US Treasuries

- Treasuries rallied in the afternoon after a strong UST 7y auction

- Today’s range for UST 10y: 4.41% – 4.535%, closing at 4.42%

- Today’s range for UST 30y: 4.91% – 5.03%, closing at 4.92%

- Fed’s Goolsbee: sees lower interest rates if tariffs fade away

- Fed’s Kugler: says it’s critical to examine US assets’ possible changing role

Bloomberg: Goldman’s Waldron Says Bond Traders Fear Debt More Than Tariffs

Bond traders are becoming increasingly spooked by mounting levels of US government debt — and it’s now a concern that holds more risk than tariffs, according to Goldman Sachs Group Inc.’s president.

Bloomberg: If Anything, Bond Markets Are Returning to Normal

There’s nothing unusual about the rise in Treasury yields. Recent bond market hysteria ignores the facts.

Talking Data: Jim Bianco: How Stressed Are Bonds?

Bloomberg: Trump Pressed Fed’s Powell to Lower Rates in White House Meeting

President Donald Trump pushed Federal Reserve Chair Jerome Powell to lower interest rates at their first in-person meeting since the president’s inauguration, the White House said.

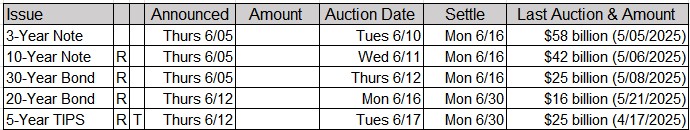

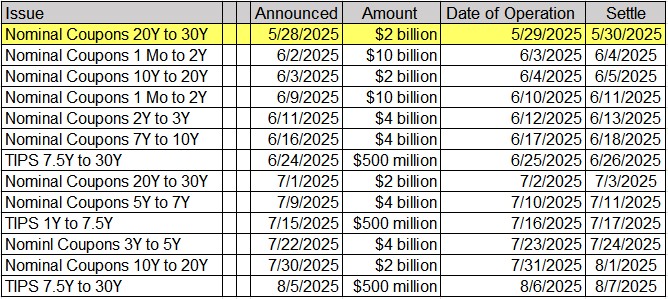

Tentative Schedule of Treasury Buyback Operations

Jim Bianco Joins Fox Business to discuss Wall Street’s Rules, Tariffs & the Bond Market’s Message

