US Treasuries

- Monday’s range for UST 10y: 4.285% – 4.37%, closing at 4.34%

Bloomberg: ‘Trump Put’ Will Limit Corporate Bond Spread Widening, BofA Says

Credit markets can expect support from the White House that will limit the extent of spread widening this year, according to Bank of America.

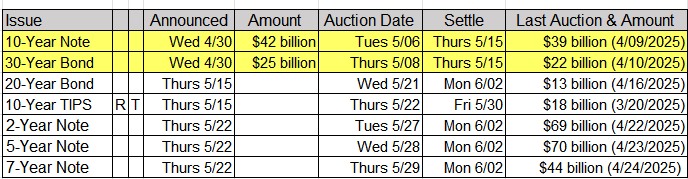

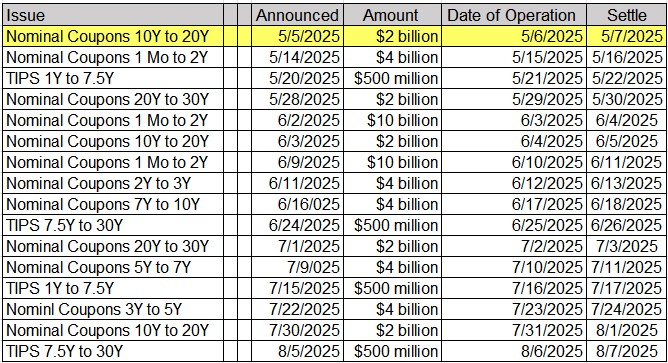

