US Treasuries

- Monday’s range for UST 10y: 4.46% – 4.56%, closing at 4.46%

- Long-dated Treasuries fell on Monday as investor attention turned to the US’ ballooning debt after Moody’s Ratings stripped the nation of its last top credit rating.

- USTs were up on the day

- Fed’s Bostic: flags inflation concerns, sees one cut this year

- Fed’s Jefferson: says Fed Policy is in a ‘very good place,’ and the Fed can be patient

- Fed’s Williams: says Fed needs to go beyond June, July to get clearer outlook

- Fed’s Logan: calls for strengthening rate -control tools

Bloomberg: Treasuries, Dollar Fall as Moody’s Sharpens Focus on US Debt

Long-dated Treasuries fell on Monday as investor attention turned to the US’ ballooning debt after Moody’s Ratings stripped the nation of its last top credit rating.

Axios: Buyers of U.S. bonds are getting nervous

There are emerging signs that global investors are losing patience with a U.S. government that shows no intention of narrowing deficits to more sustainable levels.

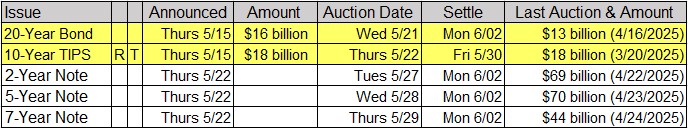

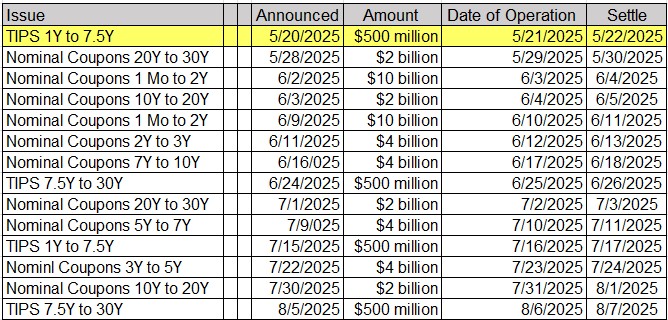

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary by Jim Bianco

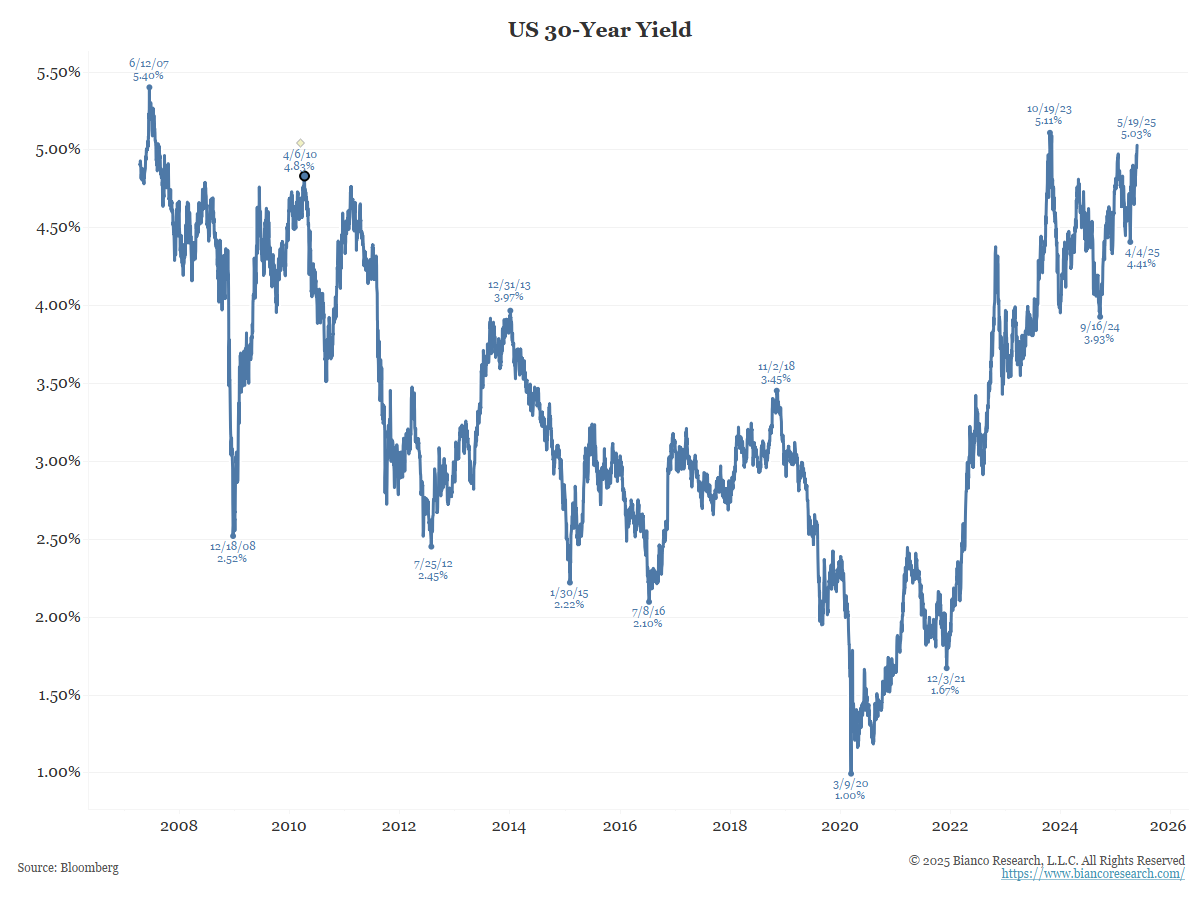

The 30-year yield is now 5.03%—highest since October 2023.

If it goes nine basis points higher, it will be a new 18-year high.

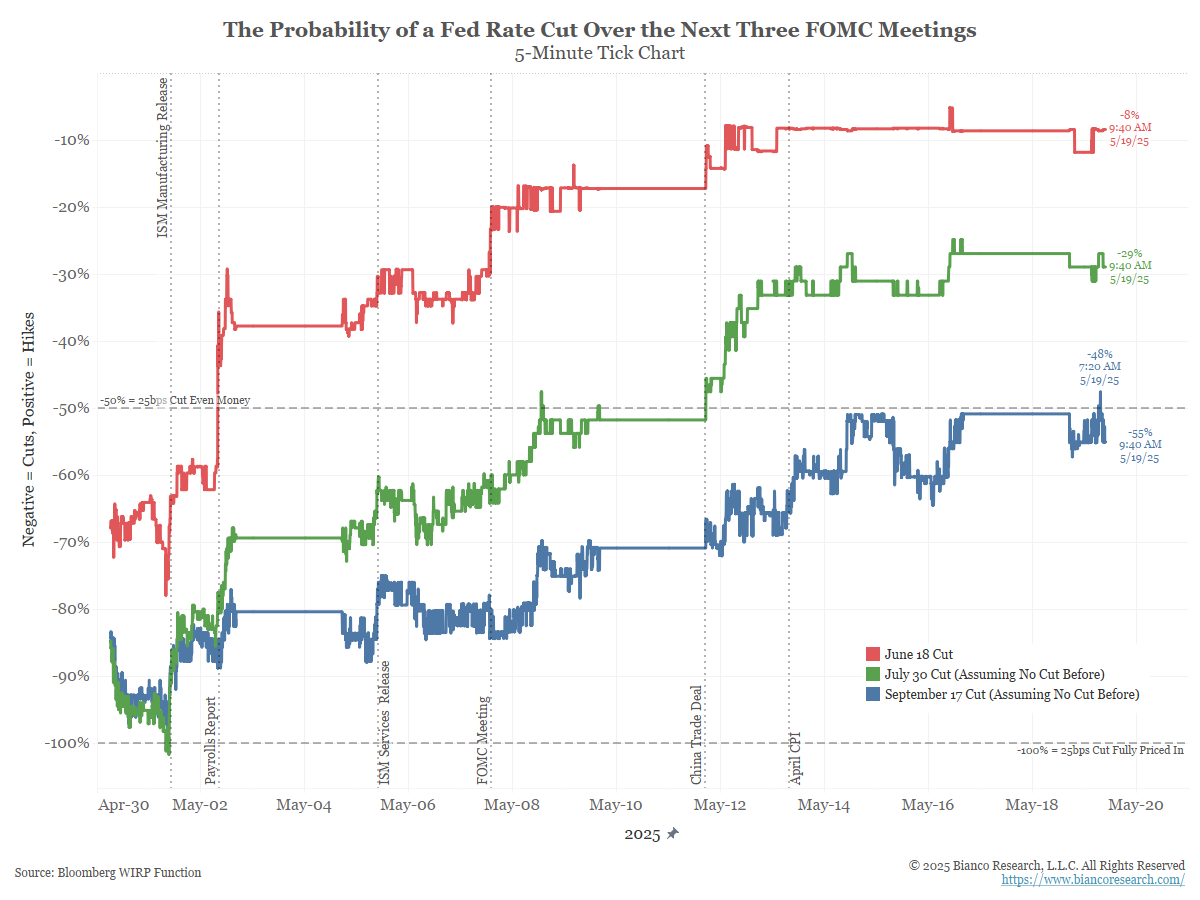

June cut (red) priced out

July cut (green) priced out

Sept cut (blue) is effectively 50/50.

