US Treasuries

- Friday’s range for UST 10y: 4.34% – 4.395%, closing at 4.37%

- Fed’s Kugler: says Fed has time to be patient amid healthy U.S. economy

- Fed’s Williams: says crucial to anchor inflation expectations

- Fed’s Barkin: says not all firms can raise prices on tariffs

- Fed’s Bostic: says it is not prudent to adjust rates amid uncertainty

Bloomberg: Munis Set to Outperform Fixed Income in Summer Redemption Season

Investors are gearing up for a favorable time of year in the municipal-bond market as state and local government debt is poised to outperform other areas of fixed income over the next few months.

Bloomberg: Mortgage Bonds, Seen as Haven, Get Hit as Rates Took Wild Ride

Asset managers and strategists have for years touted mortgage bonds as a haven when the economy stumbles, but the debt has underwhelmed since President Donald Trump announced his tariff blitz.

WSJ: Warsh Says Fed’s Current Statements Imply Impaired Credibility

Kevin Warsh, who is considered a potential candidate to become Federal Reserve chair next year, suggested that the central bank has itself to blame for concerns that tariff increases might make it harder to control inflation.

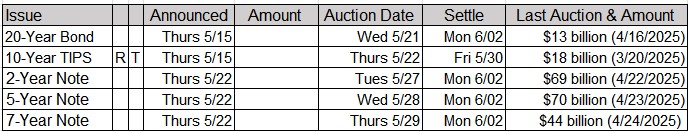

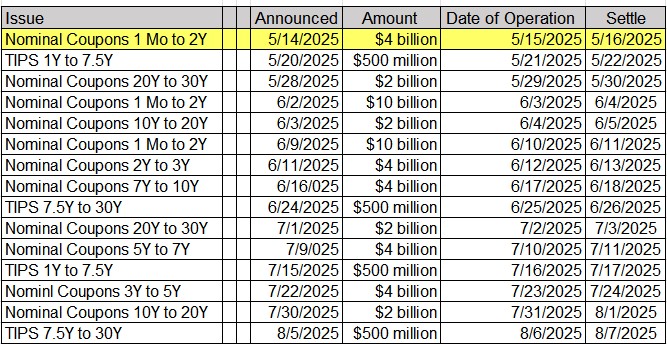

Tentative Schedule of Treasury Buyback Operations

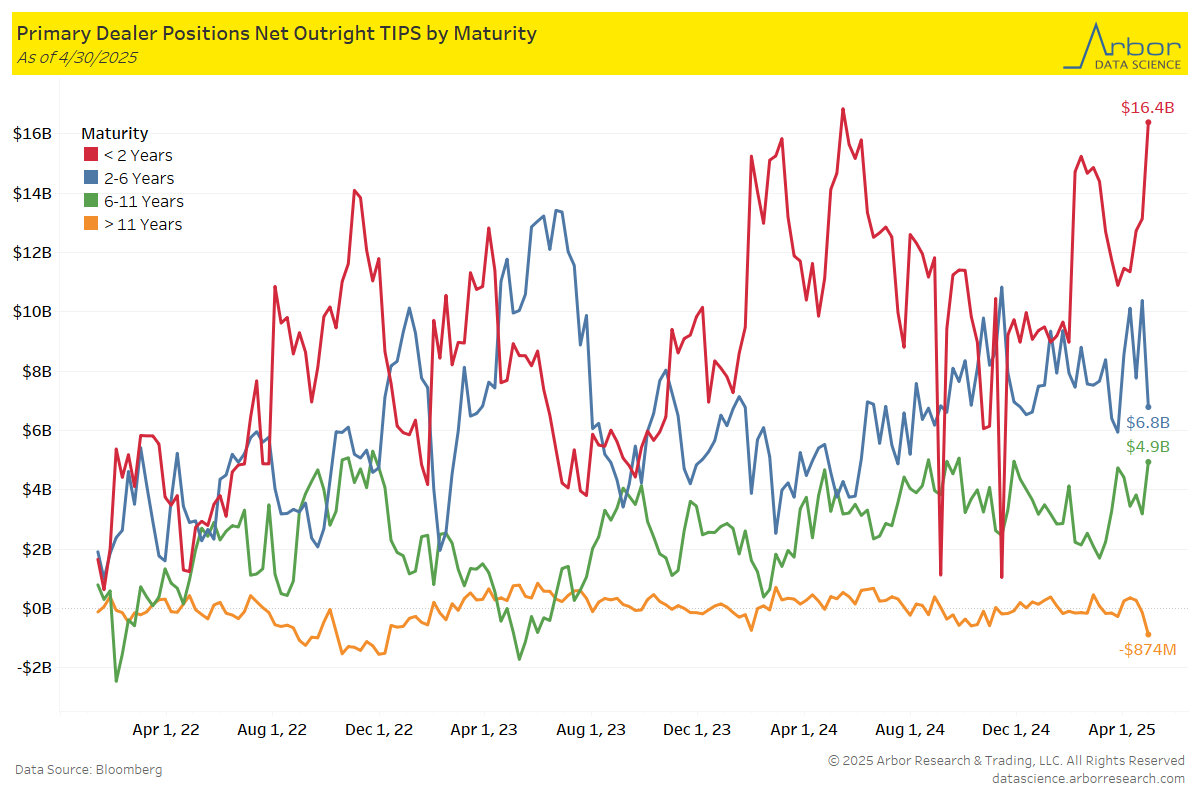

Data through 4/30/25

Week over Week Changes by Maturity

