%

Bloomberg: Fed to Shrink Staff By About 10% Over Next Several Years

MarketScreener: Former Chair Bernanke Argues for More Fed Transparency

Link to Bernanke’s proposal: Improving Fed communications: A proposal

Marketwatch: Opinion: why is the Fed quietly buying billions in bonds – and hoping nobody notices?

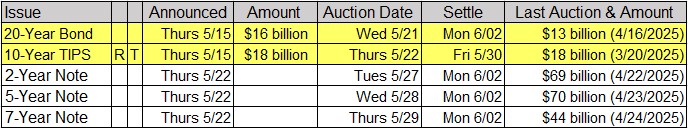

Tentative Schedule of Treasury Buyback Operations

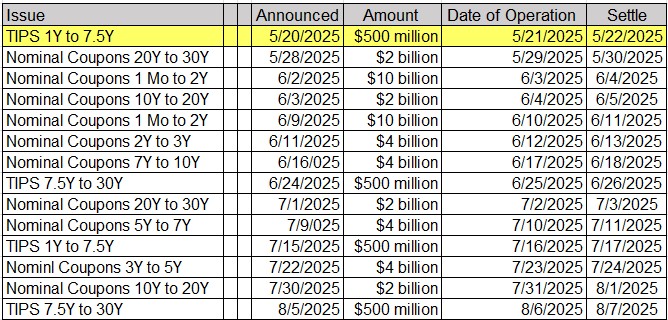

Week over Week Changes by Maturity

- < 2 years: $16.4 Bn on 4/30/25 to $17.4 Bn on 5/07/25 = $1.0 Bn

- 2 – 6 years: $6.8 Bn on 4/30/25 to $6.7 Bn on 5/07/25 = ($0.1 Bn)

- 6 – 11 years: $4.9 Bn on 4/30/25 to $4.5 Bn on 5/07/25 = ($0.4 Bn)

- > 11 years: ($874) Mn on 4/30/25 to ($931) Mn on 5/07/25 = ($57 Mn)

In Other News

ProFarmer: Three “I” States See 1% Rise in Farmland Values

Central Corn Belt “good” farmland values saw a 1% increase from a year ago, and a 4% rise from the fourth quarter of 2024, according to a survey of agricultural banks conducted by the Federal Reserve Bank of Chicago.

Business Insider: There’s a big disconnect between US economic vibes and what the data actually says

The US economy is holding up, but Americans don’t seem to see it that way.

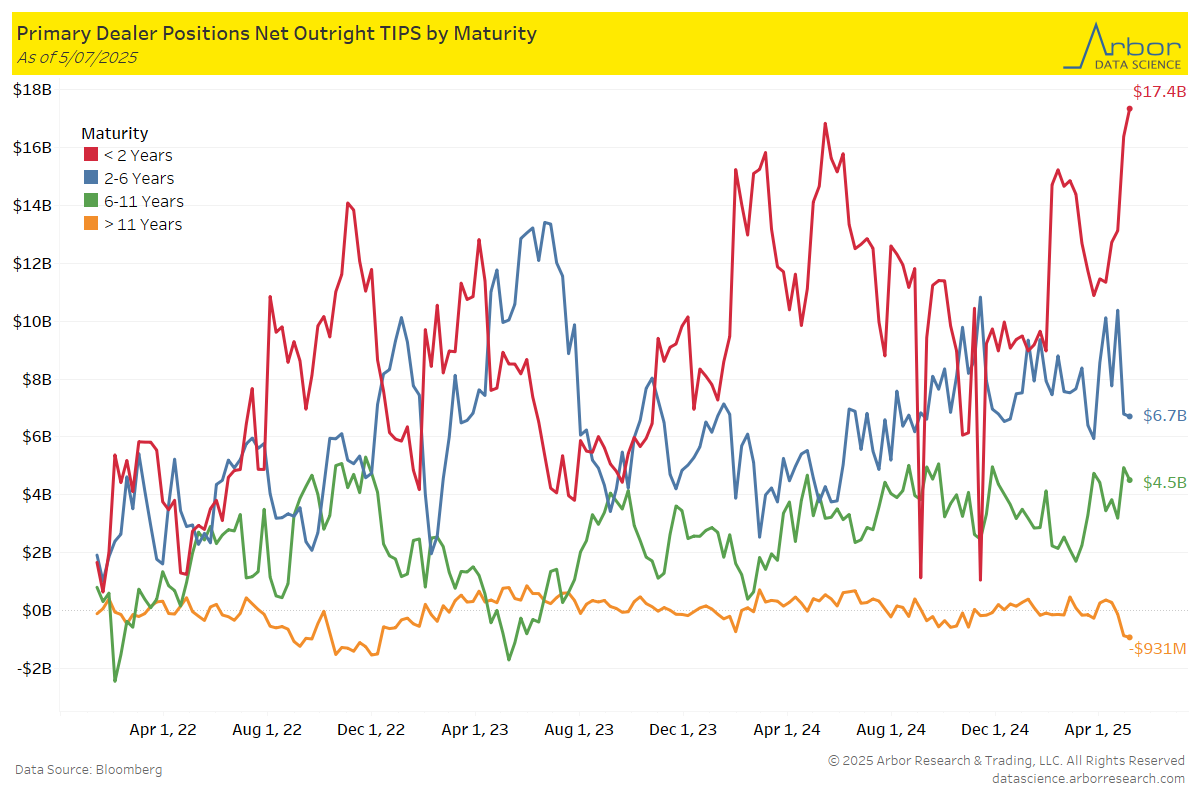

Realtor.com: Single-Family Home Construction Drops as Tariff Turmoil Hits Homebuilders

Construction activity on single-family homes slowed in April, as homebuilders grappled with uncertainty over tariff policy, high interest rates, and weak demand.

Arbor Data Science:

RVBusiness: Winnebago Industries Announces Layoffs at 4 Iowa Plants

RVBusiness: Winnebago Industries Announces Layoffs at 4 Iowa Plants

Winnebago Industries issued the following statement:

“In response to recent cyclical shifts in the RV industry including decreased customer demand, elevated inventory levels, and other business considerations, we are balancing the workforce size within the Winnebago brand’s motorhome division.”

Upcoming Economic Releases & Fed Speak