US Treasuries

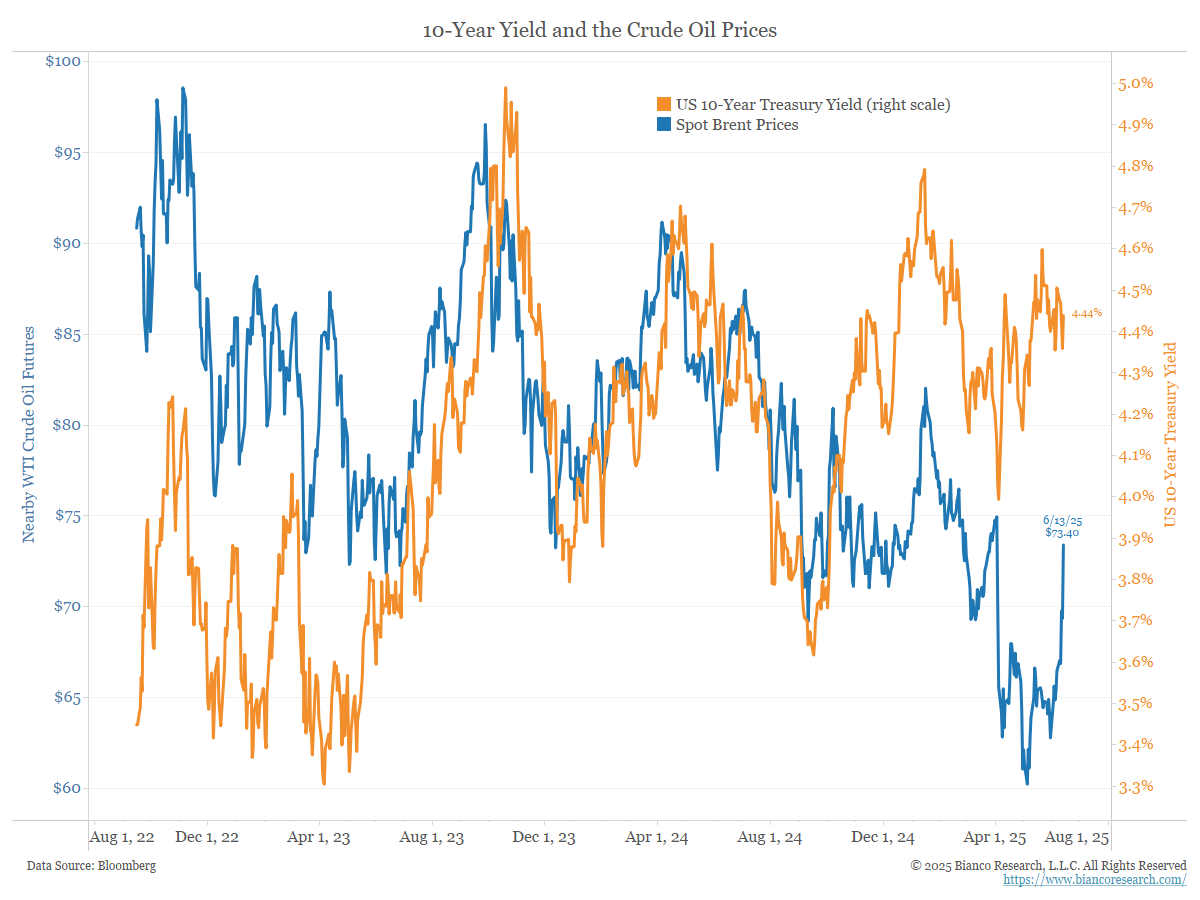

- Treasury yields climbed across the curve (led by the long end) as WTI crude oil surged after Israel attacked Iranian nuclear sites.

- Friday’s range for UST 10y: 4.31% – 4.44%, closing at 4.42%

- UST 10y range for the week: 4.31% – 4.515%

- Friday’s range for UST 30y: 4.81% – 4.94%, closing at 4.91%

- UST 30y range for the week: 4.80% – 4.99%

Bloomberg: Bets Emerge That End to Powell’s Term Means More Fed Rate Cuts

Jim Bianco Intraday Commentary

There are many questions about why yields are rising. Here is my best guess … This is not the start of World War III. Or it is, it is also the end of it. Estimates are that 76 top Iranian commanders were killed in the first Israeli attack wave. In other words, the Mullahs are screaming into the phone to counterattack, and no one is on the other end … they are dead. Iran has been incapacitated. They cannot respond and are vulnerable. See the post immediately above. So why are rates rising? Because there is no flight to quality, it is not necessary. Forget the idea that

The dollar has lost its safe-haven status. If it were a safe haven bid, stocks would likely be down significantly. They are not … they were down more on Wednesday during the intraday session.