The trend is toward fewer, not more, cuts.

Effectively, the market is saying the next cut, IF IT HAPPENS AT ALL, is ~6 months away.

In Other News

Live Insurance News: When Insurance Costs Send US Homebuyers Packing

Rising Home Insurance Costs Are Shaking Up the Housing Market

CBS News: California approves State Farm’s 17% increase in home insurance premiums in wake of L.A. wildfires

Following a judge’s ruling Monday, State Farm customers in California are one step away from paying more on their homeowners insurance to alleviate what the company described as a “dire” financial situation in the wake of the Los Angeles-area wildfires.

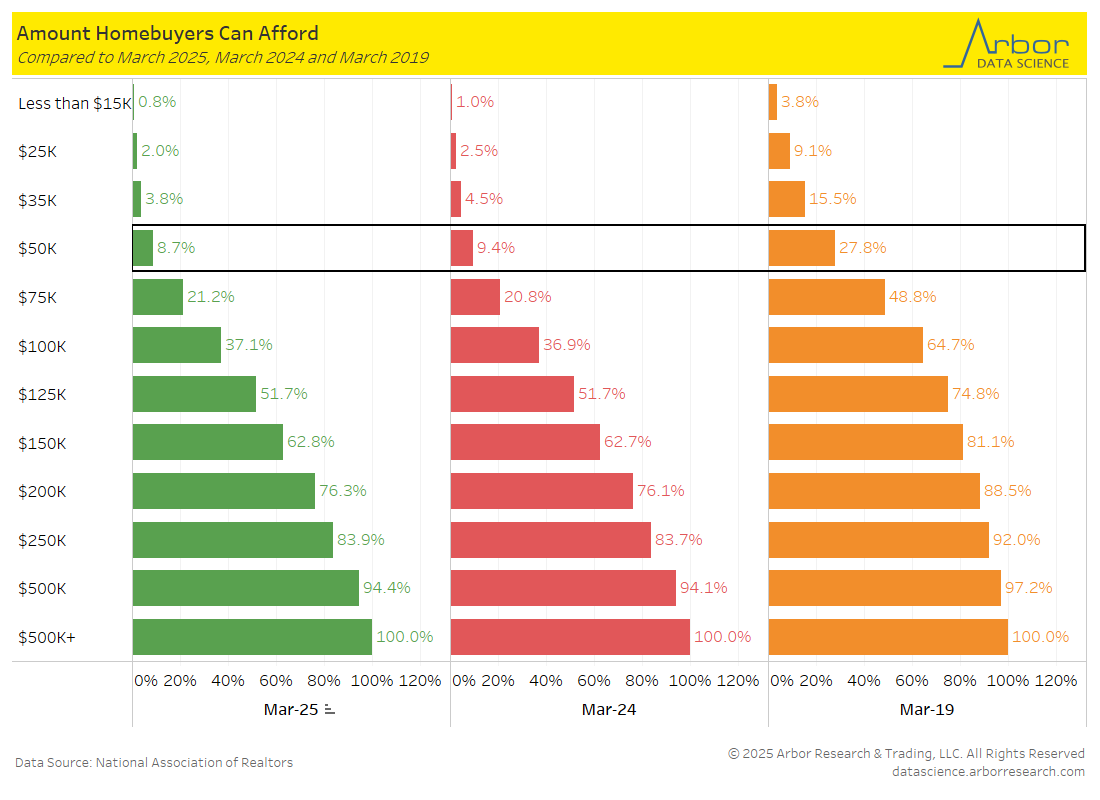

Arbor Data Science: The Share of Purchasing Power for Homebuyers Declines

SupplyChainBrain: Shipping Giant CMA CGM Sees Cargo Jump After China Tariff Relief

SupplyChainBrain: Shipping Giant CMA CGM Sees Cargo Jump After China Tariff Relief

Shipping giant CMA CGM SA is experiencing a sharp upswing in demand for freight transport out of China in a further signal that trade is rebounding after Beijing reached a temporary truce with the U.S. to lower tariffs.

ZeroHedge: Keep An Eye On Cocoa Prices

Cocoa futures surged as much as 7.9% on Friday to $11,068/ton in New York, approaching record levels once again, as mounting supply-side risks reignite upside price action.

Upcoming Economic Releases & Fed Speak