Intraday Commentary From Jim Bianco

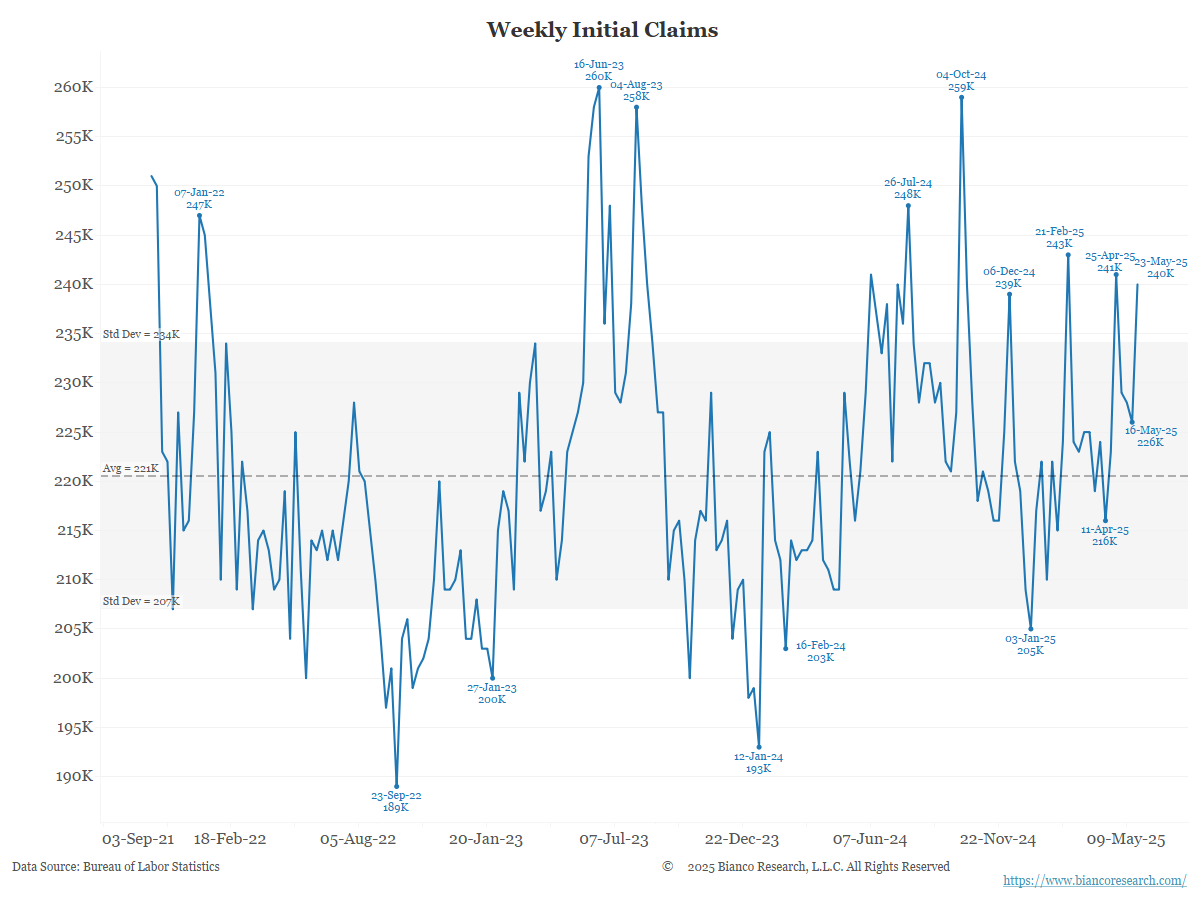

*US JOBLESS CLAIMS 240,000 IN MAY 24 WEEK; EST. 230K

This is the week before Memorial Day, and these numbers always get a little screwy around holidays. Recall everybody got all worked up about the two 141,000 on April 23rd, but that was the week of Easter, and then it came right back down the following week.

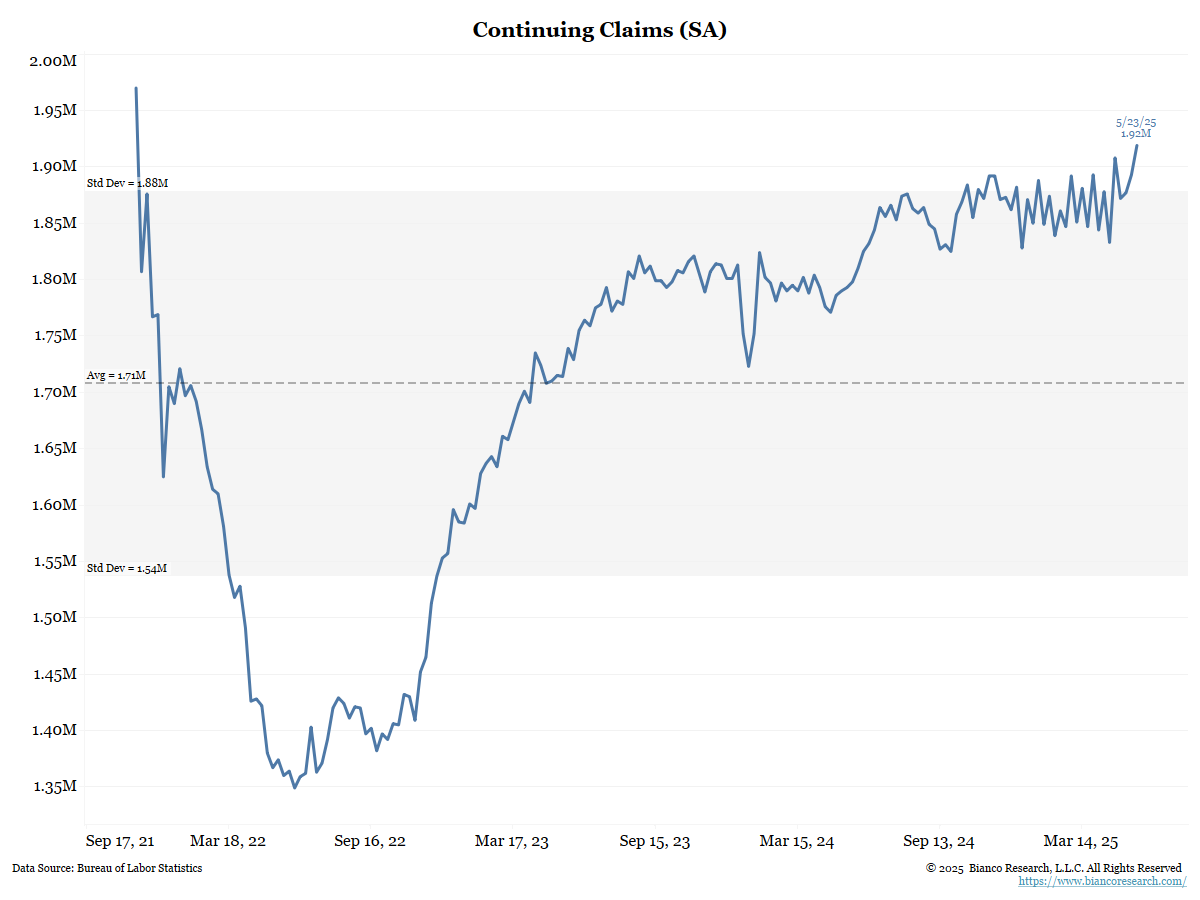

The above said …What is probably giving the bond market a bid is this chart. Continuing claims jumped to a nearly 4-year high.