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary From Jim Bianco

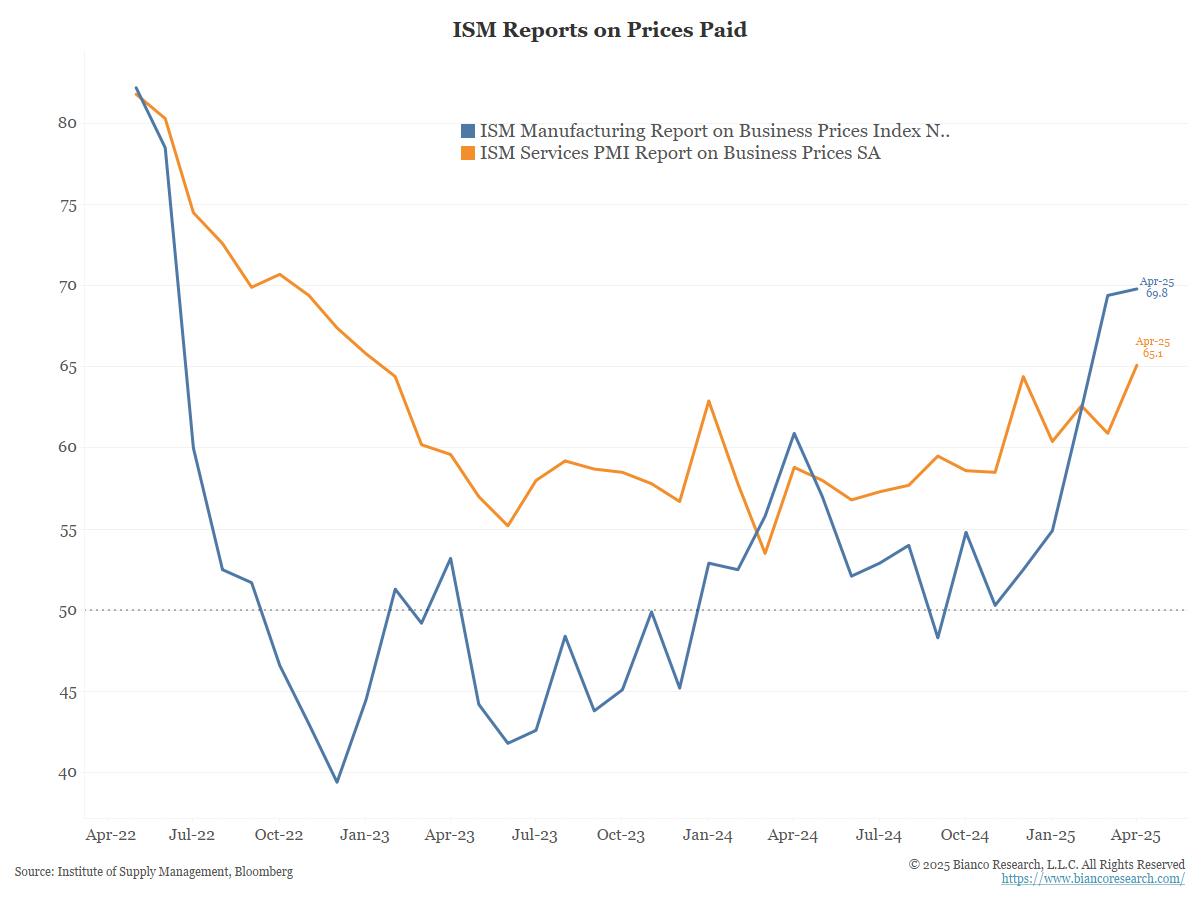

Here are both ISM prices paid measures. Services in orange, also shown above, and manufacturing in blue.

Both clearly show prices going higher.

All this data has coincided with a 22 bps rise in the 10-year yield (green annotation).

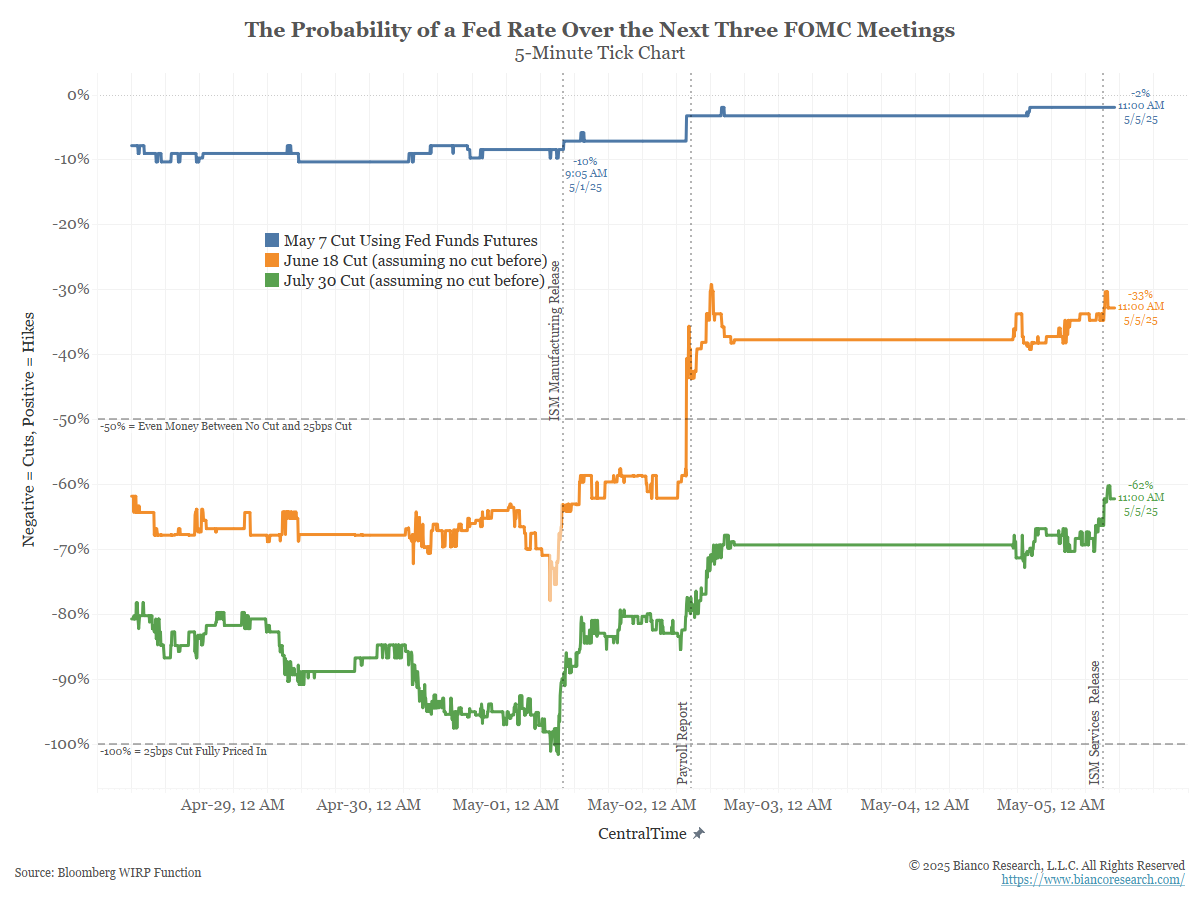

Meanwhile the probability of a Fed cut continues to disappear.