So, why are rates rising? See the chart below. They are following crude oil higher. That’s it. So, all that happened today is an event that boosted the price of crude oil, and rates are following it. Everything else is hyperbole.

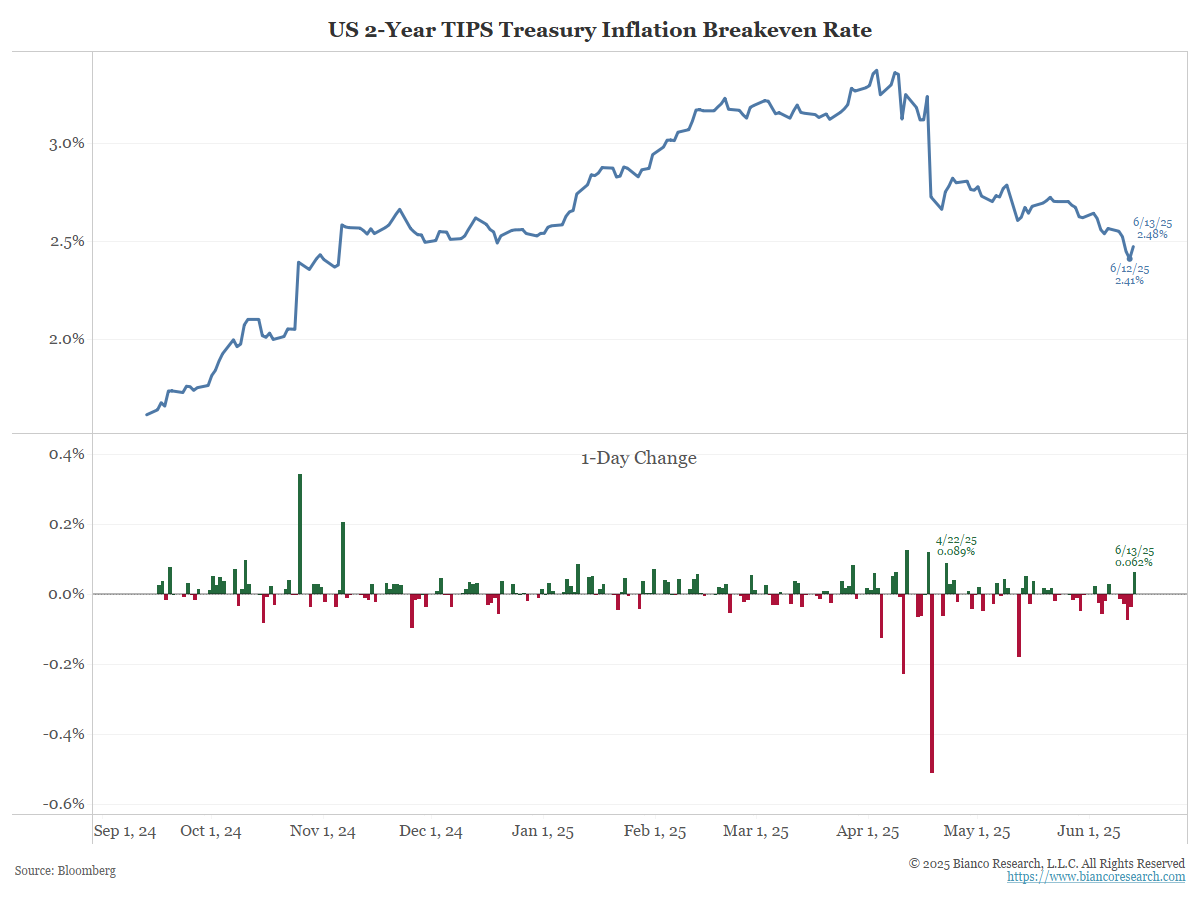

The 2-year break-even rate is up 6 bps … it’s biggest daily gain since April. The 2-Year BE is heavily influenced by crude oil. It is rising with crude’s rise today.