- < 2 years: $13.1 Bn on 4/23/25 to $16.4 Bn on 4/30/25 = $3.3 Bn

- 2 – 6 years: $10.4 Bn on 4/23/25 to $6.8 Bn on 4/30/25 = ($3.6 Bn)

- 6 – 11 years: $3.2 Bn on 4/23/25 to $4.9 Bn on 4/30/25 = $1.7 Bn

- > 11 years: ($130) Mn on 4/23/25 to ($874) Mn on 4/30/25 = ($744 Mn)

In Other News

The total number of active drilling rigs for oil and gas in the United States slipped this week, according to new data that Baker Hughes published on Friday, following a 3-rig decrease last week.

A Sign of the Times?

AutoBodyNews: Should Your Collision Shop Offer ‘Buy Now, Pay Later’ Third Party Financing?

Third-party finance is having a moment.

Collision centers are increasingly considering and offering customers unconventional payment options from third-party private lenders, or a specific subset called “buy now, pay later” to maintain cash flow if volumes slow.

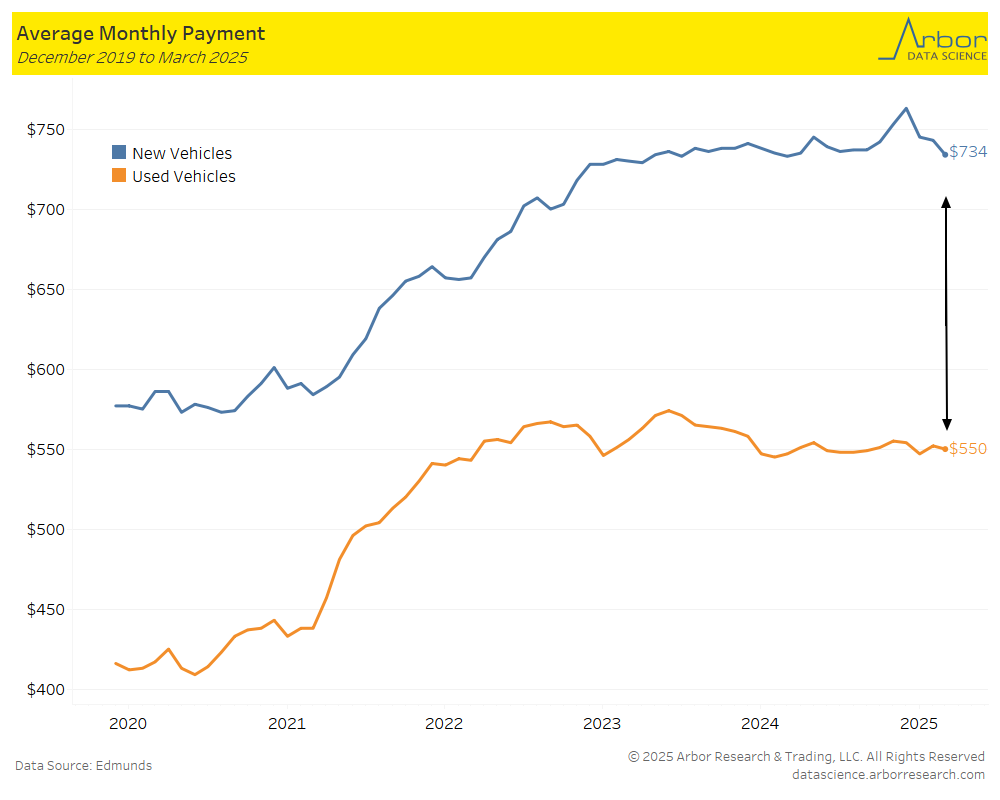

Arbor Data Science: The Rise of Monthly Car Payments and Delinquencies

Insurance Business: Late April storms cause hundreds of millions in insured losses across US – Aon

Insurance Business: Late April storms cause hundreds of millions in insured losses across US – Aon

A series of severe storms that swept across the central and eastern United States in the final week of April is expected to result in insured losses amounting to hundreds of millions of dollars, according to a new report from Aon.

Upcoming Economic Releases & Fed Speak