Goldman Sachs and Barclays are leading the charge to push the rate cut to July. (Remember they were March, May, or this week, then June). Morgan Stanley is at zero rate cuts this year (I’m here too). Citi is at five rate cuts (or 125 bps).

If the Fed cannot find a reason to cut rates this week, or in June, what is going to change in July?

In Other News

Earnings Releases Continue this Week…

Farmers Review Africa: Brazil Overtakes U.S. in Soy Exports to China – What’s Next for Global Ag?

As U.S.-China trade tensions continue to simmer, Brazil is quietly stepping into a powerful new role—emerging as China’s preferred supplier of soybeans.

ConnectCRE: Family Offices Are Doubling Down on CRE in 2025

The landscape of private wealth is shifting, and CRE is increasingly becoming a focal point for family offices.

Forbes: Predictions For the Family Office Space in 2025

According to Deloitte Private, there were an estimated 8030 single-family offices globally in 2024, with projections suggesting growth to approximately 10,720 by 2030.

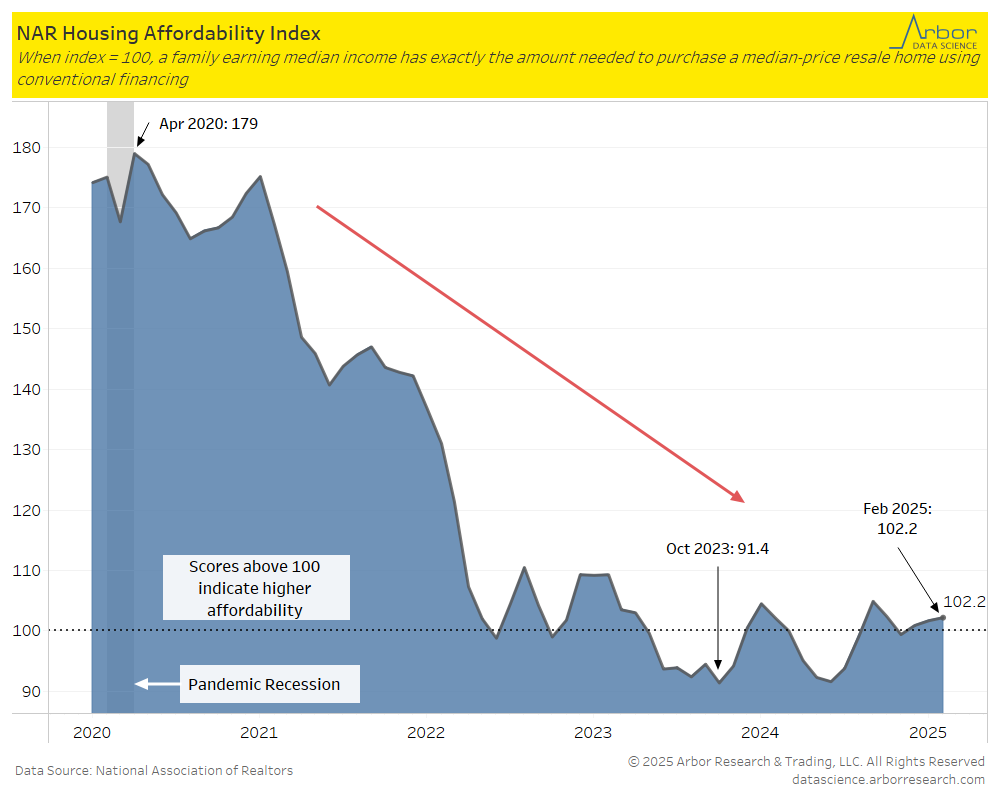

Elite Agent: Americans must now earn over US $114,00 to afford the median-priced home, Up 70% Since 2019

A household in the United States must now earn $114,000 annually to afford a median-priced home- marking a staggering 70.1% increase from six years ago, when the figure stood at $67,000.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak