US Treasuries

- Thursday’s range for UST 10y: 4.54% – 4.62%, closing at 4.55%

- Today’s range for UST 30y: 5.05% – 5.15%, closing at 5.06%

- Fed Barkin: expects fed to cut in second half 2025 if tariffs drop

- Fed Williams: says optimal reserves depend on various factors

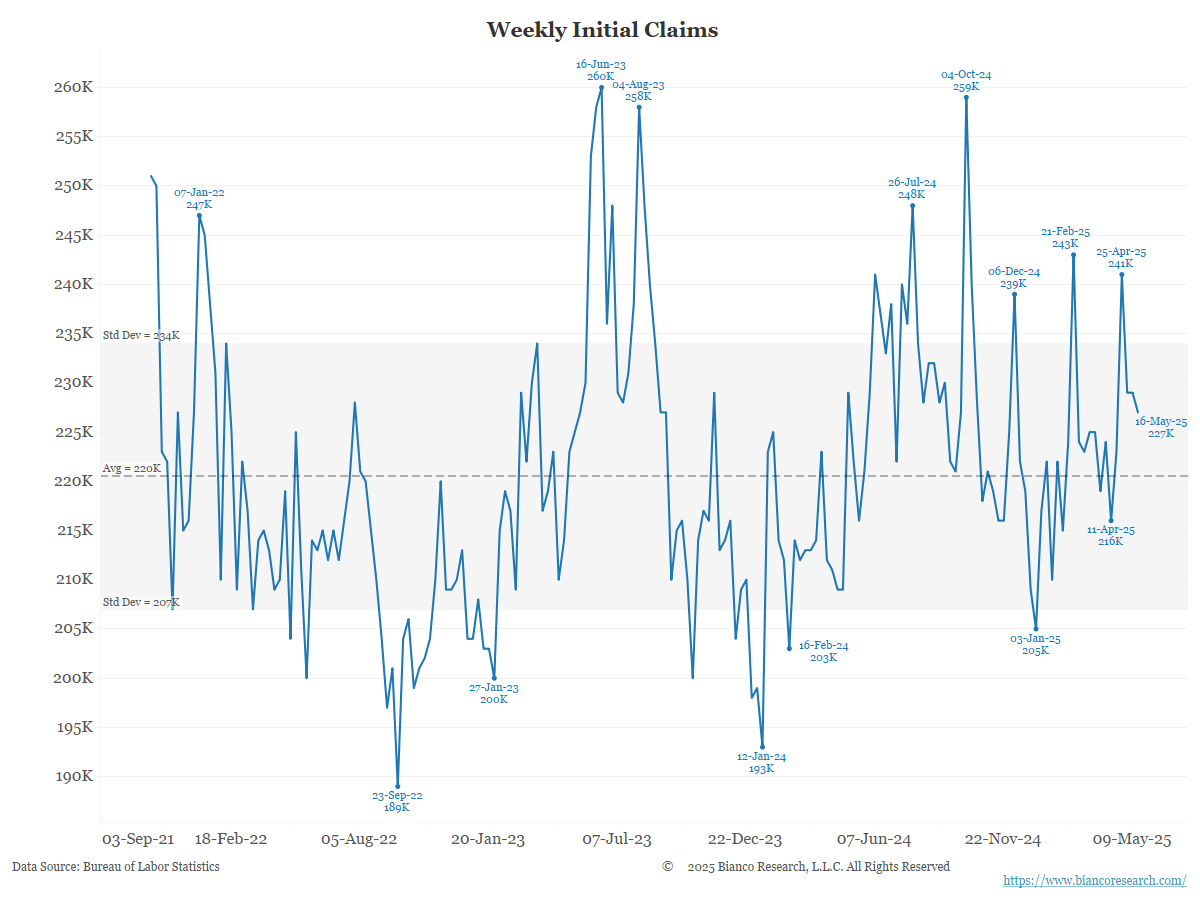

WSJ: The Bond Market is Waking Up to the Fiscal Mess in Washington

With the U.S. economy close to full capacity, more borrowing adds inflationary pressure, and so could lead the Fed to keep rates higher for longer.

Bloomberg: The Bond Vigilantes May Need a Lot of Rope

Pain at the Long End: The infamous bond vigilantes are starting to inflict some real pain, and they’re not coming for just the US. The suffering for holders of the longest-dated bonds is global, and the market’s informal enforcers have brought enough rope to ensnare them all.