What this means is that companies aren’t firing people; that’s why initial claims aren’t going up. However, they’ve slowed down their hiring, which is why the unemployed (those on continuing claims) are having a hard time finding jobs.

In Other News

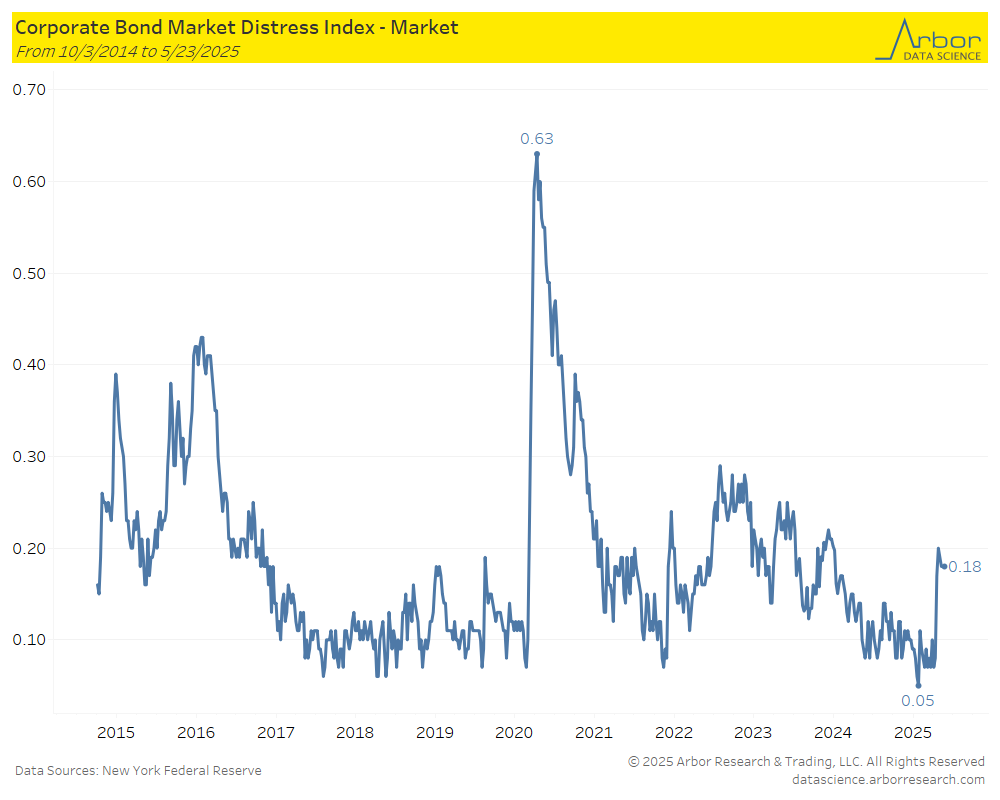

Arbor Data Science: Corporate Bond Market Distress Index

OilPrice: Chevron to Cut 800 Jobs in the Permian

Chevron is giving the slip to 800 of its employees in the Permian as part of a larger cost-cutting drive that will see its global workforce reduced by a fifth by 2026.

TheTicoTimes: Panama Declares State of Emergency After Chiquita Banana Strike

The government of Panama declared a “state of emergency” on Tuesday in a Caribbean province where a subsidiary of U.S.-based banana company Chiquita Brands laid off about 5,000 workers following a strike that has caused millions in losses.

CoStar: Tale of two downtowns: How office recovery is playing out in the Pacific Northwest’s largest cities

The office recovery has been a slog in Portland, Oregon, and in Seattle, two markets held back by high downtown vacancy rates as companies and people moved away from those areas since the early days of the pandemic largely because of safety concerns and a lack of activity.

The office recovery has been a slog in Portland, Oregon, and in Seattle, two markets held back by high downtown vacancy rates as companies and people moved away from those areas since the early days of the pandemic largely because of safety concerns and a lack of activity.

Oxford Economics: Educated but unemployed, a rising reality for US college grads

Higher recent college graduate unemployment will add to the Federal Reserve’s concerns of a slowing economy, weakening labor market, and accelerating inflation.

Upcoming Economic Releases & Fed Speak