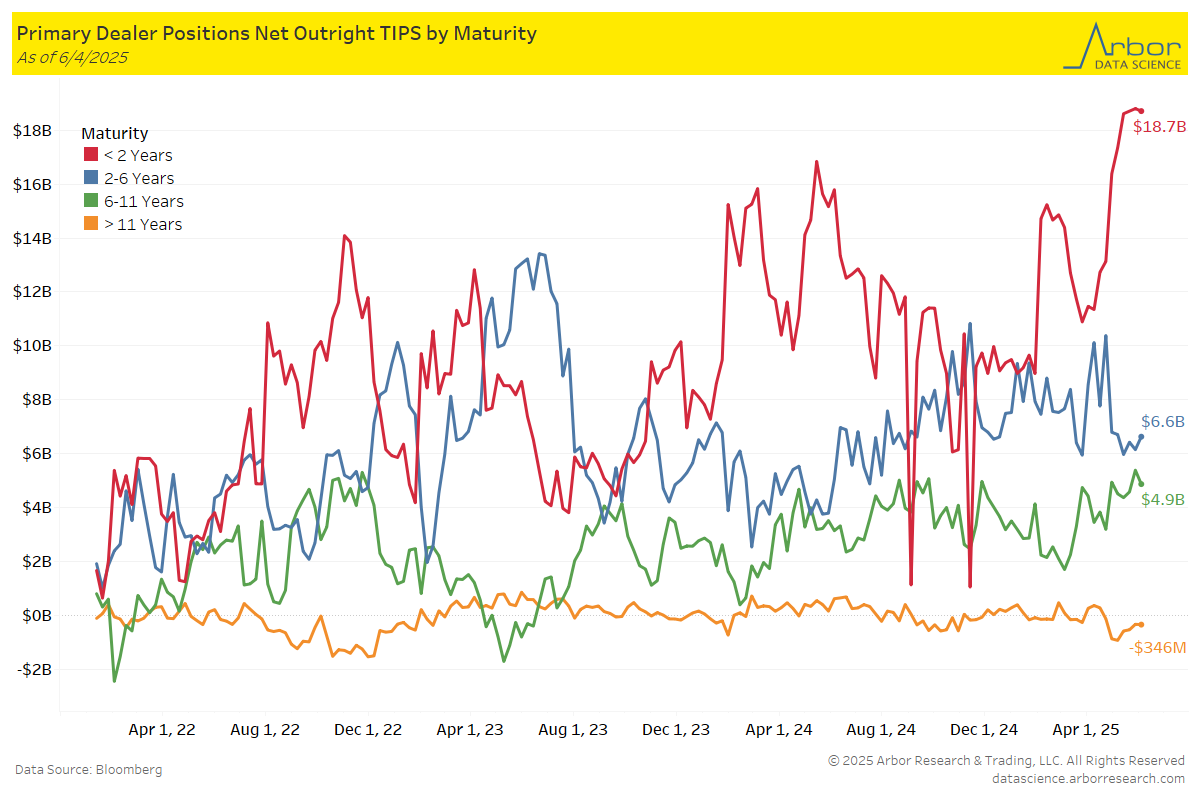

TIPS by Maturity: (data through 6/4/25)

Week over Week Changes by Maturity

-

< 2 years: $18.8 Bn on 5/28/25 to $18.7 Bn on 6/4/25 = ($0.1 Bn)

-

2 – 6 years: $6.1 Bn on 5/28/25 to $6.6 Bn on 6/4/25 = $0.5 Bn

-

6 – 11 years: $5.4 Bn on 5/28/25 to $4.9 Bn on 6/4/25 = ($0.5 Bn)

-

> 11 years: ($335) Mn on 5/28/25 to ($346) Mn on 6/4/25 = ($11 Mn)

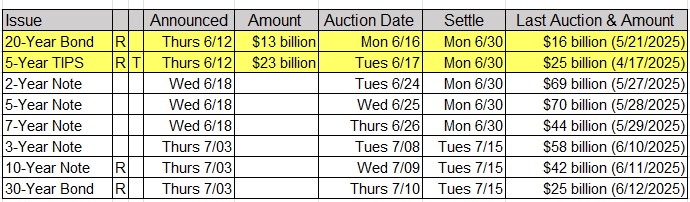

Upcoming US Treasury Supply

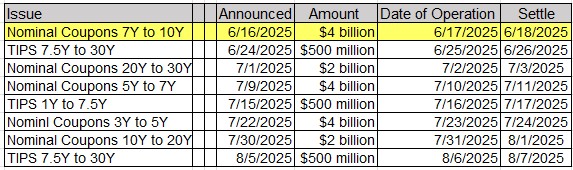

Tentative Schedule of Treasury Buyback Operations

In the News

Upcoming Economic Releases & Fed Speak