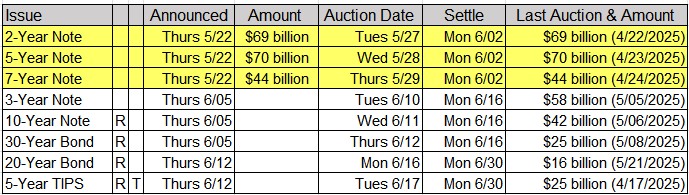

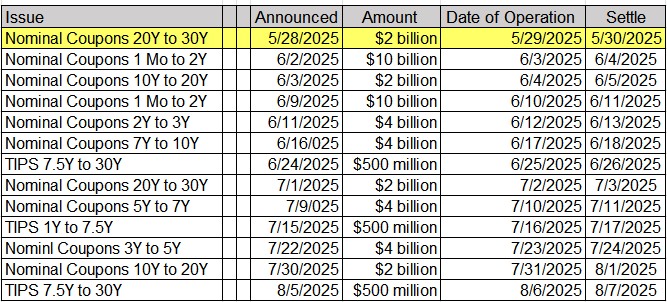

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary from Jim Bianco

In Other News

OilPrice: OPEC+ Considers Another Big Oil Production Hike in July

The OPEC+ alliance is discussing the idea to make another big production increase in oil production for July, delegates from the group told Bloomberg News on Thursday.

Miami Herald: How South Florida is answering the affordable housing crisis

South Florida faces a stubborn affordability gap as new high-end apartment complexes like Soleste Hollywood Blvd and the redeveloped Hollywood Bread Building rise across the region.

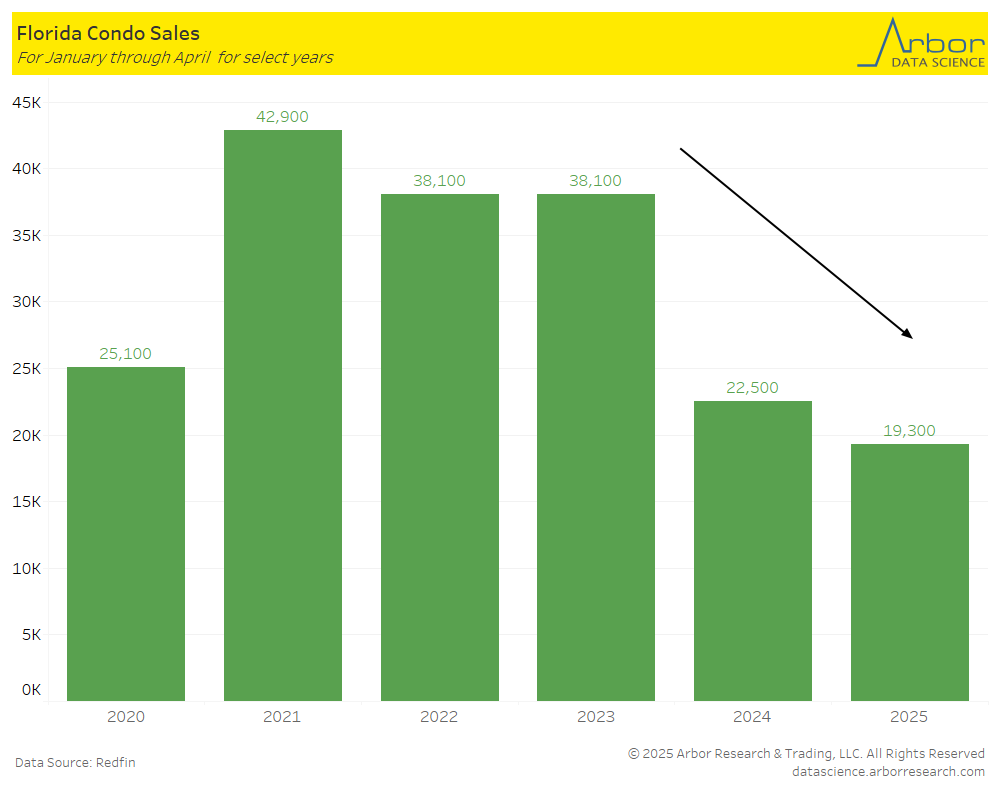

Arbor Data Science: Condo Pain in Florida

The HR Digest: Walmart Layoffs Could Be a Signal For E-tailer’s Automated Future

On May 21, Walmart layoffs once again shook its corporate hallways as nearly 1,500 employees found themselves laid off. These Walmart job cuts in 2025 have sparked widespread discussion, with a strong focus on how AI is at the cost of streamlining.

Business Insider: ‘The worst I’ve ever seen’: the demise of affordable summer getaways

After years of being cooped up at home, travelers rushed into the world with a vengeance, sparking a major travel boom from 2022 to 2024. But years of rising prices and a slew of new tariff threats have cast uncertainty over the economy.

Upcoming Economic Releases & Fed Speak